The Nasdaq Global Select exchange, for example, requires at least $550 million in market capitalization, assets of at least $80 million and a bid price of at least $4 a share. If a company fails to meet the minimum Nasdaq listing guidelines, it is delisted and moves to the OTC market. OTC Stocks Lists, Markets and Pink Sheets

Full Answer

Are OTC stocks a good investment?

OTC stocks typically have lower share prices than those of exchange-listed companies. Many OTC stocks trade at less than $5 a share and are known as penny stocks or micro cap stocks. Individual investors may find them attractive because of their low prices. However, these inexpensive shares can be risky and highly speculative.

How to find over the counter stocks?

OTC 1 Exploring The OTC Market. An over-the-counter stock is one that is not listed on an organized stock exchange. ... 2 Researching the Nasdaq. ... 3 Evaluating Listing Requirements. ... 4 OTC Stocks Lists, Markets and Pink Sheets. ...

What is the OTCQX market?

OTC Markets Group organizes OTC stocks and securities into three distinct markets: OTCQX is the first and highest tier and is reserved for companies that provide the most detail to OTC Markets Group for listing. Companies listed here must be up-to-date with regard to regulatory disclosure requirements and maintain accurate financial records.

What is OTC trading and how does it work?

OTC trading tends to focus on equities, i.e. stocks. In fact, it’s even common to see penny stocks being traded over the counter. The Securities and Exchange Commission (SEC) generally defines penny stocks as stocks that trade for less than $5 per share. Penny stocks can also be referred to as micro-cap stocks.

See more

Can OTC stocks get listed on Nasdaq?

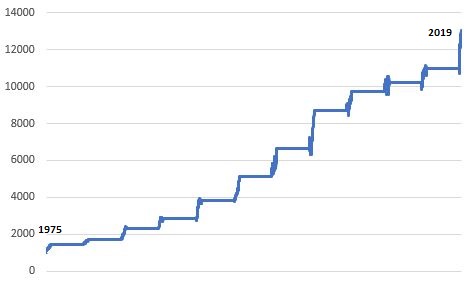

Over-the-counter markets are where stocks that aren't listed on major exchanges such as the New York Stock Exchange or the Nasdaq can be traded. More than 12,000 stocks trade over the counter, and the companies that issue these stocks choose to trade this way for a variety of reasons.

How much does a stock have to be worth to be on the Nasdaq?

NASDAQ National Market (NASDAQ) Quantitative Requirements: To be listed on the NASDAQ National Market, a company must have net tangible assets of $6 million and net income in the latest fiscal year or two of the past three fiscal years of $1 million.

How many OTC stocks make it to Nasdaq?

58 Companies Uplist From The OTC To Nasdaq & NYSE in 2018.

How long does it take for an OTC stock to Nasdaq?

In general, it takes a company between 6 and 12 months to get listed on the OTC Markets. The exact timeline can vary depending on a number of factors, including: A company needs to file certain regulatory disclosures with the SEC or OTC before applying for acceptance onto the OTC.

How long can a stock stay below $1 on Nasdaq?

30 consecutive business daysIf a company trades for 30 consecutive business days below the $1.00 minimum closing bid price requirement, Nasdaq will send a deficiency notice to the company, advising that it has been afforded a "compliance period" of 180 calendar days to regain compliance with the applicable requirements.

Does Nasdaq have a minimum market cap?

Nasdaq Capital Market companies are required to meet a net income standard of at least $750,000, a minimum public float of 1,000,000 shares, at least 300 shareholders, and a share bid price of at least $4 (with certain exceptions).

How high can OTC stocks go?

Just like mid and large cap stocks, there is no limit to how high a penny stock can go. Many massive, well-established companies were once trading for less than $5 per share.

How long does it take to uplist to Nasdaq?

four to six weeksPlease also review our list of frequently asked questions. While it generally takes four to six weeks to process a listing application, this time frame is variable and may be shortened considerably, if the application raises no issues and the company responds quickly to Staff comments.

