A stock market crash can occur at any time, but it tends to happen most frequently during times of economic or political turmoil.

Full Answer

Should you sell off your stock when the market crashes?

· Whether those factors will result in a market crash, though, is anyone's guess. The stock market can be unpredictable, and even the experts …

What will cause the next stock market crash?

· A market crash is defined as a 20% drop from an index's most recent high. Since 1945, these events have occurred roughly once every 5.4 years. Given that we experienced a downturn in 2020, this...

When will the stock market stop falling?

· A stock market crash is caused by two things: a dramatic drop in stock prices and panic. Here’s how it works: Stocks are small shares of a company, and investors who buy them make a profit when the value of their stock goes up.

What happens to your shares when the stock market crashes?

· First, the terrible news: “The biggest stock market crash of our lifetime will hit in 2022,” Harry Dent Jr., aka “The Contrarian’s Contrarian,” tells ThinkAdvisor in an interview.

Will there be a market crash in 2022?

The Fed itself puts the odds of a recession in 2022 at around 5%. Overall, Wall Street strategists are fairly bullish on the market's prospects this year, with the average 2022 S&P 500 price target at around 4,900.

How do you know if the stock market is going to crash?

Corporate Profits Turn Flat In other words, a company's profits help to determine the fair price of its stock. A clear sign that a market crash is coming is when profits begin to go flat. Investors are only happy when the companies they invest in are seeing growing profitability.

Can the stock market crash?

A stock market crash can occur at any time, but it tends to happen most frequently during times of economic or political turmoil.

What months does the market crash?

Key Takeaways. The October effect refers to the psychological anticipation that financial declines and stock market crashes are more likely to occur during this month than any other month. The Bank Panic of 1907, the Stock Market Crash of 1929, and Black Monday 1987 all happened during the month of October.

What is the forecast for the stock market in 2021?

Most economists expect a slowdown from 2021, but continued expansion. IHS Markit forecasts GDP to grow 4.3%, down from an estimated 5.6% in 2021. Truist and LPL Financial forecast 4% to 4.5% growth for 2022. Wells Fargo expects 4.5%.

Do you lose all your money if the stock market crashes?

Stock markets tend to go up. This is due to economic growth and continued profits by corporations. Sometimes, however, the economy turns or an asset bubble pops—in which case, markets crash. Investors who experience a crash can lose money if they sell their positions, instead of waiting it out for a rise.

Where should I invest if market crashes?

If you are a short-term investor, bank CDs and Treasury securities are a good bet. If you are investing for a longer time period, fixed or indexed annuities or even indexed universal life insurance products can provide better returns than Treasury bonds.

Why market is crashing?

A 1,688-point crash in Sensex wipes off Rs 7.36 lakh cr from market. Nervousness on the new coronavirus variant and expectations of the US increasing the pace of tapering has led to recent market weakness, said analysts. India VIX, a measure that shows fear in the market, spiked 25 per cent to nearly 21-level.

What causes a stock market crash?

A stock market crash is caused by two things: a dramatic drop in stock prices and panic. Here's how it works: Stocks are small shares of a company, and investors who buy them make a profit when the value of their stock goes up.

Who benefits from a market crash?

Who benefits from stock market crashes? As and when the stock market crashes, there are certain sectors that benefit. These are – utilities, consumer staples and the healthcare sectors. This is because all three sectors are necessary to run our daily lives.

Does the stock market crash every 7 years?

It's estimated that 8.7 million people lost their jobs in an economy that had not yet fully recovered from the 2000 dot-com stock market crash. Moreover, since 1966, there have been stock market crashes every 7 years, which is a pretty good indicator of the things that are yet to come.

