| year | Average | Low | High | Change from close on 2022-06-17 |

| 2022 | $209.03 | $189.5 | $232.7 | -15.59 % |

| 2023 | $131.5 | $91.96 | $182.5 | -46.9 % |

| 2024 | $110.92 | $92.45 | $126.51 | -55.21 % |

| 2025 | $155.75 | $129.13 | $176.35 | -37.11 % |

What is Microsoft current stock price?

as stock prices respond to revisions. By adding Focus List stocks, there's a great chance you'll be getting into companies whose future earnings estimates will be raised, which can lead to price momentum. Focus List Spotlight: Microsoft (MSFT) Redmond ...

When will Microsoft stock split again?

The date of record is March 12 and Microsoft will have about 5 billion shares outstanding, the company (MSFT) said in a release. This is the eighth time Microsoft has split its stock since it went public in March 1986. The split comes just a week after the company topped the earnings estimate of even the most bullish analysts.

How much is Microsoft stock per share?

- The all-time high Microsoft stock closing price was 343.11 on November 19, 2021.

- The Microsoft 52-week high stock price is 349.67, which is 16.8% above the current share price.

- The Microsoft 52-week low stock price is 224.26, which is 25.1% below the current share price.

- The average Microsoft stock price for the last 52 weeks is 285.45.

Will Microsoft split stock again?

The results announced Tuesday underscore how technology giants have adapted to become even more successful during a nearly two-year pandemic that has roiled much of the economy. In a show of confidence intended to make its shares more affordable, Google parent Alphabet also announced plans for its first stock split since 2014.

What is the future for Microsoft stock?

Microsoft stock forecast 2022-2025, 2030 Microsoft is a “good long-term investment” that's expected to rise 23% to $349.35 over the next 12 months to April 2023, according to the algorithm-based forecasts of Wallet Investor at the time of writing (28 April).

What is the target price for Microsoft?

Stock Price TargetsHigh$410.00Median$350.00Low$298.18Average$353.56Current Price$244.97

Will Microsoft continue to go up?

Microsoft investors can expect more upside Microsoft's earnings have grown at an annual rate of 18% over the past five years. Looking ahead, analysts expect the company to clock an annual earnings growth rate of 17% for the next five years.

How much will Google be worth in 5 years?

While few doubt the strong moats in GOOGL's core search and YouTube, investors should not underestimate the opportunity in the cloud market - GOOGL estimates that the market can grow to over $760 billion in less than 5 years.

How high will Microsoft stock go?

Stock Price Forecast The 37 analysts offering 12-month price forecasts for Microsoft Corp have a median target of 350.00, with a high estimate of 410.00 and a low estimate of 298.18. The median estimate represents a +41.35% increase from the last price of 247.62.

Is Microsoft stock worth buying?

Microsoft's cloud unit, Azure, is growing by more 40% annually and expanding its margins. Azure has several tailwinds given the heightened need for cybersecurity protocols and the increasing prevalence of remote work. With a strong balance sheet and a bullish outlook, Microsoft appears to be a compelling long-term buy.

Is Microsoft stock a buy 2022?

Microsoft (MSFT) is a solid stock to own this year. It is a defensive stock with massive growth potential. The gaming business could take MSFT stock to an all-time high.

Is Microsoft a good stock to buy for long-term?

Microsoft's stock remains an attractive long-term investment pick, especially under the current market climate, considering its strong balance sheet and robust growth profile still.

Will there be a Microsoft stock split in 2021?

It has been a long time since Microsoft announced the share split. Considering the present scenario, it is highly unlikely that any split will be announced in the near future.

What will alphabet stock be worth in 2030?

Based on long term forecasts, the price of Alphabet (GOOG) will increase to $3,000 by the end of 2022 then $3,500 in 2023. Alphabet stock will keep rise to $4,500 in 2025, $5,800 in 2027 and $6,800 in 2030.

What is Tesla stock prediction?

Stock Price Forecast The 36 analysts offering 12-month price forecasts for Tesla Inc have a median target of 1,000.00, with a high estimate of 1,620.00 and a low estimate of 250.00. The median estimate represents a +54.05% increase from the last price of 649.14.

What happens if I invest 1000 in Google?

Currently, Alphabet has a market capitalization of $1.86 trillion. Buying $1000 In GOOGL: If an investor had bought $1000 of GOOGL stock 15 years ago, it would be worth $12,296.42 today based on a price of $2821.60 for GOOGL at the time of writing.

Will Microsoft Shares Go Up?

Almost without exception, analysts' forecasts paint a very promising picture for Microsoft. With earnings expectations growing more quickly than th...

Is It a Good Time to Buy Microsoft Stock?

The overwhelming majority of analyst recommendations give the stock a Buy or a Strong Buy rating. So far, Microsoft has had a great year, and there...

