Probably the most useful sources of information, corporate filings provide investors with information detailing companies' financial health, future prospects and past performance. This is the kind of information you need to judge whether certain stocks, bonds or mutual funds are smart investments.

Full Answer

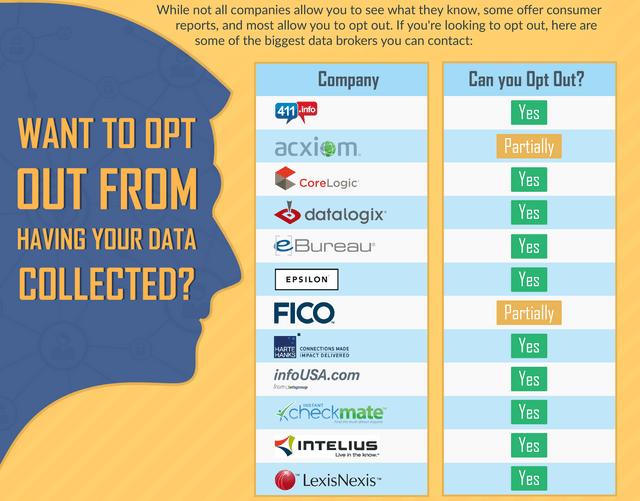

How many data brokering companies are there?

Today, there are over 4,000 data brokering companies worldwide. Acxiom, one of the largest, has 23,000 servers collecting & analyzing consumer data, Data for 500 million consumers worldwide, and up to 3,000 data points per person – and that’s just one company.

What is a data broker?

Check out our infographic for all the details. Let’s start with some background information on data brokers. Essentially, they are companies that collect information from public records, online activity, and purchase history and re-sell it to other companies for marketing purposes.

What tools do online stock brokers offer?

This question applies more to online stock brokers. Generally, if you elect to go with a big bank, they will offer tools that help with researching stocks, including quotes, charts and in-depth research reports. Smaller brokerages may not offer such services.

How does data brokering make money?

Now, data brokering is a $200 billion industry, and it isn’t showing any signs of becoming any less profitable. But how do they make their money? Different companies operate in different ways, but they generally sell the information in the form of lists contact information for people that fall into specific categories.

What do brokers get from the stock market?

Brokers receive compensation from the brokerage firm based on their trading volume as well as for the sale of investment products. An increasing number of brokers offer fee-based investment products, such as managed investment accounts.

Where do stock brokers get their data?

Generally Google gets their data, directly from the exchanges (Nasdaq, NYSE). This is really expensive -- tens of thousands of dollars a month just for the license from the exchange, and lots of telecom costs on top of that.

What do stock brokers read?

They look at the past performance of the stock's price trend for indications of future price action. These indicators can include signals like a stock's moving average or relative strength index.

Do brokers share information?

The SEC's rule also requires a brokerage firm to periodically send this information (excluding the customer's tax identification number and date of birth) to its customers to verify whether the information is accurate.

What types of data do data brokers collect and what do they do with it?

What are data brokers? Data brokers are companies selling personal information about you. Data brokers collect information from various sources to build up a detailed picture of who you are and then sell it on.

How do you get raw stock data?

Internet Sources for Historical Market & Stock DataYahoo! Finance - Historical Prices. ... Dow Jones Industrial Averages. Historical and current performance data. ... S&P Indices. Historical performance data.IPL Newspaper Collection. ... Securities Industry and Financial Markets Association. ... FINRA: Market Data Center.

Where do stock analysts get their information?

Throughout the day, analysts stay on top of any breaking news that impacts the stock markets and the companies they cover, getting input from both industry-specific and general news sources.

What do stock analysts look at?

An analyst's aim is to deeply probe the affairs of the companies on their list. They do this by analyzing the financial statements and all other available information about the company. To cross-check the facts, analysts also probe the affairs of a company's suppliers, customers, and competitors.

How do stock brokers do research?

Many brokers offer research tools on their websites. The easiest way to make these comparisons is by using your broker's educational tools, such as a stock screener. (Learn how to use a stock screener.) There are also several free stock screeners available online.

How do data brokers collect information?

Data brokers can collect information by buying it from other companies (such as credit card companies), crawling the internet for public sources of information (such as social media like LinkedIn, Instagram, Facebook etc) and many other legal means.

Why should no one use brokerage accounts?

