Full Answer

How is implied volatility calculated?

It is calculated through a formula using several variables in market and stock price. Knowing a stock's implied volatility and other data, an investor can calculate the degree to which the price might change. But that doesn't forecast which direction the price will move.

Where can I check the volatility index of a stock?

You can check Volatility at “ Volatility Index “ available at wabsite of BSE and NSE . You may also check it at “ Fear and Greed “ Meter of CNBC Awaaz News Channel . YieldStreet.com: Get access to exclusive alternative investments.

What is the implied volatility of a $10 stock?

For example, a $10 stock with a 20 percent implied volatility that expires in six months (183 days) would have a 68 percent chance of rising or falling by approximately $1.41. Historical Vs. Implied Volatility

How does implied volatility affect the market?

Implied volatility is directly influenced by the supply and demand of the underlying options and by the market's expectation of the share price's direction. As expectations rise, or as the demand for an option increases, implied volatility will rise.

What happens to implied volatility?

Options that have high levels of implied volatility will result in high-priced option premiums. Conversely, as the market's expectations decrease, or demand for an option diminishes, implied volatility will decrease. Options containing lower levels of implied volatility will result in cheaper option prices.

What happens when implied volatility is relatively low?

Conversely, if you determine where implied volatility is relatively low, you might forecast a possible rise in implied volatility or a reversion to its mean.

Why is implied volatility important?

This is important because the rise and fall of implied volatility will determine how expensive or cheap time value is to the option , which can, in turn, affect the success of an options trade.

What is time value in options?

Time value is the additional premium that is priced into an option, which represents the amount of time left until expiration. The price of time is influenced by various factors, such as the time until expiration, stock price, strike price, and interest rates. Still, none of these is as significant as implied volatility.

Which option is more sensitive to volatility?

Options with strike prices that are near the money are most sensitive to implied volatility changes, while options that are further in the money or out of the money will be less sensitive to implied volatility changes. Vega —an option Greek can determine an option's sensitivity to implied volatility changes.

Why are options less expensive?

As implied volatility decreases, options become less expensive. As implied volatility reaches extreme highs or lows, it is likely to revert to its mean. 2. If you come across options that yield expensive premiums due to high implied volatility, understand that there is a reason for this.

What is Implied Volatility?

Implied volatility is a term that refers to a certain measurement that establishes the likelihood a particular market is to change over time. So a security with a high volatility will be one that has a price that is going up and down quite frequently, while a stock with low volatility will have a price that is fluctuating much more slowly.

Understanding Implied Volatility

Implied volatility isn’t just a random guess of what is going to happen in the marketplace, rather it is a number that is calculated using many known variables. Therefore it is the forecast of a specific security based on the conditions of the market itself.

How Does Implied Volatility Affect Options?

First of all, it’s important to know that options are a specific type of stock contract that gives the buyer the choice and ability to buy or sell a specific stock before a date as outlined in the contract by paying a premium price.

How Implied Volatility Affects Pricing Options

Now that you are aware that implied volatility plays a major role in options pricing, it’s important to explore just how it affects pricing options. There are currently three different pricing models used when calculation options pricing.

How To Use Implied Volatility for Trading

Implied volatility is a great way to pick out a strategy for your options trading. It’s important, however, that you understand how implied volatility works before you start throwing all your money into options contracts.

Pros and Cons of Using Implied Volatility in Trading

Like any type of stock market trading in the world, there are many pros and cons to using implied volatility in trading. And you should definitely take a look at the pros and cons before you devote yourself to using implied volatility to trade options.

Implied Volatility Trading Tips

Have you decided that you would like to use implied volatility as you trade stocks? Then it’s important to keep in mind the following tips as you use implied volatility to trade options .