Can you make money on OTC stocks?

It is possible to make money with penny stocks. Then again, it's technically possible to make money with any type of stock. Successful investors usually focus on the potential for their stock picks, regardless of price, to gain value over the long term.

What happens when a stock gets Uplisted to Nasdaq?

But when a stock uplists to the NYSE or the Nasdaq, they can trade it. Additionally, stocks that uplist to a centralized exchange are seen as more growth-oriented, which means increased upside potential to go along with more volatility. Combining uplisted stocks with strong fundamentals can work extremely well for you.

Is it safe to buy OTC stocks?

Typically, OTC stocks tend to be highly risky microcap stocks (the shares of small companies with market capitalizations of under $300 million), which include nanocap stocks (those with market values of under $50 million). The SEC has long warned investors about the high risks associated with such stocks.

How do OTC stocks work?

Over-the-counter (OTC) securities are securities that are not listed on a major exchange in the United States and are instead traded via a broker-dealer network, usually because many are smaller companies and do not meet the requirements to be listed on a formal exchange.

What is OTC trading?

The OTC market is a generic term for companies that don't trade on a single, organized exchange such as the NYSE or the Nasdaq. The OTC divides itself into three major components: the QX market , where companies have minimum financial requirements; the QB market , where they must be current in their financial reporting; and the Pink Sheets, where companies can (and do) trade with no disclosure whatsoever, even if their share price is less than a penny.

What is an over the counter stock?

An over-the-counter stock is one that is not listed on an organized stock exchange. Instead, electronic communications networks bring information on trades in the stock, which take place among brokers, institutional market makers and individuals. Although many people assume Nasdaq stocks are over-the-counter securities, they are not.

When did the Nasdaq start?

Formerly known as the National Association of Securities Dealers Automated Quotations, the exchange run by Nasdaq Stock Market, Inc., is an electronic stock exchange that began in 1971. The Nasdaq does not operate from a single physical location or a trading floor where specialists meet, as does the New York Stock Exchange.

Is the Nasdaq bigger than the New York Stock Exchange?

The Nasdaq is younger than the New York Stock Exchange but actually much bigger in terms of daily dollar volume, number of issues listed and total market capitalization, or price multiplied by number of shares.

Is Microsoft a low capitalization company?

A listing on Nasdaq does not necessarily mean cheap stock, risky stock or a low-capitalization company, although the exchange is heavy with high-tech firms. Microsoft, Intel, Facebook, Cisco, Texas Instruments, Oracle and Comcast all trade on Nasdaq exchanges. To get on the Nasdaq ticker, companies have to meet certain listing requirements.

Is Bayer listed on the Nasdaq?

Food and beverages may be one thing. But you’d think that surely, one of the world’s largest pharmaceutical companies in the form of Bayer would be listed on the Nasdaq, if not the NYSE.

Can OTC stocks be listed on the NYSE?

These OTC stocks can easily qualify for listing in the NYSE or Nasdaq. Typically, when a company decides to list its equity units in the over-the-counter (OTC) market, it’s usually for a reason and not a good one. Unable to meet the regulatory requirements and fiscal performance standards of a major U.S.

Is OTC stock a shoddy stock?

But not all OTC stocks are shoddy affairs. In fact, some of the world’s biggest and most well-recognized companies cannot be found in major exchanges like the New York Stock Exchange or the Nasdaq. Instead, they’re among the litany of highly risky OTC stocks.

Do OTC stocks need to be listed on major exchanges?

To list in the major exchanges requires significant funds. Even if a company has a massive war chest, it may not be worth the cost for a major listing. In addition, big OTC stocks tend to be shares of foreign companies. In that case, they may have additional reasons not to want a major listing.

What is OTC Stock?

In order to grasp OTC stock trading and how it works, it helps to have a clear understanding of public stock exchanges.

