What happened to the stock market during the Obama administration?

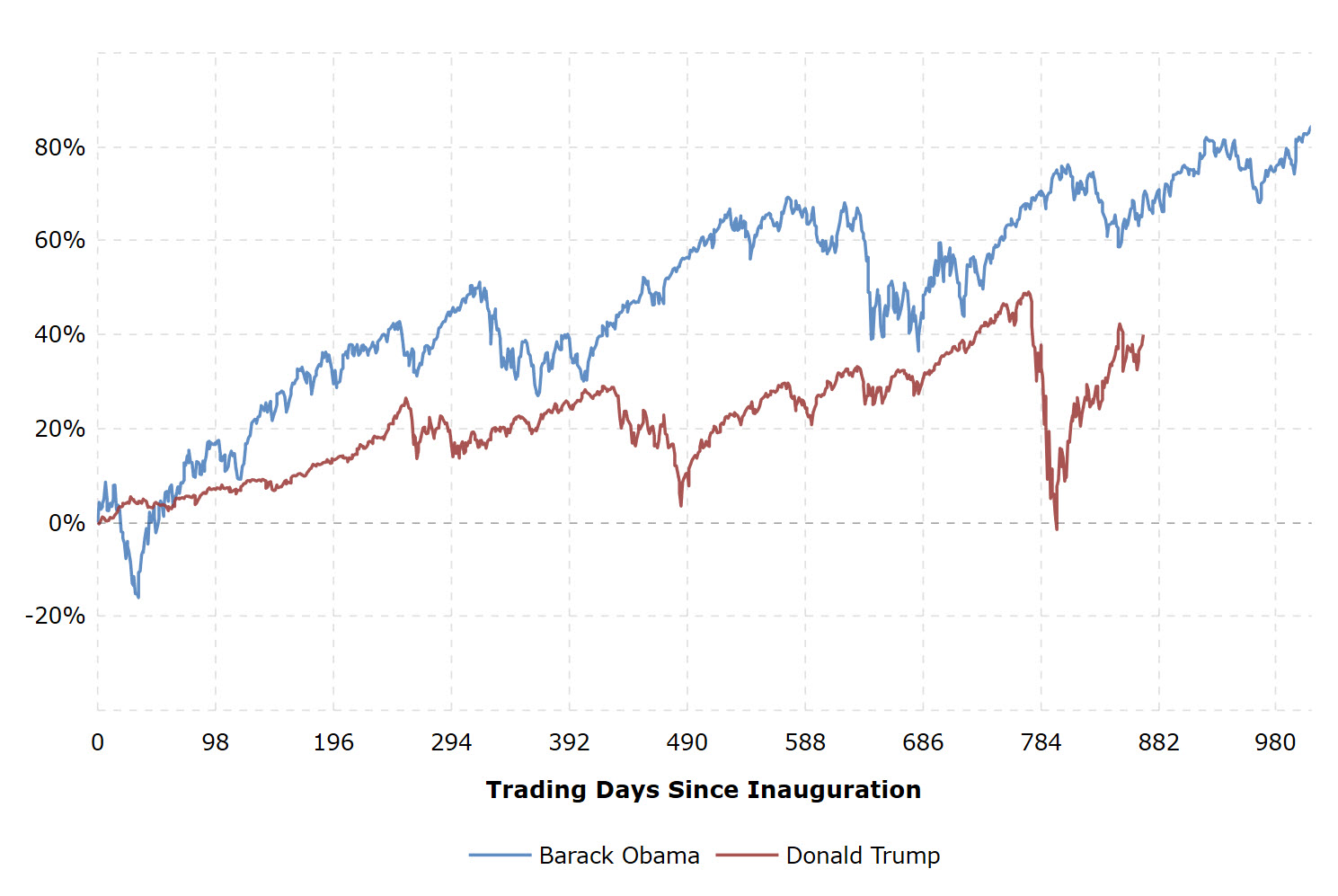

The stock market as a whole did well during the Obama Administration: On Obama's last day in office the Standard & Poor’s 500-stock index was 181 percent higher than it was the day Obama took office.

