Why is GameStop stock surging! short squeeze explained?

GameStop Corp. (NYSE:GME) trade information Sporting 1.15% in the green in last session, the stock has traded in the red over the last five days, with the highest price hit on Monday, 11/29/21 when the GME stock price touched $202.01 or saw a rise of 19.9%.

How much was GameStop shorted?

The stock, which peaked at $482.95 a share when hedge funds that had shorted GameStop were forced to buy at any price, has come back to earth. But it is still at about $112 a share, compared to less than $20 on Jan. 1, 2021.

Can GameStop stock start winning again?

Volatility is a hallmark of meme stocks like GameStop, and on a day when the stock market bounces sharply higher, it’s undoubtedly going to lift a lot of boats along with it. The video game stock is simply riding the rising tide higher, and it wouldn’t be surprising to see it resume falling again tomorrow.

Could GameStop stock supercharge your portfolio?

Regardless of where you invest, though, there are a few common mistakes that could hurt your earning potential in 2022. When the stock market ... very good chance your portfolio will recover ...

What is GameStop's current short interest?

Short interest is the volume of GameStop shares that have been sold short but have not yet been closed out or covered. As of May 15th, traders have...

What is a good short interest ratio for GameStop?

The short interest ratio, also known as the "days to cover ratio", is calculated by dividing the number of shares of a stock sold short divided by...

Which institutional investors are shorting GameStop?

As of the most recent reporting period, the following institutional investors, funds, and major shareholders have reported short positions of GameS...

What is a good short interest percentage for GameStop?

Companies that have a short interest as a percentage of float below 10% indicates positive investor sentiment and few short sellers. Stocks with a...

Is GameStop's short interest increasing or decreasing?

GameStop saw a increase in short interest in May. As of May 15th, there was short interest totaling 15,120,000 shares, an increase of 11.7% from th...

What is GameStop's float size?

GameStop currently has issued a total of 76,130,000 shares. Some of GameStop's outstanding shares are available for trading, while others are subje...

How does GameStop's short interest compare to its competitors?

23.83% of GameStop's shares are currently sold short. Here is how the short interest of companies in the sector of "retail/wholesale" compare to Ga...

Which stocks are the most shorted right now?

As of the most recent reporting period, the following stocks had the largest short interest positions: Charter Communications, Inc. ($3.79 billio...

What does it mean to sell short GameStop stock?

Short selling GME is an investing strategy that aims to generate trading profit from GameStop as its price is falling. GameStop's stock is trading...

What is GameStop's short interest?

The short interest for GME / GameStop Corp. is 15,537,841 shares.

What is the short interest for GME

The short interest for GME / GameStop Corp. is 15,537,841 shares.

Are dark pool trades counted in short interest?

Dark pools are different from lit trading venues in that there is no pre-trade information such as bid/ask data available. However, once a trade is...

Are short interest figures unreliable because they are self-reported?

Although there are likely some entities that self-report their short interest, most short interest reports are provided by broker/dealers for their...

How many shares of GME / GameStop Corp. were shorted on dark pools?

The most recent dark pool short volume data for GME / GameStop Corp. reported by FINRA was 733,358 shares.

Is GME going to short squeeze?

Although it is impossible to perfectly predict short squeezes, Fintel has developed a quantitative model that ranks companies on their likelihood....

What companies are most likely to short squeeze?

Although it is impossible to perfectly predict short squeezes, Fintel has developed a quantitative model that ranks companies on their likelihood....

Does Fintel get it's short data from a single broker?

Fintel sources short interest data from official sources that provide broad coverage of the market. In the United States, these sources are the CBO...

How much stock did GameStop sell?

As of January 31, executives at BlackBerry and GameStop had sold more than $22 million in stock since January 1. There is no allegation of insider trading among BlackBerry executives, according to CBS News. Three BlackBerry executives sold nearly $1.7 million of the company's stock, with one of the executives, Chief Financial Officer Steve Rai, selling all of his shares in the company excepting unvested employee stock options.

Why did GameStop stock fall?

