Here are 7 food staples to consider buying now, so that you can reduce your inflation risk later:

- Corn: Corn prices are on the rise, and that means that you might want to be prepared. ...

- Other Canned Vegetables: Consider other canned vegetables, like peas, carrots and green beans. ...

- Kidney Beans: Stock up on kidney beans. ...

- Wheat: Wheat is another of those things that can be stored for more than a decade, as long as it is properly stored. ...

- Peanut butter.

- Pasta.

- Canned tomatoes.

- Baking goods – flour, sugar, yeast, etc.

- Cooking oils.

- Canned vegetables and fruits.

- Applesauce.

Where should you put your money when inflation is high?

Feb 14, 2022 · The best areas to invest in during periods of inflation include technology and consumer goods. Commodities: Precious metals such as gold and silver have traditionally been viewed as good hedges ...

Which assets do best during inflation?

1 day ago · Parkev Tatevosian (Netflix): My top inflation-busting stock to buy right now is Netflix. The streaming pioneer offers its service to folks for …

What are the best investments to hedge inflation?

Dec 28, 2021 · Beat Inflation by Investing in Gold Gold is the oldest hedge against inflation. The yellow metal has seen an average annual gain of 9.48% over the 20 years between September 2001 and September...

Is it time to start worrying about inflation?

May 07, 2021 · Stock Up On Consumer Goods Due To Inflation. Peter Schiff, a strong proponent of gold and an opponent of government spending recently noted that as consumers find that inflation could be a pressing problem, they may take actions to stock up today. Indeed, from pool chemicals to other essential items, consumers may want to to stock up today.

What should I buy before hyperinflation hits 2021?

- Dry Goods Shortages of dry goods, like pasta, rice, beans, and spices, cropped up during the early days of the Covid-19 pandemic. ...

- Canned foods, including vegetables, fruit, and meats are easy to store and useable in a variety of ways.

What should I stockpile for food shortages?

- Flour (white, wholemeal, self-raising)

- Rice.

- Noodles.

- Beans (dried and canned different varieties)

- Lentils. ...

- Oats.

- Pasta (different shapes, white & wholewheat)

What should you do with your money during inflation?

It's a good idea to keep short-term cash — like an emergency fund — accessible in a savings account, but if you have savings that you don't expect to need for a year or more, you may want to consider investing those funds or buying a treasury bond.5 days ago

What should I do before hyperinflation?

- Negotiate a lower interest rate on your credit cards.

- Pay off high-interest debt first.

- Consolidate your debt into a single loan with a lower interest rate.

- Take out a personal loan to pay off your high-interest credit cards.

What should I stock up on now?

- Pasta! All shapes—linguine, fettuccine, spaghetti, penne, and rigatoni are our faves. ...

- Other grains. ...

- Canned goods. ...

- Dry goods! ...

- Eggs. ...

- Dairy! ...

- Fresh vegetables that last: cabbage, cauliflower, potatoes and sweet potatoes last and last, so we're loading up. ...

- Frozen veggies.

Should I be stocking up on food 2022?

High prices and low availability of aluminum may cause canned food and beverage shortages this year, much like the end of 2021. This extends not just to canned food, but also canned pet food.Mar 25, 2022

How do you profit from inflation?

- Real estate. Single-family homes financed with low, fixed-rate mortgages tend to perform well during periods of inflation. ...

- Value stocks. Some research has shown that value stocks tend to do better than growth stocks during periods of inflation. ...

- Commodities. ...

- TIPS. ...

- I-Bonds.

How can I invest in 2022 inflation?

Where can I put cash now?

- High-yield savings accounts. ...

- Short-term corporate bond funds. ...

- Money market accounts. ...

- Cash management accounts. ...

- Short-term U.S. government bond funds. ...

- No-penalty certificates of deposit. ...

- Treasurys. ...

- Money market mutual funds.

How do you hedge against inflation?

- Gold. Gold has often been considered a hedge against inflation. ...

- Commodities. ...

- A 60/40 Stock/Bond Portfolio. ...

- Real Estate Investment Trusts (REITs) ...

- The S&P 500. ...

- Real Estate Income. ...

- The Bloomberg Aggregate Bond Index. ...

- Leveraged Loans.

How do you dodge inflation?

- Invest in good businesses with low capital needs. ...

- Look for companies that can raise prices during periods of higher inflation. ...

- Take a look at TIPS. ...

- Invest in yourself and be the best at what you do. ...

- Steer clear of traditional bonds. ...

- Limit your wants.

Do stocks do well in inflation?

Is this really transitory inflation?

Transitory inflation is the idea that inflation is only temporary. You may have heard this phrase floating around a lot lately. If you haven’t heard it yet, listen for it. Many experts are saying that what we are experiencing right now is transitory inflation.