Is Microsoft a Buy, Hold or Sell?

Analyst opinion provided by MarketBeat shows that the consensus rating is a Buy. With only a few analysts hesitant about the stock (Hold), most Wal...

Is Microsoft Overvalued in 2021?

Microsoft shares are expensive but not overvalued. We need to consider the company's success in spite of challenging economic times, alongside its...

Will Microsoft Go Down?

Unlikely. Microsoft is nowhere near exhausting its potential. Plus, current and future initiatives are only going to boost the company in several k...

What Is Microsoft Return for the Year?

MSFT YTD return is 9.54% , which is higher than that of AAPL, AMZN, and CRM.

Is It a Good Time to Invest in Microsoft?

In the technology sector, Microsoft seems like one of the most confident Buys. The price is currently going through a trend correction. But since i...

Is Microsoft Going to Crash?

If Microsoft were ever going to have a stock crash, it would have been during the 2020 coronavirus market crisis that was nothing short of unpreced...

Is Investing in Microsoft a Good Idea?

Microsoft shows robust, synchronized global growth, which is good for investors. Business momentum through several competitively advantaged busines...

"Should I invest in Microsoft stock?" "Should I trade "MSFT" stock today?"

According to our live Forecast System, Microsoft Corporation stock is a good long-term (1-year) in...

What is the Microsoft stock price / share price today?

The Microsoft stock price is 273.310 USD today.

Will Microsoft stock price grow / rise / go up?

Yes. The MSFT stock price can go up from 273.310 USD to 328.728 USD...

Is it profitable to invest in Microsoft stock?

Yes. The long-term earning potential is + 20.28 % in one year.

Will MSFT stock price fall / drop?

No. See above .

What will Microsoft stock price be worth in five years (2027)?

The MSFT ("MSFT" ) future stock price will be 603.017 USD .

Will MSFT stock price crash?

According to our analysis, this will not happen.

Will Microsoft stock price hit 1 000 USD price in a year?

Not within a year. See above .

Will Microsoft stock price hit 2 000 USD price in a year?

Not within a year. See above .

Summary of Microsoft Stocks

The Microsoft Corporation operates within the Technology Services sector. The company develops, licenses, and supports a range of products, services, devices, and solutions. More specifically, offerings are built around segments such as Productivity and Business Processes, Intelligent Cloud, and Personal Computing.

What Will Affect Microsoft's Price in 2021 and Beyond?

Broadly speaking, most stocks are affected by the same set of factors, including supply and demand, company news and performance, ongoing domestic and international events, and investor sentiment.

MSFT Stock Forecast for 2021: Analysts Recommendations

Top analysts shared their Microsoft stock price targets and notified their clients of their Buy or Sell ratings.

Microsoft Stock Technical Analysis

First, we'll do a technical analysis of the MSFT 's biggest timeframe chart to identify long-term factors that affect market processes.

Microsoft Stock Forecast for 2022

The MSFT forecast for 2022 sees the projected stock price moving from the $279-$284 range to $329-$333. Such a positive start goes in line with all of the bullish predictions for the previous year.

Microsoft Stock Forecast for 2023

Based on the Microsoft forecast for 2023, it appears the company could continue to gain steam. Starting at $333-$339 per share, it could reach $383-$387 by the end of the year. A steady upward move over the next few years is exactly what long-term investors are looking for in such a stock.

Microsoft Stock Forecast for 2025 Through 2030

The 5-year forecast for the company looks as optimistic as all other ones we've covered. A $50 rise over the year is unlikely to be accompanied by explosive spikes. Based on historical probability, Microsoft should be consistent in 2025 price performance.

How much will Microsoft make in 2021?

In late October 2021, Microsoft announced revenue of $45.3bn for the first quarter to the end of September – 22% up on the same period in the previous year.

How much is MSFT in 2022?

Although the service does not provide a Microsoft stock 10-year forecast, it predicts that MSFT could reach $409.47 by the end of December 2022, move up to $477.60 by the end of 2023 and be at $546.03 by the end of 2024.

How many times has MSFT been split?

The MSFT stock has been split nine times since its initial public offering back in 1986. It means one original share is equal to 288 shares, according to the company.

What is Microsoft known for?

It’s particularly well known for its Windows operating systems and the Office productivity suites, which includes programs such as Word and Excel.

Is Microsoft resting on its laurels?

According to Danni Hewson, financial analyst at AJ Bell, Microsoft shows no signs of resting on its laurels, with its chief executive having promised it would only look forward.

Can you profit from a trade if the market moves in your favour?

You can still benefit if the market moves in your favour, or make a loss if it moves against you. However, with traditional trading you enter a contract to exchange the legal ownership of the individual shares or the commodities for money, and you own this until you sell it again.

Is MSFT a buy or hold stock?

