Full Answer

What exactly caused the stock market to crash in 1929?

The stock market crash of 1929 was not caused by a single factor, but a collection of events on the part of investors, regulators and international relations. Here is a quick overview of some of the main causes: Overconfidence and oversupply: Investors and institutions emerged in the early 1920s in the stock market as the economy expanded.

Which situation helped cause the stock market crash of 1929?

Which situation helped cause the stock market crash of 1929? 1.excessive speculation and buying on margin 2.unwillingness of people to invest in new industries 3.increased government spending 4.too much government regulation of business

Why is the stock market crashed in 1929?

There were several reasons for the 1929 stock market crash: overvalued stocks, low margin requirements (10 percent), interest rate hikes and poor banking structures. The Facts The stock market crash took place over a period of two weeks in October 1929. with three days referred to as Black Thursday (Oct. 24); Black Monday (Oct. 28); and Black Tuesday (Oct. 29).

Who caused the stock market crash of 1929?

The stock market crash of 1929 was largely caused by bad stock market investments, low wages, a crumbling agricultural sector and high amounts of debt that could not be liquidated. Upward trends in the stock market caused many people to invest money, even if they did not have the financial assets to back up their investments.

How long did it take for the stock market to crash in 1929?

Over the course of four business days—Black Thursday (October 24) through Black Tuesday (October 29)—the Dow Jones Industrial Average dropped from 305.85 points to 230.07 points, representing a decrease in stock prices of 25 percent.

What started the stock market crash of 1929?

By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

When did the stock market crash in the fall of 1929?

The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day.

Did the stock market crash of 1929 start the Great Depression?

The stock market crash of 1929 was a collapse of stock prices that began on October 24, 1929. By October 29, 1929, the Dow Jones Industrial Average had dropped by 30.57%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression.

What happened on October 29th 1929?

A crowd of investors gather outside the New York Stock Exchange on "Black Tuesday"—October 29, when the stock market plummeted and the U.S. plunged into the Great Depression. On October 29, 1929, the United States stock market crashed in an event known as Black Tuesday.

Will the stock market crash 2022?

Stocks in 2022 are off to a terrible start, with the S&P 500 down close to 20% since the start of the year as of May 23. Investors in Big Tech are growing more concerned about the economic growth outlook and are pulling back from risky parts of the market that are sensitive to inflation and rising interest rates.

How long did it take the stock market to recover after the 2008 crash?

The S&P 500 dropped nearly 50% and took seven years to recover. 2008: In response to the housing bubble and subprime mortgage crisis, the S&P 500 lost nearly half its value and took two years to recover. 2020: As COVID-19 spread globally in February 2020, the market fell by over 30% in a little over a month.

When did the stock market crash in 2008?

On October 24, 2008, many of the world's stock exchanges experienced the worst declines in their history, with drops of around 10% in most indices. In the U.S., the DJIA fell 3.6%, although not as much as other markets.

Who profited from the stock market crash of 1929?

The classic way to profit in a declining market is via a short sale — selling stock you've borrowed (e.g., from a broker) in hopes the price will drop, enabling you to buy cheaper shares to pay off the loan. One famous character who made money this way in the 1929 crash was speculator Jesse Lauriston Livermore.

When did stock prices begin to fall in the US?

October 1929. On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system. The Roaring Twenties roared loudest and longest on the New York Stock Exchange.

What caused the stock market crash of 2008?

The stock market crash of 2008 was a result of defaults on consolidated mortgage-backed securities. Subprime housing loans comprised most MBS. Banks offered these loans to almost everyone, even those who weren't creditworthy. When the housing market fell, many homeowners defaulted on their loans.

How much did the average stock price drop between 1929 and 1932?

This is equivalent to an 18% annual growth rate in value for the seven years. From 1929 to 1932 stocks lost 73% of their value (different indices measured at different time would give different measures of the increase and decrease). The price increases were large, but not beyond comprehension.

What happened to the stock market in 1929?