Investors in brokerage accounts that fail due to fraud can be forced to pay back to a SIPC-appointed trustee huge sums, indeed far more than what they contributed to their accounts. Wall Street pays SIPC's bills.

How will my company find out I have a personal trading account?

To answer your question, no your employer cannot see your investment holdings unless you explicitly give them access. If you use your work computer to look at your account information then someone in IT might see what you are doing.

What indicators should I use to plot a moving average?

In general, the more the better. At the very least, you should be able to plot basic indicators like volume, RSI, simple moving averages, Bollinger bands, MACD, and stochastics. If any of these basic indicators are missing, it’s time to move on.

What to do before clicking on brokerage ads?

Before you start clicking on brokerage ads, take a moment to hone in on what's most important to you in a trading platform. The answer will be slightly different depending on your investment goals and where you are in the investment learning curve.

What are the different types of stock brokers?

There are two main types of brokers: traditional full service stock brokers or discount brokers. This is the question that will help you decide which direction to go. If you are able to pick stocks yourself, you have a huge advantage.

What is a stock broker?

A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. The rise of the internet, however, has drastically changed the role of stock brokers. Online brokerages now allow investors to purchase their stocks from their computers, at much lower costs.

What to do if you have a huge amount of money to invest?

If you have a huge amount to invest, you may want to go with a combination of an advisor and a discount broker (assuming half your budget meets the minimal requirement for working with an advisor). By doing so, you effectively diversify your risk through professional advise and self-investments.

Why is choosing a broker important?

Choosing your broker is an important decision. It could be the start of a long-term relationship of which there is constant interaction. It is imperative that, like buying stocks, you do as much research as possible in order to be content with your broker.

Do discount brokerages require minimum deposits?

Discount brokerages may try to entice you with low trading fees but in-turn require minimum deposits as well. If you are part of a large bank, you can often go to your branch and ask to open a direct investing account, a seamless and easy way to begin investing.

Can an advisor buy stocks?

Some advisors may only have the ability to purchase stocks, bonds and mutual funds. Same goes with discount brokerages. It is important to think about more than just buying stocks. As you become a more advanced investor, you may want to begin using more advanced techniques such as trading options and short selling.

Can the wealthy afford a stock broker?

It the past, only the wealthy could afford hiring a broker and get access to the many great companies available on the stock market. However, advances in technology and the rise of discount brokerages has forced full service stock brokers to adapt their roles and become more of an advisor to their clients.

What should the choice of a stockbroker be related to?

The choice of a stockbroker should be related to the trading needs of the traders. Traders should focus on their trading strategy and choose a stockbroker who will help meet their trading needs. For example, for short-selling stocks, traders would need to find stockbrokers with a deep list of stocks available to short.

What exam do stockbrokers need to pass?

A stockbroker must pass the General Securities Representative Exam, controlled by the Financial Industry Regulatory Authority (FINRA). A person needs to be financed by a member firm of FINRA or a Self-Regulatory Organization (SRO).

What is a full service stockbroker?

A full-service stockbroker offers a variety of financial services to clients. Usually, clients are assigned individual licensed stockbrokers. The brokerage firms employ research departments providing analyst recommendations and access to initial public offerings (IPOs)#N#Initial Public Offering (IPO) An Initial Public Offering (IPO) is the first sale of stocks issued by a company to the public. Prior to an IPO, a company is considered a private company, usually with a small number of investors (founders, friends, family, and business investors such as venture capitalists or angel investors). Learn what an IPO is#N#.

What is the job of a stockbroker?

Stockbrokers handle transactions for both institutional and retail customers. The primary job of a stockbroker is to obtain buy and sell orders and execute them. Many market participants depend on stockbrokers’ knowledge and expertise regarding the dynamics of the market to invest in securities. A stockbroker can work either individually ...

What is financial forecasting?

Financial Forecasting Financial forecasting is the process of estimating or predicting how a business will perform in the future. This guide on how to build a financial forecast. and planning, and related laws and regulations is preferred.

Who owns mutual funds?

Mutual funds are owned by a group of investors and managed by professionals. Learn about the various types of fund, how they work, and benefits and tradeoffs of investing in them. , banking products, and other services.

Can I work as a stock broker as a college intern?

A stockbroker can start working with a brokerage firm in any role, even as a college intern, and gain experience on the job. However, to be a stockbroker, he/she must show a strong understanding of accounting standards and regulations of the financial market.