What happens when a company does a stock split?

Companies typically engage in a stock split so that investors can more easily buy and sell shares, otherwise known as increasing the company’s liquidity. Stock splits divide a company’s shares into more shares, which in turn lowers a share’s price and increases the number of shares available.

How do you calculate stock price after a split?

An easy way to determine the new stock price is to divide the previous stock price by the split ratio. Using the example above, divide $40 by two and we get the new trading price of $20. If a stock does a 3-for-2 split, we'd do the same thing: 40/ (3/2) = 40/1.5 = $26.67.

Should you buy or sell a company after a split?

Remember that splits may be a reason to buy shares in a company and reverse splits may be a reason to sell shares. Splits and buybacks may not pack the same punch as a company that gets bought out, but they do give the investor a metric to gauge the management's sentiment of their company.

Should you use a stop order after a stock split?

Often, people use a stop order to protect against significant losses, especially in cases where they can’t, or don’t intend to, monitor the stock price regularly. Don’t assume your brokerage house will adjust the trigger price following a stock split.

Is it better to buy before or after a stock split?

Should you buy before or after a stock split? Theoretically, stock splits by themselves shouldn't influence share prices after they take effect since they're essentially just cosmetic changes.

Is it good to own a stock that splits?

Stock splits are generally a sign that a company is doing well, meaning it could be a good investment. Additionally, because the per-share price is lower, they're more affordable and you can potentially buy more shares.

Do stocks usually go up after a split?

In almost all cases, after a stock split, the number of shares that are held by a shareholder increase. The caveat in this regard is the fact that the price per share reduce, because the shareholders now get more shares for the given price. The market capitalization in this regard stays the same.

Should you sell before a stock split?

Splits are often a bullish sign since valuations get so high that the stock may be out of reach for smaller investors trying to stay diversified. Investors who own a stock that splits may not make a lot of money immediately, but they shouldn't sell the stock since the split is likely a positive sign.

Can stock splits make you rich?

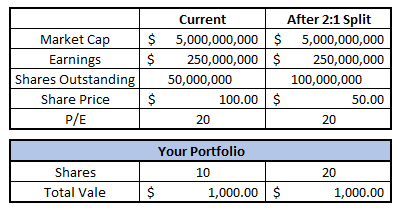

A stock split doesn't make investors rich. In fact, the company's market capitalization, equal to shares outstanding multiplied by the price per share, isn't affected by a stock split. If the number of shares increases, the share price will decrease by a proportional amount.

What are the disadvantages of a stock split?

Greater volatility: One drawback to stock splits is that they tend to increase volatility. Many new investors may buy into the company seeking a short-term bargain, or they may be looking for a well-paying stock dividend.

What does a 4 to 1 stock split mean?

If you owned 1 share of Example Company valued at $700 per share, your investment would have a total value of $700 (price per share x amount of shares held). At the time the company completed the 4-for-1 forward split, you would now own 4 shares valued at $175 per share, resulting in a total value invested of $700.

Is Tesla stock going to split again?

Today, as part of the release of its prospectus for its 2022 annual shareholder meeting, Tesla announced that it is going with a three-for-one stock split – meaning that if you own one Tesla share, you will get two more.

How long does a stock split last?

A company announcing a split usually sets an effective date of 10–30 days after the announcement. All shareholders who own the stock the trading day before the ex-date will take part in the split. The shares might take another few days to settle.

What happens if you buy a stock after the split record date?

The record date is when existing shareholders need to own the stock in order to be eligible to receive new shares created by a stock split. However, if you buy or sell shares between the record date and the effective date, the right to the new shares transfers.

What does a 20 to 1 stock split mean?

Using Amazon's 20-for-1 stock split as an example, existing shareholders will get 20 shares for each share they currently own. When a company divides each existing share into 20 new shares, that also means that each share is now worth one twentieth of the original value.

How many stock splits has Tesla had?

The company's only other stock split, a 5-to-1 split, took effect on Aug. 31, 2020. At that time, the stock was trading at a pre-split-adjusted price of about $2,213. The stock closed Aug.

Why do stocks split?

The primary motive of a stock split is to make shares seem more affordable to small investors.

Why Do Companies Engage in Stock Splits?

When a company's share price increases to levels that are too high, or are beyond the price levels of similar companies in their sector , they may decide to do a stock split. The reason for this is that a stock split can make shares seem more affordable to small investors (even though the underlying value of the company has not changed). This has the practical effect of increasing liquidity in the stock.

How Do Stock Splits Affect Short Sellers?

Stock splits do not affect short sellers in a material way. There are some changes that occur as the result of a split that can impact the short position. However, they don't affect the value of the short position. The biggest change that happens in the portfolio is the number of shares shorted and the price per share.

How many shares did Apple own before the stock split?

So, an investor who owned 1,000 shares of AAPL before the stock split had 7,000 shares after the stock split. Apple's outstanding shares increased from 861 million to 6 billion shares. However, the market capitalization of the company remained largely unchanged at $556 billion. The day after the stock split, the price had increased to a high of $95.05 to reflect the increased demand from the lower stock price. 2

What is reverse split?

