What are the best stocks to invest during the inflation?

Jan 15, 2022 · While stocks, in general, fare better than bonds during periods of high inflation, our theme of Inflation Stocks includes companies from …

What sectors do well in inflation?

Apr 11, 2022 · Baker Hughes has the highest positive historical correlation to inflation of any stock Bank of America covers, and Baker Hughes' more than 50% year-to-date gain in 2022 suggests that correlation is...

Which assets do best during inflation?

Feb 23, 2021 · But there are sectors of the market where you can hide out, because they benefit from rising rates and inflation. Inflation Helping these 3 Stock Market Sectors In fact, two of the best-performing sectors since the March 2020 low have been Energy, up 98.5%, and Materials, up 95.5%. Both are cyclical sectors tied to natural resources.

Which stocks benefit from inflation?

Nov 12, 2021 · Viewed in this context, some of the top inflation-proof stocks to buy now include Apple Inc. (NASDAQ:AAPL), Adobe Inc. (NASDAQ:ADBE), and MercadoLibre, Inc. (NASDAQ:MELI), among others discussed ...

What is Incyte Corp?

Incyte Corp. ( INCY) Incyte is a biotechnology company that develops oncology therapeutics. Incyte shares are down 15% in the past year, but analyst Tazeen Ahmad says the pullback is a buying opportunity for long-term investors.

Where is Pioneer Natural Resources located?

Pioneer Natural Resources is a U.S. oil and gas producer focused primarily on the Permian Basin in Texas. Crude oil prices are up 155% in the past year, and inflationary pressures could drive them even higher in the near future.

Is Qualcomm a semiconductor?

Qualcomm is gaining semiconductor market share and expanding into areas such as radio frequency front end, automotive technology and I oT. In the most recent quarter, RF sales were up 39%, IoT sales were up 71% and automotive sales were up 40%.

What is a comparative assessment?

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies.

What does higher interest rate mean?

And higher interest rates (i.e. a higher discount rate) could mean lower stock market values. For stock investors who have grown accustomed to the market’s big gains over the past year, higher inflation is a wake-up call.

What is the Fed's easy money policy?

In fact, the Fed’s easy money policies in recent years, and especially since the pandemic, have been geared toward two things: Keeping interest rates lower for longer to stimulate the economy and …. Producing MORE inflation. The Fed is on record saying that they want inflation above 2%.

When will the bond market rally?

In general terms, the bond market will rally when increases in the Consumer Price Index (inflation) are small and the bond market will fall when increases in the CPI are large. The equity markets generally follow the same trend as the bond market when responding to CPI numbers. In other words, the equity market will (generally) ...

Is real estate a hedge against inflation?

The Real Estate sector is often a hedge against inflation too. Consider the largest component of the sector – Real Estate Investment Trusts. REITs own and operate income-producing real estate, and property prices and rental income tend to rise when inflation rises.

Is utilities considered defensive?

Utilities are generally considered defensive as we all still need them (think electricity, heat, gas, etc.) no matter the inflationary environment. And since energy companies pass any higher costs onto us, they are able to maintain their profitability.

Is cash the worst asset class?

Generally speaking, financial advisors would suggest that cash is one of the worst asset classes to hold during rising inflationary periods. And in theory, there are some sectors that generally perform better than others if inflation rises.

Which sector has the highest correlation?

Banks have the most interest income of any sector, so they have the highest correlation. 2. Diversified financials. This extends to companies like stock brokerages, payment processors, BDCs, and anyone who holds cash that they can earn interest on as part of their business model.

What are some examples of supply shocks?

The most commonly cited example of this is the oil shocks of the 1970s and the ensuing recessions. Economists refer to this kind of event as a " supply shock, " and the resulting inflation as "cost-push inflation.". Together, they can create stagflation, which is extremely expensive and difficult to get rid of once it begins.

What are some examples of recessions?

Examples of this include 2008 and the Great Depression of the 1930s. However, a drop in the American public's standard of living can also come when aggregate supply shrinks.

What are the three types of economic policies?

There are three kinds of economic policy, left, right, and stupid . The trick for a well-run democracy is to pick economic policies from the first two categories and avoid the third. Now let's say the government decides this is a crisis and hands out stimulus vouchers for consumers to purchase cars.

Does printing money create wealth?

Printing money doesn't create wealth , so the consequence of $5 trillion+ in stimulus and a continued lack of macroeconomic understanding could well be $4 gas, coast to coast. LIFO accounting also provides a big tax boost for oil companies in inflation. Rates have little effect on the energy sector. 2. Banks.

Why are discretionary stocks a bump?

Consumer discretionary stocks also can see a bump because improving employment, coupled with a healthier housing market, makes consumers more likely to splurge on purchases outside of the realm of consumer staples (food, beverages, and hygiene goods).

Why is the Federal Reserve important?

The Federal Reserve is an important driver for rates, as Fed officials often lower rates when economic growth slows and then raise rates to cool the economy when inflation becomes a concern. 1. Increasing rates require careful attention when crafting an investment portfolio.

Who is Andrew Bloomenthal?

Andrew Bloomenthal has 20+ years of editorial experience as a financial journalist and as a financial services marketing writer . Interest rates rise and fall as the economy moves through periods of growth and stagnation.

Referenced Symbols

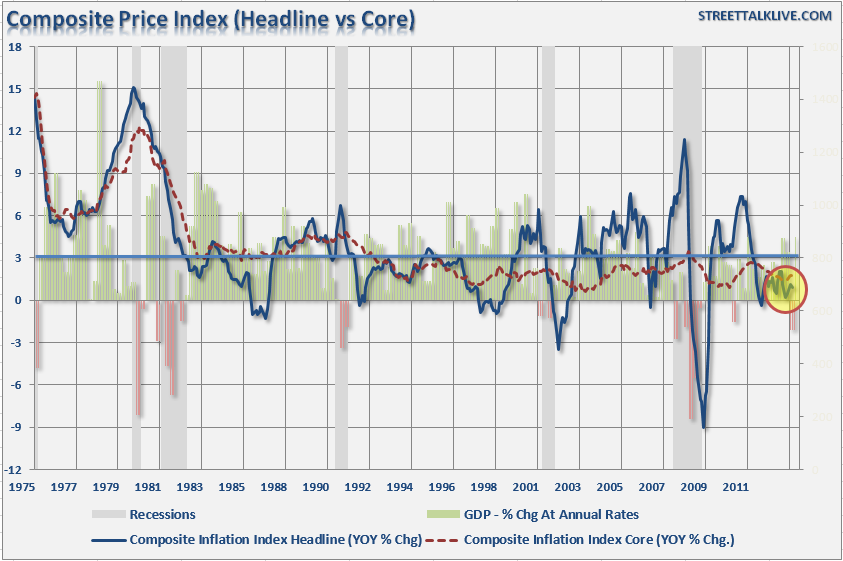

Some economists and investors are convinced that after numerous false starts, inflation is finally ready for a resurgence. But a look at how individual sectors and groups perform when inflation expectations begin to rise offers up a surprise or two.

About the Author

William Watts is MarketWatch’s senior markets writer. Based in New York, Watts writes about stocks, bonds, currencies and commodities, including oil. He also writes about global macro issues and trading strategies. Before moving to New York, he reported for MarketWatch from Frankfurt, London and Washington, D.C.