Full Answer

Should you have a 50 percent stock retirement portfolio?

It now says that some investors who have already entered retirement may be better off if they keep their stock holdings fairly high, retaining a 50 percent allocation to equities. The 50 percent stock retirement portfolio will be a new option available to companies with Vanguard target-date retirement funds in their plans.

How much should you invest in the market for retirement?

There's no one-size-fits-all approach to determining the amount of your retirement savings that should be invested in the market because a lot depends on two big factors: Your risk tolerance and the amount of time before you'll need your money.

Is too much money in the stock market putting your retirement at risk?

Having either too much money or too little money invested in the stock market can put your retirement security in jeopardy. To avoid taking on too much risk -- or risking earning too little on your investments -- make sure you evaluate your investment strategy and asset allocation every year.

What types of retirement plans own most corporate stock?

They found that a majority of corporate stock is owned by different types of retirement plans, the largest being IRAs and defined-benefit plans.

What percentage of stocks are held by pension funds?

All told, institutional investors—that is, primarily pension funds—control close to 40% of the common stock of the country's large (and many midsize) businesses.

What percentage of the stock market is wealth?

Federal Reserve data indicates that as of Q4 2021, the top 1% of households in the United States held 32.3% of the country's wealth, while the bottom 50% held 2.6%....Stock owned by richest 10%.201684%201381%200171%

How much of the stock market is owned by institutional investors?

Institutional investors own about 80% of equity market capitalization. 12 As the size and importance of institutions continue to grow, so do their relative holdings and influence on the financial markets.

How much of retirement portfolio should be in stocks?

The conservative allocation is composed of 15% large-cap stocks, 5% international stocks, 50% bonds and 30% cash investments. The moderately conservative allocation is 25% large-cap stocks, 5% small-cap stocks, 10% international stocks, 50% bonds and 10% cash investments.

What is the average net worth by age?

The average net worth for U.S. families is $748,800. The median — a more representative measure — is $121,700....Average net worth by age.Age of head of familyMedian net worthAverage net worth35-44$91,300$436,20045-54$168,600$833,20055-64$212,500$1,175,90065-74$266,400$1,217,7002 more rows

What percent of wealth is owned by the 1 2021?

32.3%The top 1% owned a record 32.3% of the nation's wealth as of the end of 2021, data show. The share of wealth held by the bottom 90% of Americans, likewise, has declined slightly since before the pandemic, from 30.5% to 30.2%.

What percent of trading is institutional?

Most of the trading that happens on the market is done by institutional investors. By some estimates, institutional investors account for 70% of stock trading volume. The percentage of corporate shares held by institutional investors has increased dramatically in the last 60 years.

What percent of stock market volume is from non institutional investors?

Kolanovic estimates “fundamental discretionary traders” account for only about 10 percent of trading volume in stocks. Passive and quantitative investing accounts for about 60 percent, more than double the share a decade ago, he said.

How much institutional money is in the market?

Institutions own about 78% of the market value of the U.S. broad-market Russell 3000 index, and 80% of the large-cap S&P 500 index. In dollars, that is about $21.7 trillion and $18 trillion, respectively. By comparison, institutions hold about 58% of the companies in the S&P Euro index.

What is the 90 10 rule in finance?

The 90/10 investing strategy for retirement savings involves allocating 90% of one's investment capital in low-cost S&P 500 index funds and the remaining 10% in short-term government bonds. The 90/10 investing rule is a suggested benchmark that investors can easily modify to reflect their tolerance to investment risk.

What is a good asset allocation for a 60 year old?

For years, a commonly cited rule of thumb has helped simplify asset allocation. According to this principle, individuals should hold a percentage of stocks equal to 100 minus their age. So, for a typical 60-year-old, 40% of the portfolio should be equities.

What is a good asset allocation for 55 year old?

As you reach your 50s, consider allocating 60% of your portfolio to stocks and 40% to bonds. Adjust those numbers according to your risk tolerance. If risk makes you nervous, decrease the stock percentage and increase the bond percentage.

What percentage of your portfolio should be stocks?

The widely quoted rule of thumb for asset allocation between stocks and bonds is that the stock portion of your portfolio should be 100 minus your age. Using that "rule," your stock allocation would be 100 minus 73, or 27 percent of your investment portfolio. Although this rule of thumb has been around for years, view it as a starting point for allocating your investments. From the 27 percent in stocks, adjust your percentage up or down, based on your financial circumstances.

What is asset allocation?

Asset allocation, including how much of your money to keep in stocks, takes on added importance during retirement. Your nest egg must provide income for living expenses and keep up with inflation. And the money must last as long as you do.

How long does it take for a stock to recover from a bear market?

Stocks can go down as well as up. Even though bear markets tend to last a short time -- one to two years -- it can take several years to recover the lost value.

How much of a stock is purchased through mutual funds?

According to the Mutual Fund Industry, about half of individually owned stocks are purchased through mutual funds. About half of those are held in retirement plans.

