Stocks that fall below minimum selling selling prices – for example there's a $4 minimum on the New York Stock Exchange – will be delisted. Investors can no longer buy or sell securities through normal channels when the stock disappears from its exchange listing. Securities with a zero value will always be delisted from major stock exchanges.

Full Answer

What happens when you sell a stock at a lower price?

The person buying it at that lower price–the price you sold it for–doesn't necessarily profit from your loss and must wait for the stock to rise before making a profit. The company that issued the stock doesn't get the money from your declining stock price either.

What is the low of a stock called?

The low is the lowest price of the period. A stock’s high and low points for the day are often called it’s intraday high and low. It is also common to see a stock’s 52-week high and 52-week low listed.

What happens when the demand for a stock is low?

If a lot of people don't want a stock (demand is low), then the price will fall. If a stock's demand sinks dramatically, it will lose much (if not all) of its value. The main factor determining the demand for a stock is the quality of the company itself.

What happens when a stock price drops to zero?

Zero value is always a common cause of delisting. Owning a stock whose price drops to zero is devastating to investors and the issuing company. If you're an investor in a public company whose stock price crashes to zero dollars, either make wall space for displaying worthless stock certificates or investigate the company further.

What happens when a stock price goes too low?

If a stock's price falls all the way to zero, shareholders end up with worthless holdings. Once a stock falls below a certain threshold, stock exchanges will delist those shares.

Why do stocks open lower than they closed?

During a regular trading day, the balance between supply and demand fluctuates as the attractiveness of the stock's price increases and decreases. These fluctuations are why closing and opening prices are not always identical.

What does it mean for a stock to close up?

Closing a position refers to canceling out an existing position in the market by taking the opposite position. In a short sale, this would mean buying back the security, while a long position entails selling the security.

What happens when a stock plummets?

Stock Price Decline Example That means the value of your stock decreased by 20%. If the stock market is down and the investment price drops below your purchase price, you'll have a “paper loss.” The opposite is also true: If the stock price increased to $12 per share, the value would increase by 16.67%.

Why closing price is important?

The Closing Price helps the investor understand the market sentiment of the stocks over time. It is the most accurate matrix to determine the valuation of stock until the market resumes trading the next day.

Should I buy stock as soon as market opens?

Trading When the Market Opens Trading during the first one to two hours that the stock market is open on any day is all that many traders need. The first hour tends to be the most volatile, providing the most opportunity (and potentially the most risk).

What does a closing price mean?

"Closing price" generally refers to the last price at which a stock trades during a regular trading session. For many U.S. markets, regular trading sessions run from 9:30 a.m. to 4:00 p.m. Eastern Time.

When should you close a trade?

Traders will generally close positions for three main reasons:Profit targets have been reached and the trade is exited at a profit.Stops levels have been reached and the trade is exited at a loss.Trade needs to be exited to satisfy margin requirements.

Does closing a position mean selling?

“Closing a trade” means terminating an investment. In the laymen's terms it would be called “selling” a stock or a financial asset. Selling an asset, synonymous with “short selling”, means entering into a contract with a broker, or simply an investment, where you believe an asset will decline in value.

Do you owe money if stock goes down?

If you invest in stocks with a cash account, you will not owe money if a stock goes down in value. The value of your investment will decrease, but you will not owe money. If you buy stock using borrowed money, you will owe money no matter which way the stock price goes because you have to repay the loan.

Can you sell a stock if there are no buyers?

When there are no buyers, you can't sell your shares—you'll be stuck with them until there is some buying interest from other investors. A buyer could pop in a few seconds, or it could take minutes, days, or even weeks in the case of very thinly traded stocks.

What is it called when a stock plummets?

Before we get to how money disappears, it is important to understand that regardless of whether the market is rising–called a bull market–or falling–called a bear market–supply and demand drive the price of stocks. And it's the fluctuations in stock prices that determines whether you make money or lose it.

What happens if a stock drops to zero?

A drop in price to zero means the investor loses his or her entire investment – a return of -100%.

How does supply and demand affect stock price?

Supply and demand determine the value of a stock, with higher demand driving the price higher in turn. Lower demand causes a stock to lose some value—and plummeting demand could cause it to lose all value.

What happens if demand is high?

