What were the causes of the stock market crash and the Great Depression quizlet?

(1929)The steep fall in the prices of stocks due to widespread financial panic. It was caused by stock brokers who called in the loans they had made to stock investors. This caused stock prices to fall, and many people lost their entire life savings as many financial institutions went bankrupt.

What were 5 causes of the stock market crash?

What were the 4 main causes of the Great Depression?

- The stock market crash of 1929. During the 1920s the U.S. stock market underwent a historic expansion. ...

- Banking panics and monetary contraction. ...

- The gold standard. ...

- Decreased international lending and tariffs.

What were the 5 causes of the Great Depression?

- of 05. Stock Market Crash of 1929. Workers flood the streets in a panic following the Black Tuesday stock market crash on Wall Street, New York City, 1929. ...

- of 05. Bank Failures. ...

- of 05. Reduction in Purchasing Across the Board. ...

- of 05. American Economic Policy With Europe. ...

- of 05. Drought Conditions.

Why did the stock market crash quizlet?

What were the effects of the Great Depression?

What were three causes of the Great Crash?

What were the 7 Major causes of the Great Depression?

- The speculative boom of the 1920s. ...

- Stock market crash of 1929. ...

- Oversupply and overproduction problems. ...

- Low demand, high unemployment. ...

- Missteps by the Federal Reserve. ...

- A constrained presidential response. ...

- An ill-timed tariff.

What were the 7 Major causes of the Great Depression quizlet?

- Buying on Credit.

- Underconsumption/ Overproduction.

- Unequal Distribution of Wealth.

- Margin Buying.

- Stock Market Crash.

What began in the fall of 1930?

What were the causes of great depression Class 10?

Tight monetary policies adopted by the Central Bank of America. Stock market crash of 1929. The failure of banks, which was the impact of the stock market crash as more people withdrew their savings from the banks leading to closure. Reduction in purchases due to diminished savings.

How many banks failed in the Great Depression?

By the end of the decade, more than 9,000 banks had failed. Surviving institutions, unsure of the economic situation and concerned for their own survival, became unwilling to lend money.

What was the Black Tuesday stock market crash?

Remembered today as "Black Tuesday," the stock market crash of October 29, 1929 was neither the sole cause of the Great Depression nor the first crash that month, but it's typically remembered as the most obvious marker of the Depression beginning. The market, which had reached record highs that very summer, had begun to decline in September.

What was the Great Depression?

The Great Depression lasted from 1929 to 1939 and was the worst economic depression in the history of the United States. Economists and historians point to the stock market crash of October 24, 1929, as the start of the downturn.

How long did the Great Depression last?

The Great Depression lasted from 1929 to 1939 and was the worst economic depression in the history of the United States. Economists and historians point to the stock market crash of October 24, 1929, as the start of the downturn. But the truth is that many things caused the Great Depression, not just one single event.

What was the Smoot-Hawley Tariff?

industry from overseas competitors, Congress passed the Tariff Act of 1930, better known as the Smoot-Hawley Tariff. The measure imposed near-record tax rates on a wide range of imported goods.

What was the cause of the 1929 stock market crash?

Most economists agree that several, compounding factors led to the stock market crash of 1929. A soaring, overheated economy that was destined to one day fall likely played a large role.

Why did people buy stocks in the 1920s?

During the 1920s, there was a rapid growth in bank credit and easily acquired loans. People encouraged by the market’s stability were unafraid of debt.

What happened in 1929?

In August 1929 – just weeks before the stock market crashed – the Federal Reserve Bank of New York raised the interest rate from 5 percent to 6 percent. Some experts say this steep, sudden hike cooled investor enthusiasm, which affected market stability and sharply reduced economic growth.

What was the worst economic event in history?

The stock market crash of 1929 was the worst economic event in world history. What exactly caused the stock market crash, and could it have been prevented?

When did the Dow go up?

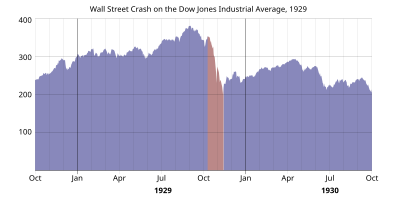

The market officially peaked on September 3, 1929, when the Dow shot up to 381.

When did the stock market peak?

The market officially peaked on September 3, 1929, when the Dow shot up to 381. By this time, many ordinary working-class citizens had became interested in stock investments, and some purchased stocks “on margin,” meaning they paid only a small percentage of the value and borrowed the rest from a bank or broker.

