What is the average market cap of small-cap stocks?

This was followed by the Dow Jones U.S. Small-Cap Total Stock Market Index with a median market cap of $899 million and a maximum market cap of $16.3 billion. The S&P SmallCap 600 Index was not far behind with a median market cap of $752 million and a maximum market cap of $4.42 billion.

Do small-cap stocks outperform large-cap stocks in the long term?

The conventional thinking is that small-cap stocks outperform large-cap stocks in the long term (periods of 10 years or more). This assumption suggests that a total stock market index fund would outperform an S&P 500 index fund over time. Compare the performance of some historical returns of a total stock market and S&P 500 indexes: 3 4

What is the difference between large cap and mid cap stocks?

The Russell Midcap Index consists of the smallest 800 stocks in the Russell 1000 Index, which is made up of the 1,000 largest U.S. stocks. A large cap stock is a company with a market capitalization greater than $10 billion.

What is a micro cap stock?

The term micro cap stock generally refers to the stock of public companies in the United States which have a market capitalization of less than $300 million. These companies are generally too small for most large institutional investors to invest in, such as the large mutual funds or large hedge funds.

How much of total stock market is small and mid-cap?

From 2000 through 2018, small-cap value 11.2%, TMI 5.2%. For the 91 years 1928 through 2018, small-cap value 13.1%, TMI 9.5%.

What percentage of US stock market is mid-cap?

approximately 24%Mid-cap stocks represent approximately 24% of the market capitalization of the U.S. equity market. However, investors are significantly underweight the group with only 11% exposure.

How big is the small-cap market?

about $300 million to $2 billionA small-cap is a public company whose total market value, or market capitalization, is about $300 million to $2 billion.

What percent of the stock market is large-cap?

87.60%Summary of the U.S. Stock MarketCategoryStock Count%Large cap76387.60%Mid cap1,0738.92%Small cap1,8372.84%Micro cap3,9790.64%2 more rows•Feb 21, 2019

What percent of S&P 500 is large-cap?

The S&P 500 index consists of most but not all of the largest companies in the United States. The S&P market cap is 70 to 80% of the total US stock market capitalization....Components of the S&P 500.CompanyMicrosoft CorporationSymbolMSFTWeight5.921424Price247.50Chg2.5366 more columns

How big is the total stock market?

The total market capitalization of the Wilshire 5000 Total Market Index is roughly $51.7 trillion.

Do small caps outperform the S&P 500?

Individual small-cap stocks offer higher growth potential, and small-cap value index funds outperform the S&P 500 in the long run. Small caps also experience higher volatility, and individual small companies are more likely to go bankrupt than large firms.

How many stocks are in large-cap?

According to SEBI's rules, all companies that are listed on the stock exchanges are ranked based on their market cap. The top 100 companies are categorised as large cap companies.

How many US small-cap stocks are there?

Investors define them in different ways, but small caps are most commonly defined as stocks with a market cap (the total value of shares held by all shareholders, including company insiders) between $300 million and $2 billion. In December 2021, there were 1,989 small-cap stocks using this definition.

Does small-cap outperform large-cap?

Small-cap stocks have historically outperformed their larger counterparts, but investment into this asset class should be approached with caution and suitable risk tolerance. They tend to offer higher returns in exchange for higher investment risk.

How much of the total US stock market is S&P 500?

75%Stocks in the S&P 500 make up about 75% of the total U.S. equity market, so the overlap is considerable. That said, the roughly 25% of the market that is found only in the total stock market index fund does provide greater diversification because of the presence of smaller stocks.

Is the Dow Jones all large-cap?

While both market indexes have the same aims, the DJIA and S&P 500 are different from each other in size and calculation methods. Critics of the Dow believe it poorly represents the U.S. market as it only contains 30 large-cap companies and is not weighted by market cap.

What percentage of total stock market is small cap?

Even though different stock trading companies provide different cut offs between what constitutes a small and large-cap company, the large-gap comp...

What percentage of the total market is the S&P 500?

The S&P 500 encompass roughly 80% of the total U.S. stock market.

How many stocks are in the S&P Total Market Index Fund?

The CRSP U.S. Total Market fund consists of a little over 3,550 stocks- much higher than the 505 stocks covered by the S&P 500.

Which S&P 500 ETF is best?

Finding the best ETF for you will be dependent on your relevant capital, experience and stock market portfolio. Laying out a definite ‘best’, there...

