What was the worst stock market crash in US history?

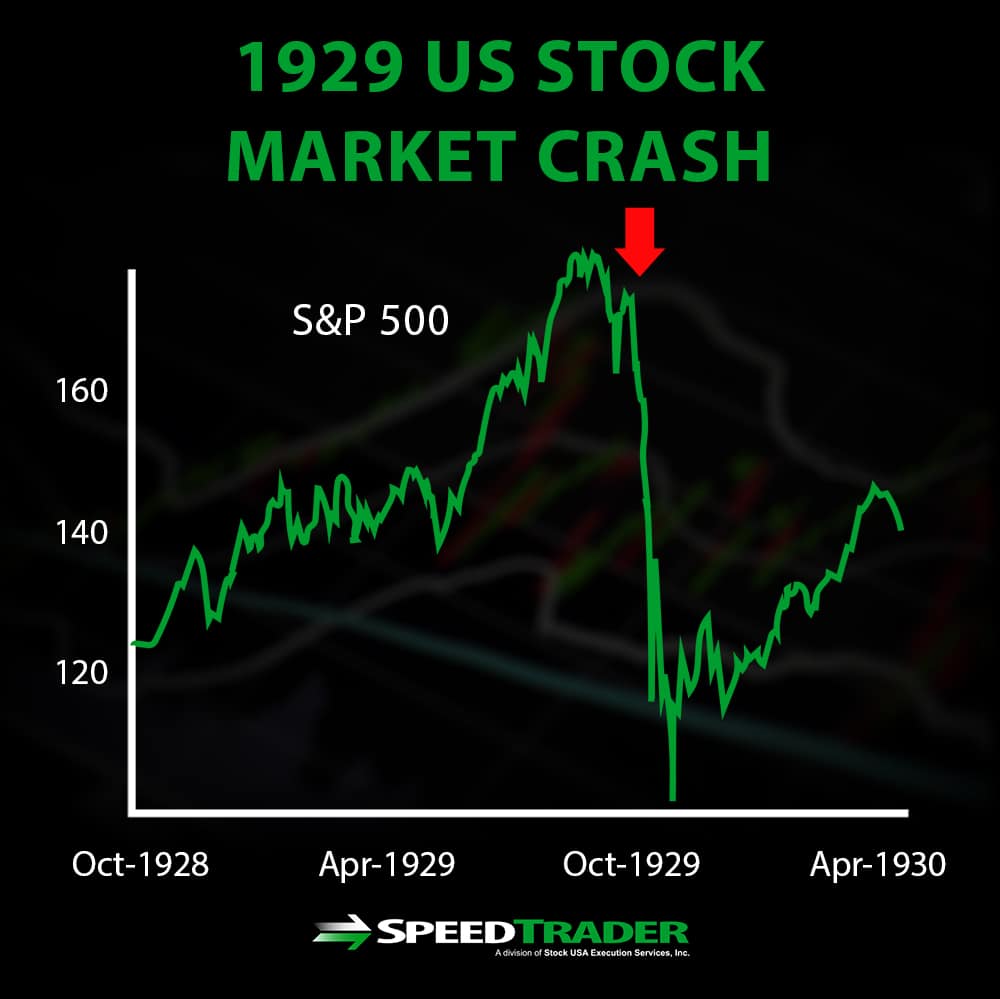

What was the worst stock market crash in history? The Black Tuesday stock market crash that took place in 1929 remains the worst crash in US history. Over a four day period, the Dow Jones dropped 25% and lost $30 billion in market value – the equivalent of $396 billion today. It was this crash that kicked off the Great Depression in the ...

What actually happens during a stock market crash?

The stock market crash of 1987 was a steep decline in U.S. stock prices over a few days in October of 1987; in addition to impacting the U.S. stock market, its repercussions were also observed in other major world stock markets.

When can we expect another market crash?

We expect a violent stock market crash in 2024 which will bring stocks back to either of the following two levels: Either back to levels of November of 2020; Or to levels of April of 2021.

What are the major stock market crashes?

The Biggest Stock Market Crashes in History

- 1929 stock market crash. The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression.

- Black Monday crash of 1987. On Monday, Oct. ...

- Dot-com bubble of 1999-2000. During the late 1990s, the values of internet-based stocks rose sharply. ...

- Financial crisis of 2008. ...

- Coronavirus crash of 2020. ...

Why did the market crash in 2008?

The stock market crash of 2008 was a result of defaults on consolidated mortgage-backed securities. Subprime housing loans comprised most MBS. Banks offered these loans to almost everyone, even those who weren't creditworthy. When the housing market fell, many homeowners defaulted on their loans.

