What should I do with my employee stock options?

· 4 Reasons to Exercise an Employee Stock Option Before the Expiration Date. Many people believe that it is wise to wait until just before the expiration date to exercise their stock options and purchase the option shares. And they may be right, under most circumstances. There are times, however, when exercising your options early is a good idea.

What does it mean when your employer offers stock options?

· When to exercise stock options Assuming you stay employed at the company, you can exercise your options at any point in time upon vesting until the expiry date — typically, this will span up to 10...

When should you exercise your nonqualified stock options?

· Keep in mind that some employee stock options will have an expiration date too – just like exchange-traded options contracts. This is usually 10 years. Wait Until You Are In The Money Let’s get one thing out of the way – it only ever makes sense for you to exercise your options if they have value.

How much does it cost to exercise stock options?

· Generally, it is the fair market price of the shares at the time you are receiving your options. People usually sell or exercise the stocks when the grant price is lower than the market value of the stock. At that time, this employee stock option is exercised in-the-money, or at a …

What is tax planning?

Tax planning involves projecting your expected income and deductions over the upcoming years. Exercising all your options in one year might bump you into a higher tax bracket. There may be benefits for exercising some options now and waiting to exercise others.

Who is Dana Anspach?

Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.

Who is Roger Wohlner?

Roger Wohlner is a financial advisor and writer with 20 years of experience in the industry. He specializes in financial planning, investing, and retirement. Some companies offer their employees the option to purchase stocks after a vesting period.

What does it mean to exercise a stock option?

Exercising a stock option means purchasing the shares of stock per the stock option agreement. The benefit of the option to the option holder comes when the grant price is lower than the market value of the stock at the time the option is exercised. Here’s an example:

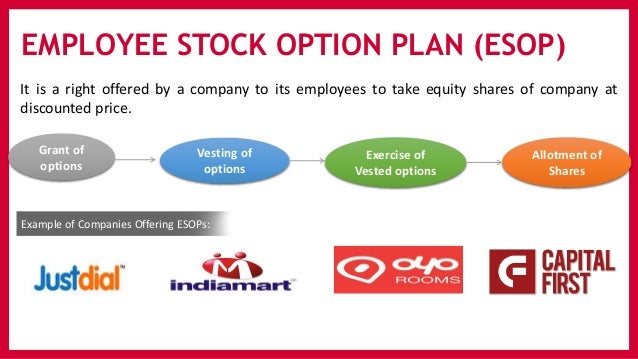

What is an employee stock option?

An employee stock option is a contract between an employee and her employer to purchase shares of the company’s stock, typically common stock, at an agreed upon price within a specified time period.

What happens if you exercise an option and sell shares?

You exercise the option and then immediately sell just enough shares to cover the purchase price, commissions, fees, and taxes. Your resulting proceeds will remain in the form of company stock.

Do employers offer stock options?

Many employers now offer stock options in place of other popular benefits as a part of their employee incentive packages. Stock options can be confusing to new employees receiving them, and even some employers offering them.

What is stock option?

Simply put, a stock option is a privilege giving its holder the right to purchase a particular stock at a price agreed upon by the assignor and the holder (called the “grant price”) within a specified time. Note that a stock option is a right, not an obligation, to purchase the stock, meaning that the option holder may choose to not exercise ...

How long do you have to hold stock to pay capital gains tax?

In regard to long-term capital gains taxes, consider that you will pay a more favorable long-term capital gains tax rate if you exercise your options, hold the shares for more than a year, and then sell your shares more than two years after the option grant date.

What is vesting date?

A vesting date is a common feature of stock options granted as part of an employee compensation package. The purpose of the vesting date is to ensure the employee’s commitment to his job position and to making the company a success.

What is the AMT exemption for 2020?

The AMT exemption level in 2020 is $72,900 for individuals and $113,400 for married filing jointly. If you have vested ISOs with taxable gain below the exemption amount, you can exercise them without having to pay any taxes. Remember, the taxable gain calculation is Total Options * (409a Price - Strike Price).

How long do you have to file an 83b?

You should look to file an 83 (b) election with the IRS within 30 days of the exercise in order to prevent taxes being owed upon vesting. 3. Reducing Taxes. There are a number of ways to reduce stock option taxes, and reducing tax impact is a common motivation when exercising stock options. a.

What does it mean to exercise stock options?

Exercising stock options means buying the company’s stock at the grant price fixed by the company under the option agreement. As an employee of the company, you have to follow all the regulations stated in the agreement to exercise your stock option.

What is employee stock option?

Employee stock options are a part of the employee compensation plan. It occurs when a company grants equity ownership to their executives and employees. Granting equity to employees doesn’t mean that the company has given direct access to own the stocks.

Can stock options be sold?

