How do you calculate the correlation between two stocks?

- Obtain a data sample with the values of x-variable and y-variable.

- Calculate the means (averages) x̅ for the x-variable and ȳ for the y-variable.

- For the x-variable, subtract the mean from each value of the x-variable (let’s call this new variable “a”). ...

How to calculate correlation between two stocks?

Calculating Stock Correlation. There are online calculators that can help you determine stock correlation but it’s possible to run the numbers on your own. To find the correlation between two stocks, you’ll start by finding the average price for each one. Choose a time period, then add up each stock’s daily price for that time period and divide by the number of days in the period. That’s the average price.

How to calculate stock correlation coefficient?

The options in the dialogue box are pretty easy to understand:

- ‘Input’: Contains all the options related to the input

- ‘Input Range’: The cell ranges with the data values on it including the labels in the first row

- ‘Grouped By’: Choose if the values are grouped in columns or in rows

- ‘Labels in First Row’: Check this if you included the labels in the first row on the ‘Input Range’

What is stock correlation analysis?

Stock correlation describes the relationship that exists between two stocks and their respective price movements. It can also refer to the relationship between stocks and other asset classes, such as bonds or real estate.

What is a strong correlation?

The relationship between two variables is generally considered strong when their r value is larger than 0.7. The correlation r measures the strength of the linear relationship between two quantitative variables.

What is a good correlation for portfolio?

Within a portfolio, if you can find assets that have correlations with each other of below 0.70, that would be a good starting point. If you find that many of the assets in your portfolio are correlated at a high level, say over 0.80, you may want to rethink what the portfolio holds.

What is considered a high correlation between stocks?

The correlation coefficient's values range between -1.0 and 1.0. A perfect positive correlation means that the correlation coefficient is exactly 1.

Is 0.6 highly correlated?

Correlation Coefficient = 0.8: A fairly strong positive relationship. Correlation Coefficient = 0.6: A moderate positive relationship. Correlation Coefficient = 0: No relationship.

What is considered low correlation?

Correlation coefficients whose magnitude are between 0.3 and 0.5 indicate variables which have a low correlation. Correlation coefficients whose magnitude are less than 0.3 have little if any (linear) correlation.

What should be the correlation between stock for best diversification effect?

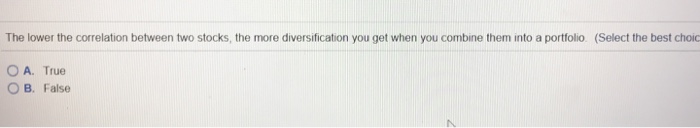

When it comes to diversified portfolios, correlation represents the degree of relationship between the price movements of different assets included in the portfolio. A correlation of +1.0 means that prices move in tandem; a correlation of -1.0 means that prices move in opposite directions.

What does a .1 correlation mean in finance?

positively correlatedThat means that they are positively correlated. When two assets are completely correlated with each other, they have a correlation of 1.0. Typically, you'll see references to assets that have high correlation with a number just under 1.0.

Which correlation is the strongest?

According to the rule of correlation coefficients, the strongest correlation is considered when the value is closest to +1 (positive correlation) or -1 (negative correlation). A positive correlation coefficient indicates that the value of one variable depends on the other variable directly.

What is negatively correlated with S&P 500?

A negative correlation means that they tend to move in exactly opposite directions. For example, when returns on some asset classes were declining, returns on others were gaining, or perhaps declining less. The chart below shows the range of correlation assets to the S&P 500 index over the past 20 years.

Is .77 a strong correlation?

Conclusion. In summary: As a rule of thumb, a correlation greater than 0.75 is considered to be a “strong” correlation between two variables.

Is a correlation of 0.4 high?

For this kind of data, we generally consider correlations above 0.4 to be relatively strong; correlations between 0.2 and 0.4 are moderate, and those below 0.2 are considered weak. When we are studying things that are more easily countable, we expect higher correlations.

Is .47 a strong correlation?

Correlation coefficient values below 0.3 are considered to be weak; 0.3-0.7 are moderate; >0.7 are strong.

What does it mean when a stock has a correlation of -1?