Another version of a stock split is called a reverse split. This procedure is typically used by companies with low share prices that would like to increase their prices. A company may do this if they are afraid their shares are going to be delisted or as a way of gaining more respectability in the market. Many stock exchanges will delist stocks if they fall below a certain price per share.

What happens when you short a stock?

When an investor shorts a stock, they are borrowing the shares with the agreement that they will return them at some point in the future. For example, if an investor shorts 100 shares of XYZ Corp. at $25, they will be required to return 100 shares of XYZ to the lender at some point in the future. If the stock undergoes a two-for-one split before the shares are returned, it simply means that the number of shares in the market will double along with the number of shares that need to be returned.

How does a stock split affect the price of a stock?

A stock's price is also affected by a stock split. After a split, the stock price will be reduced ( because the number of shares outstanding has increased). In the example of a two-for-one split, the share price will be halved. Thus, although the number of outstanding shares increases and the price of each share changes, the company's market capitalization remains unchanged.

Why do you split a stock?

Splitting the stock also gives existing shareholders the feeling that they suddenly have more shares than they did before , and of course, if the price rises, they have more stock to trade. Another reason, and arguably a more logical one, is to increase a stock's liquidity.

Why do companies split their stock?

There are several reasons companies consider carrying out a stock split. The first reason is psychology. As the price of a stock gets higher and higher , some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable.

What Is a Stock Split?

A stock split is a corporate action by a company's board of directors that increases the number of outstanding shares. This is done by dividing each share into multiple ones—diminishing its stock price. A stock split, though, does nothing to the company's market capitalization. This figure remains the same, the same way a $100 bill's value doesn't change when it's exchanged for two $50s. So with a 2-for-1 stock split, each stockholder receives an additional share for each share held, but the value of each share is reduced by half. This means two shares now equal the original value of one share before the split.

What does a 1 for 10 split mean?

Companies can also implement a reverse stock split. A 1-for-10 split means that for every 10 shares you own, you get one share. Below, we illustrate exactly what effect a split has on the number of shares, share price, and the market cap of the company doing the split.

Do splits fall in line with financial theory?

None of these reasons or potential effects agree with financial theory. A finance professor will likely tell you that splits are totally irrelevant—yet companies still do it. Splits are a good demonstration of how corporate actions and investor behavior do not always fall in line with financial theory. This very fact has opened up a wide and relatively new area of financial study called behavioral finance .

Is buying before a split a good strategy?

Historically, buying before the split was a good strategy due to commissions weighted by the number of shares you bought. It was advantageous only because it saved you money on commissions. This isn't such an advantage today since most brokers offer a flat fee for commissions.

Does a stock split hurt investors?

While this may be true, a stock split simply has no effect on the fundamental value of the stock and poses no real advantage to investors. Despite this fact, investment newsletters normally take note of the often positive sentiment surrounding a stock split. There are entire publications devoted to tracking stocks that split and attempting to profit from the bullish nature of the splits. 2 Critics would say this strategy is by no means a time-tested one and is questionably successful at best.

Why do companies split their shares?

For example, when a company decides to split its shares in order to make shares more affordable , it can have a positive effect. This opens the stock to an entirely new subset of the investing public (namely, those who previously couldn't afford even a single share), which can cause a spike in demand that pushes the stock higher. If your broker allows you to trade fractional shares, this isn't a concern, but, for many investors, high-dollar stocks are inaccessible. Stock splits also can convey management's confidence in a stock price, which can trickle down to investors.

How to tell if a stock split is forward or reverse?

Simply put, if the first number is larger (as in "3-for-1"), it is a forward split. If the first number is the smaller of the two, it is a reverse split.

What is a forward stock split?

The most common type of stock split is a forward split, which means a company increases its share count by issuing new shares to existing investors. For example, a 3-for-1 forward split means that if you owned 10 shares of company XYZ before it split, you'd own 30 shares after the split took effect. However, the overall value of your investment wouldn't change (at least in theory). So a forward split results in more outstanding shares but a lower price for each share, with no net gain or loss in the company's overall market value.

What are reverse stock splits?

There's another type of stock split, known as a reverse split, that works in the opposite way. Shares owned by existing investors are replaced with a proportionally smaller number of shares.

What is a stock split ratio?

A stock split ratio tells you the number of new shares that will be created after a forward stock split, or by how much the share count will be divided in a reverse stock split. For example, a 3-for-1 stock split means that two shares will be created for every one currently in existence, for a total of three after the split.

What is the record date for stock?

The record date is when existing shareholders need to own the stock in order to be eligible to receive new shares created by a stock split. However, if you buy or sell shares between the record date and the effective date, the right to the new shares transfers.

What happens on the morning of a stock split?

On the morning of the effective date of a stock split, the increased number of shares will appear in your account, and the share price should be adjusted accordingly.

How long after a stock split can you sell?

Keep in mind that you may not sell your stock for several years after a split, so it doesn’t hurt to do a little research and figure out if your shares were sliced up at any point after the initial purchase. Of course, you’ll want to adjust your basis each and every time the stock was split.

Why do stocks split?

