Full Answer

When a corporation acquires shares of its own common stock?

When a corporation acquires shares of its own common stock, it records a: debit to Common Stock for par value,debit to Common Stock for cost,debit to Treasury Stock for par value,debit to Treasury Stock for cost. 2. Almond Corporation acquires 10,000 shares of its own $1 par value common stock at $10 per share.

Does a stock corporation have the power to buy shares?

Yes. Among the explicit powers of a stock corporation is the Power to Acquire Own Shares as provided for under Section 40 of the Revised Corporation Code. However, as a general rule, such power is anchored on the twin conditions of legitimate corporate purpose and unrestricted retained earnings.

Why would a company buy its own shares?

There are many reasons why a company may wish to acquire its own shares. Listed companies may use this mechanism to return surplus cash to shareholders, to enhance earnings per share or net assets per share, or to adjust gearing ratios.

What happens to stock when a company sells it?

It may give or sell the stock to its employees as some type of employee compensation or stock sale. Finally, the company can retire the securities. In order to retire stock, the company must first buy back the shares and then cancel them. Shares cannot be reissued on the market, and are considered to have no financial value.

When a corporation purchases its own stock?

Treasury Stock are shares issued by the company but are reacquired or repurchased, for different purposes and reasons. This is an equity account and are deducted, to determine the total amount of stockholders' equity.

What is the journal entry for buying back stock?

The company can make the journal entry for repurchase of common stock by debiting the treasury stock account and crediting the cash account. Treasury stock is a contra account to the capital account (e.g. common stock) in the equity section of the balance sheet.

How do I record a share redemption?

Place an entry in the general ledge on the date of the purchase for the redemption. List the date of the transaction; then, on the first line of the listing, write "Treasury Stock" in the column for "Account Title and Description." In the "Debit" column, list the amount paid by the company to redeem the stock.

What is it called when a corporation only has one class of stock?

If a corporation has issued only one type, or class, of stock it will be common stock. (Preferred stock is discussed later.)

What happens when a company repurchases its own stock?

What is a stock buyback and how does it create value? A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares outstanding. In effect, buybacks “re-slice the pie” of profits into fewer slices, giving more to remaining investors.

What happens when company buyback stocks?

A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn't need to fund operations and other investments.

How does a corporation treat the redemption of stock?

Summary. A stock redemption is a transaction in which a corporation acquires its own stock from a shareholder in exchange for cash or other property. The redeeming corporation generally does not recognize gain or loss, unless it distributes appreciated property.

Why do companies redeem their own shares?

Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall.

Can a company redeem its shares?

For a company to redeem shares, it must have stipulated upfront that those shares are redeemable, or callable. Redeemable shares have a set call price, which is the price per share that the company agrees to pay the shareholder upon redemption. The call price is set at the onset of the share issuance.

What is it called when a company owns its own stock?

A shareholder, also referred to as a stockholder, is a person, company, or institution that owns at least one share of a company's stock, known as equity. Because shareholders essentially own the company, they reap the benefits of a business's success.

What are shares of ownership in a corporation called?

Stock, or shares (equity), express an ownership interest in a corporation. Shares have different designations, depending on who holds the shares. The two main types of stock are preferred stock and common stock, each with rights that often differ from the rights of the other.

What is an owner of one or more shares of a corporation called?

stockholderA stockholder (also known as a shareholder) is the owner of one or more shares of a corporation's capital stock. A stockholder is considered to be separate from the corporation and therefore has limited liability for the corporation's obligations.

Why do companies buy back their shares?

A company might buy back its shares to boost the value of the stock and to improve the financial statements. These shares may be allocated for employee compensation, held for a later secondary offering, or retired. Companies tend to repurchase shares when they have cash on hand, and the stock market is on an upswing.

What happens when a company buys back stock?

When a company performs a share buyback, it can do several things with those newly repurchased securities . First, it can reissue the stock on the stock market at a later time. In the case of a stock reissue, the stock is not canceled, but is sold again under the same stock number as it had previously. Or, it may give or sell the stock ...

How is stock repurchased?

Stock is repurchased from the money saved in the company's retained earnings, or else a company can fund its buyback by taking on debt through bond issuance. After the stock is repurchased, the issuer or transfer agent acting on behalf of the share issuer must follow a number of Securities and Exchange Commission rules.

What is a buyback in stock market?

In a buyback, a company buys its own shares directly from the market or offers its shareholders the option of tendering their shares directly to the company at a fixed price. A share buyback reduces the number of outstanding shares, which increases both the demand for the shares and the price.

What is stock compensation?

