Key Takeaways

- An employee stock ownership plan is a benefit plan that gives employees access to shares of company stock.

- It can be used as a form of retirement plan, since the shares can be sold for income when the employee retires.

- Employees aren't taxed on their shares inside the ESOP until they're sold.

Full Answer

Should I invest in my employee stock purchase plan?

Your employer may let you buy company stock at a discounted price through an employee stock purchase plan, or ESPP. If you choose to participate, these investments can boost your bottom line and offer tax advantages, depending on when you opt to sell your holdings. The company you work for may let you purchase company stock at a discounted price.

Is an employee stock purchase plan a good deal?

These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

What is the best investment plan for employees?

Who should invest in POMIS:

- Investors who are seeking fixed monthly income but are unwilling to take any risks in their investments

- It is more favourable for retired individuals or senior citizens who have landed into the no-more-paycheck zone

- Investors willing to indulge in a one-time investment to serve the purpose of getting regular income

What should I do with my employee stock options?

- What are your expectations for the stock price and the stock market in general?

- How much time remains until the stock option expires?

- If you are within 120 days of expiration, it may be time to act, to avoid the risk of letting the options expire. ...

How does employee stock ownership plan work?

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Are ESOP plans good for employees?

Research by the Department of Labor shows that ESOPs not only have higher rates of return than 401(k) plans and are also less volatile. ESOPs lay people off less often than non-ESOP companies. ESOPs cover more employees, especially younger and lower income employees, than 401(k) plans.

What is one of the benefits of employee stock ownership plans?

ESOPs have a number of significant tax benefits, the most important of which are: Contributions of stock are tax-deductible: That means companies can get a current cash flow advantage by issuing new shares or treasury shares to the ESOP, albeit this means existing owners will be diluted.

What is the risk of employee stock ownership plans?

The risk to employees' ESOP accounts comes when the ESOP takes on too much debt. An ESOP that takes on significant debt has little room to survive financial downturn of the sponsoring company, which is now owned by the employees.

What happens to ESOP if you quit?

If you quit or are laid off, the ESOP distributions are deferred for six years under IRS regulations. Once those six years pass, you may receive the value of your ESOP shares in either one lump sum, or in basically equal payments made over five years. The installment payments are limited to six in number.

Can you lose money in an ESOP?

An employee may have to work for the company for a set period of time before the shares that they own in the ESOP fully become theirs. If they leave the company before the shares vest, they lose those shares entirely. When an employee leaves the company, money from the ESOP is distributed.

Is it good to buy ESOP?

Yes, ESOPs of growth companies are always beneficial for the employees. As an employee, you must know how your company is performing and what are their plans in future, and if you are convinced that company is going to make good revenue in future, you must exercise the ESOPs.

How do employees make money in an ESOP?

When you get your money. ESOP benefits are generally paid to employees after they leave the company. The income an employee receives from an ESOP depends on the contributions made to the plan and the performance of plan investments, rather than a pre-determined benefit based on a set formula.

How do ESOPs pay out?

The company can make your distribution in stock, cash, or both. Many ESOP participants leave with an account that has both stock and cash in it. The cash will be paid out in cash. The share portion may be cashed in, so you will get cash for the shares as well.

Who benefits from an ESOP?

employeesBecause an ESOP gives employees a share of the company, individual employees will directly benefit from the success of a company and will feel a sense of ownership. This can lead to an increase in productivity and an overall performance improvement for companies with employee stock plans.

What are the pros and cons of an ESOP?

It's worth internalizing these pros and cons if you're considering an employee stock ownership plan for your closely-held company.PRO: Sellers are Paid Fair Market Value (FMV) ... CON: ESOPs Cannot Offer More than FMV. ... PRO: An Employee Trust is a Known Buyer. ... CON: An ESOP Transaction Process is Highly Structured.More items...

How much should I invest in ESPP?

If you haven't ever contributed to your company's ESPP before, select a percentage of your pay that feels comfortable (maybe 1-5% of your salary). This will help you get acquainted with how ESPPs work and will give you confidence to increase the percentage later.

What is stock ownership plan?