What Kind of Securities Trade on the Over-the-Counter Market?

OTC trading tends to focus on equities, i.e. stocks. In fact, it’s even common to see penny stocks being traded over the counter. The Securities and Exchange Commission (SEC) generally defines penny stocks as stocks that trade for less than $5 per share. Penny stocks can also be referred to as micro-cap stocks.

So Where Are OTC Securities Traded, Exactly?

In the US, the majority of over-the-counter trading takes place on networks operated by OTC Markets Group. This company runs the largest OTC trading marketplace and quote system in the country (the other is the OTC Bulletin Board or OTCBB).

Pros and Cons of OTC Trading

Investing can be risky in general, but the risks may be heightened with trading OTC stocks. But trading higher risk stocks could result in bigger rewards if they’re able to produce above-average returns.

The Takeaway

Why would you want to trade stocks over the counter? Since OTC stocks trade outside of traditional exchanges like the NYSE or Nasdaq, the OTC market gives you access to different types of securities, including penny stocks, international stocks, derivatives, corporate bonds, and even cryptocurrency.

What is OTC stock?

What Are Over-the-Counter (OTC) Stocks? Over-the-counter (OTC) stocks are also known as unlisted stocks. Typically offered by small companies, they are traded through market makers, rather than through stock exchanges like the New York Stock Exchange or Nasdaq. As a result, OTC stocks generally have a lower volume of trade than exchange-listed ...

Why do companies sell OTC shares?

So selling shares OTC allows them to raise capital and sell shares without meeting those standards. Not all OTC companies are small, however. Some large companies trade on the OTC market because they choose to avoid traditional exchanges’ requirements, which may include filing extensive financial reports.

What are OTC securities?

Other OTC Securities. OTC trades may include other kinds of securities besides stocks. Corporate and government bonds, derivatives , and other securities also trade on OTC markets. OTC platforms are also a place to trade American Depository Receipts (ADRs). These are certificates representing shares of foreign companies.

What are the OTC markets?

Many of the investors trading on the OTC markets are large institutions such as mutual fund companies. However, individual investors also own many of the low-priced OTC penny stocks. The OTC markets serve important purposes for trading bonds, ADRs, derivatives and shares of smaller companies.

What is derivative certificate?

exchanges’ listing requirements. Derivatives are also traded on OTC markets. Derivatives are contracts that get their value from an underlying asset.

Why are penny stocks called pink sheets?

Shares traded on both of these platforms are often called “pink sheets” because the color of paper on which quotes of share prices were published years ago. The paper is gone, but low-priced penny stocks are still traded as “pink sheets.”.

Why is it so hard to know what you are buying?

The lack of transparency can make it hard for investors to know what they are buying. Without any reporting requirements, investors can fall victim to fraudulent investment schemes. Securities traded on the OTC markets may be inherently more risky. Smaller companies tend to be less capitalized.

How many requirements does the NASDAQ have?

Major stock exchanges, like the NASDAQ, are exclusive clubs—their reputations rest on the companies they trade. The NASDAQ has four sets of listing requirements. Each company must meet at least one of the four requirement sets, as well as the main rules for all companies. In addition to these requirements, companies must meet all ...

How many shares of a company must be publicly traded?

Each company must have a minimum of 1,250,000 publicly traded shares outstanding upon listing, excluding those held by officers, directors, or any beneficial owners of more than 10% of the company.

How many market makers are required for a stock?

There must be at least three (or four depending on the criteria) market makers for the stock. For companies using the $3 or $2 criteria, only two market makers may be required. Each listing firm is also required to follow NASDAQ corporate governance rules 4350, 4351, and 4360.

Does the Nasdaq allow any company to be traded?

The Bottom Line. Major stock exchanges, like the Nasdaq, are exclusive clubs—their reputations rest on the companies they trade. As such, the Nasdaq won't allow just any company to be traded on its exchange.

What are the OTC markets?