Companies that offer stock compensation can give employees stock options that offer the right to purchase shares of the companies' stocks at a predetermined price, also referred to as exercise price. This right may vest with time, allowing employees to gain control of this option after working for the company for a certain period of time.

What happens when an option vests?

When the option vests, they gain the right to sell or transfer the option. This method encourages employees to stick with the company for the long term. However, the option typically has an expiration. The stock held in reserve for these options or for direct stock compensation can come directly from a buyback.

What happens when a company's stock price is too low?

If a company believes that its shares are currently priced too low, they can buy back their shares now with the intention of re-offering them to the public at a later date when the share price has recovered, or after the company has exhibited promising growth prospects.

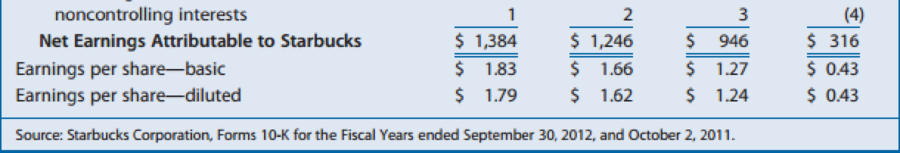

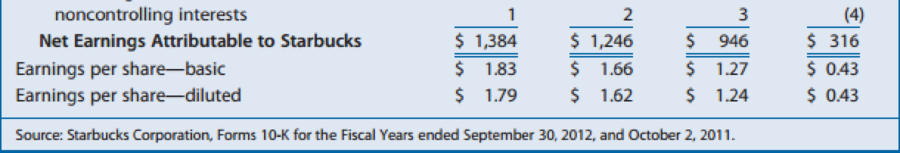

How much does a company's EPS increase if it repurchases 10,000 shares?

If it repurchases 10,000 of those shares, reducing its total outstanding shares to 90,000, its EPS increases to $111.11 without any actual increase in earnings. Also, short-term investors often look to make quick money by investing in a company leading up to a scheduled buyback.

What happens when a stock is undervalued?

If a stock is dramatically undervalued, the issuing company can repurchase some of its shares at this reduced price and then re- issue them once the market has corrected, thereby increasing its equity capital without issuing any additional shares.

How does a stock buyback affect credit?

A stock buyback affects a company's credit rating if it has to borrow money to repurchase the shares. Many companies finance stock buybacks because the loan interest is tax-deductible. However, debt obligations drain cash reserves, which are frequently needed when economic winds shift against a company. For this reason, credit reporting agencies view such-financed stock buybacks in a negative light: They do not see boosting EPS or capitalizing on undervalued shares as a good justification for taking on debt. A downgrade in credit rating often follows such a maneuver.

What is a stock buyback?

Stock buybacks refer to the repurchasing of shares of stock by the company that issued them. A buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private investors .

Why do companies do buybacks?

Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall.

How many shares did Bank of America buy back in 2017?

However, as of the end of 2017, Bank of America had bought back nearly 300 million shares over the prior 12-month period. 2 Although the dividend has increased over the same period, the bank's executive management has consistently allocated more cash to share repurchases rather than dividends.

What is the goal of a company executive?

Shareholders usually want a steady stream of increasing dividends from the company. And one of the goals of company executives is to maximize shareholder wealth. However, company executives must balance appeasing shareholders with staying nimble if the economy dips into a recession .

Why do companies buy their own shares?

There are many reasons why a company may wish to acquire its own shares. Listed companies may use this mechanism to return surplus cash to shareholders, to enhance earnings per share or net assets per share, or to adjust gearing ratios. Listed funds may wish to provide greater liquidity in their shares, especially if the market for its shares is ...

Why do listed funds buy back their shares?

Listed funds may wish to provide greater liquidity in their shares, especially if the market for its shares is relatively narrow. Private companies may effect share buybacks for a multitude of reasons, including to operate an employee incentive scheme or to re-engineer their balance sheets. Whatever the reasons for the transaction, there are many ...

What happens after an acquisition is authorised?

If, after an acquisition is authorised at Board level and before the acquisition is made, the Board ceases to be satisfied on reasonable grounds that the company will, immediately after the acquisition is made, satisfy the solvency test, any acquisition made by the company is deemed not to have been authorised and is therefore unlawful. Therefore, the Board should continue to monitor the solvency position of the company after the authorisation to ensure the solvency test will still be met immediately after the acquisition is made.

What is market acquisition?

In the case of a “market acquisition” (broadly, involving an acquisition of shares on a recognised investment exchange pursuant to a marketing arrangement ) the acquisition need only be first authorised by ordinary resolution of the company unless a live authority is already present in the Memorandum and Articles.

