9 High-Yield Dividend Stocks that Pay Monthly

- 1 - Realty Income (NYSE:O). Realty Income (NYSE: O) - Current dividend yield: 3.93% - The first of the REIT’s that...

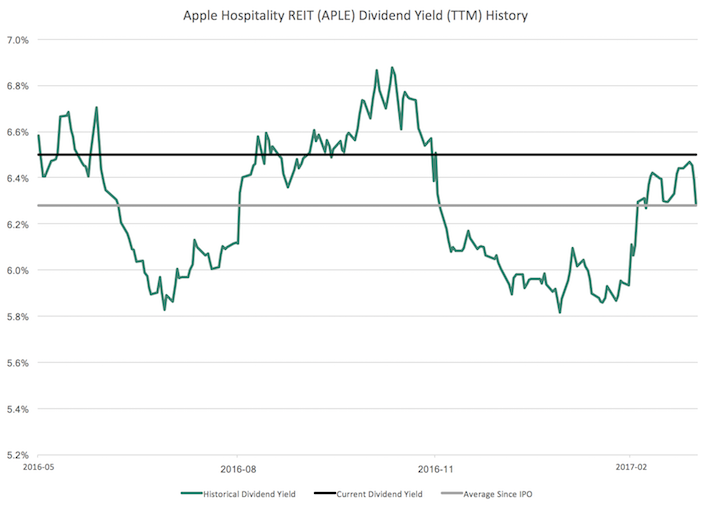

- 2 - Apple Hospitality REIT (NYSE:APLE). Apple Hospitality REIT (NYSE: APLE) - Current dividend yield: 7.33% - Another...

- 3 - Global Net Lease (NYSE:GNL). Global Net Lease (NYSE: GNL) - Current dividend...

- Agree Realty Corporation (NYSE:ADC) Number of Hedge Fund Holders: 21. Dividend Yield as of June 7: 4.00% ...

- STAG Industrial, Inc. (NYSE:STAG) ...

- Realty Income Corporation (NYSE:O) Number of Hedge Fund Holders: 22. ...

- LTC Properties, Inc. (NYSE:LTC) ...

- SL Green Realty Corp. (NYSE:SLG)

Which companies pay the highest dividend?

Which Company Has High Dividend? As of December 29, Valero Energy Corporation (NYSE:VLO) dividend yield was 5.46%…. The health of Cardinal Health Inc. (NYSE:CAH) was under scrutiny. In terms of earnings, Prudential Financial (PRU) topped the list with…. NYSE:LYB’s dividend yield stands at 4.93% as of December 29, 2011….

What are 10 of the most popular dividend stocks?

Top Dividend Stocks To Watch This Week

- Top Dividend Stocks To Consider Investing In Right Now

- Intel. Intel is an industry-leading semiconductor company that continues to create life-changing technologies.

- Apple. When it comes to top dividend stocks to buy, Apple would not be the first name to come to mind for many investors.

- Coca-Cola. ...

- Procter & Gamble. ...

What stocks have the highest dividends?

No. 1: BlackRock Inc. (NYSE: BLK) -- $2.88 per quarter. Vanguard may be the biggest money-manager of index funds, but BlackRock holds the crown as the biggest money-manager of exchange-traded ...

What are some good dividend paying stocks?

Key Points

- Western Union Yes, Western Union ( NYSE:WU) is still around, though it's well removed from its telecom roots established way back in the 1800s. ...

- Duke Energy Duke Energy ( NYSE:DUK) hasn't exactly been tossed aside like Western Union; shares of the utility giant have priced right around where they were trading in the ...

- New York Community Bancorp

What stock pays the highest monthly dividend?

Table Of ContentsHigh-Yield Monthly Dividend Stock #4: Ellington Residential Mortgage REIT (EARN)High-Yield Monthly Dividend Stock #3: AGNC Investment Corporation (AGNC)High-Yield Monthly Dividend Stock #2: ARMOUR Residential REIT (ARR)High-Yield Monthly Dividend Stock #1: Orchid Island Capital (ORC)More items...•

Do dividend stocks pay out monthly?