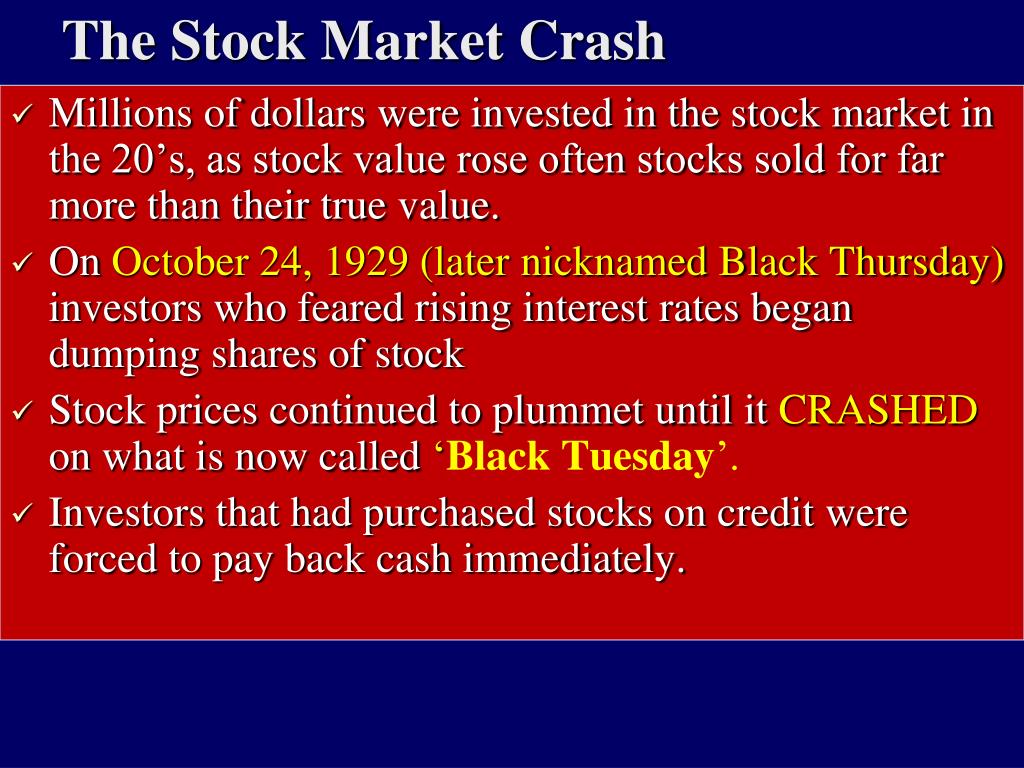

When was the biggest market crash?

19291929 stock market crash The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.

NYSE: PFE

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Whether it happens or not, investors should consider buying this pharma stock

It is impossible to know the future -- or at least the details of it -- with complete certainty. No one can know for sure whether there will be a market downturn tomorrow, next week, or next year.

Two reasons there may be a market crash in 2022

A market crash is defined as a 20% drop from an index's most recent high. Since 1945, these events have occurred roughly once every 5.4 years. Given that we experienced a downturn in 2020, this historical trend would suggest we are off the hook -- at least as far as downturns are concerned -- for a little while longer.

This company is firing on all cylinders

Few pharma companies have grabbed more headlines than Pfizer ( PFE -1.39% ) in the past year. The reason for that is obvious: Along with its partner BioNTech, the drugmaker developed and marketed the leading COVID-19 vaccine on the market, Comirnaty. This vaccine is on track to rack up $36 billion in sales in its first year on the market.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What happens when the stock market crashes?

A stock market crash is a sudden and big drop in the value of stocks, which causes investors to sell their shares quickly. When the value of stocks goes down, so does their price—and the end result is that people could lose a lot of the money they invested.

What to do if the stock market crashes again in 2021?

What to Do During a Stock Market Crash. If the market crashes again in 2021, remind yourself that you lived through another crash just last year. Of course, a crash is scary. Yes, you’ll have to make some adjustments. But with the right plan to move forward, we can and will continue to make progress.

What was the most rapid global crash in financial history?

The Coronavirus Crash: In March of 2020, the COVID-19 pandemic triggered the most rapid global crash in financial history. However, the stock market regained ground relatively quickly and the year closed with record highs in all major indexes. So, keep your head up.

How to get an overall idea of the value of stocks?

To get an overall idea of the value of stocks, we look at indexes (that’s something that tracks how well stocks do) like the Dow Jones Industrial Average (DJIA), the S&P 500 and the Nasdaq. If you look at a visual graph of one of these indexes, you can see why we use the term crash. It’s like watching a plane take a nose dive.

What happens when you panic when you sell your stock?

The same kind of panic can trigger a stock market crash. Once investors see other investors selling off their stocks, they get pretty nervous. Then, stock values start to dip, and more investors sell their shares. Next thing you know, everyone is dumping their stocks, and the market is in a full-fledged crash. Look out below!

