Full Answer

Where can I buy BA shares?

Shares of BA can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

What is the price target for Boeing stock?

Their forecasts range from $224.00 to $306.00. On average, they expect Boeing's stock price to reach $269.94 in the next twelve months. This suggests a possible upside of 36.7% from the stock's current price. View analysts' price targets for Boeing or view top-rated stocks among Wall Street analysts. Who are Boeing's key executives?

Where can I buy shares of Boeing?

Shares of BA can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here. What is Boeing's stock price today?

Are there any cheap stocks to buy after the dip?

When you know which metrics of quality to track to uncover cheap stocks to buy, you can pick winners that the market may reward with higher prices after the dip. We have identified nine cheap stocks to buy that have fallen along with the S&P 500 and other major stock indexes over recent months.

How do I buy Boeing stock directly?

How do I invest in Boeing stock? You must make your initial stock purchase through a broker. Your broker can then transfer the shares of stock to you, so that the stock will be held in your name, as opposed to the broker's name. Your broker can provide you with the details regarding the transfer process.

How do you buy stock at the lowest price?

The most inexpensive way to purchase company shares is through a discount broker. A discount broker provides little financial advice, while the more expensive full-service broker provides comprehensive services like advice on stock selections and financial planning.

Is BA a Buy Sell or Hold?

The consensus among 13 Wall Street analysts covering (NYSE: BA) stock is to Strong Buy BA stock.

At what price is Boeing a buy?

Price Target Upside/Downside According to analysts' consensus price target of $225.83, Boeing has a forecasted upside of 59.6% from its current price of $141.53.

Which stock broker is best for beginner?

Best Stock Broker for Beginners in India 2020Reliance Securities.Motilal Oswal.ICICI Direct.HDFC securities.Axis Direct.Kotak Securities.IIFL Securities.Zebu Trade.More items...

Is Robinhood a good place to buy stocks?

Stock trading costs: 5 out of 5 stars Robinhood provides 100% commission-free stock, options, ETF and cryptocurrency trades, making it attractive to investors who trade frequently. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker.

What is the target price for BA stock?

Stock Price TargetsHigh$298.00Median$225.00Low$130.00Average$223.24Current Price$132.23

Will BA stock go up?

The 21 analysts offering 12-month price forecasts for Boeing Co have a median target of 214.00, with a high estimate of 298.00 and a low estimate of 130.00. The median estimate represents a +51.35% increase from the last price of 141.39.

Is BA a buy Zacks?

How good is it? See rankings and related performance below. The VGM Score are a complementary set of indicators to use alongside the Zacks Rank....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

Is BA a buy right now?

Today BA ranks #2644 as buy candidate.

Is BA a good long term stock?

Latest Boeing Co (BA) Stock News Boeing Co's trailing 12-month revenue is $61.1 billion with a -8.0% profit margin. Year-over-year quarterly sales growth most recently was -8.1%. Analysts expect adjusted earnings to reach $-0.752 per share for the current fiscal year.

What is Boeing's dividend?

In 2022, Boeing will earn a little above $5 per share according to the analyst community, while that number will rise to $7.30 in 2023, before climbing to $11.60 in 2025.

Should I buy or sell Boeing stock right now?

19 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Boeing in the last twelve months. There are currently 5 hold ratings and...

What is Boeing's stock price forecast for 2022?

19 brokerages have issued 12-month price targets for Boeing's shares. Their forecasts range from $150.00 to $300.00. On average, they anticipate Bo...

How has Boeing's stock price performed in 2022?

Boeing's stock was trading at $201.32 at the beginning of the year. Since then, BA shares have decreased by 36.9% and is now trading at $127.00. V...

Are investors shorting Boeing?

Boeing saw a increase in short interest in May. As of May 15th, there was short interest totaling 11,340,000 shares, an increase of 28.7% from the...

When is Boeing's next earnings date?

Boeing is scheduled to release its next quarterly earnings announcement on Wednesday, July 27th 2022. View our earnings forecast for Boeing .

How were Boeing's earnings last quarter?

The Boeing Company (NYSE:BA) announced its quarterly earnings data on Wednesday, April, 27th. The aircraft producer reported ($2.75) earnings per s...

Who are Boeing's key executives?

Boeing's management team includes the following people: Mr. David L. Calhoun , Pres, CEO & Director (Age 64, Pay $5.09M) Mr. Brian J. West , Ex...

