What caused Black Tuesday stock market crash?

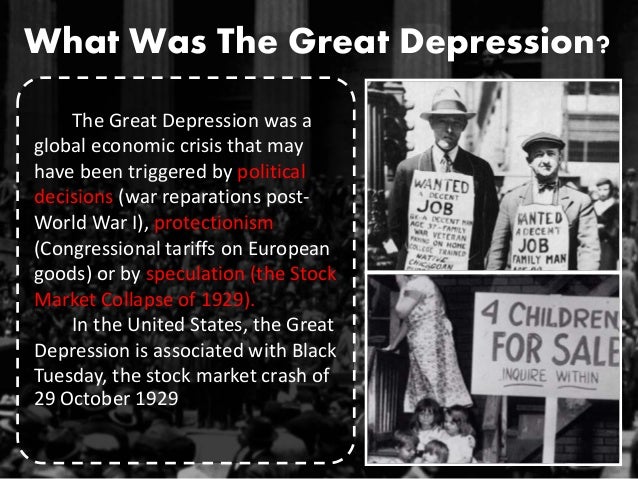

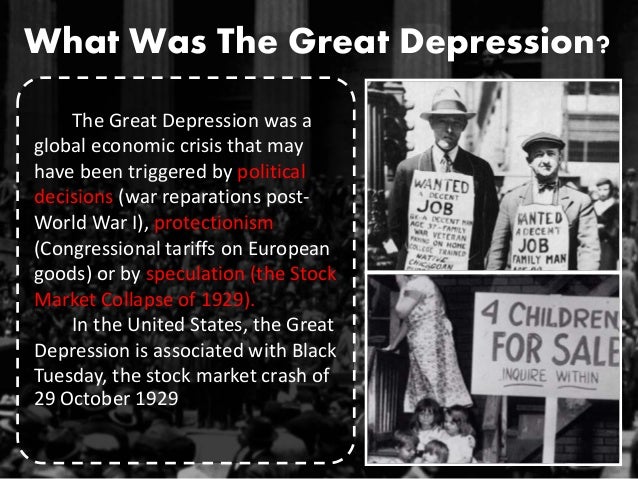

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it, during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels.Apr 17, 2022

What was Black Tuesday the stock market crash quizlet?

Black Tuesday refers to October 29, 1929, when panicked sellers traded nearly 16 million shares on the New York Stock Exchange (four times the normal volume at the time), and the Dow Jones Industrial Average fell -12%. Black Tuesday is often cited as the beginning of the Great Depression.

What happened to the stock market on Black Tuesday?

Black Tuesday was Oct. 29, 1929, and it was marked by a sharp fall in the stock market, with the Dow Jones Industrial Average (DJIA) especially hard hit in high trading volume. The DJIA fell 12%, one of the largest one-day drops in stock market history.

How did the stock market crash on Black Thursday?

Panic selling began on “Black Thursday,” October 24, 1929. Many stocks had been purchased on margin—that is, using loans secured by only a small fraction of the stocks' value. As a result, the price declines forced some investors to liquidate their holdings, thus exacerbating the fall in prices.

Why did Black Tuesday started the Great Depression?

Black Tuesday's losses destroyed confidence in the economy. That loss of confidence led to the Great Depression. In those days, people believed the stock market was the economy. What was good for Wall Street was thought to be good for Main Street.

Why is Black Tuesday considered the starting point but not the ultimate reason of the Great Depression quizlet?

On Black Tuesday the stock market crumbles completely. People started to panick and rushed to sell but their were no buyers. Black Tuesday was also the start of the Great Depression.

Why was Black Tuesday such a significant day in American history?

On October 29, 1929, the United States stock market crashed in an event known as Black Tuesday. This began a chain of events that led to the Great Depression, a 10-year economic slump that affected all industrialized countries in the world.Mar 11, 2021

What caused the stock market crash of 1929?

By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.Apr 27, 2021

What stocks survived the 1929 crash?

Coca-Cola , Archer-Daniels and Deere should like this history lesson.Oct 27, 2008

Who made money in 1929 crash?

While most investors watched their fortunes evaporate during the 1929 stock market crash, Kennedy emerged from it wealthier than ever. Believing Wall Street to be overvalued, he sold most of his stock holdings before the crash and made even more money by selling short, betting on stock prices to fall.Apr 28, 2021

What is the difference between Black Thursday and Black Tuesday?

The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day.

What happened the day before Black Tuesday?

24, 1929, when the Dow Jones Industrial Average (DJIA) plummeted drastically as soon as trading opened and an unprecedented number of shares changed hands. Black Thursday is considered the first day of the Stock Market Crash of 1929, which lasted until Oct.

What caused Black Tuesday?

Black Tuesday and the crash of the stock market had many causes, including stock speculation, consumer credit, tariffs, and low interest rates. The...

What happened on Black Tuesday?

