Where do you find quick ratio in financial statements?

Publicly traded companies generally report the quick ratio figure under the “Liquidity/Financial Health” heading in the “Key Ratios” section of their quarterly reports. Another commonly reported ratio is the current ratio, which includes all current assets in its calculation including inventory.

What is the quick ratio?

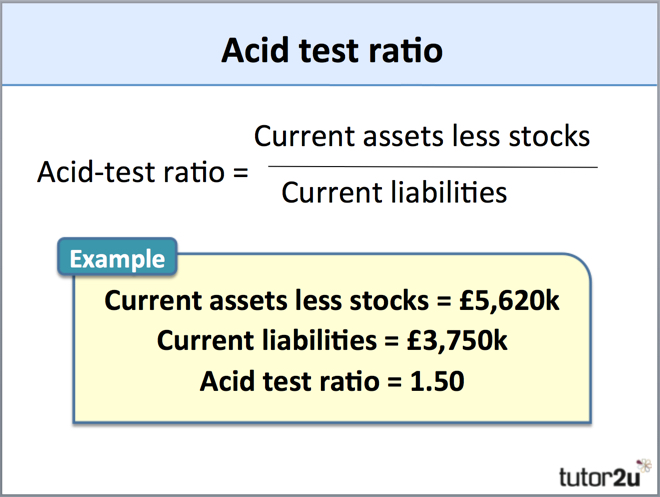

The Quick Ratio, also known as the Acid-test or liquidity ratio, measures the ability of a business to pay its short-term liabilities by having assets that are readily convertible into cash. These assets are, namely, cash, marketable securities and accounts receivable.

How do you increase quick ratio in business?

Businesses should always work to keep their quick ratio managed properly. Three of the most common ways to improve the quick ratio are: Increase sales & inventory turnover: Discounting, increased marketing, and incentivizing sales staff can all be used to increase sales, which subsequently will increase the turnover of inventory.

How do you calculate quick ratio in Excel?

Calculate the Quick Ratio. Locate each of the formula components on a company's balance sheet in the current assets and current liabilities sections. Plug the corresponding balance into the equation, and perform the calculation. While calculating the quick ratio, double-check the constituents you're using in the formula.

How do you find the quick ratio?

The quick ratio formula is:Quick ratio = quick assets / current liabilities.Quick assets = cash & cash equivalents + marketable securities + accounts receivable.Quick assets = current assets – inventory – prepaid expenses.Quick ratio = quick assets / current liabilities. = 165,000/137,500. ... Quick ratio =

Where can I find quick assets?

These are found on the balance sheet of the Company, and it is the sum of the following list of quick assets:Cash.Marketable securities. Commercial Paper, Treasury notes, and other money market instruments are included in it. ... Accounts receivable. ... Prepaid expenses. ... Short-term investments.

How do you find the ratio on a balance sheet?

Your current ratio should ideally be above 1:1.Current Ratio = Current Assets / Current Liabilities.Quick Ratio = (Current Assets – Current Inventory) / Current Liabilities.Working Capital = Current Assets – Current Liabilities.Debt-to-equity Ratio = Total Liabilities / Total Shareholder Equity.More items...•

What is quick ratio in balance sheet?

The quick ratio measures a company's capacity to pay its current liabilities without needing to sell its inventory or obtain additional financing. The quick ratio is considered a more conservative measure than the current ratio, which includes all current assets as coverage for current liabilities.

How do I calculate quick ratio in Excel?

0:000:24Calculating Quick Ratio in Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipOpen your balance sheet subtract inventory from total current assets and divide. The result with aMoreOpen your balance sheet subtract inventory from total current assets and divide. The result with a total of current liabilities.

What is a good quick ratio?

A good quick ratio is any number greater than 1.0. If your business has a quick ratio of 1.0 or greater, that typically means your business is healthy and can pay its liabilities. The greater the number, the better off your business is.

What are the 3 types of ratios?

The three main categories of ratios include profitability, leverage and liquidity ratios.

What is the formula for a ratio?

FAQs on Ratio Formula Write it in the form p:q = p/q. The sum of 'p' and 'q' would give the total quantities for the two objects. Simplify the ratios of the objects further, if possible. The simplified form of ratio is the final result.

The Quick Ratio Formula

Quick Ratio = [Cash & equivalents + marketable securities + accounts receivable] / Current liabilities

Download the Free Template

Enter your name and email in the form below and download the free template now!

Quick Ratio Template

Download the free Excel template now to advance your finance knowledge!

The Quick Ratio In Practice

The quick ratio is the barometer of a company’s capability and inability to pay its current obligations. Investors, suppliers, and lenders are more interested to know if a business has more than enough cash to pay its short-term liabilities rather than when it does not.

Quick Ratio vs Current Ratio

The quick ratio is different from the current ratio, Finance CFI's Finance Articles are designed as self-study guides to learn important finance concepts online at your own pace.

Additional Resources

Thank you for reading this guide to understanding the Acid Test as a measure of a company’s liquidity.

The Importance of Quick ratio

This ratio is one of the major tools for decision-making. It previews the ability of the company to make settlement its quick liabilities in a very short notice period.

Analysis of Quick Ratio

The following are the illustration through which calculation and interpretation of the quick ratio provided.

Microsoft Example

As noted from the below graph, the Cash Ratio Cash Ratio Cash Ratio is calculated by dividing the total cash and the cash equivalents of the company by total current liabilities. It indicates how quickly a business can pay off its short term liabilities using the non-current assets. read more of Microsoft is a low 0.110x.

Conclusion

As we note here that current assets may contain large amounts of inventory, and prepaid expenses Prepaid Expenses Prepaid expenses are expenses for which the company paid in advance in an accounting period but which were not used in the same accounting period and have yet to be recorded in the company's books of accounts.

