What does it mean when a company repurchase stock?

Updated: 12/07/2021 A stock repurchase is when a publicly-traded company uses its own cash to buy back shares of its own stock to get them out of the open market. When a company becomes a publicly-traded company, it issue shares of stock that individuals or institutional investors can purchase.

What are the drawbacks of a share repurchase?

Drawbacks of a Share Repurchase. A criticism of buybacks is that they are often ill-timed. A company will buy back shares when it has plenty of cash or during a period of financial health for the company and the stock market.

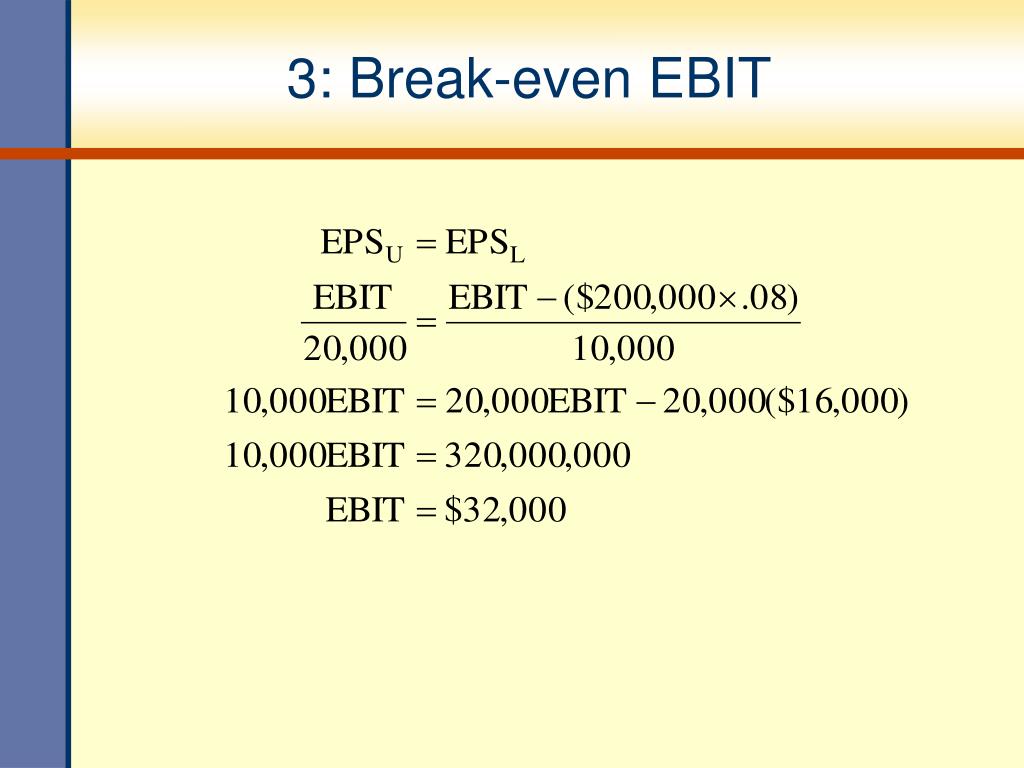

What happens to EPS when a company repurchase shares?

The share repurchase reduces the number of existing shares, making each worth a greater percentage of the corporation. The stock’s EPS increases while the price-to-earnings ratio (P/E) decreases or the stock price increases.

How much of its stock will be repurchased in open market purchases?

Additionally, it plans to repurchase $75M of its Class A and Class B stock in open market purchases over the next 12 to 18 months.

When should a company repurchase shares?

A company may choose to buy back outstanding shares for a number of reasons. Repurchasing outstanding shares can help a business reduce its cost of capital, benefit from temporary undervaluation of the stock, consolidate ownership, inflate important financial metrics, or free up profits to pay executive bonuses.

Why would a company repurchase a stock?

Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall.

Is it good to repurchase stock?

Share buybacks can create value for investors in a few ways: Repurchases return cash to shareholders who want to exit the investment. With a buyback, the company can increase earnings per share, all else equal. The same earnings pie cut into fewer slices is worth a greater share of the earnings.

What happens when you repurchase stock?

A stock buyback typically means that the price of the remaining outstanding shares increases. This is simple supply-and-demand economics: there are fewer outstanding shares, but the value of the company has not changed, therefore each share is worth more, so the price goes up.

What are some advantages and disadvantages of stock repurchases?

ADVANTAGES AND DISADVANTAGES OF STOCK REPURCHASEEnhanced dividends and E.P.S. ... Enhanced Share Price. ... Capital structure. ... Employee incentive schemes. ... 5 Reduced take over threat. ... High price. ... Market Signaling. ... Loss of investment income.

What are the most important determinants of stock repurchases?

Empirically, it categorizes such determinants by firm size, stage of the product life cycle, membership in the technology sector, ownership of overseas cash reserves, and institutional ownership. Share repurchases were used to boost earnings per share temporarily.

Do share repurchases create value?

Contrary to the common wisdom, buybacks don't create value by increasing earnings per share. The company has, after all, spent cash to purchase those shares, and investors will adjust their valuations to reflect the reductions in both cash and shares, thereby canceling out any earnings-per-share effect.

Does Amazon buy back stock?

Amazon also revealed that its board of directors authorized a stock buyback of up to $10 billion.

What are stock buybacks and why are they bad?

When done with borrowing, share buybacks can hurt credit ratings, since they drain cash reserves that can serve as a cushion if times get tough. One of the reasons given for taking on increased debt to fund a share buyback is that it is more efficient because interest on the debt is tax deductible, unlike dividends.

How do buybacks help shareholders?