What are the listing rules for a company?

Where a class of shares of a company is listed on The International Stock Exchange (“TISE”), the Listing Rules stipulate that a company must not purchase its own shares at a time when, under the provisions of the Model Code appended to the Listing Rules, a director of the company would be prohibited from dealing in its securities. Essentially, this is when the relevant director is in possession of unpublished price-sensitive information in relation to those securities or during a close period.

Can a company acquire its own shares?

A company may acquire its own shares if authorised to do so by its Memorandum and Articles of Incorporation (“Memorandum and Articles”). The terms and manner of the acquisition will also be determined by any specific stipulations of the Memorandum and Articles and the terms of issue of the shares concerned. The transaction cannot be carried out ...

Is there income tax on a Guernsey share buy back?

A Guernsey resident member (or a non-Guernsey resident member holding their shares through a Guernsey permanent establishment) will, subject to their personal circumstances , generally be subject to Guernsey income tax on the distribution arising from the share buy-back.

Why do companies buy shares?

Companies also buy the shares for compensation purposes. Some companies link the performance of the employees with rewards in the form of shares. This motivates employees to work hard. So, the share price of the share can increase. In other words, it’s a practice to align the employees’ goal with the investor’s goal.

What is the power of shareholders?

Management of voting rights / controls. The shareholders have the power to make decisions in the general meetings. If there are several shareholders of the Company, the decision-making power is diluted, and there may be difficulty in smooth operations of the Company due to conflict of opinion.

How does issuance of shares affect EPS?

The issuance of shares impacts the EPS as earning is divided among a greater number of the shares. Hence, EPS gets diluted. At the same time, the reverse impact is made by the buyback of shares. It means the EPS increases when the number of shares decreases. Hence, a buyback strategy can be used to control the EPS.

How does a company distribute return?

The Company can distribute Return in the form of dividends or by repurchasing the shares from shareholders by paying a premium price. If the Company pays Return in the form of a dividend, it’s taxed at an ordinary income tax rate, which is higher.

Is a share buyback a good option?

The share buyback is not a good option when the Company’s stock price is overvalued in the market. It will lead to a loss for the shareholders who decide to hold the shares as they’ll lose value by holding even more overvalued stock aftermarket response.

Is there an opportunity cost for piling up extra cash?

For instance, the Company could manage to invest and earn a 20% return, but the Company has lost this opportunity by piling extra cash.

Does a share buyback increase EPS?

Increasing EPS with the share buyback does not indicate the enhanced performance of the business as the Company has not earned additional income; it’s just due to a decrease in the number of shares. However, buyback leads to a decrease in cash and equity.

Constitutional Requirements

Satisfying The Solvency Test

- As explained above, companies are free to return capital and earnings to investors without recourse to the Courts and without creditor approval. Instead, it is for the board of directors (the “Board”) to consider whether the company will satisfy the solvency test set out in the Law immediately after effecting the acquisition of its own shares. This is because an acquisition by …

Information Before The Board and Directors’ Knowledge

- As for the level of information which should be tabled before the Board, the Law states that in determining whether the value of a company’s assets is greater than the value of its liabilities, the directors:- 1. must have regard to:- 1.1. the most recent accounts of the company; and 1.2. all other circumstances that the directors know or ought to know affect or may affect the value of t…

Continuing Obligation of The Board

- If, after an acquisition is authorised at Board level and before the acquisition is made, the Board ceases to be satisfied on reasonable grounds that the company will, immediately after the acquisition is made, satisfy the solvency test, any acquisition made by the company is deemed not to have been authorised and is therefore unlawful. Therefore, the Board should continue to …

Unravelling A Share Buy-Back For Failure to Satisfy The Solvency Test

- If the solvency test was not satisfied at the relevant time, the Law essentially provides for claw-back provisions and puts the common law position with regard to directors’ liabilities in effecting unauthorised distributions on a statutory footing. Thus, a payment made to shareholder at a time when the company did not immediately after the share buy-back satisfy the solvency test may b…

Listing Rules of The International Stock Exchange

- Where a class of shares of a company is listed on The International Stock Exchange (“TISE”), the Listing Rules stipulate that a company must not purchase its own shares at a time when, under the provisions of the Model Code appended to the Listing Rules, a director of the company would be prohibited from dealing in its securities. Essentially, this is when the relevant director is in po…

Tax

- This section considers only the Guernsey tax issues arising in respect of a Guernsey resident company effecting a purchase of own shares. A share buy-back will constitute a distribution for Guernsey income tax purposes unless, and to the extent that, it is a repayment of capital to the member or the amount of value of any new consideration given by the member for that distributi…