MSFT stock is a ‘buy’ based on the ratings of 32 analysts compiled by Market Beat – with the most pessimistic classifying it as a ‘hold’.

What does prediction tell AI Pickup?

This prediction tells AI Pickup's opinion about price Direction (Up or Down) with a specific closing date.

Is Microsoft stock a good investment?

From Microsoft stock forecast , Microsoft (MSFT) stock cannot be a good investment choice. According to AI Pickup, the Microsoft stock price forecast for 2025 Nov. is $113.660354623244

Microsoft stock analysis: MSFT performance and major price drivers

Although the MSFT stock price appears to have endured a slightly lacklustre start to 2022, it’s not actually quite as bad as it initially looks.

Microsoft stock news: multi-billion acquisition of Activision Blizzard

In the middle of January 2022, Microsoft announced it was buying games developer Activision Blizzard for $95.00 per share, in an all-cash transaction valued at $68.7bn.

Microsoft outlook: What the company provides

Before analysing the most recent results and outlining Microsoft stock predictions, let’s look at the company’s structure and how it makes its money.

Microsoft (MSFT) stock fundamental analysis: Latest earnings

The company recently unveiled bumper results for the second quarter, ending 31 December 2021, with substantial increases in both revenue and net income.

Microsoft stock projection: Analyst sentiment

Danni Hewson, financial analyst at AJ Bell, pointed out that Microsoft hasn’t been immune to the sell-off of technology stocks but believes the share price fall needs to be seen in context.

Microsoft (MSFT) stock forecast: Where will it go from here?

Microsoft could be a “good long-term (one year) investment” that’s expected to rise 17% to $361.56 over the next 12 months to January 2023, according to the algorithmic forecasts of Wallet Investor (as of 31 January).

Where Will Microsoft Stock Be In 10 Years?

Today, Microsoft trades at 34x this year's earnings, using a share price of $280 and the consensus EPS estimate of $8.30. When we look at how MSFT has been valued in the past, we see that this is substantially above the long-term averages:

How much will Microsoft earnings be in 2031?

Earnings per share growth in 2025-2031 could thus very well be lower than that. If we assume that Microsoft manages to grow its earnings per share by 9.6% between 2022 and 2031, which is two-thirds of the 14.4% forecast, then Microsoft would hit earnings per share of $21.70 in 2031, which seems like a more realistic assumption to me, even though it might be a little conservative. What does that mean for Microsoft's share price? This depends a lot on the valuation that Microsoft will trade at in 2031, and there is, of course, no way to forecast that precisely. We can look at a couple of scenarios, however.

How does MSFT grow?

As stated above, share price gains will depend on two main factors in the long run, MSFT's ability to grow its earnings per share, and changes in its valuation. We can break that down further, as there are many ways to grow earnings per share. First, the company can, of course, continue to grow its business organically. Microsoft Corporation can add more clients to its cloud computing services, can sell more Office 365 licences, and so on, which will drive revenue growth. Revenue growth can, on top of that, also be generated through non-organic ways, i.e. by taking over assets or entire companies. Microsoft is not ultra-active when it comes to M&A, but the company has made sizeable acquisitions from time to time, such as LinkedIn in 2016. Microsoft also bid for the US TikTok business last year, although it did not get that deal. Microsoft's interest in acquiring that business still shows that the company continues to be interested in growing inorganically where it makes sense from a valuation standpoint and when executives see assets that they deem a good strategic fit for the company.

How are share prices driven?

In the long run, however, share prices are mainly driven by a combination of valuation changes (either multiple expansion or multiple compression) and by underlying growth. Underlying growth rests on a company's quality, e.g. its market position relative to peers, its moat, its returns on capital, and so on.

How does Microsoft grow its profit?

