Is it finally time to get rid of GameStop stock?

Feb 02, 2021 · It was fun while it lasted, but it’s finally time to pull out. GAMESTOP STOCK PRICE IS CRASHING, AND IT’S TIME TO MOVE ON The story of middle-class gamers sticking it up on the big man on Wall ...

Is it advisable to pull out of the GameStop trend?

Aug 31, 2021 · Unless something dramatic has changed about the company’s fundamentals over the past quarter, there’s a decent chance the Sept. 8 …

How much money did GameStop lose in 2019?

Jul 10, 2017 · GameStop expects to enhance collectibles business approximately $650–$700 million during fiscal 2017 and anticipates becoming a $1 billion business by the end of fiscal 2019. In the second ...

What happened to GameStop's short sellers?

Jul 10, 2017 · T he year so far has turned out to be an eventful one for Retail-Consumer Electronic industry. Year to date, the industry has witnessed a sharp …

When should you pull out of a stock?

It really depends on a number of factors, such as the kind of stock, your risk tolerance, investment objectives, amount of investment capital, etc. If the stock is a speculative one and plunging because of a permanent change in its outlook, then it might be advisable to sell it.

Is GameStop still worth investing in?

GameStop is down 70% from record highs but remains a high-risk bet for investors given its negative profit margins and falling revenue.Jan 20, 2022

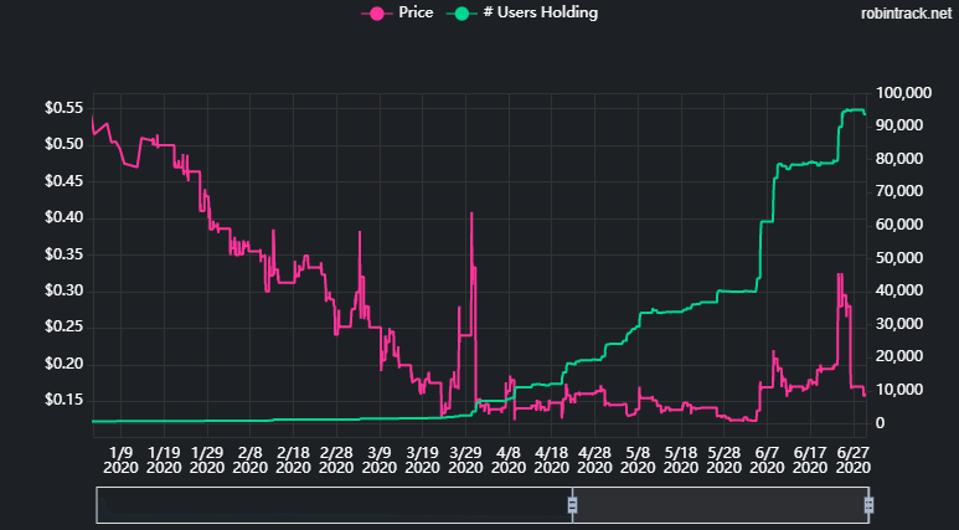

Is GME short squeeze over?

The dollar amount of shorted GME shares has greatly declined over the last year, however. GameStop's share price also went through a large drop in pricing. A short squeeze, one year after GME gained traction on WallStreetBets, is unlikely to happen.Feb 12, 2022

Will GameStop shares increase again?

The reasons for this second increase are not fully clear. At the close of trade on January 31, 2022, GameStop shares were trading at 107.54 U.S. dollars....CharacteristicShare price in U.S. dollars01/21/2022106.3601/20/2022102.6701/19/2022106.5701/18/2022108.919 more rows•Jan 31, 2022

Is GameStop still being shorted?

GameStop stock is still being heavily shorted. With GameStop becoming a technology company, its value has not only significantly gone up but it now has even more potential to keep driving its momentum. Retail investors have a strong conviction towards GameStop investment.

What does it mean when a stock is squeezed?

The term squeeze can be used to describe several situations that involve some sort of market pressure. In finance, the term is used to describe situations wherein short-sellers purchase stock to cover losses or when investors sell long positions to take capital gains off the table.

Can GME reach 1000?

So, can GME stock reach $1,000 per share. It's certainly a possibility given that GameStop's dark pool trading percentage is rather high, according to Stonk-O-Tracker data.

Is Melvin capital in trouble?

And the troubles didn't end with 2021. In just the first few weeks of 2022, Melvin Capital has seen a 17% drop. Struggling with compounding losses, Melvin Capital has now announced that it will create a new long-only fund. It's an attempt to regain the confidence of its investors.Feb 4, 2022

What happened Melvin capital?

At the worst point in January 2021, Melvin Capital Management was losing more than $1 billion a day as individual investors on online forums such as Reddit banded together to push up prices of stocks Melvin was betting against. “We were in a terrible position. Stared death in the face,” Mr.Jan 28, 2022

What was Gamestops highest stock price?