On September 20, 1929, the London Stock Exchange crashed when top British investor Clarence Hatry and many of his associates were jailed for fraud and forgery. The London crash greatly weakened the optimism of American investment in markets overseas: in the days leading up to the crash, the market was severely unstable.

What was the cause of the 1929 stock market crash?

Cause. Fears of excessive speculation by the Federal Reserve. The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed.

How did the stock market crash of 1929 affect the world?

The stock market crash of October 1929 led directly to the Great Depression in Europe. When stocks plummeted on the New York Stock Exchange, the world noticed immediately. Although financial leaders in the United Kingdom, as in the United States, vastly underestimated the extent of the crisis that ensued, it soon became clear that the world's economies were more interconnected than ever. The effects of the disruption to the global system of financing, trade, and production and the subsequent meltdown of the American economy were soon felt throughout Europe.

How many points did the Dow Jones Industrial Average recover from the 1929 crash?

The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day. The trading floor of the New York Stock Exchange Building in 1930, six months after the crash of 1929.

What was the prediction of the Great Bull Market?

The optimism and the financial gains of the great bull market were shaken after a well-publicized early September prediction from financial expert Roger Babson that "a crash is coming, and it may be terrific". The initial September decline was thus called the "Babson Break" in the press.

What was the biggest stock crash in 1929?

The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day.

Why did the uptick rule fail?

Also, the uptick rule, which allowed short selling only when the last tick in a stock's price was positive, was implemented after the 1929 market crash to prevent short sellers from driving the price of a stock down in a bear raid.

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What caused the stock market to go down in 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic. During the mid- to late 1920s, the stock market in the United States underwent rapid ...

What was the Great Depression?

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

What was the cause of the 1929 Wall Street crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it , during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels. Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier ...

Why did people sell their Liberty bonds?

People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

What lessons did the Federal Reserve learn from the 1929 stock market crash?

9. First, central banks – like the Federal Reserve – should be careful when acting in response to equity markets. Detecting and deflating financial bubbles is difficult.

How much did the Dow drop in 1932?

The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

When did the Dow Jones Industrial Average increase?

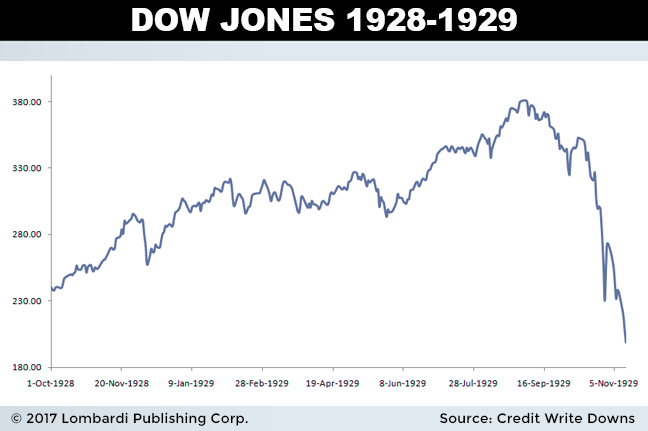

The Dow Jones Industrial Average increased six-fold from sixty-three in August 1921 to 381 in September 1929 . After prices peaked, economist Irving Fisher proclaimed, “stock prices have reached ‘what looks like a permanently high plateau.’” 2. The epic boom ended in a cataclysmic bust.

Who published a monetary history of the United States in 1963?

Consensus coalesced around the time of the publication of Milton Friedman and Anna Schwartz’ s A Monetary History of the United States in 1963.

Who created the Dow Jones Industrial Average?

Dow Jones Industrial Average (Created by: Sam Marshall, Federal Reserve Bank of Richmond) Enlarge. The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds.

What was the stock market crash of 1929?

The stock market crash of 1929 followed a bull market that had seen the Dow Jones rise 400% in five years. But with industrial companies trading at price-to-earnings ratios (P/E ratios) of 15, valuations did not appear unreasonable after a decade of record productivity growth in manufacturing—that is, until you take into account the public utility holding companies.