Who was the bankrupt investor who tried to sell his roadster?

Bankrupt investor Walter Thornton trying to sell his luxury roadster for $100 cash on the streets of New York City following the 1929 stock market crash. (Credit: Bettmann Archive/Getty Images) Bettmann Archive/Getty Images.

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

What happened on Black Monday 1929?

Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely ...

When was the New York Stock Exchange founded?

The New York Stock Exchange was founded in 1817, although its origins date back to 1792 when a group of stockbrokers and merchants signed an agreement under a buttonwood tree on Wall Street.

What was the New Deal?

The relief and reform measures in the “ New Deal ” enacted by the administration of President Franklin D. Roosevelt (1882-1945) helped lessen the worst effects of the Great Depression; however, the U.S. economy would not fully turn around until after 1939, when World War II (1939-45) revitalized American industry.

What was the stock market crash of 1929?

The stock market crash of 1929 followed an epic period of economic growth during what's now known as the Roaring Twenties. The Dow Jones Industrial Average ( DJINDICES:^DJI) was at 63 points in August 1921 and increased six-fold over the next eight years, closing at a high of 381.17 points on Sept. 3, 1929. That September day marked the peak of the ...

What happened to the stock market in 1929?

When the stock market crashed in September 1929, all of the entwined investment trusts similarly collapsed. In the wake of the crash, the banks and other lenders that financed the stock-buying spree had little means to collect what they were owed. Their only collateral was stocks for which the amount of debt outstanding exceeded the stocks' worth.

What was the Dow Jones Industrial Average in 1921?

The Dow Jones Industrial Average ( DJINDICES:^DJI) was at 63 points in August 1921 and increased six-fold over the next eight years, closing at a high of 381.17 points on Sept. 3, 1929. That September day marked the peak of the greatest uninterrupted bull market the United States had ever seen.

When did the Dow drop?

By mid-November 1929, the Dow had declined by almost half. It didn't reach its lowest point until midway through 1932, when it closed at 41.22 points -- 89% below its peak. The Dow didn't return to its September 1929 high until November 1954.

What happened on Oct 29th?

On Monday, Oct. 29, the Dow Jones Industrial Average plunged by nearly 13%. The next day, the index tumbled by almost another 12%. These devastating two days have since become known as Black Monday and Black Tuesday. Over the months and years that followed, the stock market continued to lose value.

What was the stock market crash of 1929?

The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929. By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

What happened to the Dow Jones Industrial Average in 1929?

By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

What happened in 1929?

Updated September 02, 2020. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929. By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929.

Who is Kimberly Amadeo?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

How did the stock market crash affect the 1930s?

The stock market crash preceding the Great Depression had not only spread over the United States, in the early 1930s it also affected worldwide economies. Credit froze, many factories closed, unemployment increased, several banks failed, mortgages on farms and houses were being foreclosed in large numbers and commodities steadily fell in prices.

What was the cause of the Great Depression?

Many experts argue that one of the main causes of the Great Depression was the stock market crash in 1929. Before the Great Depression, many people were speculating in the stock market, particularly the buying of stocks on margin (on credit). Prior to the stock market crash of 1929, people would put down as little as three percent ...

What happened before the Great Depression?

Before the Great Depression, many people were speculating in the stock market, particularly the buying of stocks on margin (on credit). Prior to the stock market crash of 1929, people would put down as little as three percent of a stock’s price and borrow the remainder through a broker. The booming demand for stocks led to a general rise in ...

What happened to the stock market in 1929?

On October 29, 1929 the largest stock exchange, the New York Stock Exchange, had its worst day of selling. By the end of 1929, declines in stocks reached $15 billion.

What happened in 1929?

By the end of 1929, declines in stocks reached $15 billion. The stock market crash of 1929 had a ripple effect on the economy.

What happened on October 29, 1929?

By the end of 1929, declines in stocks reached $15 billion. The stock market crash of 1929 had a ripple effect on the economy. According to John B. Kirkwood in “The Great Depression”, the “gross national product in real terms declined almost ...

Why did the New Deal work?

The New Deal was also to effect a change that would prevent severe economic crises in the future. After Roosevelt was elected president, he began enacting his New Deal programs to improve the struggling economy; however, many of the effects of the Great Depression continued to be felt until the beginning years of World War II.