If a lot of people don't want a stock (demand is low), then the price will fall. If a stock's demand sinks dramatically, it will lose much (if not all) of its value.

Can a stock lose its value?

To summarize, yes, a stock can lose its entire value. However, depending on the investor's position, the drop to worthlessness can be either good (short positions) or bad (long positions).

Is a loss in a stock arbitrary?

So, although stocks carry some risk, it would not be accurate to say that a loss in a stock's value is completely arbitrary. There are other factors that drive supply and demand for companies.

What happens if a stock has zero value?

Zero value is always a common cause of delisting.

What happens when a stock falls to zero?

If you don't share the belief that the company will make a comeback, consider taking the offer, however low it may be. Remember, the next step for most zero stocks is worthlessness.

Is OTC stock market volatile?

The OTC market tends to be extremely volatile and a haven for speculators hoping to make fast profits. While it seldom happens, OTC stocks can be popular, even after losing their stock exchange listing privileges. The company could still be experiencing growth, and could be relisted on a major exchange in the future.

What happens if you buy a stock for $10 and sell it for $5?

If you purchase a stock for $10 and sell it for only $5, you will lose $5 per share. It may feel like that money must go to someone else, but that isn't exactly true. It doesn't go to the person who buys the stock from you.

What happens when a stock tumbles?

When a stock tumbles and an investor loses money, the money doesn't get redistributed to someone else. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock. That's because stock prices are determined by supply and demand and investor perception of value and viability.

How is value created or dissolved?

On the one hand, value can be created or dissolved with the change in a stock's implicit value, which is determined by the personal perceptions and research of investors and analysts.

What is implicit value in stocks?

Depending on investors' perceptions and expectations for the stock, implicit value is based on revenues and earnings forecasts. If the implicit value undergoes a change—which, really, is generated by abstract things like faith and emotion—the stock price follows.

How is implicit value determined?

A stock's implicit value is determined by the perceptions of analysts and investors, while the explicit value is determined by its actual worth, the company's assets minus its liabilities.

What is short selling?

Short Selling. There are investors who place trades with a broker to sell a stock at a perceived high price with the expectation that it'll decline. These are called short-selling trades. If the stock price falls, the short seller profits by buying the stock at the lower price–closing out the trade.

What happens when investors perceive a stock?

When investor perception of a stock diminishes, so does the demand for the stock, and, in turn, the price. So faith and expectations can translate into cold hard cash, but only because of something very real: the capacity of a company to create something, whether it is a product people can use or a service people need.

What is the closing price of a stock?

A closing price for a stock is the price at the end of a trading day. It's a standard figure watched by investors, financial institutions and other organizations making decisions about the stock and the company.

What does it mean when the stock market is closed?

This means that even though the stock market is closed, the stock is still available to trade. The New York Stock Exchange, NASDAQ and other markets have limited before and after hours trading. In such a case, the stock's after-market price may be slightly different than ...

Why is closing price important?

The closing stock price is significant for several reasons. Investors, traders, financial institutions, regulators and other stakeholders use it as a reference point for determining performance over a specific time such as one year, a week and over a shorter time frame such as one minute or less.

What does it mean to short a stock?

He decides to "short" the stock with the expectation of the price falling lower. Shorting a stock means that he makes money if the stock declines in value. It's a process that lets investors borrow shares of the stock from other investors for a small fee, sell them and buy them back to return to the original owner at a later date.