On October 29, 1929 (Black Tuesday), stock market prices started to decrease. Fearful of losing the money they invested, people frantically began s...

What is Black Tuesday and why does it mark the Great Depression?

On Thursday October 24, the market fell 11% causing investors to panic. The market fell another 13% on Monday October 28 and 12% on Tuesday October...

What happened on Black Thursday?

Selling intensified in mid-October. On October 24, "Black Thursday", the market lost 11% of its value at the opening bell on very heavy trading . The huge volume meant that the report of prices on the ticker tape in brokerage offices around the nation was hours late, and so investors had no idea what most stocks were trading for. Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor. The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank of New York. They chose Richard Whitney, vice president of the Exchange, to act on their behalf.

What was the cause of the 1929 stock market crash?

Cause. Fears of excessive speculation by the Federal Reserve. The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed.

How did the stock market crash of 1929 affect the world?

The stock market crash of October 1929 led directly to the Great Depression in Europe. When stocks plummeted on the New York Stock Exchange, the world noticed immediately. Although financial leaders in the United Kingdom, as in the United States, vastly underestimated the extent of the crisis that ensued, it soon became clear that the world's economies were more interconnected than ever. The effects of the disruption to the global system of financing, trade, and production and the subsequent meltdown of the American economy were soon felt throughout Europe.

When did the Dow Jones go up?

The largest percentage increases of the Dow Jones occurred during the early and mid-1930s. In late 1937, there was a sharp dip in the stock market, but prices held well above the 1932 lows. The Dow Jones did not return to the peak closing of September 3, 1929, until November 23, 1954.

What was the biggest stock crash in 1929?

The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day.

When did the uptick rule start?

Also, the uptick rule, which allowed short selling only when the last tick in a stock's price was positive, was implemented after the 1929 market crash to prevent short sellers from driving the price of a stock down in a bear raid.

What was the Roaring 20s?

The " Roaring Twenties ", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector.

What was the last day of the stock market crash?

Black Tuesday was the fourth and last day of the stock market crash of 1929. It took place on October 29, 1929. 1 Investors traded a record 16.4 million shares. They lost $14 billion on the New York Stock Exchange, worth $206 billion in 2019 dollars. 2 3 .

Why did Black Tuesday happen?

Part of the panic that caused Black Tuesday resulted from how investors played the stock market in the 1920s. They didn't have instant access to information via the internet. Stock prices were printed by a ticker tape machine onto a strip of paper. As share prices dropped the ticker tapes literally could not keep up with the pace. Panic ensued because no one knew how bad it was.

When did the Dow drop?

After the crash, the Dow continued sliding for three more years. It finally bottomed on July 8, 1932, closing at 41.22. 4 All told, it lost almost 90% of its value since its high on September 3, 1929. In fact, it didn't reach that high again for 25 years until November 23, 1954.

Who is Kimberly Amadeo?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

When was the New York Stock Exchange founded?

The New York Stock Exchange was founded in 1817, although its origins date back to 1792 when a group of stockbrokers and merchants signed an agreement under a buttonwood tree on Wall Street.

What happened to stock market in 1929?

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What was the New Deal?

The relief and reform measures in the “ New Deal ” enacted by the administration of President Franklin D. Roosevelt (1882-1945) helped lessen the worst effects of the Great Depression; however, the U.S. economy would not fully turn around until after 1939, when World War II (1939-45) revitalized American industry.

How many shares were traded on Black Tuesday?

On Black Tuesday, October 29, stock holders traded over sixteen million shares and lost over $14 billion in wealth in a single day. To put this in context, a trading day of three million shares was considered a busy day on the stock market. People unloaded their stock as quickly as they could, never minding the loss.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

Why did banks fail?

Many banks failed due to their dwindling cash reserves. This was in part due to the Federal Reserve lowering the limits of cash reserves that banks were traditionally required to hold in their vaults, as well as the fact that many banks invested in the stock market themselves.

What was Hoover's agenda?

Upon his inauguration, President Hoover set forth an agenda that he hoped would continue the “Coolidge prosperity ” of the previous administration. While accepting the Republican Party’s presidential nomination in 1928, Hoover commented, “Given the chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation forever.” In the spirit of normalcy that defined the Republican ascendancy of the 1920s, Hoover planned to immediately overhaul federal regulations with the intention of allowing the nation’s economy to grow unfettered by any controls. The role of the government, he contended, should be to create a partnership with the American people, in which the latter would rise (or fall) on their own merits and abilities. He felt the less government intervention in their lives, the better.

When did the Dow Jones Industrial Average peak?

As September began to unfold, the Dow Jones Industrial Average peaked at a value of 381 points, or roughly ten times the stock market’s value, at the start of the 1920s.

What happened on October 29, 1929?