Overview

- My interpretation of these events is that the statement by Snowden, Chancellor of the Exchequer, indicating the presence of a speculative orgy in America is likely to have triggered the October 3 break. Public utility stocks had been driven up by an explosion of investment trust formation and investing. The trusts, to a large extent, bought stock on margin with funds loaned not by banks b…

Causes Of The Crash

- Although it can be argued that the stock market was not overvalued, there is evidence that many feared that it was overvalued — including the Federal Reserve Board and the United States Senate. By 1929, there were many who felt the market price of equity securities had increased too much, and this feeling was reinforced daily by the media and statements by influential government offi…

- The stock market crash of 1929 resulted in a loss of around $14 billion of wealth. Now after the crash, certain reform acts had to be set up to again stabilize the market. One of the steps that were taken was the setting up of the Securities and Exchange Commission or the SEC. The role of this institution was to lay down the market rules and punish in case of any violation of the laws. …

- Selling intensified in mid-October. On October 24 (\"Black Thursday\"), the market lost 11 percent of its value at the opening bell on very heavy trading. The huge volume meant that the report of prices on the ticker tape in brokerage offices around the nation was hours late and so investors had no idea what most stocks were actually trading for at the moment, increasing panic. Severa…

Aftermath

- In 1932, the Pecora Commission was established by the U.S. Senate to study the causes of the crash. The following year, the U.S. Congress passed the Glass–Steagall Act mandating a separation between commercial banks, which take deposits and extend loans, and investment banks, which underwrite, issue, and distribute stocks, bonds, and other securities. After the expe…

- After the crash of 1929, there was a gradual but slow improvement in the market as mentioned before. But that was just temporary. No one could guess that the year 1932 would bring such a huge crash again. The crash of 1932 was so huge that the crash of 1929 seemed really petty in front of it. There was 50% depreciation even from the lowest point of 1929. The drop was so ma…

Academic Debate

- There is ongoing debate among economists and historians as to what role the crash played in subsequent economic, social, and political events. The Economist argued in a 1998 article that the Depression did not start with the stock market crash, nor was it clear at the time of the crash that a depression was starting. They asked, "Can a very serious Stock Exchange collapse produc…

- Together, the 1929 stock market crash and the Great Depression formed the biggest financial crisis of the 20th century. The panic of October 1929 has come to serve as a symbol of the economic contraction that gripped the world during the next decade. The crash of 1929 caused fear mixed with a vertiginous disorientation, but shock was quickly cauterized with denial, both o…

Background

- The stock market fell. The "Roaring Twenties", the decade that followed World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector. While American cities prospere…

- The Roaring Twenties, the decade that followed World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector. While American cities prospered, the overprod…

Timeline

- The Roaring Twenties, the decade that led up to the Crash, was a time of wealth and excess. Despite the dangers of speculation, many believed that the stock market would continue to rise indefinitely. The market had been on a six-year run that saw the Dow Jones Industrial Average increase in value fivefold, peaking at 381.17 on September 3, 1929. Shortly before the crash, eco…

Analysis

- The crash followed a speculative boom that had taken hold in the late 1920s. During the latter half of the 1920s, steel production, building construction, retail turnover, automobiles registered, and even railway receipts advanced from record to record. The combined net profits of 536 manufacturing and trading companies showed an increase, in the first six months of 1929, of 36…

Effects

- United States

Together, the 1929 stock market crash and the Great Depression formed the largest financial crisis of the 20th century. The panic of October 1929 has come to serve as a symbol of the economic contraction that gripped the world during the next decade. The falls in share prices o… - Europe

The stock market crash of October 1929 led directly to the Great Depression in Europe. When stocks plummeted on the New York Stock Exchange, the world noticed immediately. Although financial leaders in the United Kingdom, as in the United States, vastly underestimated the exten…

Further Reading

- 1. Axon, Gordon V. The Stock Market Crash of 1929. London, England: Mason & Lipscomb Publishers Inc., 1974. 2. Web site: The 1929 Stock Market Crash. March 26, 2008. Harold. Bierman. EH.Net Encyclopedia. Economic History Association. Santa Clara, California. Whaples. Robert. February 2, 2017. 3. Brooks, John. (1969). Once in Golconda: A True Drama of Wall Stree…

- 1. Bierman, Harold (March 26, 2008), \"The 1929 Stock Market Crash\", in Whaples, Robert, EH.Net Encyclopedia, Santa Clara, CA: Economic History Association, http://eh.net/encyclopedia/article/Bierman.Crash, retrieved May 13, 2010. 2. Brooks, John. (1969). Once in Golconda: A True Drama of Wall Street 1920–1938. New York: Harper & Row. ISBN 0-39…