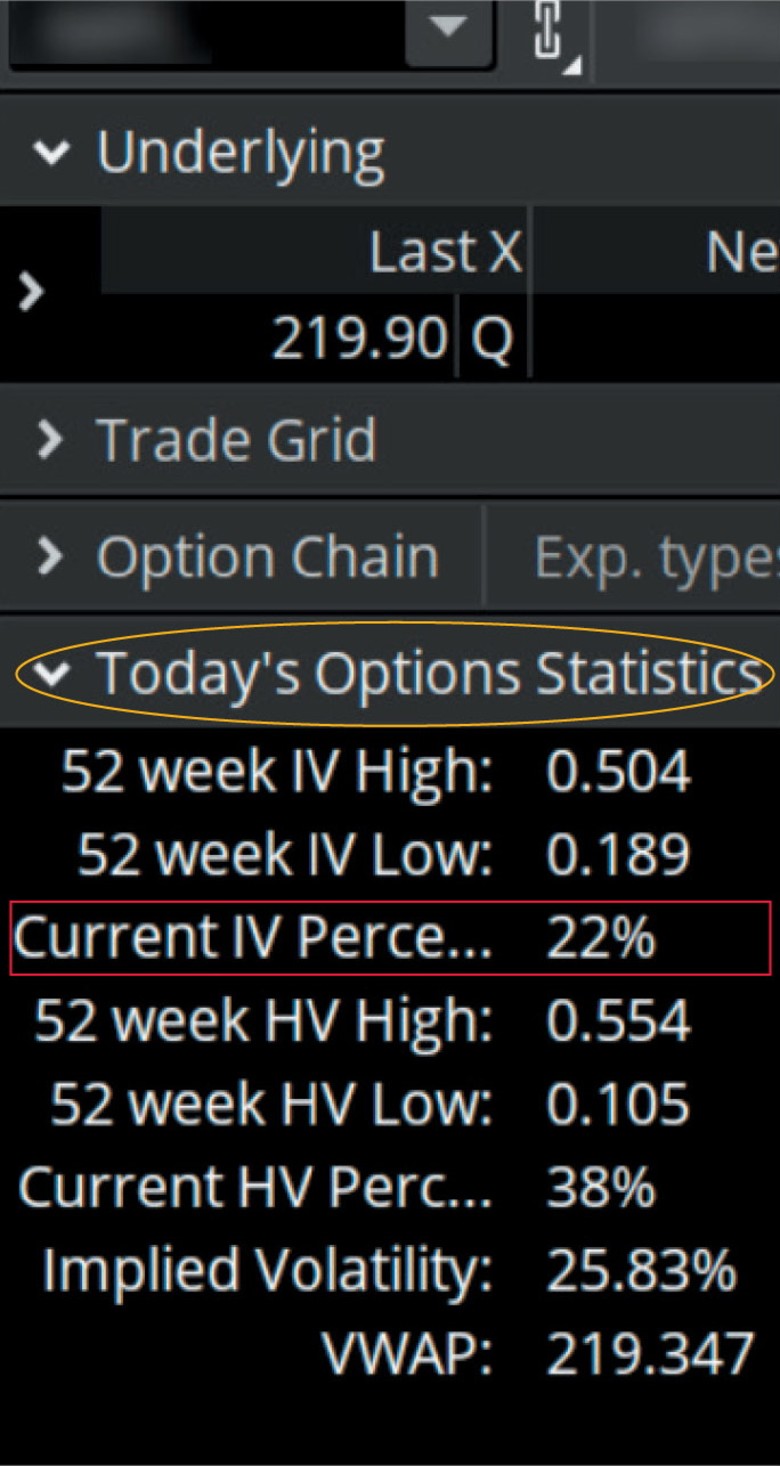

Determine Whether Implied Volatility Is High Or Low

Determine whether IV is high or low, rising or falling, by looking at a metrics that shows the IV rank.

Research Why Some Options Yield Higher Premiums

There will always be a reason why some options yield higher premiums due to high implied volatility. It could be a product approval, or news about a merger or acquisition.

Identifying Options With High Implied Volatility For Short Premium Strategies

After you’ve done your research, you could identify options with high implied volatility that you might consider selling. You can sell options and still be bullish or neutral.

Identifying Options With Low Implied Volatility For Long Premium Strategies

When the implied volatility is low and the premiums are low-priced, it’s typically a buyers’ market. In a low IV environment, you can consider options buying strategies such as:

What is implied volatility?