In the United States, companies usually pay dividends quarterly, though some pay monthly or semiannually. A company's board of directors must approve each dividend. The company will then announce when the dividend will be paid, the amount of the dividend, and the ex-dividend date.

How can I get 5000 a month on dividends?

How To Make $5,000 A Month In DividendsDevelop a long term perspective.Determine how much you can allocate for investment.Select dividend stocks that are consistent with your strategy.Invest in your selected dividend stocks regularly.Keep investment costs and trading to a minimum.Reinvest all dividends received.More items...

Which dividend stocks kinda pay monthly dividends?

7 monthly dividend stocks with high yields:AGNC Investment Corp. (AGNC)Prospect Capital Corp. (PSEC)Main Street Capital Corp. (MAIN)LTC Properties Inc. (LTC)Broadmark Realty Capital Inc. (BRMK)Ellington Financial Inc. (EFC)Gladstone Commercial Corp. (GOOD)

How do I make $100 a month in dividends?

How To Make $100 A Month In Dividends: A 5 Step PlanChoose a desired dividend yield target.Determine the amount of investment required.Select dividend stocks to fill out your dividend income portfolio.Invest in your dividend income portfolio regularly.Reinvest all dividends received.

Where should I invest my monthly income?

Some investments that can provide a monthly income include property, stocks, bonds, funds, peer-to-peer lending, and cash. Make sure you research any investments you intend to make before you buy.

How much do I need to invest to get 2000 a month in dividends?

In order to make $2000 a month in dividends, you'll need to invest approximately $960,000 in dividend stocks. The exact amount will depend on the dividend yields for the stocks you buy for your portfolio. Take a closer look at your budget and decide how much money you can set aside each month to grow your portfolio.

Can you live off stock dividends?

Over time, the cash flow generated by those dividend payments can supplement your Social Security and pension income. Perhaps, it can even provide all the money you need to maintain your preretirement lifestyle. It is possible to live off dividends if you do a little planning.

Can you live off dividends of 1 million dollars?

The average person would need to build a portfolio of at least $1 million to fully cover living expenses with dividend income. A portfolio of $2 million would produce an amount that provides a comfortable lifestyle for most people.

How much money do I need to invest to make $1000 a month?

Assuming a deduction rate of 5%, savings of $240,000 would be required to pull out $1,000 per month: $240,000 savings x 5% = $12,000 per year or $1,000 per month.

How can I earn 2000 a month in dividends?

How To Make $2,000 A Month In Dividends: A 5 Step PlanChoose a desired dividend yield target.Determine the amount of investment required.Select dividend stocks to fill out your dividend income portfolio.Invest in your dividend income portfolio regularly.Reinvest all dividends received.

How much do I need to invest to make 1000 a month in dividends?

How much money do you need to invest to make $1000 a month in dividends? To make $1000 a month in dividends you need to invest between $342,857 and $480,000, with an average portfolio of $400,000.

What are dividend stocks?

Dividend stocks are regular distributions of the company's earnings to its shareholders. These companies are usually well-established, typically pu...

What is the dividend yield, and why is it important?

A dividend yield is how much a company pays out in dividends annually divided by its stock price. For example, if a stock trades at $40 and a compa...

How to evaluate dividend stocks?

Firstly, avoid buying stocks based solely on dividend yield and use the payout ratios to gauge a dividend's sustainability. Next, study the balance...

What benefits does dividend investing present?

One of the primary benefits of dividend investing is the potential for double profits. On top of the potential price appreciation, shareholders als...

What does a high payout ratio mean?

A very high payout ratio could indicate that a company’s dividend is in danger of being reduced or eliminated completely. For readers unfamiliar with Microsoft Excel, this section will show you how to list the stocks in the spreadsheet in order of decreasing payout ratio.

Is it better to combine dividend stocks with a dividend reinvestment plan?

