How to buy and sell stock using cash app?

Cash App is the simplest way to start investing in your favorite companies. ... Investing is often done through stocks, sometimes called “shares.” Stocks are just small pieces of a business …

How to buy stocks on Cash App right now?

Aug 05, 2021 · Apple Inc. (NASDAQ: AAPL) is ranked sixth on the list of 10 best cash app stocks to invest in, with Apple Pay being accepted as a digital payment option at 90% of retail outlets …

How to make money off Cash App stocks?

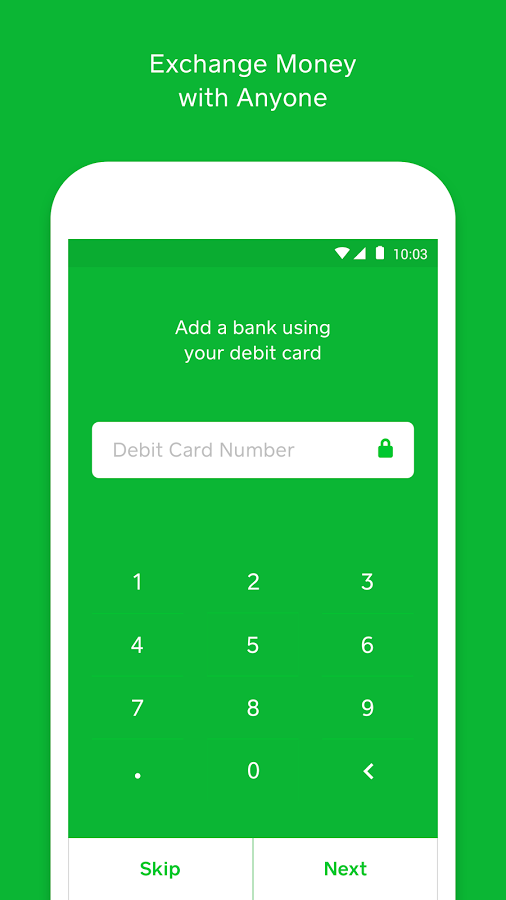

To buy stock using Cash App Investing: Go to the Investing tab on your Cash App home screen. Enter a company name or ticker symbol in the search bar. Select the company stock you want …

Is Cash App safe to invest in stocks?

Apr 07, 2022 · As one of the world’s most popular fintech applications, Cash App boasts a user base of more than 30 million active monthly users, according to Business of Apps. While the …

What type of stock is Cash App?

Does Cash App have stock?

Is Cash App a good way to invest?

What happens when you buy a stock on Cash App?

Start with stocks

Break into bitcoin

With just $1, you can buy what's known as fractional shares, or smaller pieces of stocks comission-free. Choose from a broad range of stocks and funds.

Common questions

Try out bitcoin or add to an existing trove. Buy and sell, send some to friends and family, or transfer your funds to another digital wallet on the blockchain.

What is cash app investing?

Want to know more about how investing works? We’ve answered some common questions to help you get you started.

How to invest in cash app?

Cash App Investing is designed for beginning investors who want to dip their toes into the stock market by investing small amounts of money in blue-chip (high-quality) stocks. It isn't well-suited for investors who like to analyze stocks on their own, as it doesn't have access to third-party stock research.

Does Cash App have mutual funds?

This brokerage is right for you if: 1 You're a beginning investor. Cash App Investing is clearly designed with beginning investors in mind, particularly those who want to invest a small amount of money in stocks. It is not intended for experienced investors, or those who want tons of features. 2 You already use Cash App. It can be very useful to keep your finances in as few different places as possible, and if you're already a fan of Cash App's other functions, it could be a good reason to invest through Cash App Investing rather than Robinhood or a competing brokerage. 3 You don't care about options, margin, or mutual funds. Cash App Investing allows you to trade stocks. That's all. If you want any other type of investment vehicle (besides bitcoin), you should look elsewhere. 4 You want a standard brokerage account. If you need to open an IRA or any investment account other than a standard taxable brokerage account, or if you want a joint account, you'll need to open it somewhere else.

Does Cash App support margin trading?

Cash App Investing allows investors to buy and sell stocks (and bitcoin, elsewhere in the Cash App), but does not support mutual funds, stock options, or bonds. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs.

Does the Ascent cover all offers?

However, there are some cases where it can make sense, and many active investors like having margin access. At this point, Cash App Investing doesn't support margin trading.

Where is Matt from Ascent?

The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.