An Employee Stock Ownership Plan is designed in a way that limits benefits to newer employees. Employees who enrolled in the plan earlier benefit from the continuous contribution to the plan, giving them a higher voting power. This is, however, different for newer employees who, even in stable companies, may not accumulate as much in savings as the longstanding employees. Therefore, newer employees are given limited opportunity to participate in crucial decisions during annual general meetings and other forums.

What is the difference between an employee stock ownership plan and a worker corporative plan?

The difference with an employee stock ownership plan, as compared to a worker corporative, is that with an ESOP the company’s capital is not evenly distributed. Senior employees are allocated more shares than newly hired employees, and therefore, the latter exercise less voting power during shareholder meetings.

How does an ESOP work?

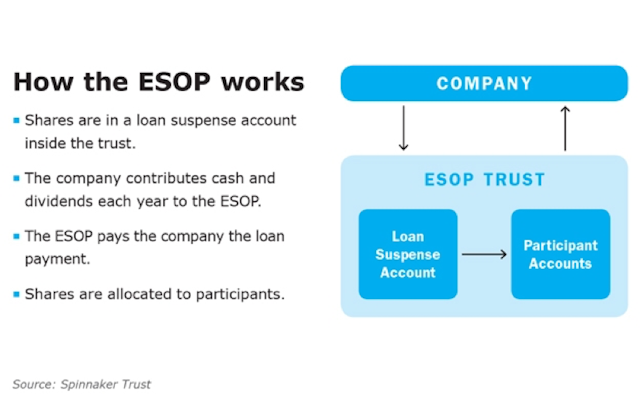

How an ESOP works. When a company wants to create an Employee Stock Ownership Plan, it must create a trust in which to contribute either new shares of the company’s stock or cash to buy existing stock. These contributions to the trust are tax-deductible up to certain limits.

What is an ESOP?

What is an Employee Stock Ownership Plan (ESOP)? An Employee Stock Ownership Plan (ESOP) refers to an employee benefit plan that gives the employees an ownership stake. Stockholders Equity Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus.

Why do companies have ESOP?

Companies with an ESOP in place tend to see higher employee engagement and involvement. It improves awareness among employees since they are given the opportunity to influence decisions about products and services. Employees can see the big picture of the company’s plans#N#Corporate Strategy Corporate Strategy focuses on how to manage resources, risk and return across a firm, as opposed to looking at competitive advantages in business strategy#N#in the future and make recommendations on the kind of direction the company wants to take. An ESOP also increases employee trust in the company.

What are the benefits of an ESOP?

Benefits of an ESOP. 1. Tax benefits for employees. One of the benefits of Employee Stock Ownership Plans is the tax benefit that employees enjoy. The employees do not pay tax on the contributions to an ESOP. Employees are only taxed when they receive a distribution from the ESOP after retirement or when they otherwise exit the company.

How does stock ownership affect voting power?

This reduces the overall percentages of the shares held by older members in the plan. The dilution also affects voting power, since employees who hold high voting power , owing to their higher number of shares, end up with reduced voting powers after new members are admitted.

What is employee stock ownership plan?

An employee stock ownership plan is a type of benefit plan that invests in company stock and distributes shares to its employees. It's a way of transferring company stock to employees without requiring selling the business to a third party.

How long do employees hold shares in an ESOP?

Each employee’s shares are held in the company’s ESOP trust until the employee leaves or retires. At that point, employees can sell the shares, either on the open market or back to the company. Employees are not taxed until they sell their shares.

What is an ESOP?

An employee stock ownership plan (ESOP) is an employee benefit offered to new and existing employees which gives them access to an allocation of company stock. Learn more about how ESOPs work, as well as their advantages and disadvantages.

Why is ESOP not a good benefit?

If the company does not offer additional retirement benefits, such as a 401 (k) plan, for instance, and you are concerned with the company's overall health, an ESOP may not be a great benefit, because of the risk you take if the company's performance goes south.

Can an ESOP be used as a retirement plan?

It can be used as a form of retirement plan, since the shares can be sold for income when the employee retires. Employees aren't taxed on their shares inside the ESOP until they're sold. Companies with ESOPs are often linked to positive employee outcomes such as lower turnover.

How do employees become owners of stock?

Employees can buy stock directly, be given it as a bonus, can receive stock options, or obtain stock through a profit sharing plan . Some employees become owners through worker cooperatives where everyone has an equal vote. But by far the most common form of employee ownership in ...

