What is the American Stock Exchange?

AMERICAN STOCK EXCHANGE Historical Timeline 1865 Following the Civil War, stocks in small industrial companies, such as iron and steel, textiles and chemicals, are first sold by curbstone brokers. 1904 Emanuel S. Mendels begins to organize the curb market to promote sound and ethical dealings.

When did the first Stock Exchange Open in America?

NYSE welcomed the historic American Stock Exchange into its group of exchanges in 2008. This union significantly enhanced NYSE's scale in U.S. options, exchange traded funds (ETFs), closed-end funds, structured products and cash equities. In addition, the combined company:

When did the American Stock Exchange become independent?

Apr 17, 2007 · The New York Stock Exchange . The first stock exchange in London was officially formed in 1773, a scant 19 years before the New York Stock Exchange.

When did the New York Stock Exchange become a publicly traded company?

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City.It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately US$ 169 billion in 2013.

Who was the chairman of the New York Stock Exchange?

As chairman, Kolton oversaw the introduction of options trading. Kolton opposed the idea of a merger with the New York Stock Exchange while he headed the exchange saying that "two independent, viable exchanges are much more likely to be responsive to new pressures and public needs than a single institution".

When did Euronext acquire Amex?

Until 1953, it was known as the New York Curb Exchange. NYSE Euronext acquired AMEX on October 1, 2008, with AMEX integrated with the Alternext European small-cap exchange and renamed the NYSE Alternext U.S.

What is the NYSE?

Website. NYSE American. NYSE American, formerly known as the American Stock Exchange ( AMEX ), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange.

What was the curb exchange?

The curb exchange was for years at odds with the New York Stock Exchange (NYSE), or "Big Board", operating several buildings away. Explained the New York Times in 1910, the Big Board looked at the curb as "a trading place for 'cats and dogs.'".

When did the NYSE stop listing?

On April 1, 1910, however, when the NYSE abolished its unlisted department, the NYSE stocks "made homeless by the abolition" were "refused domicile" by the curb brokers on Broad Street until they had complied with the "Curb list" of requirements.

Who invented the electronic trading platform?

In 1977, Thomas Peterffy purchased a seat on the American Stock Exchange and played a role in developing Interactive Brokers, an electronic trading platform. Peterffy created a major stir among traders by introducing handheld computers onto the trading floor in the early 1980s.

When did the curbstone move to Broad Street?

The text reads: "On June 27, 1921, the curbstone brokers moved from their outdoor Market on Broad Street to establish on this site the indoor securities market that became the American Stock Exchange."

When was the AMEX invented?

The AMEX dates back to the late 18th century when the American trading market was still developing . At that time, without a formalized exchange, stockbrokers would meet in coffeehouses and on the street to trade securities. For this reason, the AMEX became known at one time as the New York Curb Exchange. 3

What is the AMEX?

What Is the American Stock Exchange (AMEX)? The American Stock Exchange (AMEX) was once the third-largest stock exchange in the United States, as measured by trading volume. The exchange, at its height, handled about 10% of all securities traded in the U.S. Today, the AMEX is known as the NYSE American. In 2008, NYSE Euronext acquired the AMEX.

When did Euronext acquire Amex?

NYSE Euronext acquired the AMEX in 2008 and today it is known as the NYSE American. The majority of trading on the NYSE American is in small cap stocks. The NYSE American uses market makers to ensure liquidity and an orderly marketplace for its listed securities.

What is an ETF?

The ETF, now a popular investment, is a type of security that tracks an index or a basket of assets. They are much like mutual funds but differ in that they trade like stocks on an exchange. 2 . Over time, the AMEX gained the reputation of listing companies that could not meet the strict requirements of the NYSE.

What is an AMEX option?

For example, it launched its options market in 1975. Options are a type of derivative security. They are contracts that grant the holder the right to buy or sell an asset at a set price on or before a certain date, without the obligation to do so. When the AMEX launched its options market, it also distributed educational materials to help educate investors as to the potential benefits and risks. 2

Who is James Chen?

American Stock Exchange (AMEX) James Chen, CMT, is the former director of investing and trading content at Investopedia. He is an expert trader, investment adviser, and global market strategist. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years.

Is the NYSE American a blue chip company?

Over the years, the NYSE American has become an attractive listing place for younger, entrepreneurial companies, some of whom are in the early stages of their growth and certainly not as well-known as blue chip companies. Compared to the NYSE and Nasdaq, the NYSE American trades at much smaller volumes.

When was the first stock exchange?