What were the causes of the 1929 stock market crash?

The 1929 crash was preceded by a decade of record economic growth and speculation in a bull market that saw the DJIA skyrocket 400% over five years. Other factors leading up to the stock market crash include unscrupulous actions by public utility holding companies, overproduction of durable goods, and an ongoing agricultural slump.

What caused the 1929 financial crash?

Another factor experts cite as leading to the 1929 crash is the overproduction in many industries that caused an oversupply of steel, iron, and durable goods. When it became clear that demand was low and there were not enough buyers for their goods, manufacturers dumped their products at a loss and share prices began to plummet. Some experts also cite an ongoing agricultural recession as another factor impacting the financial markets.

What was the cause of the 1929 crash?

The lack of government oversight was one of the major causes of the 1929 crash—thanks to laissez-faire economic theories. In response, Congress passed an array of important federal regulations aimed at stabilizing the markets.

What was the effect of the Great Depression on the working population?

In the end, a quarter of America’s working population would lose their jobs as the Great Depression ushered in an era of isolationism, protectionism, and nationalism. The infamous Smoot-Hawley Tariff Act in 1930 started a spiral of beggar-thy-neighbor economic policies.

What broke the camel's back?

However, the straw that broke the camel’s back was probably the news in Oct. 1929 that the public utility holding companies would be regulated. The resulting sell-off cascaded through the system as investors who had bought stocks on margin became forced sellers.

When did the Dow Jones Industrial Average bottom out?

In fact, the Dow Jones Industrial Average (DJIA) did not bottom out until July 8, 1932, by which time it had fallen 89% from its Sept. 1929 peak, making it the biggest bear market in Wall Street’s history. The Dow Jones did not return to its 1929 high until Nov. 1954.

How much did the stock market lose in 1929?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket.

When did the stock market drop?

The stock market, which had been growing for years, began to decline in the summer and early fall of 1929, precipitating a panic that led to a massive stock sell-off in late October. In one month, the market lost close to 40 percent of its value.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

What was Hoover's agenda?

Upon his inauguration, President Hoover set forth an agenda that he hoped would continue the “Coolidge prosperity ” of the previous administration. While accepting the Republican Party’s presidential nomination in 1928, Hoover commented, “Given the chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation forever.” In the spirit of normalcy that defined the Republican ascendancy of the 1920s, Hoover planned to immediately overhaul federal regulations with the intention of allowing the nation’s economy to grow unfettered by any controls. The role of the government, he contended, should be to create a partnership with the American people, in which the latter would rise (or fall) on their own merits and abilities. He felt the less government intervention in their lives, the better.

How did the stock market crash affect people?

Although only a small percentage of Americans had invested in the stock market, the crash affected everyone. Banks lost millions and, in response, foreclosed on business and personal loans, which in turn pressured customers to pay back their loans, whether or not they had the cash.

What happened to the stock market on September 20th?

Even the collapse of the London Stock Exchange on September 20 failed to fully curtail the optimism of American investors. However, when the New York Stock Exchange lost 11 percent of its value on October 24—often referred to as “Black Thursday”—key American investors sat up and took notice.

What happened on October 29, 1929?

October 29, 1929, or Black Tuesday, witnessed thousands of people racing to Wall Street discount brokerages and markets to sell their stocks. Prices plummeted throughout the day, eventually leading to a complete stock market crash. The financial outcome of the crash was devastating.

How many times did stock prices go up in 1929?

Until the peak in 1929, stock prices went up by nearly 10 times. In the 1920s, investing in the stock market became somewhat of a national pastime for those who could afford it and even those who could not—the latter borrowed from stockbrokers to finance their investments. The economic growth created an environment in which speculating in stocks ...

What happened in 1929?

