During hyperinflation, stock prices will rise just like other prices. Background Hyperinflation is an economic condition resulting in the increase in prices at an extremely high rate. In a hyperinflation situation, prices can increase as much as 50 percent per month, perhaps even more.

What is hyperinflation and how does it affect you?

If inflation is a devaluing of a currency’s buying power, hyperinflation is an extreme devaluing of a currency’s buying power. Think of hyperinflation as an economic pandemic that wreaks havoc on the financial system of a country and its citizens. Hyperinflation is present when inflation rises to at or above 50% in a month.

Should you invest in stocks in a hyper-inflationary economy?

Stocks can work well in a hyper-inflationary economy, but generally only if your portfolio is well diversified with many stocks and you hold on to the investments over the longer term. Craig Woodman began writing professionally in 2007. Woodman's articles have been published in "Professional Distributor" magazine and in various online publications.

How does inflation affect the stock market?

However, inflation's varying impact on stocks confuses the decision to trade positions already held or to take new positions. In the U.S. market, the historical proof is noisy, but it does show a correlation to high inflation and lower returns for the overall market in most periods.

Will hyperinflation take hold in America?

The new thought for me was the realization of how quickly, even in a place like America, hyperinflation could take hold, and all it requires is that the commodities market becomes the last refuge that all money flees to during a simultaneous market crash in stocks, bonds, and real estate now that global shortages have added a level of perceived ...

What should I invest in during hyperinflation?

Here's where experts recommend you should put your money during an inflation surgeTIPS. TIPS stands for Treasury Inflation-Protected Securities. ... Cash. Cash is often overlooked as an inflation hedge, says Arnott. ... Short-term bonds. ... Stocks. ... Real estate. ... Gold. ... Commodities. ... Cryptocurrency.

What stocks do best during hyperinflation?

Wells Fargo: Here's The Best Asset To Own When Inflation StrikesEnergy. XLE. 1.32%Industrials. XLI. -0.39%Utilities. XLU. -0.48%Materials. XLB. -0.97%Consumer Staples. XLP. -1.01%Health Care. XLV. -1.17%Real Estate. XLRE. -1.26%Financials. XLF. -1.44%More items...•

Will stocks survive hyperinflation?

Stocks Will Probably Do Just Fine During Hyperinflation.

What should I buy before hyperinflation hits 2022?

If you are wondering what food to buy before inflation hits more, some of the best food items to stockpile include:Peanut butter.Pasta.Canned tomatoes.Baking goods – flour, sugar, yeast, etc.Cooking oils.Canned vegetables and fruits.Applesauce.

What should I buy before hyperinflation hits 2021?

Storing the Basics Before HyperinflationDry Goods Shortages of dry goods, like pasta, rice, beans, and spices, cropped up during the early days of the Covid-19 pandemic. ... Canned foods, including vegetables, fruit, and meats are easy to store and useable in a variety of ways.More items...•

Is it good to be in debt during hyperinflation?

Fewer lenders will be willing to offer debt as economic conditions sour, so borrowers will be expected to pay higher interest rates. On the other hand, if someone takes on debt before hyperinflation begins, then the borrower benefits because the value of the currency falls.

How do you hedge against hyperinflation?

5 ways investors can stay protected against inflationTIPS. TIPS, or Treasury inflation-protected securities, are a useful way to protect your investment in government bonds if you expect inflation to speed up. ... Floating-rate bonds. ... A house. ... Stocks. ... Gold. ... Long-dated bonds. ... Long-dated fixed-rate CDs. ... Learn more:

Why should stocks hedge against inflation?

In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow at the same rate as inflation, after a period of adjustment. However, inflation's varying impact on stocks confuses the decision to trade positions already held or to take new positions.

What is the effect of inflation?

Investors, the Federal Reserve, and businesses continuously monitor and worry about the level of inflation. 1 Inflation—the rise in the price of goods and services —reduces the purchasing power each unit of currency can buy. Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, ...

What happens to the purchasing power of a dollar when inflation increases?

When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services. For investors interested in income-generating stocks, or stocks that pay dividends, the impact of high inflation makes these stocks less attractive than during low inflation, since dividends tend to not keep up with inflation levels. 19

How to predict expected inflation?

One way investors can predict expected inflation is to analyze the commodity markets, although the tendency is to think that if commodity prices are rising, stocks should rise since companies “produce” commodities. However, high commodity prices often squeeze profits, which in turn reduces stock returns.

Why is inflation greater than or less than this range?