What is an ESOP plan?

ESOP Rules. An ESOP is a kind of employee benefit plan, similar in some ways to a profit-sharing plan. In an ESOP, a company sets up a trust fund, into which it contributes new shares of its own stock or cash to buy existing shares. Alternatively, the ESOP can borrow money to buy new or existing shares, with the company making cash contributions ...

What is an ESOP in India?

A benefit plan in another country called an ESOP may be very different. For example, an "ESOP" in India is a stock option plan, which has nothing to do with a U.S. ESOP. For a book-length orientation to how ESOPs work, see Understanding ESOPs.

How much can an ESOP deduct from taxable income?

To create an additional employee benefit: A company can simply issue new or treasury shares to an ESOP, deducting their value (for up to 25% of covered pay) from taxable income. Or a company can contribute cash, buying shares from existing public or private owners. In public companies, which account for about 5% of the plans and about 40% ...

How much does it cost to set up an ESOP?

The cost of setting up an ESOP is also substantial—perhaps $40,000 for the simplest of plans in small companies and on up from there. Any time new shares are issued, the stock of existing owners is diluted.

How long does it take to get 100% vested in a company?

Employees must be 100% vested within three to six years, depending on whether vesting is all at once (cliff vesting) or gradual.

Is ESOP a pro rata share?

Note, however, that the ESOP still must get a pro-rata share of any distributions the company makes to owners. Dividends are tax-deductible: Reasonable dividends used to repay an ESOP loan, passed through to employees, or reinvested by employees in company stock are tax-deductible. Employees pay no tax on the contributions to the ESOP, ...

How long do you have to reinvest a stock in the ESOP?

To qualify, reinvestments must be made within a. 15-month window that starts three months before the date of sale and ends 12 months after the date of the sale to the ESOP.

What is an ESOP company?

The ESOP company is a C corporation at the time of the sale. The ESOP owns at least 30 percent of the company immediately after the sale. (The sale of stock by two or more shareholders counts toward this 30 percent requirement). The sale proceeds are re-invested in U.S. domestic corporation stocks and bonds within a set time period.

What is vesting schedule in ESOP?

The shares of company stock and other plan assets allocated to participants’ accounts under the ESOP must be subject to a vesting schedule in which each participant has a right to an increasing percentage of the ESOP account over time. The two basic vesting schedules allowed by law are:

How long does an ESOP put option last?

The put option right has two 60-day periods.

What is an ESOP?

An Employee Stock Ownership Plan (ESOP) is a tax- qualified retirement plan authorized and encouraged by federal tax and pension laws. Unlike most retirement plans, ESOPs:

Why do companies have an ESOP?

In fact, for some companies, the ownership and benefit incentive is the primary reason for the ESOP.

What is an ESOP in business?

By contrast, an ESOP: Helps keep the business—and its jobs—in the community. Helps provide job security for employees.

How An ESOP Works

Benefits of An ESOP

- 1. Tax benefits for employees

One of the benefits of Employee Stock Ownership Plans is the tax benefit that employees enjoy. The employees do not pay tax on the contributions to an ESOP. Employees are only taxed when they receive a distribution from the ESOP after retirement or when they otherwise exit the comp… - 2. Higher employee engagement

Companies with an ESOP in place tend to see higher employee engagement and involvement. It improves awareness among employees since they are given the opportunity to influence decisions about products and services. Employees can see the big picture of the company’s pla…

Drawbacks of An ESOP

- 1. Lack of diversification

Employees who are members of ESOP concentrate their retirement savings in a single company. This lack of diversification is against the principle of investment theory that advises investors to invest in different companies, industries, and locations. Worse still, the employees lock their savi… - 2. Limits newer employees

An Employee Stock Ownership Plan is designed in a way that limits benefits to newer employees. Employees who enrolled in the plan earlier benefit from the continuous contribution to the plan, giving them a higher voting power. This is, however, different for newer employees who, even in …

Related Reading

- Thank you for reading CFI’s guide to an employee stock ownership plan. CFI is the official provider of the Financial Modeling & Valuation Analyst certification. To continue learning and advancing your career, these additional resources will be helpful: 1. Sweat Equity 2. Enterprise Value vs Equity Value 3. Valuation Methods 4. Equity Carve-out