What happened to Aphria stock after the Tilray merger?

Apr 14, 2021 · By Faizan Farooque Apr 14, 2021, 5:21 am EST. April 14, 2021. Aphria (NASDAQ: APHA) stockholders will vote April 16 on the mega-merger with its longtime Canadian cannabis-market competitor, Tilray...

Will Tilray stock continue to trade on the NASDAQ?

Apr 26, 2021 · Each Aphria share will become 0.8381 shares of Tilray stock, on top of that company’s existing share base. Against pro forma revenue of $693 million, what will be Tilray looks cheap by sector ...

Is Aphria delisted from the Stock Exchange?

May 03, 2021 · In reality, this is Aphria taking over Tilray. In an all-stock deal agreed to last December, each Aphria share held as of April 30 was swapped for 0.8381 of a Tilray share. Aphria's CEO Irwin Simon...

How much of Tilray will APHA get in the deal?

May 03, 2021 · The company will continue to trade on the Nasdaq Global Select Exchange under the symbol "TLRY" and will commence trading on the Toronto Stock Exchange under the symbol "TLRY" on May 5. Under the...

Is Aurora cheaper than Aphria?

But Aurora Cannabis (NYSE: ACB) is cheaper on that basis — and, again, not all of Aphria’s revenue is created equal. Per the company’s earnings releases, low-margin distribution revenue has totaled nearly $290 million over the past four quarters. That’s 40% of the pro forma total for both companies.

Is Aphria merged with Tilray?

Aphria’s pending merger with Tilray (NASDAQ: TLRY) admittedly makes some sense. Canadian operators desperately need consolidation amid an ongoing supply glut. The two companies see $79 million in cost synergies achievable within two years.

Is Aphria coming off an ugly earnings report?

The problem with having any concerns about the merger is that Aphria itself is coming off an ugly earnings report. Yet Aphria is the business that needs to do more of the heavy lifting post-merger.

Does Aphria own Sweetwater Brewing?

That business has gross margins of just 13% — and not all of the revenue comes from cannabis. Second, Aphria also now owns Sweetwater Brewing. That firm generated revenue of $67 million in 2019.

Latest Stocks Videos

In The Money: Groundhog Day: Mega-Cap Tech Stocks Out From the Shadows? Feb 02, 2022

TipRanks

TipRanks is the most comprehensive data set of sell side analysts and hedge fund managers. TipRanks' multi-award winning platform ranks financial experts based on measured performance and the accuracy of their predictions so investors know who to trust when making investment decisions.

When will tilray stock start trading?

dollars. In addition, Tilray currently expects to begin trading on the TSX on May 5, 2021, which will trade in Canadian dollars.

How to calculate tilray shares?

Step 1: Calculate the number of Tilray Shares that you will receive. Calculate the number of Tilray shares that you will receive on closing by multiplying the number of Aphria Shares that you own by 0.8381 (which is the Exchange Ratio). Step 2: Calculate the value of the Tilray Shares that you will receive in US$.

Is Aphria taxable in Canada?

Aphria Shareholders who are non -residents of Canada for purposes of the Tax Act and that do not hold their Aphria Shares as “taxable Canadian property” will generally not be subject to tax under the Tax Act on the exchange of their Aphria Shares for Tilray Shares under the arrangement.

Do you own Aphria shares?

You will no longer own any Aphria shares, but instead will own Tilray shares. As an example, if you owned 1,000 Aphria shares on the closing day of the transaction, after the closing, you will own 838 Tilray Shares (since no fractional Tilray Shares are issued). Tilray Stockholders.

Does Aphria recognize gain or loss?

Aphria Shareholders should not recognize gain or loss as a result of the arrangement for U.S. tax purposes. Each holder’s aggregate tax basis in Tilray Shares received should equal the aggregate tax basis of the holder’s Aphria Shares surrendered in the arrangement, as applicable.

What is the name of the company that merged with Aphria?