The OTC market is an electronic network of buying and selling activity made of securities that are not listed on a major exchange such as the NASDAQ or NYSE.

How does the NMS relate to the OTC?

The National Market System (NMS) governs all equity trading undertaken on formal US stock exchanges and the NASDAQ market. In contrast, OTC trades are not traded on an NMS exchange.

What is the OTC Markets Group?

OTC Markets Group, Inc. engages in the provision of trading, corporate, and market data services. The firm operates through the following business lines: OTC Link, Market Data Licensing and Corporate Services.

Pros and Cons of Investing in OTC Stocks

Investing in the OTC market is an attractive way to take a shot at achieving exponential gains. It gives start-ups access to public money and investors an opportunity to own a piece of an exciting business.

How to Purchase OTC Stocks

If you would like to purchase shares in an OTC-listed company, here are the steps to follow:

Investing in OTC Stocks

Buying and trading stocks on OTC markets is not for everyone. These stocks are less liquid (which means fewer people are buying and selling) and carry more risk than equities traded on well-known exchanges. The OTC markets are notoriously speculative, and you can quickly lose your money without careful planning.

What Are OTC Stocks?

OTC stocks are almost always going to be penny stocks, which means that each share of stock is worth less than $1. Companies offering OTC stocks usually have a market capitalization of less than $50 million.

What is the Difference Between OTC and a Stock Exchange?

Stock exchanges offering securities for sale to the general public have tight listing requirements around accounting and transparency. These requirements are promulgated and enforced by the SEC (Securities and Exchange Commission), a branch of the federal government established after the 1929 stock market crash to prevent market manipulation.

Infinity Investing Featured Event

In this FREE event you’ll discover how the top 1% use little-known “compounders” to grow & protect their reserves. Our Infinity team of experts show you how to be the best possible steward of your finances and how to make your money and investments work for you instead of you working for them.

How to Buy OTC Stocks

Now that we’ve gone over what OTC stocks are and how they are typically sold, let’s go over the process of investing in them:

How to Sell OTC Stocks

The process for selling OTC stocks is similar to buying them. Namely, you will just place trades on the online platform you’re using, or tell your broker to unload them.

OTC Trading Can Be Volatile, So Proceed with Caution

OTC trading isn’t for everyone. At the same time, there are plenty of OTC stocks that are foreign companies that could present significantly stable, forward-thinking investments. They’re just not a listed stock on the NYSE or NASDAQ because they don’t meet the requirements of the SEC and/or those particular marketplaces.

Infinity Investing Workshop

In this FREE workshop you’ll discover how the top 1% use little-known “compounders” to grow & protect their reserves. This plan isn’t some get-rich-quick vision board. It’s an actionable guide, simplifying the very same processes used by many of the most successful people.

Exploring The Otc Market

Researching The Nasdaq

- Formerly known as the National Association of Securities Dealers Automated Quotations, the exchange run by Nasdaq Stock Market, Inc., is an electronic stock exchange that began in 1971. The Nasdaq does not operate from a single physical location or a trading floor where specialists meet, as does the New York Stock Exchange. The Nasdaq is a sort of virtual stock market, a vas…

Evaluating Listing Requirements

- A listing on Nasdaq does not necessarily mean cheap stock, risky stock or a low-capitalization company, although the exchange is heavy with high-tech firms. Microsoft, Intel, Facebook, Cisco, Texas Instruments, Oracle and Comcast all trade on Nasdaq exchanges. To get on the Nasdaq ticker, companies have to meet certain listing requirements. The Nasdaq Global Select exchang…

Otc Stocks Lists, Markets and Pink Sheets

- The OTC market is a generic term for companies that don't trade on a single, organized exchange such as the NYSE or the Nasdaq. The OTC divides itself into three major components: the QX market, where companies have minimum financial requirements; the QB market, where they must be current in their financial reporting; and the Pink Sheets, where com...