The first stock exchange in London was officially formed in 1773, a scant 19 years before the New York Stock Exchange. Whereas the London Stock Exchange (LSE) was handcuffed by the law restricting shares, the New York Stock Exchange has dealt in the trading of stocks, for better or worse, since its inception. The NYSE wasn't the first stock exchange in the U.S., however. That honor goes to the Philadelphia Stock Exchange, but the NYSE quickly became the most powerful.

Where did the New York Stock Exchange originate?

Formed by brokers under the spreading boughs of a buttonwood tree, the New York Stock Exchange made its home on Wall Street. The exchange's location, more than anything else, led to the dominance that the NYSE quickly attained.

Why did East India have no stock exchange?

Because the shares in the various East India companies were issued on paper, investors could sell the papers to other investors. Unfortunately, there was no stock exchange in existence, so the investor would have to track down a broker to carry out a trade. In England, most brokers and investors did their business in the various coffee shops around London. Debt issues and shares for sale were written up and posted on the shops' doors or mailed as a newsletter.

What happened in the 1600s?

In the 1600s, the emergence of various East India companies that issued stock led to a financial boom, which was followed by a bust when it was revealed some companies conducted very little actual business.

What did moneylenders do in Europe?

The moneylenders of Europe filled important gaps left by the larger banks. Moneylenders traded debts between each other; a lender looking to unload a high-risk, high-interest loan might exchange it for a different loan with another lender. These lenders also bought government debt issues. As the natural evolution of their business continued, the lenders began to sell debt issues to the first individual investors. The Venetians were the leaders in the field and the first to start trading securities from other governments .

What is the Nasdaq?

The New Kid on the Block. The Nasdaq was the brainchild of the National Association of Securities Dealers (NASD )—now called the Financial Industry Regulatory Authority (FINRA). From its inception, it has been a different type of stock exchange. It does not inhabit a physical space, as with 11 Wall Street.

What were the advantages of the British East India Company?

The British East India Company had one of the biggest competitive advantages in financial history —a government-backed monopoly. When the investors began to receive huge dividends and sell their shares for fortunes, other investors were hungry for a piece of the action.

What was the first securities exchange in New York?

The earliest recorded organization of securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, securities exchange had been intermediated by the auctioneers, who also conducted more mundane auctions of commodities such as wheat and tobacco. On May 17, 1792, twenty four brokers signed the Buttonwood Agreement, which set a floor commission rate charged to clients and bound the signers to give preference to the other signers in securities sales. The earliest securities traded were mostly governmental securities such as War Bonds from the Revolutionary War and First Bank of the United States stock, although Bank of New York stock was a non-governmental security traded in the early days. The Bank of North America, along with the First Bank of the United States and the Bank of New York, were the first shares traded on the New York Stock Exchange.

When did the New York Stock Exchange change its name?

In 1863, the name changed to the New York Stock Exchange. In 1865, the New York Gold Exchange was acquired by the NYSE. In 1867, stock tickers were first introduced. In 1885, the 400 NYSE members in the Consolidated Stock Exchange withdraw from Consolidated over disagreements on exchange trade areas.

What was the original signal for the NYSE?

The original signal was a gavel (which is still in use today along with the bell), but during the late 1800s, the NYSE decided to switch the gavel for a gong to signal the day's beginning and end. After the NYSE changed to its present location at 18 Broad Street in 1903, the gong was switched to the bell format that is currently being used.

When did the NYSE merge with the Archipelago?

The floor of the New York Stock Exchange in 1908. On April 21, 2005, the NYSE announced its plans to merge with Archipelago in a deal intended to reorganize the NYSE as a publicly traded company. NYSE's governing board voted to merge with rival Archipelago on December 6, 2005, and became a for-profit, public company.

When did the Dow Jones Industrial Average drop?

NYSE's stock exchange traders floor before the introduction of electronic readouts and computer screens. On October 19, 1987, the Dow Jones Industrial Average (DJIA) dropped 508 points, a 22.6% loss in a single day, the second-biggest one-day drop the exchange had experienced.

When will the NYSE reopen?

The NYSE reopened on May 26, 2020.

When did the NYSE start?

In 1966, NYSE begins a composite index of all listed common stocks. This is referred to as the "Common Stock Index" and is transmitted daily. The starting point of the index is 50. It is later renamed the NYSE Composite Index. In 1967, Muriel Siebert becomes the first female member of the New York Stock Exchange.

Where was the first stock exchange?

The first modern stock trading was created in Amsterdam when the Dutch East India Company was the first publicly traded company. To raise capital, the company decided to sell stock and pay dividends of the shares to investors. Then in 1611, the Amsterdam stock exchange was created.

When did the stock market start?