GameStop, an American chain of brick-and-mortar video game stores, had struggled in recent years due to competition from digital distribution services, as well as the economic effects of the COVID-19 pandemic, which reduced the number of people who shopped in-person. As a result, GameStop's stock price declined, leading many institutional investors to short sell the stock. On January 22, 2021, approximately 140 percent of GameStop's public float had been sold short, meaning some shorted shares had been re-lent and shorted again. Analysts at Goldman Sachs later noted that short interest exceeding 100 percent of a company's public had only occurred 15 times in the prior 10 years.

What happened to GameStop stock in 2021?

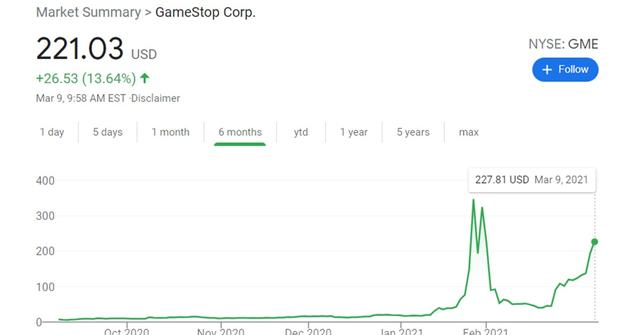

In January 2021, a short squeeze of the stock of the American video game retailer GameStop ( NYSE : GME) and other securities took place , causing major financial consequences for certain hedge funds and large losses for short sellers. Approximately 140 percent of GameStop's public float had been sold short, and the rush to buy shares to cover those positions as the price rose caused it to rise even further. The short squeeze was initially and primarily triggered by users of the subreddit r/wallstreetbets, an Internet forum on the social news website Reddit, although a number of hedge funds also participated. At its height, on January 28, the short squeeze caused the retailer's stock price to reach a pre-market value of over US$ 500 per share, nearly 30 times the $17.25 valuation at the beginning of the month. The price of many other heavily shorted securities and cryptocurrencies also increased.

How much did Bitcoin increase in value?

In addition, the price of Bitcoin, the world's largest cryptocurrency, increased 20 percent in value to more than $37,000 after Elon Musk endorsed it in his Twitter bio, partially related to the surge in the GameStop share price by Reddit users. Robinhood then began limiting the trading on Dogecoin.

What is the price of GameStop in 2021?

As of January 28, 2021. [update] , the all-time highest intraday stock price for GameStop was $483.00 (nearly 190 times the low of $2.57 reached 9 months earlier in April 2020). In pre-market trading hours the same day, it briefly hit over $500, up from $17.25 at the start of the month.

What happened to Robinhood?

A Robinhood customer filed a class-action lawsuit against the company on January 28 for halting trading on GameStop. The lawsuit, which was filed in the United States District Court for the Southern District of New York, claimed that Robinhood "purposefully, willfully, and knowingly removing the stock 'GME' from its trading platform in the midst of an unprecedented stock rise thereby deprived retail investors of the ability to invest in the open-market"; the lawsuit also accused Robinhood of "manipulating the open-market". Several other investors began using the app DoNotPay to automatically join the lawsuit.

What is short selling?

Short selling is a finance practice in which an investor, known as the short-seller, borrows shares and immediately sells them, hoping to buy them back later ("covering") at a lower price, return the borrowed shares (plus interest) to the lender and profit off the difference . The practice carries an unlimited risk of losses, because there is no inherent limit to how high a stock's price can rise. This is in contrast with taking a long position (simply owning the stock), where the investor's loss is limited to the cost of their initial investment.

GameStop is currently the 12th biggest U.S. equity short

Deborah D'Souza is the former news editor at Investopedia. She also writes articles that bring together information from across different financial fields.

GME: The Highest Percentage of Float Shorted in the World

GameStop short interest is currently at $5.51 billion, up from $276 million a year ago, making it the 12th biggest U.S. equity short. It's also an extremely crowded short because even as shorts close their positions and buy, there are others ready to initiate new positions.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Sobering Quarterly Results

The only way GameStop can hold onto its gains is through delivering excellent quarterly results. Unfortunately, that doesn’t seem to be happening.