Buybacks tend to boost share prices in the short-term, as the buying reduces the supply out outstanding shares and the buying itself bids the share higher in the market. Shareholders may view buybacks as a signal of corporate health and optimism from company managers that their shares are under-valued.

What is a stock repurchase?

Stock repurchase or stock buyback is the process of a company purchasing its own stock from the current holder. The company simply buys back the stock from the capital market base on the market price. Or they go to negotiate with the major holders and offer them a fixed price which is higher than the market.

Does a company's share price decrease after a buyback period?

The investors may believe that the company does not have any investment opportunity and they decide to buy back the share instead of using the cash to expand the business. It will lead to share price decrease after the buyback period.

What is a stock repurchase?

A stock repurchase is when a publicly-traded company uses its own cash to buy back shares of its own stock to get them out of the open market. When a company becomes a publicly-traded company, it issue shares of stock that individuals or institutional investors can purchase. Each share of that stock equals one little piece of ownership in that company, and, as a partial owner, whoever owns that stock has a claim on their ownership percentage of the profits generated by the company they partially own.

Why is it important to buy back stock?

A stock buyback is one thing that can be done with extra cash, and generally, it makes everyone happy. The stock price goes up, so investors are happy, and management is happy because it have more control and more wealth in stock.

Why Buy Back Shares?

The market value of the company is the dollar amount each share of that company's stock is worth multiplied by the total number of shares of stock owned, by either the company or its stakeholders. Sometimes, the company has extra cash it generates through operations, and management might feel like their shares are undervalued.

What is the financial metric used to determine the value of a stock?

An important financial metric that many investors use to identify the value of a share of stock is called earnings per share, or EPS. Earnings are equal to net income. The cash used to repurchase stock, pay a dividend, or use for some other reason can impact future earnings per share. Thus, how cash is used now might impact EPS in the future.

Why do shares go up?

Because there are fewer shares in the open market, the price of the shares goes up.

What are the considerations before utilizing extra cash?

In the real world, there are a number of important considerations before utilizing extra cash, such as shareholder expectations, internal vs. external uses of cash, market signals that are sent by either paying a dividend or buying back shares of stock, how any use would be reflected in certain metrics, and future needs of the company.

How much can management buy back?

So, perhaps it dedicates $10,000,000 to buying back shares of stock. Assuming the price stays at $50 per share, management could buy back 200,000 shares.

What does a stock repurchase mean?

As discussed earlier, and if company management acts in good faith, a stock repurchase typically signals to investors that the stock price is likely to increase due to some positive factor. However, keep in mind that the company’s management may only be trying to prevent a decline in the stock price. Thus, it is important to consider ...

Why do companies repurchase their shares?

For instance, a company may choose to repurchase shares to send a market signal that its stock price is likely to increase, to inflate financial metrics denominated by the number of shares outstanding (e.g., earnings per share or EPS.

What happens when a stock price drops?

When the stock price of a company declines below a number of support levels in a short period of time and does not show any sign of stopping, the company may choose to repurchase some shares in hopes that doing so will support the price of the stock and halt the downslide.

What is a share repurchase?

A share repurchase refers to the management of a public company. Private vs Public Company The main difference between a private vs public company is that the shares of a public company are traded on a stock exchange, while a private company's shares are not. buying back company shares that were previously sold to the public.

What happens when a company buys back shares?

When a company buys back shares, the total number of shares outstanding diminishes. It paves the way for a few different phenomena.

Why do companies want to see the stock price rise?

This is because of their fiduciary duty to increase shareholder value as much as possible and also because these individuals are likely partly compensated in stock.

How do companies return profits to shareholders?

There are two main ways in which a company returns profits to its shareholders – Cash Dividends and Share Buybacks. The reasons behind the strategic decision on dividend vs share buyback differ from company to company. Equity Value.

How do Stock Repurchases Work?

Unfortunately, they can’t go to their broker and buy the shares there; it is a bit more complicated than that. There are two ways that companies can execute stock repurchases.

What is stock repurchase?

In today’s market, stock repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as Warren Buffett and Jamie Dimon applaud these efforts.

How much stock has Brighthouse repurchased?

Through January 2020, Brighthouse Financial has repurchased approximately $570 million of its common stock.

How many shares of Apple stock were repurchased?

It states that Apple repurchased 70.4 million shares of its common stock for $20 billion, as well as 30.4 million shares under an accelerated repurchase agreement .

How much money will be spent on stock repurchases in 2019?

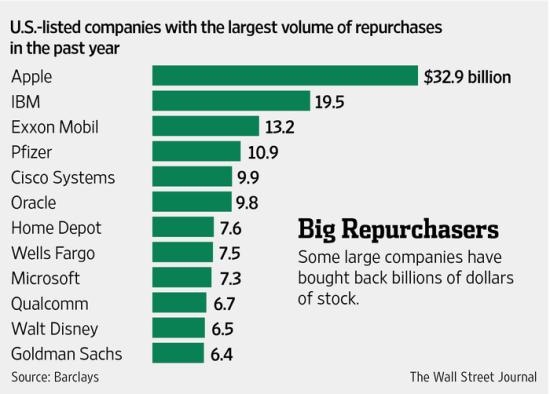

According to the Wall Street Journal, total spending on stock (or share) repurchases projects to reach $940 million in 2019.

Why do stocks reward repurchases?

The stock market will always reward share repurchases by increasing the shareholder’s value with an increase in the share price. However, the question investors need to ask, are the buybacks merely a way to prop up ratios and provide short-term relief to a struggling company.

Why do companies repurchase stock?

One of the pros that we have not discussed so far is that it allows a company to benefit from the undervaluation of shares. If the company is trading below their intrinsic value, and they conduct stock repurchases, this will unlock tremendous value for the shareholders as the stock price eventually rises toward fair value.