After Aphria and Tilray merge, the combined entity will be called Tilray and the shares will continue to trade on Nasdaq under the ticker TLRY. Yet the terms of the deal look more advantageous to Aphria. First of all, the company’s CEO and chairman, Irwin Simon, will remain at the helm.

How many directors does Aphria have?

Aphria will also have seven directors and Tilray will have two. Next, the economics of the deal are more favorable for APHA stock. The company will receive 0.8381 shares of Tilray and get about 62% of the ownership of the new entity. Interestingly enough, based on these terms, APHA stock is trading at a discount.

Why is Aphria merger important?

Having a cost advantage is extremely important especially as markets get saturated. This is why Aphria’s merger with Tilray is so critical. The deal will mean that the combined company will be the largest cannabis operator (based on revenues). There will also be significant cost reductions.

Is Aphria a distributor?

To this end, Aphria has its SweetWater Brewing segment, which is a craft beer manufacturer and distributor. The division has a presence in 27 states. And then Tilray has its U.S. Hemp and Wellness platform, which has distribution in 17,000 stores and a line of BD products.

Why was the merger with Tilray delayed?

The merger had got delayed due to the delay in approval from Tilray shareholders. However, the company lowered the quorum requirement for the shareholder meeting and it was eventually approved overwhelmingly towards the end of April.

What is the ticker symbol for Tilray?

After the merger completion, the new entity trades under Tilray’s ticker symbol, “TLRY” on both the US and Canadian stock exchanges. In a press release, Tilray said that the combined entity had proforma revenue of $685 million in the last year.

Is Tilray a good buy?

Is Tilray stock a buy? Tilray stock has fallen sharply from the peaks. However, it looks a good buy now given the strong fundamentals of the new entity. Cannabis stocks have been on a fire over the last few trading sessions amid renewed hopes of marijuana legalization. Even Amazon has supported the federal legalization of marijuana.

Is Aphria a Tilray?

Aphria has stopped trading and all Aphria shares are now converted to Tilray shares. The merger had got delayed due to the delay in approval from Tilray shareholders.

How much money will Aphria/Tilray save?

By combining forces, the combined Aphria/Tilray should be able to save at least $75 million in annual operating costs. This, in turn, should trim the company’s overall operating loss dramatically. Meanwhile, by uniting, the overall company will be by far the largest marijuana producer in Canada.

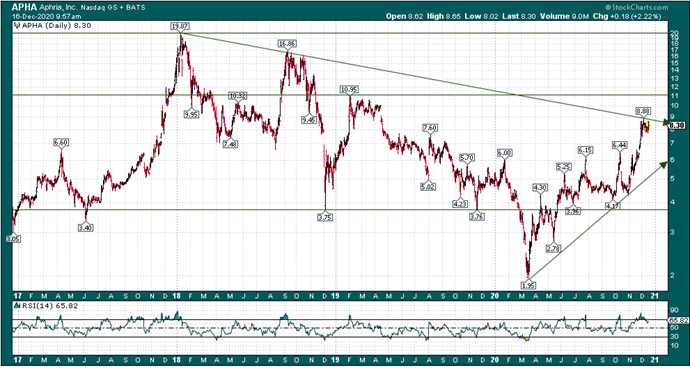

What is the price of APHA in 2021?

Now APHA stock is at $14.41, as of the morning of April 20, 2021. This is part of a broader trend for the marijuana industry. In the Canadian market anyway, the initial gold rush has ended. We’ve moved into the maturation stage.

Does APHA stock trade as individual stock?

Once the merger is done, APHA stock will no longer trade as an individual listing. Rather, current Aphria shareholders will see their ownership exchanged for new shares of TLRY stock. Tilray will give Aphria owners .8381 shares of Tilray for every share of Aphria that they owned previously.

Is Aphria going to be taken over?

While Aphria isn’t being taken over at its all-time valuation, this is still a great price for the company. For people that bought shares in 2019 or 2020, most have sizable gains based on this exit price. Do remember, however, that Aphria shareholders will be receiving Tilray stock, rather than cash.