| Service | Premium Stock-Picking Newsletters |

|---|---|

| Wealth Management Pricing | Index funds portfolios: 0.40% Stock portfolios: 0.95% (for stock portfolios) For accounts less than $1 million range |

| Customer Service Phone Number | (877) 629-2589 |

| Customer Service Hours | Mon-Fri, 9 AM to 5 PM (ET) |

Is the Motley Fool’s stock advisor service worth it?

Five years from now you’ll probably wish you’d started investing with Stock Advisor. Introductory offer for new members. 50% off list price for one year of unlimited access. Discounted offers ...

When is it best to use Stock Advisor?

If you are a Stock Advisor member, check out the below links to get started with your service. If you are not a member Stock Advisor, you can sign up for Stock Advisor here. Please ensure that you are logged into your account on Fool.com prior to clicking any of these links. Home - The location of Stock Advisor's latest updates, including the ...

What is the Motley Fool's Stock Advisor track record?

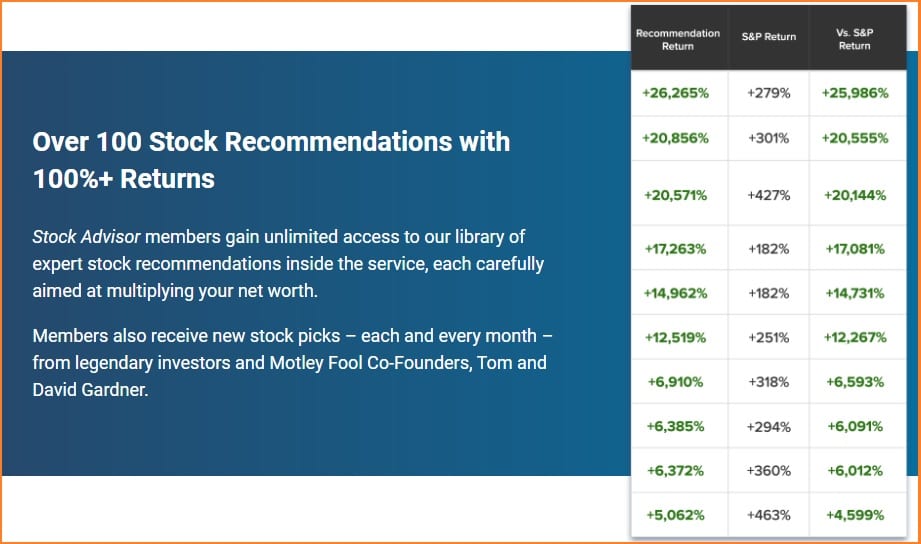

The Motley Fool Stock Advisor track record stretches back to 2002 when the stock picking service began. The average return of a Stock Advisor pick has been 575%, compared to 129% for the S&P 500. 90% of the Stock Advisor picks have produced positive returns, 62% have posted over 100% returns and 40% produced returns greater than 250%.

How long should I hold a stock on Stock Advisor?

Jul 10, 2021 · How Much Does the Motley Fool Stock Advisor Cost? If you look on their website, you can see that Motley Fool actually offers a few dozen different subscription packages. The annual subscription fees vary greatly, from $149/year to $1999/year, depending on the service.

Is the Motley Fool stock Advisor worth it?

What time does Motley Fool Rule Breakers release stock picks?

How often does Motley Fool Release stock picks?

What are Motley Fool stock Advisor picks?

Is Motley Fool a rip-off?

For the current promotional rate of $99/year, Stock Advisor is priced competitively compared to similar investor subscriptions, and a good number o...

Is Motley Fool Stock Advisor worth it?

If you want a fresh set of well-researched fundamental stock picks each month, Stock Advisor is worth it for $100-200/year. Their historical return...

What does Reddit think about Motley Fool's Everlasting Portfolio?

Reddit users have generally favorable opinions of Motley Fool's stock picks and their Everlasting Portfolio. One user using the service noted that...

Which stock advisor is the best?

Morningstar Premium is best for guidance building a well-rounded, diversified portfolio. Motley Fool's subscription service is better for those onl...

How long has Motley Fool been around?

The Motley Fool has become synonymous with stock picks. They’ve been around since 1993 and since 2002 they’ve run some of the most widely used stock picking services with over 700k paying subscribers.