What happened to the Dow when Obama left office?

The Coronavirus pandemic spread disease and uncertainty across the globe and the economy fell in sharp bursts until finally hitting a YTD low of 18,917.46, 600 points below where the Dow was when Obama left office.

Where does Obama rank among all presidents' stock market gains?

Among all presidents, the market's annualized gain under Obama ranks third behind Clinton and Gerald Ford -- although Ford presided over less than a single term.

Was Obama's second term the second best for the stock market?

The stock market's performance in the two terms under Obama represents "the second best run under a Democrat president," trailing only the 14.9% annual gains under Bill Clinton in the 1990s, according to Sam Stovall, chief investment strategist for the market research firm CFRA.

What was the stock market on January 19 2017?

Those gains are gone. On January 19, 2017, the day before Trump took office, the Dow Jones Industrial Average closed at 19,804.72.

What did the stock market close at in 2008?

On September 29, 2008, the DJIA had a record-breaking drop of 777.68 with a close at 10,365.45.

What was the stock market at on January 20th 2016?

On January 20, 2016, due to crude oil falling below $27 a barrel, the DJIA closed down 249 points after falling 565 points intraday.

What President crashed the stock market?

The 1920s were a period of optimism and prosperity – for some Americans. When Herbert Hoover became President in 1929, the stock market was climbing to unprecedented levels, and some investors were taking advantage of low interest rates to buy stocks on credit, pushing prices even higher.

How long did it take for stock market to recover after 2008?

The S&P 500 dropped nearly 50% and took seven years to recover. 2008: In response to the housing bubble and subprime mortgage crisis, the S&P 500 lost nearly half its value and took two years to recover. 2020: As COVID-19 spread globally in February 2020, the market fell by over 30% in a little over a month.

How much did the stock market drop in 2008 and 2009?

Much of the decline in the United States occurred in the brief period around the climax of the crisis in the fall of 2008. From its local peak of 1,300.68 on August 28, 2008, the S&P 500 fell 48 percent in a little over six months to its low on March 9, 2009.

What caused the 2015 stock market crash?

The stock market bubble was largely driven by a massive inflow of money from small investors who bought up stocks on huge margins. For the most part, these inexperienced investors were the last to get into the surging market and the first to panic when it came crashing down.

What happened to the stock market in 2014?

2014 Review: Economy & Markets The S&P 500 Index rose 13.69% (including reinvested dividends), marking the third straight year in which the benchmark has returned more than 10%. The Dow closed at a record high on 38 calendar days, while the S&P 500 had 53 record closes.

What was the Dow Jones average January 2020?

35,131.86The Dow Jones industrial average added over 406 points, or 1.2 percent, to close at 35,131.86.

Who's the best president of all time?

Abraham Lincoln has taken the highest ranking in each survey and George Washington, Franklin D. Roosevelt, and Theodore Roosevelt have always ranked in the top five while James Buchanan, Andrew Johnson, and Franklin Pierce have been ranked at the bottom of all four surveys.

Who was blamed for the Great Depression?

Herbert HooverContents. Herbert Hoover (1874-1964), America's 31st president, took office in 1929, the year the U.S. economy plummeted into the Great Depression. Although his predecessors' policies undoubtedly contributed to the crisis, which lasted over a decade, Hoover bore much of the blame in the minds of the American people.

Who was president when the stock market crashed and the Great Depression?

Before serving as America's 31st President from 1929 to 1933, Herbert Hoover had achieved international success as a mining engineer and worldwide gratitude as “The Great Humanitarian” who fed war-torn Europe during and after World War I.

When did Obama take office?

President Barack Obama first took office on Jan. 20, 2009. The Dow Jones Industrial Average (DJIA) had been in a bit of a slump since the 2008 economic recession and credit crisis. The DJIA stood at a paltry 7,949.09, which made the lowest inaugural performance since the Dow was created in 1896.