What is the biggest stock market crash in history?

1929 stock market crash The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.

What years have the stock market crashes?

Famous stock market crashes include those during the 1929 Great Depression, Black Monday of 1987, the 2001 dotcom bubble burst, the 2008 financial crisis, and during the 2020 COVID-19 pandemic.

How long did the market crash in 2008 last?

The US bear market of 2007–2009 was a 17-month bear market that lasted from October 9, 2007 to March 9, 2009, during the financial crisis of 2007–2009.

Does the stock market crash every 7 years?

It's estimated that 8.7 million people lost their jobs in an economy that had not yet fully recovered from the 2000 dot-com stock market crash. Moreover, since 1966, there have been stock market crashes every 7 years, which is a pretty good indicator of the things that are yet to come.

How long did it take the stock market to recover after the 2008 crash?

The S&P 500 dropped nearly 50% and took seven years to recover. 2008: In response to the housing bubble and subprime mortgage crisis, the S&P 500 lost nearly half its value and took two years to recover. 2020: As COVID-19 spread globally in February 2020, the market fell by over 30% in a little over a month.

What caused 1987 crash?

Key Takeaways. The "Black Monday" stock market crash of Oct. 19, 1987, saw U.S. markets fall more than 20% in a single day. It is thought that the cause of the crash was precipitated by computer program-driven trading models that followed a portfolio insurance strategy as well as investor panic.

What triggered the 2000 crash?

The 2000 stock market crash was a direct result of the bursting of the dotcom bubble. It popped when a majority of the technology startups that raised money and went public folded when capital went dry.

What are 3 causes of the Great Depression?

What were the major causes of the Great Depression? Among the suggested causes of the Great Depression are: the stock market crash of 1929; the collapse of world trade due to the Smoot-Hawley Tariff; government policies; bank failures and panics; and the collapse of the money supply.

How long did it take the 1929 crash to recover?

Wall Street lore and historical charts indicate that it took 25 years to recover from the stock market crash of 1929.

How much did the stock market drop in 2008 and 2009?

Much of the decline in the United States occurred in the brief period around the climax of the crisis in the fall of 2008. From its local peak of 1,300.68 on August 28, 2008, the S&P 500 fell 48 percent in a little over six months to its low on March 9, 2009.

How long does it take to recover from a market crash?

Once the S&P 500 does hit the 20% threshold, stocks typically fall by another 12% and it takes the index an average of 95 days to hit the end of a bear market, according to Bespoke data.

When did the stock market get spooked?

17 May 1901. Lasting 3 years, the market was spooked by the assassination of President William McKinley in 1901, coupled with a severe drought later the same year.

What happened to the stock market in 2002?

After recovering from lows reached following the September 11 attacks, indices slid steadily starting in March 2002, with dramatic declines in July and September leading to lows last reached in 1997 and 1998.

How long did the Japanese asset bubble last?

1991. Lasting approximately twenty years, through at least the end of 2011, share and property price bubble bursts and turns into a long deflationary recession. Some of the key economic events during the collapse of the Japanese asset price bubble include the 1997 Asian financial crisis and the Dot-com bubble.

How long is Black Monday trading suspended?

Today, circuit breakers are in place to prevent a repeat of Black Monday. After a 7% drop, trading would be suspended for 15 minutes, with the same 15 minute suspension kicking in after a 13% drop. However, in the event of a 20% drop, trading would be shut down for the remainder of the day.

How long did the oil boom last?

Lasting 23 months, dramatic rise in oil prices, the miners' strike and the downfall of the Heath government.

What happened on August 24th 2015?

On Monday, August 24, world stock markets were down substantially, wiping out all gains made in 2015, with interlinked drops in commodities such as oil, which hit a six-year price low, copper, and most of Asian currencies, but the Japanese yen, losing value against the United States dollar.

What was the stock market crash of 1929?

The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse ...

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What happened to stock market in 1929?

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

When did stock prices drop in 1929?

Stock prices began to decline in September and early October 1929 , and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded.

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

When was the New York Stock Exchange founded?

The New York Stock Exchange was founded in 1817, although its origins date back to 1792 when a group of stockbrokers and merchants signed an agreement under a buttonwood tree on Wall Street.

What happens when the stock market crashes?

Often, a stock market crash causes a recession. That’s even more likely when it’s combined with a pandemic and an inverted yield curve . An inverted yield curve is an abnormal situation where the return, or yield, on a short-term Treasury bill is higher than the Treasury 10-year note.