A correlation of -1 is a "perfect" negative correlation, meaning that when one stock goes up five points, the other loses five points.

How do stocks correlate?

How and Why Do Stocks Correlate? Most stocks have a correlation somewhere in the middle of the range, with a coefficient of 0 indicating no relationship whatsoever between the two securities. A stock in the online retail space, for example, likely has no correlation with the stock of a tire and auto body shop.

What is the correlation coefficient used to predict a stock's performance?

Stock analysts use a measure called the correlation coefficient to make predictions about how a stock will behave based on past performance and the activity of another security with which the stock in question has been shown to correlate.

Why is correlation important in the stock market?

Correlation, by itself, cannot affect the stock market because it is simply the degree to which two things behave in the same way. However, the correlation between the activity of two stocks, or between a stock and the performance of a given index, sector or industry, can be a very important factor in developing a prudent investing strategy.

What is correlation coefficient?

What Is the Correlation Coefficient? The correlation coefficient is used to measure both the degree and direction of the correlation between any two stocks. It can be anywhere between -1 and 1, though it is almost always in between. Any two securities that have a coefficient of 1 are said to be "perfectly" correlated.

What is the most common and effective diversification strategy?

Choosing a variety of stocks with different degrees and directions of correlation is one of the most common and effective diversification strategies. The result is a portfolio that displays a general upward trend, since, at any given time, at least one security should be doing well even if others are failing.

What is correlation in investing?

Correlation refers to the method of determining the relationship between two variables. There are multiple methods of determining the correlation between those variables. For our purposes, our interests lie in the correlation between two stocks, bonds, or ETFs.

What is the difference between positive and negative correlation?

Positive correlation – when the equity value of one security increases with respect to the other security. Negative correlation – when the equity value of one security decreases in respect to the other security. No correlation – when there are zero relationships between the securities.

What is a perfect correlation coefficient?

A correlation coefficient of one equals a perfect positive correlation. For stock correlations, a perfect correlation indicates that as one stock moves, either up or down, the other stock moves in tandem, in the same direction. Likewise, a perfect negative correlation means those two stocks move in opposite directions.

What does it mean when a coefficient is closer to a negative?

A coefficient closer to a negative one indicates a negative correlation between the securities, with the increase in one stock tying to the other stock’s decrease. There are three types of correlation related to our interests: Positive correlation – when the equity value of one security increases with respect to the other security.

What does it mean when a stock is close to zero?

A stock correlation closer to zero, either positive or negative, implies little or no correlation between them . The coefficients move closer to a positive one, the closer the correlation to the securities.

What is investment portfolio?

Building an investment portfolio encompasses many different ideas, such as what kind of assets you want to hold, how much risk you want to take on, and how much effort you want to put into the portfolio.

What happens if the market goes down in March 2020?

Now, if there is an overall market downturn, such as during March 2020, all assets dropped, with a few exceptions such as Walmart and Amazon.

What is correlation value?

What is Correlation? Correlation is a measure of how one security moves in relation to another. A correlation value of 1 means that Stock A is exactly Correlated with Stock B.

What does it mean when a stock has a high beta?

Alpha is the difference between the returns of a stock vs the expected returns based on its Beta. If a stock has a high Beta value then it has more risk and so the expected returns are higher . If Alpha is zero then it is returning as expected. If Alpha is negative it is underperforming for its risk level.

How to sort correlation matrix?

The Correlation Matrix is interactive. If you click on any column header you will sort the matrix top to bottom by ascending or descending correlations. If you click on any row symbol you will sort the matrix left to right by ascending or descending correlations.

What is correlation in stock market?

Updated May 25, 2020. Correlation is a statistical measure that determines how assets move in relation to each other. It can be used for individual securities, like stocks, or it can measure general market correlation, such as how asset classes or broad markets move in relation to each other. It is measured on a scale of -1 to +1.

Why is correlation important in portfolio management?

Modern portfolio theory (MPT) uses a measure of the correlation of all the assets in a portfolio to help determine the most efficient front ier. This concept helps to optimize expected returns against a certain level of risk. Including assets that have a low correlation to each other helps to reduce the amount of overall risk for a portfolio.

How to diversify a portfolio of stocks?