Generally, a stock option is issued by the company and can’t be sold, unlike the exchange-listed options or standard listed ones. And the most significant benefit of stock options are realized when the stock of the company rises above the exercise price. In this situation, the holder obtains the company’s stock at a discount.

What is the strike price of a stock?

The price at which you will buy the stocks is also known as the strike price, exercise price, or grant price. Generally, it is the fair market price of the shares at the time you are receiving your options. People usually sell or exercise the stocks when the grant price is lower than the market value of the stock.

What is the vesting date?

The date on which you can earn the right to exercise your stocks is known as the vesting date. In short, the employee has to wait until the stock options, ‘vests’, under the option agreement before they can purchase, and ultimately sell, the stocks.

How long do you have to keep stock options?

In order to qualify for this benefit, you need to keep your shares for at least two years after the option grant date, and one year after exercising .

Why are employee benefits so expensive?

In general, employee benefits are expensive for companies who wish to attract good talent in the field . And these employee benefits can range from a variety of options from traditional salary raises, bonuses, extra annual leave or other perks. So there are chances that every employee doesn’t receive all the benefits.

Can you exercise an unvested stock option?

The first opportunity you have to exercise your stock option (s) is when they vest. Prior to vesting, you can’t exercise. Unvested shares are simply a future promise of hopefully valuable stock options.

What happens if you don't exercise an option?

Any “in the money” value in the option will be lost if you don’t exercise before the options expire. This exercise option is often used by someone who simply hasn’t made a decision or felt afraid to act — and now they’re forced to act if they don’t want to lose the option.

What is exercise and hold strategy?

An “exercise and hold” strategy could describe anything that falls between “exercise and sell ASAP” and “wait until the bitter end.”. In this strategy, you exercise your options — but you do not sell the stock.

What is the other end of the stock option spectrum?

The other end of the stock option spectrum from Strategy 1, where you exercise and sell ASAP, is Strategy 2: wait as long as possible to exercise. “As long as possible” means right before your options are set to expire. Employee’s stock options are issued with an expiration date. The expiration date is the final day you can exercise your stock ...

What is after tax value?

After-tax value is a clearer representation of the actual dollars received should you exercise and sell your stock options. This is the amount you would have available to fund your lifestyle, to spend in retirement, or to save for another day. A good time to exercise your stock options may be when this after-tax value is “enough.”.

What is concentration risk?

Concentration risk is the risk of having too many eggs in one basket. Having one stock position take up too much of your overall investment portfolio can expose you to far more volatility than you want to deal with (or can handle).

How long do you have to work to exercise stock options?

Usually, until you work at your company for at least a year , you won’t be able to exercise stock options. The typical vesting schedule gives you a chunk of options every year. Then it ends on a vesting period of 4 or 5 years. The number of years depends on your Employee Stock Options Plan.

Do ESOs expire?

The upside is, you can decide if and when to exercise them. The downside is, if you don’t exercise them by their expiration date, they’ll expire. So make sure you know your expiration date. And make sure to exercise your ESOs before then. Now, let’s talk about how to do it.

Can you exercise stock options before termination?

Many people jump from startup to startup and often leave a startup with some options vested. You can only exercise your stock options before your past employer’s post-termination exercise period ends. Once this period end, you will no longer have the ability to exercise your options and they simply go back into the company’s option pool.

What is an ISO stock?

Incentive Stock Options (ISO) – ISOs are stock options that have the ability to qualify for preferential tax treatment. For this reason, ISOs are also known as qualified stock options.

Your Financial Needs

The Risk/Return Tradeoff

- There's a component to your employee stock options called "time value." When there are many years left until the expiration date, the time value is the potential for additional future gains or losses. Time value could be linked to lost opportunity cost. If you exercised the option, what opportunities would you lose? You might reinvest the money, but would the company stock hav…

Tax-Planning Opportunities

- Tax planning involves projecting your expected income and deductions over the upcoming years. Exercising all of your options in one year might bump you into a higher tax bracket. There may be benefits for exercising some options now and waiting to exercise others. It might make good tax sense to exercise a portion of your options annually rather than wait until the expiration date to e…

Market Conditions

- Consider the volatility of your company's stock and the volatility of market conditions as a whole. The sun doesn’t always shine on a company, regardless of how well it manages its cash and innovates. Recessions can be ruthless on a company's operations and stock prices. If your company is experiencing significant, rapid growth in an industry, you may want to consider exerc…

Quantity of Options/Investor Sophistication

- If yours is a financially sophisticated, high-net-worth household, you might pursue more advanced strategies than a family with less financial acumen. One good rule to follow is that if you don't understand it, don't do it. John Olagues, the author of Getting Started In Employee Stock Options, discusses advanced employee stock option exercise strategies. John is a former stock options …