What is the formula for forecasting long-term stock returns?

To that must be added the effect of inflation. The formula for forecasting long-term stock returns is therefore: 1) current dividend yield plus 2) expected real earnings growth plus 3) expected inflation. Per the history, stated Buffett, investors should expect an annualized 2% in real earnings growth and 3% for inflation.

Are returns on US stocks predictable over the long run?

Returns for U.S. stocks have been erratic in the short run, but they are reasonably foreseeable over the long haul. By “long haul” I mean several decades. True, many investors will not survive that horizon, but nevertheless the knowledge that equities perform predictably over prolonged time is useful.

What is the average return on investment in the US?

A survey by Natixis found that the average American investor believes they need to achieve an 8.9% annual return, after inflation, in order to meet their investment goals. Americans are slightly less optimistic about future investment returns than investors globally, which expected a 9.9% return on their investments.

How does the stock market measure returns?

Stock returns consist of dividend receipts plus price changes. Dividend yield is apparent. The amount of price change is trickier to determine, but ultimately the stock market reflects reality, by tracking the growth in real corporate earnings. To that must be added the effect of inflation.

What stock market return should I expect?

The historical average stock market return is 10% Keep in mind: The market's long-term average of 10% is only the “headline” rate: That rate is reduced by inflation. Currently, investors can expect to lose purchasing power of 2% to 3% every year due to inflation.

What is a good stock return for 2020?

According to the company's data, the compounded annual gain in the S&P 500 between 1965 and 2021 was 10.5%. While that sounds like a good overall return, not every year has been the same....The S&P 500's return can fluctuate widely year to year.YearS&P 500 annual return201931.5%202018.4%202128.77 more rows•May 26, 2022

What is expected return of the market 2022?

On December 31st, 2021, the consensus estimates, according to Factset, for 2021, 2022 and 2023 were $204.95, $223.46 and $245.01. As of February 10, 2022, they are $207.79, $224.89, and $247.53. There is no assurance that a Portfolio will achieve its investment objective.

How do you forecast stock market returns?

Bogle's model is pretty simple: Expected returns (nominal, annualized over the next 10 years) = Starting Dividend Yield + Earnings Growth rate + Percentage change (annualized) in the P/E multiple. Not bad! A simple three-factor model to predict stock returns.

What is a good rate of return on investments in 2021?

Expectations for return from the stock market Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market.

What should my portfolio look like at 55?

The point is that you should remain diversified in both stocks and bonds, but in an age-appropriate manner. A conservative portfolio, for example, might consist of 70% to 75% bonds, 15% to 20% stocks, and 5% to 15% in cash or cash equivalents, such as a money-market fund.

Is now a good time to invest 2022?

Reasons to Feel Cautious About the Stock Market in 2022: Rising interest rates – In an effort to fight inflation, the Federal Reserve started raising interest rates in early 2022—and there could be more rate hikes on the way soon. While this could slow down inflation, it could also trigger another U.S. recession.

Will the stock market Crash 2022?

Stocks in 2022 are off to a terrible start, with the S&P 500 down close to 20% since the start of the year as of May 23. Investors in Big Tech are growing more concerned about the economic growth outlook and are pulling back from risky parts of the market that are sensitive to inflation and rising interest rates.

Will 2022 be a down year for stocks?

How bad will things get? Capital Economics' end-2022 and end-2023 projections are extremely grim to say the least. They project a peak-to-trough decline of "about a third in the S&P 500" by the time next year is over. While their end-2022 target is 3,600 for the S&P 500, their end-2023 target slumps down to 3,200.

What is the most accurate stock predictor?

The MACD is the best way to predict the movement of a stock.

What is the simplest way to forecast returns?

Long-term returns are relatively easy to forecast. Short-term returns are dominated by randomness, but long-term forecasts for most asset classes can, in part, be derived mathematically (give or take some arguing about the assumptions)....The “Relatively” Easy Way to Forecast Long-Term Returns.Asset ClassAverage Forecast (per annum)Private equity8%–9%7 more rows•Oct 20, 2015

How accurate are stock forecasts?

Expect 1 to 3 inches but if the center of the low-pressure system passes further south, then we might only get flurries. People who make financial forecasts tend to sound extremely confident. But meteorologists tend to sound uncertain, even wishy-washy, about their own forecasts.

Why should investors receive a higher rate of return?

What was the average return on stocks in 1926?

On average, investors should receive a higher rate of return for bearing greater risk. While risk is a tricky concept to measure, the variability of returns (or their standard deviation) is often used as a reasonable proxy for what we normally consider risk to represent.