Are food prices going up in 2022?

Yes! That is a given. We’ve noticed the effects on our budget, and the latest research confirms it. Average food at home inflation is currently at 7.4%! But let’s break it down a bit more.

How much are food prices expected to increase in 2022?

According to Research firm IRI, food prices are expected to continue rising 5 to 8% in 2022.

How can I prepare for inflation with food prices?

There are a couple simple ways to prepare for inflation with food prices. I think it is wise to prepare now and start buying things before you need them. This is what I have been focused on lately.

What else can I do to get ready for inflation?

There are some simple things everyone can do, regardless of their family size or income level.

Beat Inflation by Investing in Gold

Gold is the oldest hedge against inflation. The yellow metal has seen an average annual gain of 9.48% over the 20 years between September 2001 and September 2021. Over the same period, inflation averaged 2.4%, netting investors a 7.08% rate of return.

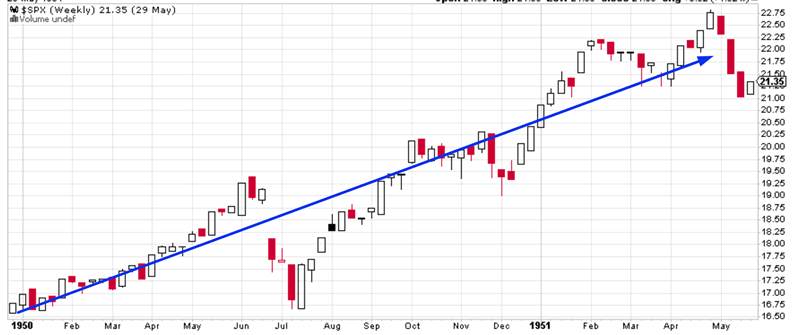

Invest in Stocks to Beat Inflation

Investing in a diversified portfolio of stocks is an excellent way to fend off inflation. From September 2001 to September 2021, the S&P 500 —a key benchmark for U.S. stocks—generated an average return of around 9.5% (with dividends reinvested). After accounting for inflation, you’re still looking at about 7% average annual returns.

Beat Inflation with Real Estate

Many inflation-averse investors turn to real estate to hedge their holdings, although the size and variability of the market can make it very difficult to generalize about this particular asset class.

TIPS Are Designed to Beat Inflation

Treasury Inflation-Protected Securities ( TIPS) are designed to protect your investment from rising prices. The U.S. Treasury sells TIPS and adjusts their par value each year to keep up with inflation. This boosts your interest payments, and it also ensures you’ll likely see some appreciation from inflation-adjustments too.

Beat Inflation with I Bonds

Series I savings bonds, better known as I bonds, are another government-issued security designed to beat inflation.

How to prepare for inflation?

Prepare for inflation with responsible borrowing. Consider refinancing your home when interest rates are low and lock in a low fixed rate mortgage. Just beware of adding to the length of the loan. Taking out a 15 year loan can substantially reduce your total interest payments.

What does inflation mean for stocks?

Inflation means rising prices, so stock up now on non-perishables, 2. If you’re thinking of buying a home or a car, you’re better off taking on the debt when rates are lower, rather than waiting until they rise along with inflation. 3. Inflation stocks might prosper during inflationary periods.

What was the inflation rate in 1950?

According to Lawrence H. White at econlib.org, inflation rates since 1950, as measured by the Consumer Price Index (CPI), ranged from -0.7% in 1954 to a high of 13.3% in 1979. Although since 1991, the inflation rate has remained relatively constant, between 1.6% and 3.3% per year.

What is the most commonly cited measure of inflation in the United States?

The most commonly cited measure of inflation in the United states is the CPI. It’s a measure that calculates the weighted average prices of a basket of consumer goods like transportation, food, medical care, education, recreation and more.

Who promoted moderate inflation to prevent the paradox of thrift?

A Little Inflation Goes a Long Way. You must prepare for inflation, even though there are advantages of inflation. Famous British economist, John Maynard Keynes, promoted moderate inflation to prevent the “paradox of thrift.”.

Why did John Maynard Keynes promote moderate inflation?

Famous British economist, John Maynard Keynes, promoted moderate inflation to prevent the “paradox of thrift.”. If prices fall too much, because the country is becoming too productive, then consumers will slow spending, expecting that if they wait, they’ll snare a better deal.

What happens when inflation hits real estate?

When inflation hits, real estate prices usually rise as well. The opportunities for small and large investors to invest in real estate continues to grow. There are so many ways to invest in real estate: Real estate crowdfunding. Buying real estate outright and either renting or fixing up and flipping.