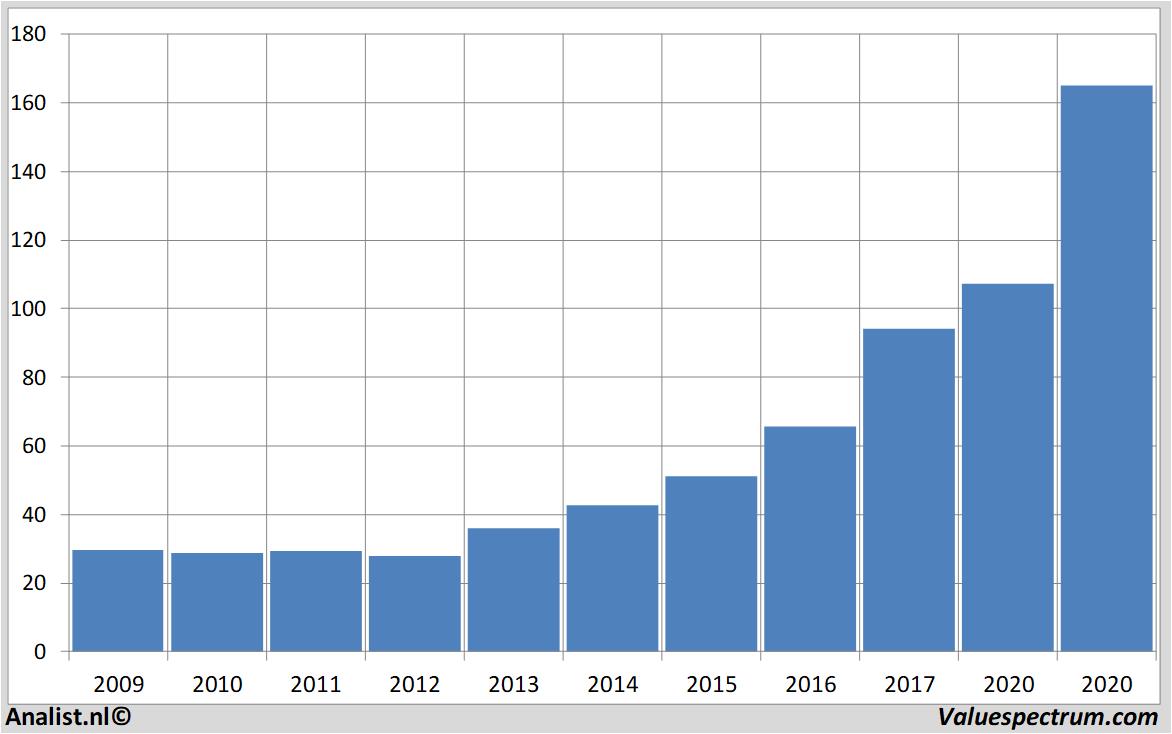

Apart from revenue growth, either organically or through M&A, Microsoft can also grow its profits by boosting its margins. Margins do, of course, depend on the product mix that is sold to some degree, but generally, a software company like Microsoft should, thanks to low proportionate costs, be able to grow margins over time, as most costs are fixed and will decline on a per-customer basis as more customers are added. Looking at MSFT's margins over the last decade, we get the following picture:

Is MSFT profitable?

Since this move has been quite successful, however, Microsoft has been reaping the benefits of that over the last couple of years, seeing its margins rise again. Right now, with an operating margin of 40%, MSFT is immensely profitable already, but due to the relationship between revenue and fixed costs shown above, it can be expected that MSFT will expand its margins further in coming years, although at some point there will be a limit to that. Nevertheless, over the next couple of years, margin expansion should result in some earnings growth tailwinds, I believe, as was the case over the last couple of years.

Is Microsoft a good investment?

Microsoft Corporation has been a great investment over the last five years, but shares will, in all likelihood, not deliver the same return over the next five or even ten years. Investors can still expect very solid returns from Microsoft in the coming decade, I believe, and on top of that, MSFT seems like a company with below-average business risks, the company has a great balance sheet, and so on. MSFT is a quality company that looks a little expensive today, but for someone willing to hold shares for a long time, the underlying growth will likely still result in very solid returns, even if MSFT experiences some multiple compression going forward.

How much will Microsoft make in 2026?

The rest of Microsoft's business would earn about $6.65 per share in 2026. Add them together, and Microsoft should be able to earn about $13.02 per share over the next 5 years before accounting for buybacks.

How Much Is Microsoft Expected To Grow?

10 years ago, it wasn't entirely clear where Microsoft was going to get growth from. Then Microsoft reinvented itself in the cloud computing business with Azure and hit a slow-motion home run. Azure completely changed Microsoft's business model, and Microsoft's management followed when Satya Nadella (who led Microsoft's cloud operation) was promoted to CEO in 2014. Incidentally, with Jeff Bezos departing Amazon (NASDAQ: AMZN) in 2021, AMZN took a page out of Microsoft's playbook by promoting their head of cloud computing (Andy Jassy) to CEO.

How much of Microsoft's operating income is net income?

Microsoft typically converts about 75 percent of its operating income into net income, with the rest going to items like stock compensation (absolutely a necessary expense), depreciation & amortization (I'll assume these are equal to Azure's capex in the long run), and a bunch of other miscellaneous items.

How much can a business grow annually?

As a general rule, no business can grow at 30 percent annually forever. This makes investing in growth stocks tricky when you pay a high multiple for them, you have to do a substantial amount of handicapping to determine whether you're overpaying or not.

Is Microsoft's earnings up or down?

As you can see here, Microsoft's earnings have been up and down a bit but mostly up over the past decade. Microsoft's earnings trend is actually smoother than it looks because of some one-time tax charges, in 2018 for the repatriation tax, for example.

Is Microsoft a good stock?

Microsoft is a great business trading for a premium price. The high valuation is likely to cap the upside for new buyers of MSFT stock.