Typically, the underlying reason for a stock split is that the company’s share price is beginning to look expensive. Say, XYZ Bank was selling for $50 a share a couple of years ago but has risen to $100. Its investors, no doubt, are pretty happy.

Why do stocks split before dividends?

This is due to the fact that companies want to maintain the amount of dividends issued. The dividend payout ratio of a company reveals the percentage of net income or earnings paid out to shareholders in dividends.

What is short selling?

First, let’s look at short-selling, a strategy in which the investor is betting that the stock price will decline. Basically, the investor borrows shares through their brokerage account and agrees to replace them back at a later date. They immediately sell the stock on the secondary market, hoping that they’ll be able to buy the same number of shares at a lower price before the loan comes due.

What is short selling strategy?

First, let’s look at short-sellin g , a strategy in which the investor is betting that the stock price will decline. Basically, the investor borrows shares through his/her brokerage account and agrees to replace them back at a later date. She immediately sells the stock on the secondary market, hoping that s/he’ll be able to buy the same number of shares at a lower price before the loan comes due. (See " An Overview of Short Selling .")

What does it mean when a company splits its stock?

For investors in a company, it can be pretty exciting to hear that a stock you own is about to be split, as it indicates the company's value has outgrown its share price. While it doesn’t actually make your investment any more valuable in and of itself, new investors may be attracted to the new lower share prices and bid them up. However, sometimes that initial feeling of pride that a company split its stock is followed by one of confusion as investors wonder how the stock split affects things like outstanding market orders, dividend payouts, and even capital gains taxes .

What is a dividend in stock?

A dividend, or cash payment made periodically by a company, is impacted by a stock split depending on the dividend's date of record, or the date on which one must be a shareholder to receive a dividend.

What Is A Stock Split?

Common Stock Splits

- Stock splits can take many different forms. The most common stock splitsare 2-for-1, 3-for-2 and 3-for-1. An easy way to determine the new stock price is to divide the previous stock price by the split ratio. Using the example above, divide $40 by two and we get the new trading price of $20. If a stock does a 3-for-2 split, we'd do the same thing: 40/(3/2) = 40/1.5 = $26.67. Companies can a…

Reasons For Stock Splits

- There are several reasons companies consider carrying out a stock split. The first reason is psychology. As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, while small investorsmay feel it is unaffordable. Splitting the stock brings the share price down to a more attractive level. While the actual value of the stock doesn'…

Advantages For Investors

- There are plenty of arguments over whether stock splits help or hurt investors. One side says a stock split is a good buying indicator, signaling the company's share price is increasing and doing well. While this may be true, a stock split simply has no effect on the fundamental value of the stock and poses no real advantage to investors. Despite this fact, investment newsletters norma…

Factoring in Commissions

- Historically, buying before the split was a good strategy due to commissions weighted by the number of shares you bought. It was advantageous only because it saved you money on commissions. This isn't such an advantage today since most brokersoffer a flat fee for commissions. This means they charge the same amount whether you trade 10 or 1,000 shares.

The Bottom Line

- A stock split should not be the primary reason for buying a company's stock. While there are some psychological reasons why companies split their stock, it doesn't change any of the business fundamentals. Remember, the split has no effect on the company's worth as measured by its market cap. In the end, whether you have two $50 bills or single $100, you have the same amoun…

Stock Splits 101

Advanced Trading Strategies

- For most trading activity, the effect of a stock split is pretty straightforward. But naturally, investors with more complicated positions in the stock—for instance, if they’re short-selling it or trading options—may wonder how the split affects those trades. If this is you, take a deep breath. In both these cases, your trades are adjusted in a way that neutralizes the impact on your invest…

Cancelation of Stop Orders

- One area where stock splits can have an impact is a stop order. Such orders instruct the brokerto sell a stock if the price goes above or below a given level. Often, people use a stop order to protect against significant losses, especially in cases where they can’t, or don’t intend to, monitor the stock price regularly. Don’t assume your brokerage ...

Eligibility For Dividends

- One of the common questions that investors have after a stock split is whether their new shares are eligible for previously declared dividends. This usually isn’t the case, because companies splitting their stock are not increasing total dividend payments in doing so. Only shares held as of the dividend’s record datequalify for dividend payouts. As always, investors shouldn’t buy the sto…

Calculating Capital Gains

- Figuring out how much capital gains taxyou owe can be a pain as it is, and stock splits don’t make it any easier. Investors will have to adjust their cost basis—that is, the cost of the shares they own—to accurately calculate their profit or loss.3 If you owned XYZ Bank stock prior to its 2:1 split, your basis for each of those original shares is now $50, not $100. Otherwise, it may look lik…

New Stock Certificates?

- While you may have paper stock certificates for the original shares you purchased, don’t necessarily wait for new ones to appear in the mail following a stock split. More companies are now issuing new shares in book-entry form (i.e. electronically) rather than the old-fashioned way. To figure out how a particular company handles this, check the Investor Relationssection of its …

The Bottom Line

- In most cases, your brokerage will automatically adjust your trades to reflect the new price of a stock that has split. Still, investors should take extra care when reporting a post-split cost basis and be sure to re-submit any stop orders placed prior to the split.