Who owns the majority of stocks?

What's clear is that the majority of Equities are owned by individuals, but held by institutions, in trust or on behalf of beneficial owners.

What is a pension fund?

Pension funds, (CALPERS for one) mutual funds , (401K, IRA, Roth’s etc are mostly in mutual funds) , insurance companies, banks, hedge funds, etc. so a massive horde of cash that moves around in the markets and moves the markets. Individual investors are a small part of things.

What happened to the capital in a company during the weekend?

During the weekend, the capital in the company turned from cash to non-cash, then back to cash again.

What is capital made of?

Capital is made up of cash and other forms of valuable things that are not cash at all.

What happens when the stock market crashes?

When the stock market crashes, most companies have a significant portion of their value in non-cash form. If someone insists on divesting, they don't get a high cash value for their stock.

When does the corporate fiscal year end?

You see, the Corporate Fiscal Year End is at the end of October for a majority of global corporations, not the Calendar Year, as most people think. Once their books are closed out for that Fiscal Year, then pension contributions come in at the beginning of the next fiscal year, which is the month of November.

How much of your portfolio should be in stocks?

One old rule of thumb: subtract your age from 100. The result was the percentage of your portfolio that should be in stocks. For example, at age 65, 35% of your portfolio should be in stocks. But with today's longer life spans, many planners say you need more stock than that. Perhaps the rule of thumb should be updated to subtracting your age from 110 or 120.

What are the factors that determine the right portion of a stock?

Even if you update that old rule of thumb, figuring out the right portion to devote to stocks boils down to two factors, not just one: time horizon and risk tolerance.

Why do young investors need stocks?

Young investors are told again and again, don't be overly cautious. You need stocks to make your retirement savings grow. Many older investors in or near retirement want the smoother ride that bonds provide. But again and again they're told they need stocks too and lots of them, for growth to get through as much as 30 years or more of retirement.

What is target date fund?

Target dates often stand for retirement dates.

Who increased the stock allocations for investors in some age groups?

T. Rowe Price, for one, recently increased the stock allocations for investors in some age groups. "We decided that portfolios must last and fulfill investors' needs for more years in retirement ," Young said.

What is the stock weighting of the 2020 target date?

2020 target date funds average 40.73% stock weighting. Two of the largest funds in the group have stock weightings of 56.41% and 48.31%.

How to get retirement income that won't drop?

Start by developing sources of retirement income that won’t drop when the market crashes; these sources should cover the cost of your “needs,” or at least come close. Such sources include Social Security, a pension if you’re lucky enough to have one, and cost-effective annuities you can purchase from an insurance company.

How much did the S&P 500 gain in 2019?

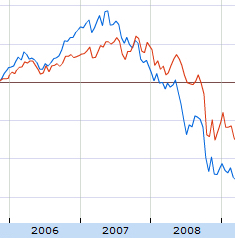

The chart below illustrates the annual percentage returns, including dividends, in the S&P 500 since 1926. You can see that 2019 produced a 31% gain, following an 4% loss in 2018, which represented the first annual loss in the stock market after a nine-year winning streak.

What is the challenge you face regarding your future financial security?

Are you an older worker or retiree who’s worried about the recent volatility in the stock market? If you’re at this stage of life, the challenge you face regarding your future financial security is that you’re going to need to rely more on your financial resources than on your future earning power.

Can you sell stocks during a market crash?

Most people who do this lock in their losses, and then they miss out when the stock market recovers. So the best thing is to resolve not to sell when the market declines.

How much of your portfolio should be in stocks?

The result is the percentage of your portfolio that should be invested in stocks. That means if you're, say, 65 years old, you should have around 45% of your portfolio in stocks and 55% in bonds.

Why do younger investors invest in stocks?

Younger investors generally allocate more of their portfolios toward stocks, because stocks tend to see much higher rates of returns than bonds and other conservative investments. A portfolio that's heavily invested in stocks will be hit harder if the market crashes, but younger investors have decades to let their money recover.

Why are stock prices slipping?

There are many reasons stock prices may be slipping, including supply chain challenges, increasing COVID-19 cases, and labor shortages across the country. While some investors believe a market crash could be looming, it's uncertain what the future holds for the stock market.

Is the stock market intimidating?

The stock market can be intimidating, especially if you're worried about losing your retirement savings. The good news, though, is that by double-checking your asset allocation, you can protect your money as much as possible.

Is it safe to pull money out of the stock market?

It's also important to continue investing in the stock market even during periods of volatility. It can be tempting to pull all your money out of the market (especially if you're nearing retirement), but that can be a dangerous move. If you sell at the wrong time when prices are lower, you could lose money and lock in your losses.

Does Motley Fool have a disclosure policy?

The Motley Fool has a disclosure policy.

Is it wise to invest in stocks?

Regardless of your age, it's still wise to have at least some money in stocks. While stocks can be riskier than bonds, they also help your savings grow much faster.