What were the driving forces behind the stock market crash of 2020?

The driving forces behind the stock market crash of 2020 were unprecedented . However, investor confidence remained high, propelled by a combination of federal stimulus and vaccine development. Though unemployment remains a significant economic problem in 2021, the stock market continues to reach record highs.

Why did the US economy crash in 2020?

Causes of the 2020 Crash. The 2020 crash occurred because investors were worried about the impact of the COVID-19 coronavirus pandemic . The uncertainty over the danger of the virus, plus the shuttering of many businesses and industries as states implemented shutdown orders, damaged many sectors of the economy.

What happened to the interest rates on the 10-year Treasury note?

Strong demand for U.S. Treasurys lowered yields, and interest rates for all long-term, fixed-interest loans follow the yield on the 10-year Treasury note. As a result, interest rates on auto, school, and home loans also dropped, which made it less expensive to get a home mortgage or a car loan in both 2020 and 2021.

How does a recession affect stocks?

How It Affects You. When a recession hits, many people panic and sell their stocks to avoid losing more. But the rapid gains in the stock market made after the crash indicated that in 2020, many investors continued to invest, rather than selling.

What was the Dow's record high in February 2020?

Prior to the 2020 crash, the Dow had just reached its record high of 29,551.42 on February 12. From that peak to the March 9 low, the DJIA lost 5,700.40 points or 19.3%. It had narrowly avoided the 20% decline that would have signaled the start of a bear market . On March 11, the Dow closed at 23,553.22, down 20.3% from the Feb. 12 high.

How much did the Dow Jones drop in 2020?

The Dow Jones’ fall of nearly 3,000 points on March 16, 2020, was the largest single-day drop in U.S. stock market history to date. In terms of percentage, it was the third-worst drop in U.S. history. Unlike some previous crashes, however, the market rebounded quickly and set new records in late 2020 and early 2021.

What happened to the stock market after the 1929 crash?

After the crash, the stock market mounted a slow comeback. By the summer of 1930, the market was up 30% from the crash low. But by July 1932, the stock market hit a low that made the 1929 crash. By the summer of 1932, the Dow had lost almost 89% of its value and traded more than 50% below the low it had reached on October 29, 1929.

What is a stock crash?

Stock Market Crash is a strong price decline across majority of stocks on the market which results in the strong decline over short period on the major market indexes (NYSE Composite, Nasdaq Composite DJIA and S&P 500).

How much wealth was lost in the 2000 crash?

The Crash of 2000. A total of 8 trillion dollars of wealth was lost in the crash of 2000. From 1992-2000, the markets and the economy experienced a period of record expansion. On September 1, 2000, the NASDAQ traded at 4234.33. From September 2000 to January 2, 2001, the NASDAQ dropped 45.9%.

What happened in 1987?

The Crash of 1987. During this crash, 1/2 trillion dollars of wealth were erased. The markets hit a new high on August 25, 1987 when the Dow hit a record 2722.44 points. Then, the Dow started to head down. On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day.

How much did the Dow drop in 1987?

On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day. This was a drop of 36.7% from its high on August 25, 1987.

How much wealth was lost in the 1929 stock market crash?

The Crash of 1929. In total, 14 billion dollars of wealth were lost during the market crash. On September 4, 1929, the stock market hit an all-time high. Banks were heavily invested in stocks, and individual investors borrowed on margin to invest in stocks.

Why are stocks bearish?

Those of the public who still hold these stocks are potentially bearish factors because, having bought, they must sooner or later sell, and their selling will bring pressure upon the market. This was the case in 1929. The whole market became saturated with stocks held by those who were looking for profit.

Why did the stock market crash in 2008?

The Dow Jones Industrial Average fell 777.68 points in intraday trading. 1 Until the stock market crash of 2020, it was the largest point drop in history. The market crashed because Congress rejected the bank bailout bill. 2 But the stresses that led to the crash had been building ...

When did the Dow go up in 2009?

Soon afterward, President Barack Obama's economic stimulus plan instilled the confidence needed to stop the panic. On July 24, 2009, the Dow reached a higher plane. It closed at 9,093.24, beating its January high. 34 For most, the stock market crash of 2008 was over.

What was the Dow Jones open at?

The Dow opened the year at 12,474.52. 1 It rose despite growing concerns about the subprime mortgage crisis. On Nov. 17, 2006, the U.S. Commerce Department warned that October's new home permits were 28% lower than the year before. 3 But economists didn't think the housing slowdown would affect the rest of the economy. In fact, they were relieved that the overheated real estate market appeared to be returning to normal.