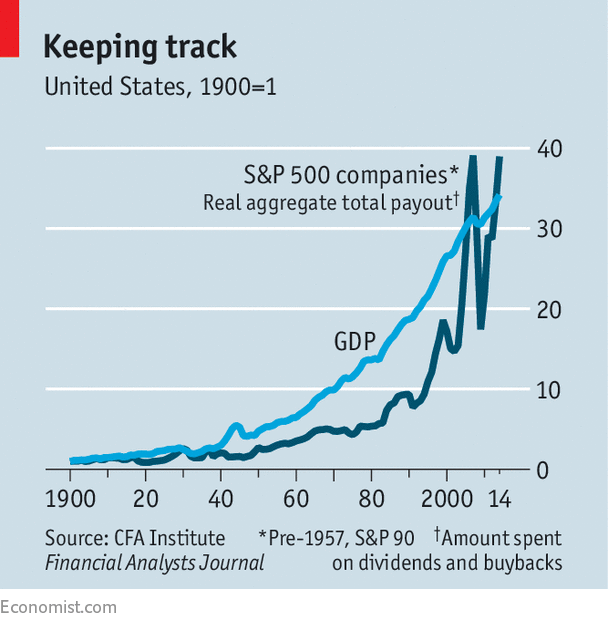

How much of the variability in future market returns can be predicted as the basis of the initial dividend yield of the market as

From 1926 to the present, for example, common stocks provided an average annual rate of return of about 10%. The dividend yield for the market as a whole on January 1, 1926, was about 5%. The long-run rate of growth of earnings and dividends was also about 5%.

Why can't we project historical returns into the future?

Two academic studies—one by Eugene Fama and Kenneth French and the other by Robert Shiller—concluded that as much as 40% of the variability in future market returns can be predicted as the basis of the initial dividend yield of the market as a whole.

What is the third method of projecting stock returns?

But we cannot simply project historical returns into the future because the returns on safe assets have fallen dramatically. U.S Treasury bills are usually considered the risk-free asset in models of risk and return. Today the Treasury bill yield is about 0.25%. If we add 6.5 percentage points to that yield ...

Do investors have higher total rates of return from the stock market?

There is a third method to project stock returns that is widely used both by Wall Street security analysts and financial economists. It uses net present value analyses to determine the implicit rate of return given by the current level of share prices.

Is future equity return modest?

In general, the exhibit shows that investors have earned higher total rates of return from the stock market when the initial dividend yield of the market portfolio was relatively high, and relatively low future rates of return when stocks were purchased at low dividend yields.

What is Dave Ramsey's projection of future returns?

While none should be considered even close to precise, all of them suggest similar outlooks at the present time. Future equity returns are very likely to be modest and well below the returns that have been achieved over the past century.

Can you predict the future?

Dave Ramsey has one of the most optimistic projections for future returns. He has been stating for years that investors should expect a 12% return on their stock investments. It’s part of Dave Ramsey’s Financial Peace University course that has been taken by millions. Dave argues that his 12% projection of future investment returns is based on ...

Is real return better than nominal return?

Of course, no one can predict the future. Investment returns could be really good, average, or really bad in the future. You should plan your retirement savings using conservative projections to ensure that you’ll be able to meet your retirement goals even if the market has returns lower than the historical average.

Did investors take inflation into their return estimates?

Real returns is a better metric than nominal returns in retirement planning. If you use nominal returns, then you have to adjust your projected spending in retirement by the inflation rate.

The Biggest Misconception About Investing

It’s unclear whether investors did not take into account inflation into their return estimates. Regardless, it is promising that financial advisors, at least when responding to a survey, appearing to be using historical data to guide their estimates of the future returns they can deliver to their clients.

But Things Are Crazy Now

The biggest misconception about successful investing is that you have to know what will happen in the future. Sure, a crystal ball would be great, but nobody has one. Study after study has shown that expert stock market predictions are worthless.

What To Do Instead

But surely you say a bear market must be looming because the stock market, private equity, and venture capital have been on a tear, valuations are high, and most investors seem gripped in a speculative frenzy? Those things are true, but a bear market is not guaranteed in 2022 because the market is expensive in 2021.

Wall Street Analyst Stock Predictions Have Built-in Biases

Accepting that we can’t know what the market will do next year with any specificity is key to successful investing. Instead of relying on flawed predictions, enter 2022 fully confident that nobody knows what will happen. Don’t try to time the market by cashing out, but don’t follow the crowd and pile into the investment trend of the day either.

So Why Do We Use Analyst Stock Forecasts at All?

Sell-side analysts have a strong bias towards giving a "buy" recommendation.

Don't Use Stock Market Predictions for Anything Other Than Entertainment

We incorporate analyst forecasts as a data point to help you make better long-term investment decisions, but they should be taken with a grain of salt.

So If You Can't Trust Stock Market Forecasts, What Should You Do?

The financial media likes to obsess about the stock market's future. They provide minute by minute coverage of every fluctuation in the markets like it's a competitive sport.

1. Buy and Hold in Companies With a Durable Competitive Advantages

Instead of listening to the financial media's prognostications, we should listen to what successful investors themselves have to do and say.

2. Don't Try to Time the Market

Successful investors like Warren Buffett suggest that investors should focus on long-term fundamentals of companies, rather than the day to day fluctuations of the market.

3. Diversify Your Portfolio Into Uncorrelated Investments

Instead of monitoring the price of stocks, Warren Buffett suggests that you should be focused on a company's fundamentals.