In October of 1929, the stock market crashed, wiping out billions of dollars of wealth and heralding the Great Depression. Known as Black Thursday, the crash was preceded by a period of phenomenal growth and speculative expansion. A glut of supply and dissipating demand helped lead to the economic downturn as producers could no longer readily sell ...

Why did companies acquire money cheaply?

Essentially, companies could acquire money cheaply due to high share prices and invest in their own production with the requisite optimism. This overproduction eventually led to oversupply in many areas of the market, such as farm crops, steel, and iron.

What was the result of the Great War?

The result was a series of legislative measures by the U.S. Congress to increase tariffs on imports from Europe.

What happens when the stock market falls?

However, when markets are falling, the losses in the stock positions are also magnified. If a portfolio loses value too rapidly, the broker will issue a margin call, which is a notice to deposit more money to cover the decline in the portfolio's value.

Why did the economy stumbled in 1929?

In mid-1929, the economy stumbled due to excess production in many industries, creating an oversupply.

What happens if a broker doesn't deposit funds?

If the funds are not deposited, the broker is forced to liquidate the portfolio. When the market crashed in 1929, banks issued margin calls. Due to the massive number of shares bought on margin by the general public and the lack of cash on the sidelines, entire portfolios were liquidated.

What was the cause of the 1929 stock market crash?

Most economists agree that several, compounding factors led to the stock market crash of 1929. A soaring, overheated economy that was destined to one day fall likely played a large role.

Why did the stock market crash make the situation worse?

Public panic in the days after the stock market crash led to hordes of people rushing to banks to withdraw their funds in a number of “bank runs,” and investors were unable to withdraw their money because bank officials had invested the money in the market.

What was the economic climate in the 1920s?

Additionally, the overall economic climate in the United States was healthy in the 1920s. Unemployment was down, and the automobile industry was booming. While the precise cause of the stock market crash of 1929 is often debated among economists, several widely accepted theories exist. 17. Gallery.

What was the worst economic event in history?

The stock market crash of 1929 was the worst economic event in world history. What exactly caused the stock market crash, and could it have been prevented?

Why did people buy stocks in the 1920s?

During the 1920s, there was a rapid growth in bank credit and easily acquired loans. People encouraged by the market’s stability were unafraid of debt.

When did the Dow go up?

The market officially peaked on September 3, 1929, when the Dow shot up to 381.

When did the Federal Reserve raise the interest rate?

The Government Raised Interest Rates. In August 1929 – just weeks before the stock market crashed – the Federal Reserve Bank of New York raised the interest rate from 5 percent to 6 percent. Some experts say this steep, sudden hike cooled investor enthusiasm, which affected market stability and sharply reduced economic growth.

Why did the stock market crash in 1929?

Richardson says that Americans displayed a uniquely bad tendency for creating boom/bust markets long before the stock market crash of 1929. It stemmed from a commercial banking system in which money tended to pool in a handful of economic centers like New York City and Chicago. When a market got hot, whether it was railroad bonds or equity stocks, these banks would loan money to brokers so that investors could buy shares at steep margins. Investors would put down 10 percent of the share price and borrow the rest, using the stock or bond itself as collateral.

What was the message of the stock market in 1929?

Back in 1929, the message was “Stop loaning money to investors, ” says Richardson. “This is creating a problem.”. Recommended for you.

Why did the Federal Reserve start?

One of the reasons Congress created the Federal Reserve in 1914 was to stem this kind of credit-fueled market speculation. Starting in 1928, the Fed launched a very public campaign to slow down runaway stock prices by cutting off easy credit to investors, Richardson says.

What was the first warning sign of a looming market correction?

He says that the first warning sign of a looming market correction was a general consensus that the blistering pace at which stock prices were rising in the late 1920s was unsustainable. “People could see in 1928 and 1929 that if stock prices kept going up at the current rate, in a few decades they’d be astronomic,” says Richardson.

When did Babson say that stock prices were going to be high?

That was on October 15, 1929, less than two weeks before Black Monday.