Implied volatility is one of the important parameters and a vital component of the Black-Scholes model which is an option pricing model that shall give the option’s market price or market value. Implied volatility formula shall depict where the volatility of the underlying in question should be in the future and how the marketplace sees them. ...

Can implied volatility be forecast?

However, it has to be not ed that the implied volatility will not forecast in which the direction an option is leaning towards. This implied volatility can be used to compare with historical volatility, and hence decisions can be made based on those cases. This could be the measure of risk that the trader is putting into.

Can interpolation be near implied volatility?

One can also do interpolation , which could be near to the implied volatility, and by doing this, one can get approximate nearby implied volatility. This is not simple to calculate as it requires care at every stage to compute the same.

What does it mean when implied volatility is high?

When implied volatility is high that can signal that a large price swing is ahead, but it won’t tell you which way the swing will move. Similarly, low implied volatility can be a sign that a security’s price is set to remain relatively stable, without any rapid up or down movements.

What are the indicators used to track the price of a stock?

When trading stocks or stock options, there are certain indicators you may use to track price momentum. Implied volatility, which measures how likely a security’s price is to change, can be useful for determining whether the market is set for bearish or bullish movements. It can also be important when pricing options contracts.

Is implied volatility accurate?

What’s important to remember is that implied volatility is not an accurate forecasting tool for determining which direction a stock’s price will move. You also need to be aware of how certain events may trigger an increase or decrease in volatility surrounding a particular security. For example, the release of a quarterly earnings report or ...

Does supply and demand affect implied volatility?

Other technical indicators. In terms of supply and demand, both can impact implied volatility so it’s important to be aware of how they’re trending when investing in a particular stock or option. Higher demand can lead to higher prices, which can trigger higher implied volatility and send option premiums higher.

Can you use implied volatility to trade options?

Using Implied Volatility for Options Trading. Implied volatility is not a magic crystal ball, though it can give you some insight into how the market as a whole views a particular security. When using implied volatility to trade stocks or options, there are other things to consider as well, including: Supply and demand balance.

How is implied volatility calculated?

It is calculated through a formula using several variables in market and stock price.

Why use implied volatility?

Investors can use implied volatility to help judge market sentiment of a company stock, but it doesn't always take into account certain market factors. Because implied volatility considers historical data and certain market conditions, it doesn't forecast larger market swings based on investor emotions.

What is volatility in stocks?

Volatility is a measurement of how much a company's stock price rises and falls over time. Stocks with high volatility see relatively large spikes and dips in their prices, and low-volatility stocks show more consistent gains and losses.

How long do you have to know when an option expires?

When calculating for options trading, investors need the number of days until the option expires.

Can volatility be realized?

Once volatility is no longer "implied" -- it becomes "realized" -- an investor can look at historical volatility. Over a given period, a security's movement regarding its price offers a comparison from its historical volatility to its implied volatility. This comparison may help investors make investing decisions.

The Black-Scholes Formula

- The Black-Scholes model, also called the Black-Scholes-Merton model, was developed by three economists—Fischer Black, Myron Scholes, and Robert Merton in 1973.1 It is a mathematical model that projects the pricing variation over time of financial instruments, such as stocks, futur…

The Iterative Search

- Suppose that the value of an at-the-money call option for Walgreens Boots Alliance, Inc. (WBA) is $3.23 when the stock price is $83.11, the strike price is $80, the risk-free rate is 0.25%, and the time to expirationis one day. Implied volatility can be calculated using the Black-Scholes model, given the parameters above, by entering different values of implied volatility into the option prici…

Historical Volatility

- Historical volatility, unlike implied volatility, refers to realized volatilityover a given period and looks back at past movements in price. One way to use implied volatility is to compare it with historical volatility. From the example above, if the volatility in WBA is 23.6%, we look back over the past 30 days and observe that the historical volatilityis calculated to be 23.5%, which is a mo…

The Bottom Line

- The Black-Scholes formula has been proven to result in prices very close to the observed market prices. And, as we've seen, the formula provides an important basis for calculating other inputs, such as implied volatility. While this makes the formula quite valuable to traders, it does require complex mathematics. Fortunately, traders and investors who use it do not need to do these cal…