GameStop - Stock Price History | GMEThe all-time high GameStop stock closing price was 347.51 on January 27, 2021.The GameStop 52-week high stock price is 344.66, which is 128.6% above the current share price.The GameStop 52-week low stock price is 77.58, which is 48.5% below the current share price.More items...

Is GameStop going out of business?

GameStop Stores Are Closing At the end of 2020, GameStop announced that they planned to close 1,000 stores by March of 2021. GameStop's CFO Jim Bell explained the reasoning behind the closures, saying the move “will allow us to more efficiently and profitably service our customers.”Nov 23, 2021

How high can a short squeeze go?

You can sell it at $10 and then be forced to buy it back at $20 … or $200 … or $2 million. There is no theoretical limit on how high a stock can go.

The Safe Road for GME Stock Trades

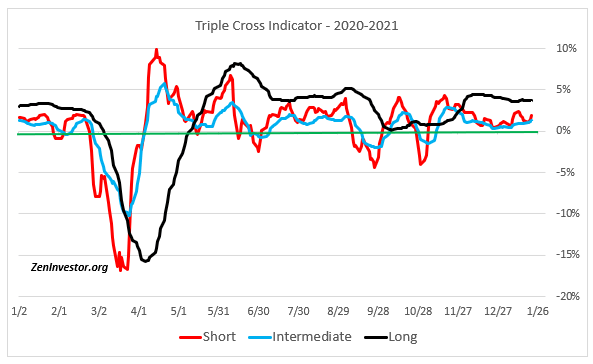

Starting on Wednesday, six trading sessions remain before the quarterly report. At the same time, GME is on the cusp of triggering a high base breakout setup. Since blasting higher on Aug. 24, prices have been skirting sideways in a tight range. This type of price action is extremely constructive and usually presages more gains.

The High Probability Road

If you’re willing to limit your gain in exchange for juicing your odds of success, then this next idea is for you. Sell far out-of-the-money puts. Consider it a bet that GME won’t completely implode over the next month. It capitalizes on the sky-high implied volatility and traders’ willingness to pay out the nose for insurance.

The Moonshot

Let’s say you want to bet on fireworks. Specifically, you think GME could ramp beyond $300 again. In that case, you’ll want to build a spread that delivers eye-popping profits to reward you for such a brave bet. Long calls are costly, so you’ll want to enter a spread trade to offset the cost.

How much did GameStop lose in 2019?

GameStop lost $470 million in 2019 and announced hundreds of store closures in 2020, another year for which it is also likely to report a big loss. By the company’s underlying numbers, the stock shouldn’t be worth nearly what it is now. But assets can trade durably above where they “should” for long stretches.

What is option trading?

Options trading, where someone can pay up front for the right to buy a stock at a certain price by a certain date, can speed up this process. Those trades can mean a rapid profit if a stock rises well past the option strike price, as has happened for many GME owners.

Did Redditors surrender?

After all, the Redditors have yet to publicly surrender. Advertisement. Advertisement. On the other side of the coin are short sellers, mainly institutional investors such as hedge funds, that had borrowed the stock, sold it, and hoped they’d buy it back at a lower price.

Does GameStop float?

GameStop could “float” more stock to the public, basically offering more people a piece of the company, and use their purchases to raise money to grow its business. But that, according to Harvey, could send a “bad signal” about the stock to current shareholders and drive the stock price down on its own.

Is GameStop stock going to increase?

It will be hard for GameStop to turn its stock boom into material improvements to its core business that might make a big price more durable. The increased price means the company’s shareholders can pay for college, buy themselves yachts, or just feel good about making a few bucks. But it’s not like the company itself collects a toll every time someone buys a share.

Who said "You're asking me to be like an oracle of the future"?

“You’re asking me to be like an oracle of the future,” says Campbell Harvey, a Duke international business professor who also works as a partner and adviser to large funds. “The answer’s kind of unsatisfactory for you, but all these scenarios are possible.”

What makes GameStop so compelling?

What makes the GameStop story so compelling is not just the unlikely bounce-back of a company that has arguably more in common with Blockbuster or Radio Shack than, say, Amazon or Facebook. The underlying story is that a group of seemingly ordinary retail investors harnessed the power of the internet to humiliate hedge fund investors who had bet deliberately and enormously against GameStop.

What forum sent shares of a seemingly moribund company through the roof?

(CNN Business) This week, the investing world looked on with a mix of admiration and horror as members of a Reddit forum devoted to stock trading collectively sent shares of a seemingly moribund company through the roof.

Is GameStop an example of social media?

It's too soon to tell whether the saga unfolding with GameStop will go down in history as an example of the internet being used for good, or for ill. But it is very evidently another example of social media's power to unsettle established institutions.