For example, the most common way to diversify in a portfolio of stocks is to include bonds, as the two have historically had a lower degree of correlation with each other. Investors also often use commodities such as precious metals to increase diversification; gold and silver are seen as common hedges to equities.

Why was it so hard to pick stocks?

It was also hard to select stocks in different sectors to increase the diversification of a portfolio. Investors had to look at other types of assets to help manage their portfolio risk.

Why are international markets so correlated?

International markets can also become highly correlated during times of instability. Investors may want to include assets in their portfolios that have a low market correlation with the stock markets to help manage their risk.

Does correlation increase during volatility?

Unfortunately, correlation sometimes increases among various asset classes and different markets during periods of high volatility. For example, during January 2016, there was a high degree of correlation between the S&P 500 and the price of crude oil, reaching as high as 0.97 – the greatest degree of correlation in 26 years.

Can correlation change over time?

Still, correlation can change over time. It can only be measured historically. Two assets that have had a high degree of correlation in the past can become uncorrelated and begin to move separately. This is one shortcoming of MPT; it assumes stable correlations among assets.

Learn how to use Python to identify similarities in stock movements

Note from Towards Data Science’s editors: While we allow independent authors to publish articles in accordance with our rules and guidelines, we do not endorse each author’s contribution. You should not rely on an author’s works without seeking professional advice. See our Reader Terms for details.

Starting the Project!

First, we must import all the dependencies we will need throughout the program. The primary libraries we will use are Yfinance, Datetime, and Yahoo-fin.

What is correlation in trading?

Correlation in trading is a mathematical term that measures the relationship between two variables or datasets.

What is correlation risk in trading?

The correlation risk is the risk of having a portfolio of strategies that tend to move in tandem. If you lose in strategy A, you have a high probability of losing in strategy B at the same time.

Why correlation in trading is important to understand

A portfolio of trading strategies most likely has a high degree of correlation but is often ignored by beginners. Correlation is essential to understand for a trader!

Spurious correlations in trading

Because most of the backtesting involves predicting future prices based on history, you will likely find many spurious correlations. Many relationships are not direct but indirect.

Correlations in trading breakdowns – nothing lasts forever

Correlations vary over time. Something that is highly correlated over long intervals might be erratic on a shorter time frame:

Non-correlation and diversification – the holy grail in trading?

The goal in trading system development is to have strategies that cancel each other out to lower the returns’ variability – we can call it correlation trades. To do this, you need to include various asset classes, trade both long and short, and use different time frames in your trading strategies.

Conclusion – What does correlation mean in trading?

Correlation in trading refers to how your strategies perform together. In trading, you want a low correlation between your trading strategies.

What Is Perfect Negative Correlation?

In most cases, the negative correlation between stocks is inexact. For example, the factors causing a decrease for one group might drive share prices down by 25 percent, while negatively correlated stocks only increase by 5 percent. The exact relationship between stocks is expressed on a scale from -1.0 to 1.0.

What Industries Are Negatively Correlated?

Some industries can be relied upon to move in opposite directions. For example, a number of industries are heavily dependent on oil prices and related stocks. Airlines, trucking companies, and aerospace companies all respond poorly when the price of oil increases. When the price of fuel goes down, these stocks go up.

What Is An Example Of Negative Correlation?

Stocks aren’t the only assets to consider if you want to structure your portfolio with an eye on mitigating risk through negative correlation. In many cases, other asset classes move in the opposite direction of the stock market.

Are Stocks And Bonds Negatively Correlated?

Nearly every investment advisor recommends a blend of stocks and bonds to keep a portfolio balanced. That’s because bonds add stability, while stocks tend to generate higher returns.

What Is Negatively Correlated to S&P 500?

The best way to protect against downturns in the S&P 500 is to include gold and bonds in your larger portfolio. Both have demonstrated that they hold their value when the S&P 500 drops, and in some cases, you will see returns.

What Stocks Are Negatively Correlated? The Bottom Line

Many financial services professionals spend their entire careers studying correlation between various assets. The most reliable negative correlations occur when the factors that cause one stock to go up have the opposite effect on the other stock. However, it is important to note that correlations can be cyclical, or they can change over time.