When did the DJIA lose its value?

The Great Recession, 2008: The DJIA lost more than 50% of its value in a really short time. 7 But after a couple of years, the market was stronger than ever before—we were basically in a bull market (a period of large economic growth) from 2009 to just before the coronavirus crash.

When did the stock market recover from the nose dive?

But after the initial nose dive in March, the market started to inch its way back to recovery. And by the time the New Year’s Eve ball dropped on December 31, 2020, the stock market had regained all of its lost ground—and then some! Did you catch that? All of the major indexes grew in 2020: 9

Crashes and corrections are the price of admission to take part in one of the world's greatest wealth creators

A Fool since 2010, and a graduate from UC San Diego with a B.A. in Economics, Sean specializes in the healthcare sector and investment planning. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Follow @AMCScam

Key Points

Everything from COVID-19 variants to politics and history are potential threats to the S&P 500's historic bounce from a bear market bottom.

2. Historically high inflation

Some level of inflation (i.e., the rising price of goods and services) is expected in a growing economy. However, the 6.2% increase in the Consumer Price Index for All Urban Consumers in October marked a 31-year high.

3. Energy price indigestion

Crude oil could also spell doom for Wall Street over the next three months.

4. Fed speak

The tone and actions of the Federal Reserve could also cause the stock market to crash over the next three months.

5. A debt ceiling impasse

Keeping politics out of your portfolio is generally a smart move. But every once in a while, politics can't be swept under the rug.

6. Margin debt

Generally speaking, margin debt -- the amount of money borrowed from a broker with interest to purchase or short-sell securities -- is bad news. Although margin can multiply an investors' gains, it can also quickly magnify losses.

What is the warning sign of a market crash?

The ratio is a 10-year moving average of the traditional price-to-earnings ratio, which measures a company’s profitability in relation to its share price.

When did the stock market bubble?

Bubbles appear in the stock market all the time. Some of the most memorable in recent history include the dot-com bubble in the late 1990s and the real estate bubble in the 2000s:

Why do investors pull out of equities?

economy at any given time, which is important when determining whether a crash is coming. Investors tend to pull out of equities when economic conditions are poor.

What is the best way to gauge if the market is going to crash?

One of the best ways to gauge this is by using the Fear & Greed index.

How long did the bull market last?

While economic conditions dwindled for some time, the bear market only lasted a few months, then the bulls took control once again.

Why do traders make it their life's work?

In fact, active traders make it their life’s work to take advantage of the inconsistent balance in the market.

Why do people take advantage of loans when buying cars?

Most people take advantage of loans when buying vehicles because they simply can’t afford to buy them comfortably with cash.

A case is mounting for a big drop in the stock market

The first thing to realize about stock market crashes and corrections is that they're really quite common. Optimists might dislike when they rear their head on Wall Street, but the data shows that a double-digit decline has occurred in the S&P 500, on average, every 1.87 years since 1950.

5 things to do if a crash or big correction occurs

That's the bad news. The good news is that every single crash and correction throughout history has eventually been erased by a bull-market rally. This is a fancy way of saying that all major dips in the S&P 500, Dow Jones, and Nasdaq Composite have proved to be buying opportunities.

1. Understand your risk tolerance ahead of time

Before the next stock market crash or correction occurs, one of the most important things to do is understand your tolerance for risk. For example, buying tech stocks can lead to wilder vacillations than if you were to put your money to work in defensive companies, such as electric utility stocks.

2. Reassess your holdings

Although you don't need to wait for a crash or correction to occur, a tumbling market is always a good time for investors to reassess their holdings. By this, I mean examining your initial investment thesis and determining if the reason (s) you bought a stake in a company still holds water today.

3. Have cash at the ready

Third, you're going to want to have cash available to take advantage of any significant declines in the market.

4. Don't forget about dividend stocks

If you're looking to put your money to work during a crash or correction, don't overlook dividend stocks. Mature businesses that pay a dividend may not offer the same growth rate or return potential as high-growth companies or small-cap stocks.

5. Think value during the early stages of an economic recovery

Fifth and finally, consider putting your money to work in value stocks. While I know growth stocks have run circles around value stocks since the end of the Great Recession, it's value stocks that are the better performer over the very long term (1926-2015).