Turnaround Strategy

Ryan Cohen and his leadership are one of the main reasons a certain set of investors remains optimistic regarding the chances of GME mounting a comeback.

Time Could Be Running Out for GME Stock

On innumerable occasions this year, analysts predicted doomsday for GME stock. But each time these analysts have had to eat humble pie, yours truly included. Considering the year, we have had and GME’s status as an iconic meme stock, it might seem like the eventual drop will never happen.

The GameStop short squeeze was a David versus Goliath battle

Many touted the tussle between Wall Street firms and retail investors as the David versus Goliath battle and a “democratization” of stock markets. Indeed, acting as a cohort, WallStreetBets members almost led to the demise of Melvin Capital.

What happened to GameStop stock in 2021?

GameStop stock entered 2021 on a strong note after almost tripling in 2020 amid optimism over its restructuring and the pivot towards e-commerce. However, Wall Street funds weren't too convinced about the rally and went overboard shorting the stock.

GME stock was an epic short squeeze

WallStreetBets members pounced on the opportunity and went on a buying spree. The “diamond hands” or the “HODLers” wouldn’t simply sell their shares and as a result, the short borrow fees on GameStop exploded. Left with no option, shorts had to cover their positions at a massive loss.

GameStop stock continued to plunge

GameStop stock remained volatile with a downwards bias and by the middle of February, it was trading near $40—a fall of over 90 percent from its peaks. However, the stock soared again in March and traded above $200 that month.

GameStop continues to fall in 2022

Fast forward to 2022, meme stocks aren't as popular as they were in 2021. A lot of retail investors, especially those who made huge losses on meme stocks, have been getting disillusioned with WallStreetBets.

Overview

Background

Short selling is a finance practice in which an investor, known as the short-seller, borrows shares and immediately sells them, hoping to buy them back later ("covering") at a lower price, return the borrowed shares (plus interest) to the lender and profit off the difference. The practice carries an unlimited risk of losses, because there is no inherent limit to how high a stock's price can rise. …

Timeline

In January 2021, Reddit users on the r/wallstreetbets subreddit built the foundations for a short squeeze on GameStop, pushing up the stock price significantly. This occurred shortly after a comment from Citron Research predicting the value of the stock would decrease. The stock price increased 1,500 percent by January 27 over the course of two weeks, and its high volatility caused trading to be halted multiple times. According to Dow Jones market data, more than 175 million s…

Impact on involved entities

Short sellers who had bet against GameStop suffered large losses as a result of the short squeeze.

By January 28, 2021, Melvin Capital, an investment fund that heavily shorted GameStop, had lost 30 percent of its value since the start of 2021, and by the end of January had suffered a loss of 53 percent of its investments. Citadel LLC and firm partners then invested $2 billion into Melvin, while Point72 …

Other affected assets

Apart from GameStop, many other heavily shorted securities (as well as securities with low short interest) saw increases in their prices:

Prices may be higher during extended-hours trading.

The shares of GME Resources, an Australian mining company with Australian Securities Exchange (ASX) symbol GME, increased more than 50 percent during intraday trading, closing with a 13.3-…

Aftermath

On January 27, 2021, White House press secretary Jen Psaki said that Treasury Secretary Janet Yellen and others in the Biden administration were monitoring the situation. Yellen convened a meeting of financial regulators, including the heads of the U.S. Securities and Exchange Commission, Federal Reserve, Federal Reserve Bank of New York and the Commodity Futures Trading Commission, to discuss the volatility surrounding the short squeeze. Because Yellen ha…

Reactions

A variety of politicians and commentators across the political spectrum made statements in support of those driving up the price of GameStop and other stocks, as well as against Robinhood and other companies' decision to limit these trades, including Representative Alexandria Ocasio-Cortez, Senator Ted Cruz, Representatives Ro Khanna, Ted Lieu, and Rashida Tlaib, Fox Business host Charles …

See also

• Cryptocurrency bubble – Speculative bubble involving cryptocurrency prices

• Everything bubble

• Philip Falcone – businessman who performed a short squeeze in 2012

• Greater fool theory – Theory that the price of an object is determined by consumer demand