Although the first stock market began in Amsterdam in 1611, America didn’t get into the stock market game until the late 1700s. Although the Buttonwood traders are considered the inventors of the largest stock exchange in America, the Philadelphia Stock Exchange was America’s first stock exchange.

What is the stock market?

A stock exchange or stock market is a physical or digital place where investors can buy and sell stock, or shares, in publicly traded companies. The price of each share is driven by supply and demand. The more people want to buy shares, the higher the price goes. Less demand, and the price of a share drops.

What happened in 1929?

In 1929, the market dropped 11% in an event known as Black Thursday. The drop in the market causes investors to panic, and it took all of the 1930s to recover from the crash. This period is known as the Great Depression.

How many stages are there in the stock market?

There are typically four stages to a market cycle: accumulation, mark-up, distribution and the mark-down phase.

What are the stages of the market cycle?

There are typically four stages to a market cycle: accumulation, mark-up, distribution and the mark-down phase. The accumulation phase happens when a market is at a low and buyers begin to snap up stocks at discounted prices.

When did the NASDAQ start trading?

In 1971 , trading began on another stock exchange in America, the National Association of Securities Dealers Automated Quotations or otherwise known as the NASDAQ. In 1992, it joined forces with the International Stock Exchange based in London. This linkage became the first intercontinental securities market.

Overview

History

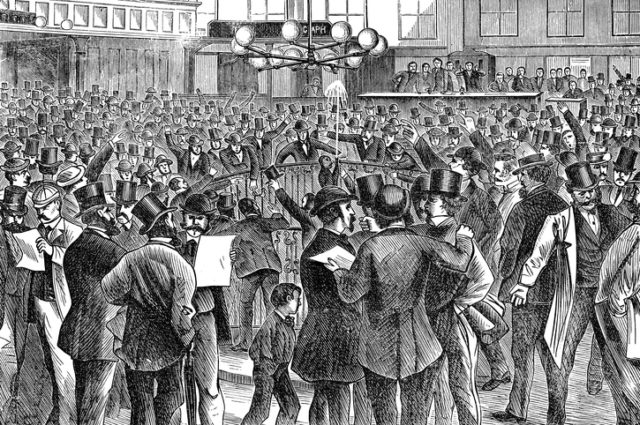

The exchange grew out of the loosely organized curb market of curbstone brokers on Broad Street in Manhattan. Efforts to organize and standardize the market started early in the 20th century under Emanuel S. Mendels and Carl H. Pforzheimer. The curb brokers had been kicked out of the Mills Building front by 1907, and had moved to the pavement outside the Blair Buildingwhere cabbies …

Products

• Intellidex

• Stocks

• Options

• Exchange-traded funds (ETFs)

• Structured Products

Management

Past presidents of the American Stock Exchange include:

• John L. McCormack (1911–1914)

• Edward R. McCormick (1914–1923)

• John W. Curtis (1923–1925)

Gallery

• The text reads: "On June 27, 1921, the curbstone brokers moved from their outdoor Market on Broad Street to establish on this site the indoor securities market that became the American Stock Exchange."

• 2004: Vice Adm. Gary Roughead, right, rings the opening bell at the American Stock Exchange, during the 17th Annual Fleet Week in New York

See also

• NYSE Arca Major Market Index

• Microcap stock

• Economy of New York City

• List of stock exchanges in the Americas

Further reading

• Sobel, Robert (1970). The Curbstone Brokers: The Origins of the American Stock Exchange. Washington, D.C.: BeardBooks. ISBN 1-893122-65-4.

• Sobel, Robert (1972). AMEX: A History of the American Stock Exchange. Washington, D.C.: BeardBooks. ISBN 1-893122-48-4.

External links

• NYSE American

What Is The American Stock Exchange (AMEX)?

Understanding The American Stock Exchange

- The AMEX developed a reputation over time as an exchange that introduced and traded new products and asset classes. For example, it launched its options market in 1975. Options are a type of derivative security. They are contracts that grant the holder the right to buy or sell an asset at a set price on or before a certain date, without the obligation to do so. When the AMEX launch…

History of The American Stock Exchange

- The AMEX dates back to the late 18th century when the American trading market was still developing. At that time, without a formalized exchange, stockbrokers would meet in coffeehouses and on the street to trade securities. For this reason, the AMEX became known at one time as the New York Curb Exchange.3 The traders who originally met in the stre...

Special Considerations

- Over the years, the NYSE American has become an attractive listing place for younger, entrepreneurial companies, some of whom are in the early stages of their growth and certainly not as well-known as blue chip companies. Compared to the NYSE and Nasdaq, the NYSE American trades at much smaller volumes. Because of these factors, there could be concerns that investo…