What Is the Quick Ratio?

The quick ratio is an indicator of a company’s short-term liquidity position and measures a company’s ability to meet its short-term obligations with its most liquid assets.

Understanding the Quick Ratio

The quick ratio measures the dollar amount of liquid assets available against the dollar amount of current liabilities of a company.

Customer Payment Impact on the Quick Ratio

A business may have a large amount of money as accounts receivable, which may bump up the quick ratio.

Example of Quick Ratio

Publicly traded companies generally report the quick ratio figure under the “Liquidity/Financial Health” heading in the “Key Ratios” section of their quarterly reports.

Quick Ratio vs. Current Ratio

The quick ratio is more conservative than the current ratio because it excludes inventory and other current assets, which are generally more difficult to turn into cash. The quick ratio considers only assets that can be converted to cash in a short period of time. The current ratio, on the other hand, considers inventory and prepaid expense assets.

Why Is it Called the "Quick" Ratio?

The quick ratio looks at only the most liquid assets that a company has available to service short-term debts and obligations. Liquid assets are those that can quickly and easily be converted into cash in order to pay those bills.

What Assets Are Considered the Most "Quick"?

The quickest or most liquid assets available to a company are cash and cash equivalents (such as money market investments), followed by marketable securities that can be sold in the market at a moment's notice through the firm's broker.

How the Quick Ratio Works

The quick ratio is a liquidity ratio, like the current ratio and cash ratio, used for measuring a company’s short-term financial health by comparing its current assets to current liabilities.

Quick Ratio Formula

The quick ratio formula takes a company’s current assets, excluding inventory, and divides them by its current liabilities. Current assets include liquid assets like cash and cash equivalents while current liabilities include short-term liabilities like accrued compensation and payroll taxes.

How to Interpret Quick Ratio Results

In general, the higher the quick ratio is, the higher the likelihood that a company will be able to cover its short-term liabilities.

Why the Quick Ratio Is Important

The quick ratio provides a conservative overview of a company’s financial well-being and helps investors, lenders, and company stakeholders to quickly determine its ability to meet short-term obligations.

Examples of Other Liquidity Ratios

Using multiple ratios to understand the current standing of a business is always advised. Small business owners should consider current and cash ratios as well because both of them are popular alternatives and work in conjunction with the quick ratio.

Pros and Cons of Using the Quick Ratio

The quick ratio is one of several liquidity ratios and just one way of measuring a company’s short-term financial health. Among its positives are its simplicity as well as its conservative approach. Among its negatives, it cannot provide accurate information regarding cash flow timing, and it also may not properly account for A/R values.

How to Improve Quick Ratio

A company with a higher quick ratio is considered to be more financially stable than those with a lower quick ratio. A quick ratio greater than one is considered “healthy.” Having a healthy quick ratio is important for companies themselves as well as their creditors, lenders, investors, capitalists, and other stakeholders.

What Is the Quick Ratio?

What if a company needs quick access to more cash than it has on hand to meet financial obligations? Perhaps a hurricane knocked out power for several days, forcing the business to close its doors and lose sales, or maybe a customer is late making a large payment — but payroll still needs to be run, and invoices continue to flow in.

Quick Ratio Explained

The quick ratio represents the extent to which a business can pay its short-term obligations with its most liquid assets. In other words, it measures the proportion of a business’s current liabilities that it can meet with cash and assets that can be readily converted to cash.

Why Is Quick Ratio Important?

The quick ratio is widely used by lenders and investors to gauge whether a company is a good bet for financing or investment. Potential creditors want to know whether they will get their money back if a business runs into problems, and investors want to ensure a firm can weather financial storms.

What Is Included in the Quick Ratio?

The quick ratio is the value of a business’s “quick” assets divided by its current liabilities. Quick assets include cash and assets that can be converted to cash in a short time, which usually means within 90 days. These assets include marketable securities, such as stocks or bonds that the company can sell on regulated exchanges.

Quick Ratio vs Current Ratio

The quick ratio is one way to measure business liquidity. Another common method is the current ratio. Whereas the quick ratio only includes a company’s most highly liquid assets, like cash, the current ratio factors in all of a company’s current assets — including those that may not be as easy to convert into cash, such as inventory.

Quick Ratio Analysis

The quick ratio measures a company’s ability to raise cash quickly when needed. For investors and lenders, it’s a useful indicator of a company’s resilience. For business managers, it’s one of a suite of liquidity measures they can use to guide business decisions, often with help from their accounting partner.

3 Steps to Calculating Quick Ratio

Financial managers can calculate their company’s quick ratio by identifying the relevant assets and liabilities in the company’s accounting system. Investors and lenders can calculate a company’s quick ratio from its balance sheet. Here’s how:

Profitability Ratios

Profitability is a key aspect to analyze when considering an investment in a company. This is because high revenues alone don't necessarily translate into high earnings or high dividends .

Liquidity Ratios

Liquidity measures how quickly a company can repay its debts. It also shows how well company assets cover expenses.

Solvency Ratios

Solvency ratios, also known as leverage ratios, are used by investors to get a picture of how well a company can deal with its long-term financial obligations. As you might expect, a company weighed down with debt is probably a less favorable investment than one with a minimal amount of debt on its books.

Valuation Ratios

Valuation ratios are some of the most commonly quoted and easily used ratios for analyzing the attractiveness of an investment in a company. These measures primarily integrate a company’s publicly traded stock price to give investors an understanding of how inexpensive or expensive the company is in the market.

The Bottom Line

Ratios are comparison points for companies. They evaluate stocks within an industry. Likewise, they measure a company today against its historical numbers.