October 29, 1929, or Black Tuesday, witnessed thousands of people racing to Wall Street discount brokerages and markets to sell their stocks. Prices plummeted throughout the day, eventually leading to a complete stock market crash. The financial outcome of the crash was devastating.

How much did the stock market lose in 1929?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket.

Overview

- My interpretation of these events is that the statement by Snowden, Chancellor of the Exchequer, indicating the presence of a speculative orgy in America is likely to have triggered the October 3 break. Public utility stocks had been driven up by an explosion of investment trust formation and investing. The trusts, to a large extent, bought stock on margin with funds loaned not by banks b…

Causes Of The Crash

- Although it can be argued that the stock market was not overvalued, there is evidence that many feared that it was overvalued — including the Federal Reserve Board and the United States Senate. By 1929, there were many who felt the market price of equity securities had increased too much, and this feeling was reinforced daily by the media and statements by influential government offi…

- The stock market crash of 1929 resulted in a loss of around $14 billion of wealth. Now after the crash, certain reform acts had to be set up to again stabilize the market. One of the steps that were taken was the setting up of the Securities and Exchange Commission or the SEC. The role of this institution was to lay down the market rules and punish in case of any violation of the laws. …

- Selling intensified in mid-October. On October 24 (\"Black Thursday\"), the market lost 11 percent of its value at the opening bell on very heavy trading. The huge volume meant that the report of prices on the ticker tape in brokerage offices around the nation was hours late and so investors had no idea what most stocks were actually trading for at the moment, increasing panic. Severa…

Aftermath

- In 1932, the Pecora Commission was established by the U.S. Senate to study the causes of the crash. The following year, the U.S. Congress passed the Glass–Steagall Act mandating a separation between commercial banks, which take deposits and extend loans, and investment banks, which underwrite, issue, and distribute stocks, bonds, and other securities. After the expe…

- After the crash of 1929, there was a gradual but slow improvement in the market as mentioned before. But that was just temporary. No one could guess that the year 1932 would bring such a huge crash again. The crash of 1932 was so huge that the crash of 1929 seemed really petty in front of it. There was 50% depreciation even from the lowest point of 1929. The drop was so ma…

Academic Debate

- There is ongoing debate among economists and historians as to what role the crash played in subsequent economic, social, and political events. The Economist argued in a 1998 article that the Depression did not start with the stock market crash, nor was it clear at the time of the crash that a depression was starting. They asked, "Can a very serious Stock Exchange collapse produc…

- Together, the 1929 stock market crash and the Great Depression formed the biggest financial crisis of the 20th century. The panic of October 1929 has come to serve as a symbol of the economic contraction that gripped the world during the next decade. The crash of 1929 caused fear mixed with a vertiginous disorientation, but shock was quickly cauterized with denial, both o…

Background

- The stock market fell. The "Roaring Twenties", the decade that followed World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector. While American cities prospere…

- The Roaring Twenties, the decade that followed World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector. While American cities prospered, the overprod…

Timeline

- The Roaring Twenties, the decade that led up to the Crash, was a time of wealth and excess. Despite the dangers of speculation, many believed that the stock market would continue to rise indefinitely. The market had been on a six-year run that saw the Dow Jones Industrial Average increase in value fivefold, peaking at 381.17 on September 3, 1929. Shortly before the crash, eco…

Analysis

- The crash followed a speculative boom that had taken hold in the late 1920s. During the latter half of the 1920s, steel production, building construction, retail turnover, automobiles registered, and even railway receipts advanced from record to record. The combined net profits of 536 manufacturing and trading companies showed an increase, in the first six months of 1929, of 36…

Effects

- United States

Together, the 1929 stock market crash and the Great Depression formed the largest financial crisis of the 20th century. The panic of October 1929 has come to serve as a symbol of the economic contraction that gripped the world during the next decade. The falls in share prices o… - Europe

The stock market crash of October 1929 led directly to the Great Depression in Europe. When stocks plummeted on the New York Stock Exchange, the world noticed immediately. Although financial leaders in the United Kingdom, as in the United States, vastly underestimated the exten…

Further Reading

- 1. Axon, Gordon V. The Stock Market Crash of 1929. London, England: Mason & Lipscomb Publishers Inc., 1974. 2. Web site: The 1929 Stock Market Crash. March 26, 2008. Harold. Bierman. EH.Net Encyclopedia. Economic History Association. Santa Clara, California. Whaples. Robert. February 2, 2017. 3. Brooks, John. (1969). Once in Golconda: A True Drama of Wall Stree…

- 1. Bierman, Harold (March 26, 2008), \"The 1929 Stock Market Crash\", in Whaples, Robert, EH.Net Encyclopedia, Santa Clara, CA: Economic History Association, http://eh.net/encyclopedia/article/Bierman.Crash, retrieved May 13, 2010. 2. Brooks, John. (1969). Once in Golconda: A True Drama of Wall Street 1920–1938. New York: Harper & Row. ISBN 0-39…