Inflation greater than or less than this range tends to signal a U.S. macroeconomic environment with larger issues that have varying impacts on stocks. 14 Perhaps more important than the actual returns are the volatility of returns inflation causes and knowing how to invest in that environment.

How does rising inflation affect the economy?

Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, revenues, and profits decline, and the economy slows for a time until a measure of economic equilibrium is reached.

Why do consumers feel the unexpected pinch?

These consumers become less likely to hold cash because the value over time decreases with inflation.

What is Hyperinflation?

Many of us haven’t heard much about hyperinflation since the 1970s and don’t know much about it beyond the fact that it’s a word we don’t want to hear.

Types of Inflation

Let’s talk about the main types of inflation, aside from hyperinflation.

Effects of Hyperinflation

One of the most noteworthy effects of hyperinflation has to do with the devaluation of the U.S. currency. Since 1935, the U.S. dollar has lost over 96% of its value. Plus, compared to a group of other countries, the U.S. dollar devalued by 12% in 2020.

Can We Predict Hyperinflation?

After the past few years of the pandemic, it’s easy to see how inflation affects stocks.

How to Protect Yourself from Inflation

The best thing we can do to stay on our financial course is to try to slowly soften the blow from the effects of hyperinflation to work our way out of it.

What is inflation measured with?

But inflation is measured with something called the Consumer Price Index. In short, this refers to the modifications in the price of a basket of goods (eg: bread, milk, etc). Well, if inflation did not skyrocket since March, it underlines one thing: the money generally didn’t go into consumer goods.

Is the S&P 500 going to recover in 2020?

After the news of the Coronavirus soon-to-be pandemic shook market confidence into a flash crash, the S&P 500 went right into a V-shaped recovery.

Inflation and The Value of $1

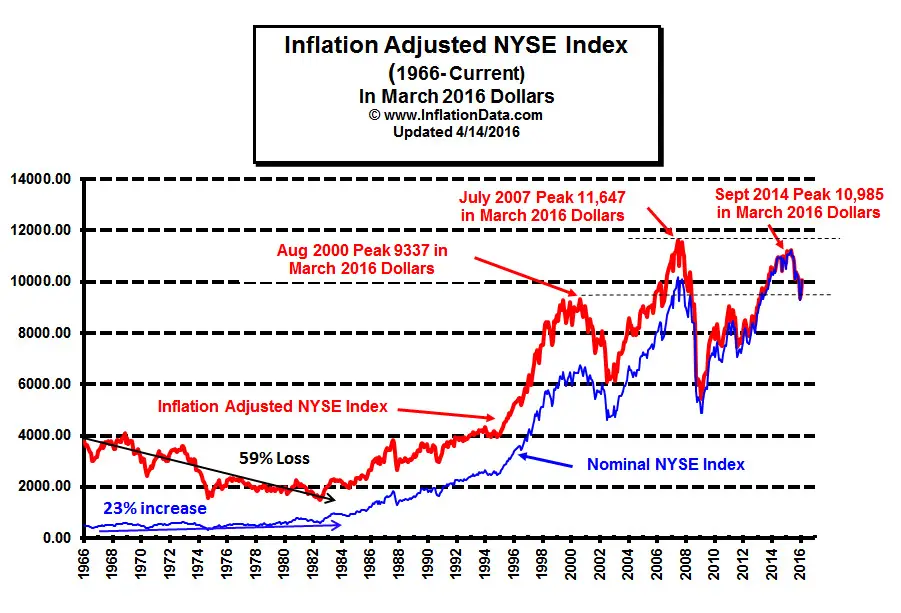

Inflation and Stock Market Returns

- Examining historical returns data during periods of high and low inflation can provide some clarity for investors. Numerous studies have looked at the effect of inflation on stock returns. Unfortunately, the studies have often produced conflicting results.78 Still, most researchers have found that higher inflation has generally correlated with lowe...

Growth vs. Value Stock Performance and Inflation

- Stocks are often subdivided into value and growth categories. Value stocks have strong current cash flows more likely to grow slowly or diminish over time, while growth stocks are likely to represent fast-growing companies that may not be profitable.12 Therefore, when valuing stocks using the discounted cash flow method, in times of rising interest rates, growth stocks are negat…

The Bottom Line

- Investors try to anticipate the factors that impact portfolio performanceand make decisions based on their expectations. Inflation is one of the factors that may affect a portfolio. In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow with inflation after a period of adjustment. However, inflation's varying impact on st…