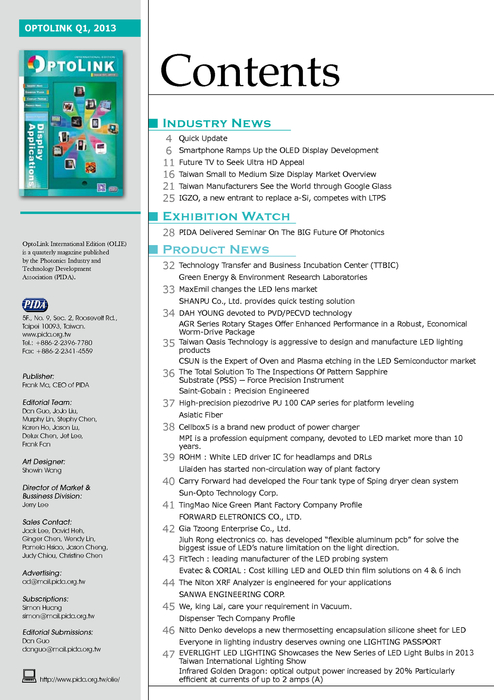

Total stock market index

This table provides Total Stock Market Index Funds from four different providers. The objective is to approximate these Morningstar style boxes using available funds chosen from the two-fund and three-fund tables below.

Approximating total stock with two funds

These examples match the composition of the total US stock market using two funds.

Approximating total stock with three funds

These examples match the composition of the total US stock market using three funds.

Table notes

The style box numbers were computed by Morningstar Instant XRay by entering each fund ticker as a holding, and entering the dollar value based on the percentage; for example, for VFIAX at 81% and VEXAX at 19%, enter $81 and $19 respectively and observe the computed Morningstar Style Box on the Instant X-Ray tab.

Stock market classifications

Style boxes use the following format. Numbers shown are percentages. Because values are rounded, the percentages may not total exactly 100%.

How many small cap stocks are there in the Russell 2000?

The Russell 2000 Index is the most widely known small-cap stock market index. So are there 2,000 small-cap stocks? Not necessarily. The Russell 2000 includes the 2,000 smallest stocks in the broader Russell 3000 Index, but its holdings actually don't have to be small-cap stocks.

What is an IPO?

An initial public offering ( IPO) is the process used by private companies to go public and sell their shares to outside investors. In many cases the market caps of these companies at their IPO qualifies them as small-cap stocks.

What is total stock market?

Funds that claim to be "total stock market" index funds typically track an index that includes between 3,000 and 5,000 small-, mid-, and large-cap U.S. stocks. Examples of total stock indexes include the Wilshire 5000 Index and the Russell 3000 index. The Vanguard Total Stock Market Index Fund (VTSAX) tracks the CRSP U.S. Total Stock Market Index, which includes approximately 3,500 stocks. 1

What is the S&P 500 index fund?

Unlike total stock market index funds, S&P 500 index funds only track specific stocks on the Standard & Poors 500 index. The S&P 500 consists of about 500 stocks of the largest U.S. publicly traded companies, as measured by market capitalization. 2

Is a total stock market fund a large cap?

A total stock market fund does not capture the total stock market; it captures a majority of the large-cap stock market with a small representation of other segments, such as mid-cap and small-cap stocks. Therefore, its average market cap is large-cap, explaining why it performs similarly to an S&P 500 index fund.

How to invest in the S&P 500?

Investors can easily invest in the S&P 500 by buying an Exchange Traded Fund (ETF) which replicates the performance of the S&P 500 index. These are issued by: iShares, State Street Corporation and The Vanguard Group and work by acquiring the same stocks as the S&P 500 in the same exact quantities.

What is the Standard and Poor's 500 index?

The Standard & Poor’s 500 index consists of the 500 largest stocks in the US by reference to their market capitalizations. Having 500 stocks in an index fund/ETF offers sufficient diversification. But the index is weighted by market capitalization.

Is the S&P 500 a gold standard?

The S&P 500 is the “gold standard”. The original S&P Index Fund was made up of merely 90 stocks; nowadays that number has skyrocketed to 505. Despite this, the S&P 500 Index Fund has consistently held an average annual return of roughly 10% from the day of its origination (almost 100 years ago).

What is a micro cap stock?

The term micro cap stock generally refers to the stock of public companies in the United States which have a market capitalization of less than $300 million. These companies are generally too small for most large institutional investors to invest in, such as the large mutual funds or large hedge funds. As a general rule, micro cap stocks have tended to under perform the stock market as a whole, probably because of the lack of interest from large institutional investors.

How many size categories are there in common stocks?

The common stocks of public companies are categorized into one of four size categories based on the size of the company's market capitalization (i.e. number of shares outstanding times the stock market price per share):

What is a multi cap ETF?