What is the Motley Fool?

The Motley Fool has become synonymous with stock picks . They’ve been around since 1993 and since 2002 they’ve run some of the most widely used stock picking services with over 700k paying subscribers. The two most popular services they run are Stock Advisor and Rule Breakers which can help investors build out a market beating portfolio.

Who runs Rule Breakers?

David Gardner and his team of analysts run the Rule Breakers service, which offers everything that Stock Advisor does however the focus of the stock picks is different. While both services focus on high growth stocks, Rule Breakers has the singular focus of disruptive innovation companies.

What is Motley Fool Stock Advisor?

Founded in 1993 by brothers Tom and David Gardner, Motley Fool, or simply "The Fool," is an online platform offering financial and investing guidance.

How does Motley Fool Stock Advisor Work?

Motley Fool's business model works like any other stock newsletter subscription. Once you sign up for Stock Advisor, you instantly receive their two stock picks for that month, and for each month moving forward. You also get instant access to all of their previous recommendations as well.

Features

As we previously noted, the Stock Advisor subscription gets you Dave and Tom's top two stock picks each month and 10 timely new buys selected from over 300 stocks. Here's what else you get:

Motley Fool Stock Advisor

The Fool offers different packages as well. Review the prices and perks for these subscriptions to see which one fits your financial goals:

Motley Fool Stock Advisor Picks

Since the service's inception in 2002, The Fool advertises that an equal-weighted portfolio of its Stock Advisor picks returned a total of 551% vs. just 129% for the S&P 500 index.

How Much Does the Motley Fool Stock Advisor Cost?

If you look on their website, you can see that Motley Fool actually offers a few dozen different subscription packages.

Customer Service

Motley Fool is generally easy to reach and tries to do right by their customers, as evidenced by their 30-day money-back guarantee for anyone not happy with their stock picks.

What is the Motley Fool?

At its core, Motley Fool operates under the belief that individual investors can “beat the market” by investing in single stocks. To help investors achieve this goal, Motley Fool Stock Advisor is a premium newsletter that recommends two new stocks each month.

What makes Motley Fool different from most investing newsletters?

What makes Motley Fool different than most investing newsletters is its “buy and hold” mindset. Other newsletters advise using trailing stops to reduce downside risk. Stock Advisor will hold stocks through sharp corrections if the stock remains a good long-term investment.

How much has the S&P 500 returned in 2020?

Consumer staples. According to Motley Fool, the total performance of the Stock Advisor portfolio is 501% since launch. The S&P 500 has only returned 102% over the same period (as of October 27, 2020).

Why is investing important?

Investing is important to building wealth and saving for retirement. In addition to investing in index funds and target-date retirement funds, holding individual stocks can boost your investment performance. However, finding high-quality stocks to invest in can be time-consuming. Motley Fool can help you invest in individual stocks ...

When will the Motley Fool send out their stock picks for 2019?

If you subscribed to the Motley Fool Stock Advisor service, on January 2, 2019, you would have also received an email of their “Top Stock Picks For 2019.”. The Motley Fool created this list based on shares that made huge gains over the previous year AND also had the potential for BIG PROFITS in 2019.

How much is Motley Fool stock up in 2019?

In addition, their 2019 stock picks are up 111% ; their 2018 stock picks are up 208%; their 2017 stocks are up 188% and amazingly their 216 stock picks are up 373%. The Motley Fool has done so well because they have quickly identified stocks each year that will perform well in the current environment.

What is the average return on Motley Fool stock picks for 2020?

Motley Fool FACT: The average return of their 2020 stock picks is 93% as of July 3, 2021; their 2019 picks are up 130% and 2018 picks are up 232%. Their next pick comes out Thursday. New users can save 50% now and get their next 24 stock picks in real-time for only $99/year.

Is Netflix destroying traditional video stores?

Motley Fool Analysis: Netflix has led the charge on the destruction of traditional video stores and its DVD-by-mail rental service began a trend toward receiving goods at home instead of going out to stores to shop for them.

Who is the Motley Fool?