It is more feasible to combine monthly dividend stocks with a dividend reinvestment plan to dollar cost average into your favorite dividend stocks. The last benefit of monthly dividend stocks is that they allow investors to have – on average – more cash on hand to make opportunistic purchases.

Is Transalta a dividend stock?

TransAlta earns a place on the list of top monthly dividend stocks, not just because of its high yield, but also because of its future growth potential. TransAlta stands on the forefront of a major growth theme–renewable energy. TransAlta Renewables reported its first quarter results on May 12th.

A closer look at the top monthly income stocks for yield-focused investors

Matthew is a senior energy and materials specialist with The Motley Fool. He graduated from Liberty University with a degree in Biblical Studies and a Masters of Business Administration. You can follow him on Twitter for the latest news and analysis of the energy and materials industries: Follow @matthewdilallo

Top monthly dividend stocks for 2022

Nearly 50 stocks paid a monthly dividend in early 2022. However, not all of them are worth an investor's consideration. Many didn't offer an above-average dividend yield. Meanwhile, others seemed to be at a higher risk of reducing their dividends if market conditions deteriorate. That narrows the options considerably.

Agree Realty

Agree Realty is a real estate investment trust (REIT). These companies often make for good monthly dividend stocks because they generate recurring rental income.

EPR Properties

EPR Properties is another REIT. It specializes in owning experiential real estate such as movie theaters, eat-and-play venues, ski resorts, and gaming facilities. It secures these properties by signing triple-net leases with the venue operators.

Gladstone Commercial Corporation

Gladstone Commercial is a diversified REIT. It focuses on owning net-leased office and industrial properties in the U.S. -- each represents 48% of its portfolio -- along with some retail and medical office buildings. This REIT also concentrates on secondary markets because they offer higher investment yields.

LTC Properties

LTC Properties is a healthcare REIT. It primarily invests in senior housing and skilled nursing properties secured by triple-net leases, mortgage loans, and other cash-generating investment structures. This strategy provides the REIT with relatively steady income to support its monthly dividend.

Pembina Pipeline

Pembina Pipeline is a Canadian energy infrastructure company. It operates pipelines, processing plants, storage terminals, and export facilities. The company primarily leases the capacity to utilize its assets to other energy companies under long-term, fixed-rate contracts. These agreements enable Pembina to generate steady cash flow.

1. Sabine Royalty Trust (NYSE: SBR)

Sabine Royalty Trust holds royalty and mineral interests in oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma and Texas. The trust was established in 1982 between Sabine Corp, a Texas-based oil and natural gas company, and InterFirst Bank in Dallas, Texas. Simmons Bank is the trustee.

2. Invesco High Income Trust II (NYSE: VLT)

Invesco High Income Trust II seeks to provide high income through its diversified holdings of income-producing, fixed-income securities. The trust invests in a range of sectors, including:

3. Putnam Premier Income Trust (NYSE: PPT)

Putnam Premier Income Trust seeks high current income by investing in a wide range of fixed-income securities, including US government, high-yield and international fixed-income securities. Putnam Investments is an investment management firm founded in 1937 and headquartered in Boston, Massachusetts.

4. BlackRock Income Trust (NYSE: BKT)

New York City-based BlackRock Income Trust seeks the preservation of capital and high monthly income by investing primarily in mortgage-backed securities.

5. Pembina Pipeline (NYSE: PBA)

Pembina Pipeline is a Canadian energy and midstream service provider that transports hydrocarbon liquids and natural gas through its system of owned pipelines. The company also owns gas-gathering and -processing facilities plus an oil and natural gas liquids infrastructure business.

6. Gladstone Investment (Nasdaq: GAIN)

Gladstone Investment is a business development company and private equity fund that makes debt and equity investments in established US-based private businesses. Debt investments include senior term loans, senior subordinated loans and junior subordinated loans.

7. Realty Income (NYSE: O)

Realty Income is a San Diego, California-based real estate investment trust that seeks to provide investors with dependable monthly income through its investments in commercial real estate properties. Its portfolio comprises over 7,000 commercial properties owned under long-term leases.