But the ETF only selectively buys some of those stocks. So the ETF is not a "total market" ETF, because total market ETFs literally try to replicate the performance of the entire stock market, whereas a "multi-cap" ETF is selectively buying only some of those stocks. ETFs classified as "multi-cap" ETFs are typically actively managed ETFs or smart beta ETFs that are attempting to outperform the entire stock market.

What are the most common ETFs?

These indexes are referred to as "total market indexes". The most common total market index is probably the Russell 3000 Index, which tracks the largest 3,000 stocks on the U.S. stock market. Another total market index is the CRSP U.S. Total Market Index, which tracks roughly 4,000 stocks across mega, large, small and micro capitalizations, representing nearly 100% of the U.S. investable equity market.

How to calculate market cap of mutual funds?

To calculate market cap, take the share price and multiply it by the number of shares outstanding (meaning shares that anyone can buy).

What to consider when investing in stocks?

One thing to consider is your own personal level of risk tolerance. Everyone’s asset allocation for stocks is going to be different based on the level of risk that they’re willing to take on. The first thing to consider is your allocation between stocks and bonds.

How much of your portfolio should be in bonds?

Because of this, I recommend no more than 10% of your portfolio in bonds.

What is the minimum balance for M1 finance?

M1 charges no commissions or management fees, and their minimum starting balance is just $100. Visit Site

Is a small company more volatile?

Smaller companies are more volatile. While you may get a larger return on your investment, you also open yourself up to more risk. Many smaller companies have not been around as long and may not last. This is the beauty of small-cap ETFs and mutual funds. You don’t have to pick individual small companies to invest in.

Do you have to pick a small company to invest in?

You don’t have to pick individual small companies to invest in. You immediately diversify yourself and invest in a basket of smaller companies. So while investing in a small-cap ETF or mutual fund can be riskier than investing in a large-cap fund, it’s a necessary element in a diversified portfolio.

Do small cap companies outperform large cap companies?

Lastly, small cap companies have the ability to outperform large cap companies. This doesn’t come without risk, though.

How many small cap funds does Vanguard provide?

Vanguard currently provides seventeen non-institutional small cap funds:

What percentage of the total stock market do small caps represent?

About 10% small caps would equal the weighting of the total stock market. International small cap would also require about 10% to complete the FTSE All World ex. U. S. index. Note that whereas the Vanguard U. S.

Are small cap funds necessary in my portfolio?

If you desire to hold small cap allocations at market capitalization weightings you can hold a US Total Market Index fund and meet your allocation desires without adding a small cap fund.

What are the expected returns of the different funds?

According to 30 year return estimates from William Bernstein and Rick Ferri small cap stocks can be expected to provide the following returns:

What does "tilting" to small mean and how much should I tilt?

"Impressed both by the long-term performance (and recent performance) of value stocks and small-cap stocks, some investors hold the all-market (or S&P 500) index fund as the core, and add a value index fund and a small-cap index fund as satellites. I'm skeptical that any kind of superior performance will endure forever.

My company plan does not have a small cap fund, how can I add one?

If you would like to invest in a small cap fund outside of your company plan you can place the investment in either your personal retirement plan ( Traditional IRA or Roth IRA) or in your taxable account. (For guidance on asset location considerations refer to Principles of tax-efficient fund placement ).

How tax-efficient are the small cap funds?

Actively managed small cap funds are not very tax efficient, as the distribution history of the Vanguard Explorer fund and the Vanguard International Explorer Fund demonstrate. Active funds tend to distribute hefty capital gains distributions.

What is the market cap of the CRSP?

This was followed by the Dow Jones U.S. Small-Cap Total Stock Market Index with a median market cap of $899 million and a maximum market cap of $16.3 billion.

Is it difficult to gain informational advantage in small cap?

No different than large caps, it is difficult for investors to gain and maintain an informational advantage in the small-cap space, especially as the cost of acquiring and processing publicly available information has never been lower.

Total Stock Market Index

- This table provides Total Stock Market Index Funds from four different providers. The objective is to approximate these Morningstar style boxesusing available funds chosen from the two-fund and three-fund tables below.

Table Notes

- For the above tables: 1. The style box numbers were computed by Morningstar Instant XRayby entering each fund ticker as a holding, and entering the dollar value based on the percentage; for example, for VFIAX at 81% and VEXAX at 19%, enter $81 and $19 respectively and observe the computed Morningstar Style Box on the Instant X-Ray tab. Enter different dollar amounts (alway…

Stock Market Classifications

- Style box format

Style boxes use the following format. Numbers shown are percentages. Because values are rounded, the percentages may not total exactly 100%. - Size

Stocks may be classified by the size of the corporation. This is most commonly done looking at the market capitalization. Market capitalizationis simply a measurement found by taking a stock's current share price and multiplying it by the number of stock shares outstanding. Exact market c…

See Also