How much has the DJIA increased in the last eight years?

The DJIA had risen to 19,732 over the course of his term. That’s roughly a 150 percent increase in eight years. Uncertainty still loomed, however. Donald Trump’s unexpected victory over Democratic candidate Hillary Clinton was a surprise to many Americans.

Why should investors be very careful about drawing conclusions from election or inauguration day performance?

Investors should be very careful about drawing conclusions from election or inauguration day performance because there isn't enough data. For example, except for Franklin Roosevelt, the maximum number of inauguration days for any president is two, which is too small for statistical analysis.

Was Obama's first inauguration a bad day?

While former President Obama's first inauguration was a bad day for the market, the first year of a presidential administration or even the first term might be a better measuring stick for economic performance. From that perspective, former President Trump's first-year performance was the best since Carter, while former President Clinton's first ...

How much did the Dow go up in 2009?

When he entered office, Jan 20, 2009, the Dow closed at 7,949. In other words, in his 8 years in office the Dow went up roughly 150%. If Trump stays in office 8 years, the Dow would have to be 49,369 for his term in office to equal Obama’s as it relates to the stock market and the Dow Jones Industrial average.

Why did Bill OReilly complain about Obama's job creation?

In Obama’s last year, Bill OReilly, then the most popular Fox news host, complained that jobs created under Obama were misleading because the labor participation rate was only 63% which is virtually exactly where it is after the first quarter of 2018.

How much did Trump's Dow grow in 2020?

He had an annual growth rate of 12.1%. As of today, March 1, 2020, trump has seen the Dow grow at an annual rate of 8.3% (his annualized growth rate has been occasionally higher that 13%, but the market usually adjusts back down). trump has had the 8 highest single day drops in the market.

When did the Great Recession start?

Stock market under Obama. The Great Recession officially started in December 2007, about a year before Obama became President and two months after the Dow 30 Industrials hit an all-time high of 14,165. The Dow then fell over 50% to 6,547 in March 2009, which was three months before the recession officially ended in June.

When did earnings move higher?

After the stock markets recovered from the downturn created by the Great Recession, from 2009 to 2012 earnings moved consistently higher until 2014. This led to 50 and 38 record highs in 2013 and 2014, respectively.

When did the stock market bottom out?

The stock market bottomed out in March 2009, but then the economy slowly healed, beginning what would eventually become the longest bull market in American history. Digging out of the depths of the Great Recession was a long and slow process, though. Annual GDP growth never topped 3% in the Obama era.

When did the bull market end?

A trade war with China temporarily sucked some of the air out of the market’s gains in late 2018, but it wasn’t until the coronavirus pandemic hit the United States in early 2020 that the bull market officially came to an end.

What was the economic crisis of 1981?

Crushed by Federal Reserve Chairman Paul Volcker’s war on inflation, the economy stumbled into a brief recession in July 1981. Unemployment spiked to nearly 11%.

How did the S&P 500 decline under Bush?

The S&P 500 declined 40% under Bush, the worst among modern administrations. Bush inherited the dotcom bust, which spawned the 2001 recession. The downturn was deepened by the 9/11 terror attacks. Growth gathered steam in 2004 and 2005, fueled in part by low interest rates and the housing boom.

When is the S&P 500 closing?

Cumulatively, the S&P 500 gained 67% from Trump’s inauguration to the market close on Tuesday, January 19, 2021 — his last full day in office.

Who was the first president to go into recession?

Ronald Reagan. President Ronald Reagan’ s first four years in the White House weren’t particularly lucrative for Wall Street. Crushed by Federal Reserve Chairman Paul Volcker’s war on inflation, the economy stumbled into a brief recession in July 1981. Unemployment spiked to nearly 11%.

Does Biden put much emphasis on stocks?

Unlike his predecessor, incoming President-elect Joe Biden does not put nearly as much emphasis on stocks as a gauge of the country’s strength or wellbeing. “The idea that the stock market is booming is his only measure of what’s happening,” Biden said of Trump in the final presidential debate in October.