What was the rallying of the economy in 1929?

economy was riding high on the decade-long winning spree called the Roaring Twenties, but the Fed was raising interest rates to slow a booming market and an increasingly vocal minority of economists and bankers were beginning to wonder how long the party could possibly last.

When did the stock market throw signals back?

Hindsight is 20/20, but the stock market threw signals back in the summer of 1929 that trouble lay ahead. In the spring and summer of 1929, the U.S. economy was riding high on the decade-long winning spree called the Roaring Twenties, but the Fed was raising interest rates to slow a booming market and an increasingly vocal minority ...

Overview

Academic debate

There is a constant debate among economists and historians as to what role the crash played in subsequent economic, social, and political events. The Economist argued in a 1998 article that the Depression did not start with the stock market crash, nor was it clear at the time of the crash that a depression was starting. They asked, "Can a very serious Stock Exchange collapse produce a serious setback to industry when industrial production is for the most part in a healthy and balan…

Background

The "Roaring Twenties", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector.

Crash

Selling intensified in mid-October. On October 24, "Black Thursday", the market lost 11% of its value at the opening bell on very heavy trading. The huge volume meant that the report of prices on the ticker tape in brokerage offices around the nation was hours late, and so investors had no idea what most stocks were trading for. Several leading Wall Street bankers met to find a solution to the pani…

Aftermath

In 1932, the Pecora Commission was established by the U.S. Senate to study the causes of the crash. The following year, the U.S. Congress passed the Glass–Steagall Act mandating a separation between commercial banks, which take deposits and extend loans, and investment banks, which underwrite, issue, and distribute stocks, bonds, and other securities.

After, stock markets around the world instituted measures to suspend trading in the event of rap…

Analysis

The crash followed a speculative boom that had taken hold in the late 1920s. During the latter half of the 1920s, steel production, building construction, retail turnover, automobiles registered, and even railway receipts advanced from record to record. The combined net profits of 536 manufacturing and trading companies showed an increase, in the first six months of 1929, of 36.6% over …

Effects

Together, the 1929 stock market crash and the Great Depression formed the largest financial crisis of the 20th century. The panic of October 1929 has come to serve as a symbol of the economic contraction that gripped the world during the next decade. The falls in share prices on October 24 and 29, 1929 were practically instantaneous in all financial markets, except Japan.

See also

• Causes of the Great Depression

• Criticism of the Federal Reserve

• Great Contraction

• List of largest daily changes in the Dow Jones Industrial Average

What Was The Stock Market Crash of 1929?

Understanding The Stock Market Crash of 1929

- The stock market crash of 1929 followed a bull market that had seen the Dow Jones rise significantly in five years. But with industrial companies trading at price-to-earnings ratios (P/E ratios) of over 15, valuations did not appear unreasonable after a decade of record productivity growth in manufacturing; that is, until you take into account the public utility holding companies.…

Other Factors Leading to The 1929 Stock Market Crash

- Another factor experts cite as leading to the 1929 crashis the overproduction in many industries that caused an oversupply of steel, iron, and durable goods. When it became clear that demand was low and there were not enough buyers for their goods, manufacturers dumped their products at a loss and share prices began to plummet. Some experts also cite an ongoing agricultural rec…

The Aftermath of The 1929 Stock Market Crash

- Instead of trying to stabilize the financial system, the Fed, thinking the crash was necessary or even desirable, did nothing to prevent the wave of bank failures that paralyzed the financial system—and so made the slump worse than it might have been. As Treasury Secretary Andrew Mellon told President Herbert Hoover: "Liquidate labor, liquidate stocks, liquidate the farmers, liq…

Special Considerations

- The lack of government oversight was one of the major causes of the 1929 crash, thanks to laissez-faire economic theories. In response, Congress passed an array of important federal regulations aimed at stabilizing the markets. These include the Glass Steagall Act of 1933, the Securities and Exchange Act of 1934, and the Public Utility Holding Companies Act of 1935.