The Motley Fool was founded by David Gardner and Tom Gardner in 1993. Tom and David Gardner's most popular stock recommendation service is called “The Stock Advisor” and was launched in 2002. The Fool’s Stock Advisor service has only one purpose – to help YOU invest, better.

Who is the founder of Motley Fool?

The Motley Fool was founded by David Gardner and Tom Gardner in 1993. Tom and David Gardner 's most popular stock recommendation service is called “The Stock Advisor” and was launched in 2002.

When did Zoom go up in 2019?

They recommended ZOOM July 3, 2019 when it was at $90; then again on Oct 3, 2019 when it was at $76; again on March 19, 2020 when it was at $123 and finally again on April 16, 2020 when it was at $150. Now the stock is at $374. THAT is exactly how the Stock Advisor gets its incredible returns year after year.

Is Motley Fool a stock broker?

Motley Fool isn’t a trading platform or brokerage; they simply provide content (articles, videos, podcasts, etc.) to help you invest better. Let’s dig into the details of what you get with a Stock Advisor membership, including screenshots from inside the membership area.

What is a stock advisor?

Stock Advisor offers a ton of premium content on how to cultivate a winning mindset for the stock market. Their articles cover common topics such as when to buy and sell a stock, how to find profitable stock ideas, and more.

Who are the founders of Motley Fool?

The company was founded in 1993 by two brothers, Tom and David Gardner. Their mission is to “make the world smarter, happier, and richer.”. Motley Fool founders, Tom and David Gardner; Source Motley Fool. In this review, I’ll focus specifically on their flagship service, Stock Advisor.

Does the Motley Fool have a podcast?

In addition to written articles, educational videos, and live broadcasts, Motley Fool offers a range of podcasts: Motley Fool podcasts: Source: Motley Fool. These discuss general investing and finance, and are freely available to anyone. They’re not just for Stock Advisor subscribers.

What is the difference between Morningstar and Motley Fool?

While they have many differences, the biggest difference is that the Motley Fool’s Stock Advisor is a “list of ideas” service while Morningstar StockInvestor is a “model portfolio” service.

Is the Motley Fool a pump and dump company?

Pump and dump companies tend to be shady and rely on high-pressure sales tactics to get you to buy their unknown stocks. The Motley Fool doesn’t use any pump-and-dump practices and provides subscribers with complete transparency on their stock recommendations. Stock Advisor is not a pump-and- dump scheme.

1. Motley Fool Stock Advisor

Motley Fool Stock Advisor is the flagship premium subscription product from The Motley Fool. Priced at $99 per year for new subscribers and built around frequent investment newsletters with exclusive stock tips and recommendations, its highlights include:

2. Motley Fool Rule Breakers

Cut from the same cloth as Motley Fool Stock Advisor, Motley Fool Rule Breakers surfaces handpicked growth stocks that the Motley Fool team believes will dominate the markets of tomorrow — think Apple in 2005, Amazon in 2008, Netflix in 2011, Facebook in 2012.

3. Motley Fool Rule Breakers: Industry and Trend Packages

Not content with the same old Rule Breakers recommendations? Motley Fool offers a handful of higher-priced Rule Breakers stock picking services tailored to specific industries, trends, or investor strategies.

4. Motley Fool Options

Motley Fool Options is a beginner-friendly service for options traders. In the aggregate, its recommended options trades are profitable a staggering 85% of the time, although (as always) past performance is no guarantee of future results.

5. Everlasting Stocks

Everlasting Stocks is a newer stock picking service built to mimic the personal portfolio of Tom Gardner, The Motley Fool co-founder. Priced at $299 per year, it’s overseen by the same team behind the Motley Fool Stock Advisor service and touts the same eye-popping 4x returns over the S&P 500 since that service’s inception.

6. Everlasting Portfolio

Everlasting Portfolio is another Gardner-validated portfolio, albeit considerably more expensive at $2,999 per year than Everlasting Stocks. Backed by $15 million of The Motley Fool’s own money, the portfolio contains the only individual stocks Gardner himself owns (some of which also make an appearance in the Everlasting Stocks service).

7. Everlasting: Industry and Trend Packages

Like the Rule Breakers industry and trend packages, Tom Gardner’s Everlasting packages drill down on specific trends and opportunities for buy-and-hold investors in the 2020s and beyond.