What was the Dow's intraday low in 2008?

The Dow dropped to an intraday low of 11,650.44 but seemed to recover. In fact, many thought the Bear Stearns rescue would avoid a bear market . By May, the Dow rose above 13,000. 1 It seemed the worst was over. In July 2008, the crisis threatened government-sponsored agencies Fannie Mae and Freddie Mac.

When did the bailout bill pass?

20 The Labor Department reported that the economy had lost a whopping 159,000 jobs in the prior month. 21 On Monday, Oct. 6, 2008, the Dow dropped 800 points, closing below 10,000 for the first time since 2004. 22

Did the Dow Jones crash cause a recession?

Like many other past stock market crashes, it did not lead to a recession. The correction ended in August 2018, and the Dow ended 2018 at 23,327.46. 39 In 2019, it set a record of 27,359.16 in July. 40 It then began declining due to concerns about trade wars initiated by President Donald Trump. 41 .

What was the worst stock market crash in history?

The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.

What was the cause of the 1929 stock market crash?

The primary cause of the 1929 stock market crash was excessive leverage. Many individual investors and investment trusts had begun buying stocks on margin, meaning that they paid only 10% of the value of a stock to acquire it under the terms of a margin loan.

What happened on Black Monday 1987?

Black Monday crash of 1987. On Monday, Oct. 19, 1987, the Dow Jones Industrial Average plunged by nearly 22%. Black Monday, as the day is now known, marks the biggest single-day decline in stock market history. The remainder of the month wasn't much better; by the start of November, 1987, most of the major stock market indexes had lost more ...

Why did the Dow drop in 1929?

The Dow didn't regain its pre-crash value until 1954. The primary cause of the 1929 stock market crash was excessive leverage. Many individual investors and investment trusts had begun buying stocks on margin, meaning that they paid only 10% of the value of a stock to acquire it under the terms of a margin loan.

Why did the stock market recover from Black Monday?

Because the Black Monday crash was caused primarily by programmatic trading rather than an economic problem, the stock market recovered relatively quickly. The Dow started rebounding in November, 1987, and recouped all its losses by September of 1989.

When did the Dow lose its value?

The stock market was bearish, meaning that its value had declined by more than 20%. The Dow continued to lose value until the summer of 1932, when it bottomed out at 41 points, a stomach-churning 89% below its peak. The Dow didn't regain its pre-crash value until 1954.

When did the Dow Jones Industrial Average rise?

The Dow Jones Industrial Average ( DJINDICES:^DJI) rose from 63 points in August, 1921, to 381 points by September of 1929 -- a six-fold increase. It started to descend from its peak on Sept. 3, before accelerating during a two-day crash on Monday, Oct. 28, and Tuesday, Oct. 29.

The Fall from A Record High

Compare to Previous Black Mondays

- Before March 16, 2020, two previous Black Mondays had worse percentage drops. The Dow fell 22.6% on Black Monday, Oct. 19, 1987.4 On Black Monday, Oct. 28, 1929, the average plunged nearly 13%. This was part of the four-day loss in the stock market crash of 1929 that started the Great Depression.5

Causes of The 2020 Crash

- The 2020 crash occurred because investors were worried about the impact of the COVID-19 coronavirus pandemic. The uncertainty over the danger of the virus, plus the shuttering of many businesses and industries as states implemented shutdown orders, damaged many sectors of the economy. Investors predicted that workers would be laid off, resulting in high unemployment an…

Effects of The 2020 Crash

- Often, a stock market crash causes a recession. That's even more likely when combined with a pandemic and an inverted yield curve. An inverted yield curve is an abnormal situation where the return, or yield, on a short-term Treasury bill is higher than the Treasury 10-year note. It only occurs when the near-term risk is greater than in the distant future. Usually, investors don't need …

How It Affected Investors

- When a recession hits, many people panic and selltheir stocks to avoid losing more. But the rapid gains in the stock market after the crash indicated that throughout 2020 and 2021, many investors continued to invest rather than sell. Recessions can be good or bad for investors. Whether they survive a market downturn depends on how they invest and control their emotions…

Actions That Reduced The Length of The 2020 Recession

- The 2020 stock market crash was followed by a recession. That, however, was followed by a substantial but unevenly distributed recovery. Under both the Trump and Biden administrations, the federal government passed multiple bills to stimulate the economy. These included help directed at specific sectors, cash payments to taxpayers, increases in unemployment insurance…