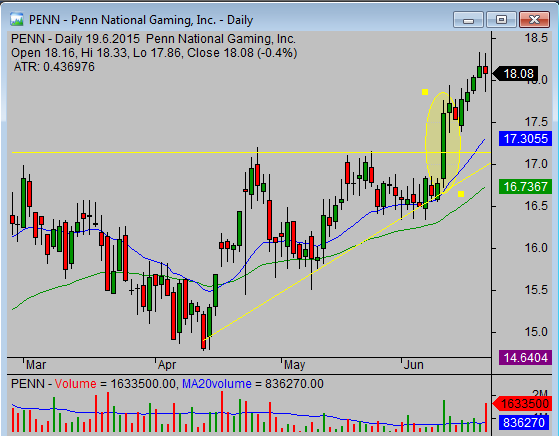

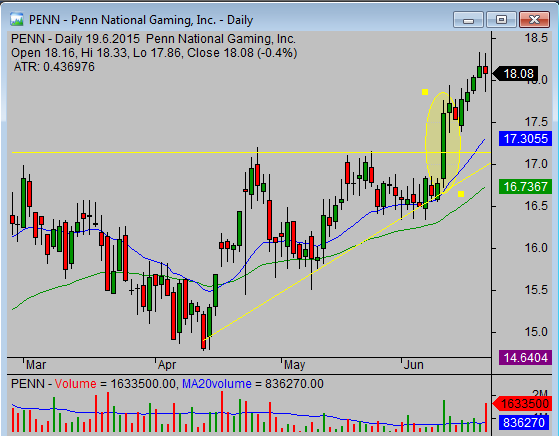

What is the difference between "open" and "low"?

The "high" is the highest at which the stock traded for the day and the "low" is the lowest price for the trading day. You'll also notice a "52-week range" for the stock.

What do investors and other stakeholders base their decisions on?

In fact, investors and other stakeholders base their decisions on closing stock prices. Institutional investors monitor a stock's closing price to make decisions regarding their investment portfolios.

Can you use only a single price point to draw support?

Rather, they’re on areas or levels. So, you cannot simply use only a single price point to draw support or resistance. But you can use opening/closing prices and high/low prices to use them together to define these important levels.

Do you use the close price in stock chart?

But some traders often ask whether it’s more important to use the close price compared with the high or low price levels. There are several ways to use these data points.

What is the high low close in stock?

What is Open High Low Close in Stocks? In stock trading, the high and low refer to the maximum and minimum prices in a given time period. Open and close are the prices at which a stock began and ended trading in the same period. Volume is the total amount of trading activity. Adjusted values factor in corporate actions such as dividends, ...

Why do companies issue additional shares of stock?

A company may also decide to issue additional shares of stock to raise capital for growth projects, debt repayment, or acquisitions. This has a similar effect to stock splits as there are more shares out there. However, issuing new equity changes the company’s cost of capital.

What is OHLCV in stock trading?

When discussing open, high, low, close, and volume (OHLCV) of a securities price, it’s essential to understand the period. Unless otherwise specified, the period is commonly daily; however, traders incorporate multiple periods when reviewing the price action of a security. This is called multiple timeframe analysis. For example, a stock could be in a daily uptrend with a series of higher highs and higher lows, but be in a weekly downtrend with a string of lower highs and lower lows. With this out of the way, let’s dig deeper into these definitions through the lens of the most common trading period: the daily time period.

What is the difference between a low and a high?

Low is the minimum price of a stock in a period, while high is the maximum value reached by the stock in the same period. These terms are most often discussed in the context of a single trading day but could easily refer to the highs and lows of any period, including minute, hour, week, month, year, etc., or even a stock’s entire trading history.

What does "open" mean in stock market?

Open means the price at which a stock started trading when the opening bell rang. It can be the same as where the stock closed the night before, but not always. Sometimes events such as company earnings reports that happen in after-hours trading can alter a stock’s price overnight. Then there is “close”.

What does volume mean in stock trading?

Volume refers to the number of shares that exchange hands for a stock with a specific period. Closing on a ‘high’ note, all of these terms help give us a better picture of a stock’s price action at a given point in time, helping us to make better trading decisions.

Why do companies split their shares?

A company may also split its shares to reduce the stock price or perform a reverse split to increase it. With more shares out there, each share has a lower claim on the company than it did before. The opposite is also true. With fewer shares available in the case of a reverse stock split, the stock’s price will increase.

Determining Stock Price and Bankruptcy

Impact on Long and Short Positions

- The effects of a stock losing all its value will be different for a long position than for a short position. Someone holding a long position (owns the stock) is, of course, hoping the investment will appreciate. A drop in price to zero means the investor loses his or her entire investment: a return of -100%. Conversely, a complete loss in a stock's...

Real-World Example of A Stock Losing All Its Value

- Sometimes a company will be forced into bankruptcy and its stock fall to zero as the result of an accounting scandal or fraud. Take the famous case of Enron, a large and influential energy and trading company in the 1990s. By the early 2000s, the company was riding high and its stock was seeing all-time highs. What people didn't know yet, however, was that Enron was using accounti…