What is David Calhoun's approval rating as Boeing's CEO?

494 employees have rated Boeing CEO David Calhoun on Glassdoor.com . David Calhoun has an approval rating of 67% among Boeing's employees.

Who are some of Boeing's key competitors?

Some companies that are related to Boeing include Honeywell International (HON) , Lockheed Martin (LMT) , Northrop Grumman (NOC) , General Dyna...

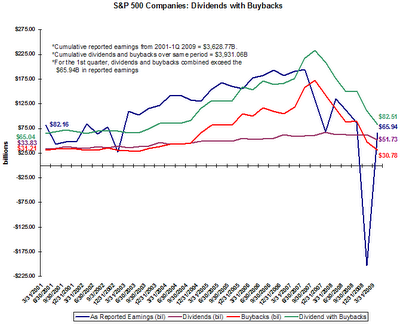

What happened to Boeing in the first quarter of 2019?

Boeing’s earnings fell in the first quarter of 2019 after the company suspended its stock repurchase program in light of its 737 MAX 8 grounding . The company said that it booked $1 billion in costs in the first quarter that involved the 737 MAX 8, although the stock rose following the release of that information.

What is the key to Boeing?

The key for Boeing is in solving the cultural issues and returning to the old path of excellence. In that case, it could be one of the most promising turnaround stories.

When will the Boeing 777X be released?

Boeing now expects the 777X (a larger version of the 777) to enter service by late 2023 — 3 years later than planned and with a longer, more expensive certification project. The cost of the delay is $6.5 billion.

Is Boeing a volatile stock?

High volatility: With a 5-year monthly beta of 1.63, Boeing is an above-average volatile stock. Although not an intrinsically negative measure — buyers should be ready to endure long drawdowns.

How much did Boeing stock gain in 2021?

The Boeing Company (The) stock price gained 1.61% on the last trading day (Wednesday, 30th Jun 2021), rising from $235.76 to $239.56. During the day the stock fluctuated 2.19% from a day low at $236.00 to a day high of $241.17. The price has fallen in 7 of the last 10 days and is down by -1.12% for this period. Volume fell on the last day by -5 million shares and in total, 12 million shares were bought and sold for approximately $2.87 billion. You should take into consideration that falling volume on higher prices causes divergence and may be an early warning about possible changes over the next couple of days.

Does Boeing have a buy signal?

The Boeing Company (The) stock holds a buy signal from the short-term moving average; at the same time, however, the long-term average holds a general sell signal. Since the longterm average is above the short-term average there is a general sell signal in the stock giving a more negative forecast for the stock.

Is Boeing Company (The) stock A Buy?

The Boeing Company (The) stock holds several negative signals and despite the positive trend, we believe Boeing Company (The) will perform weakly in the next couple of days or weeks. Therefore, we hold a negative evaluation of this stock. Due to some small weaknesses in the technical picture we have downgraded our analysis conclusion for this stock since the last evaluation from a Hold/Accumulate to a Sell candidate.

What is Boeing stock worth in 2020?

The Boeing's stock was trading at $189.08 on March 11th, 2020 when Coronavirus (COVID-19) reached pandemic status according to the World Health Organization. Since then, BA shares have increased by 26.0% and is now trading at $238.29. View which stocks have been most impacted by COVID-19.

What is Boeing's business?

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space and security systems. It operates through the following segments: Commercial Airplanes; Defense, Space and Security; Global Services; and Boeing Capital. The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems; global mobility, including tanker, rotorcraft and tilt-rotor aircraft; and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The Boeing Capital segment seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. T

How much money does Boeing make?

How much money does The Boeing make? The Boeing has a market capitalization of $139.35 billion and generates $58.16 billion in revenue each year . The aircraft producer earns $-11,873,000,000.00 in net income (profit) each year or ($23.25) on an earnings per share basis.

Does Boeing pay dividends?

Boeing does not currently pay a dividend.

Is a B better than a C?

An A is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F. Value Score A. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B.

Is Boeing a Dow Jones company?

The Boeing Company is the largest constituent of the Dow Jones Industrial Average. The company’s premier jet aircraft along with varied defense products positions it as one of the largest defense contractors in the United States. Its customers include domestic and foreign airlines, the U.S. Department of Defense (DoD), the Department of Homeland Security, the National Aeronautics and Space Administration (NASA), other aerospace prime contractors, and certain U.S. government and commercial communications customers. Currently the company operates in four segments: