What does YTD stand for?

Year to date (YTD) refers to the period of time beginning the first day of the current calendar year or fiscal year up to the current date. YTD information is useful for analyzing business trends over time or comparing performance data to competitors or peers in the same industry.

Where can you find YTD returns for benchmarks?

Toggle over the Growth tab, and you'll get a dropdown menu. Select the Rolling Returns option. You'll then see the three-month rolling returns for the investment--how often it was in the black in various three-month periods as well as how often it posted negative returns.

How do I calculate YTD income?

- Identify revenue earned so far during the fiscal year. ...

- Subtract any sales returns, allowances or discounts from total sales revenue earned to determine net sales. ...

- Identify all business expenses incurred so far this fiscal year. ...

- Subtract business expenses incurred from net sales to determine YTD income. ...

How to calculate YTD annualization?

To annualize data from a single month, the formula will be:

- = [Value for 1 month] * 12.

- = [Value for 2 months] * 6.

- = [Value for X months] * (12 / [Number of months])

See more

What is YTD calculation?

March 29, 2021. Year to date = (Specified date value / Start of specified date value) - 1. Year to date (YTD) calculations are useful in business management, accounting and finance. It is an effective way to determine the financial health of a company without waiting until the end of the fiscal year.

What is a good YTD rate of return?

Good Average Annual Return for a Mutual Fund For stock mutual funds, a “good” long-term return (annualized, for 10 years or more) is 8% to 10%. For bond mutual funds, a good long-term return would be 4% to 5%.

What is YTD in Indian stock market?

YTD stands for Year-to-Date. It is a period starting from the beginning of the current year and continuing up to the present day. The year can start from January 1 (calendar year) or April 1 (financial year).

Is a high YTD good?

YTD stands for "year to date," which refers to how a stock has done since the start of the calendar year. Like any most other measures of performance, the higher the YTD return, the better the stock is doing.

What is YTD example?

Examples of Year to Date Then, divide the difference by the value on the first day, and multiply the product by 100 to convert it to a percentage. For example, if a portfolio was worth $100,000 on Jan. 1, and it is worth $150,000 today, its YTD return is 50%.

What does a negative YTD mean?

A YTD return can be either positive or negative. A positive YTD return represents an investment profit, while a negative YTD return represents a loss. You can calculate a stock's YTD return to determine how well it has performed so far this year.

What is MTD and YTD?

YTD: Year-to-Date (from January 1 of this year to current date) QTD: Quarter-to-Date (From beginning date of the current quarter to current date) MTD: Month-to-Date (From beginning date of the current month to current date)

What is daily total return?

YTD# (Daily) shows a fund's returns from the first trading day of the year through the most recently ended trading day. 1Yr, 3Yr, and 5Yr show a fund's returns over that specific number of years, through the most recently ended trading day.

What is a YTD?

Year to Date (YTD) refers to the period from the beginning of the current year to a specified date before the year’s end. In other words, year to date is based on the number of days from the beginning of the calendar year (or fiscal year. ) up until a specified date.

When is YTD in a company?

The YTD with reference to the calendar and fiscal year up until March 30 is as follows: Company A Calendar YTD: Period from January 1 to March 30. Company A Fiscal YTD: Period from January 31 to March 30. When the YTD is not specifically referenced to a calendar or fiscal year, it is safe to assume that the YTD is in reference to the calendar year.

What is YTD in accounting?

The YTD can be used in reference to a calendar year or a fiscal year. Fiscal Year (FY) A fiscal year (FY) is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. .

When is YTD used in a calendar year?

Therefore, if someone uses YTD while referring to the calendar year, it is the time period between January 1 and the specified date.

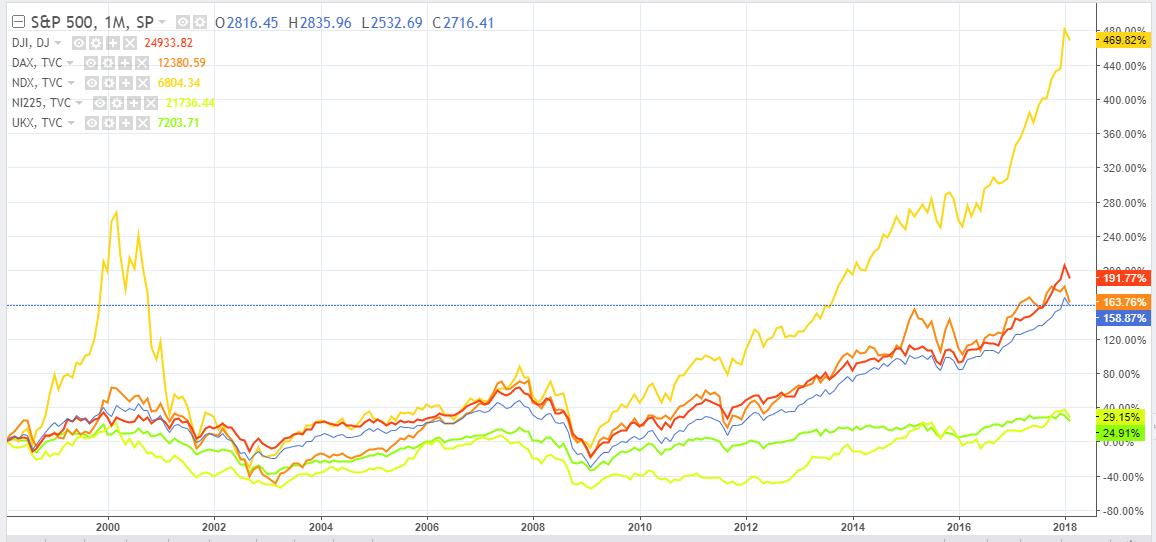

What Is a Benchmark?

Benchmarks are market barometers used to track the performance of a group of securities and these gauges are used to analyze market performance. The S&P 500 index is one of the more popular benchmarks for the performance of the U.S. stock market, as it includes 500 companies and represents about 80% of the total market capitalization of all U.S.

Calculating Year-to-Date Performance

Year-to-date (YTD) performance refers to the change in price since the first day of the current year. For example, if a stock ends the previous calendar year trading for $50 per share and is worth $60 at the end of June, the return (assuming the stock paid no dividends) is $10 or 20%.

Sources of Year-to-Date Information

Yahoo Finance has a charts section with the option to view price history over various period lengths, including YTD. Yahoo Finance also provides downloadable historical price data for a variety of different investment types.

We Need Your Support!

Backlinks from other sites are the lifeblood of our site and our primary source of new traffic.

We Need Your Support!

Backlinks from other sites are the lifeblood of our site and our primary source of new traffic.

How Year to Date (YTD) Is Used

- If someone uses YTD for a calendar year reference, they mean the period of time between Jan. 1 of the current year and the current date. If they use YTD for a fiscal year reference, they mean the period of time between the first day of the fiscal year in question and the current date. A fiscal y…

Examples of Year to Date

- Year to Date Returns

YTD return refers to the amount of profitmade by an investment since the first day of the current year. Investors and analysts use YTD return information to assess the performance of investments and portfolios. To calculate a YTD return on investment, subtract its value on the fir… - Year to Date Earnings

YTD earnings refer to the amount of money an individual has earned from Jan. 1 to the current date. This amount typically appears on an employee's pay stub, along with information about Medicare and Social Security withholdings and income taxpayments. YTD earnings may also de…

Month to Date vs. Year to Date

- Month to date (MTD) refers to the period of time between the 1st of the current month and the last finalized business day before the current date. Typically, MTD does not include the current date because business has not yet ended for that day. For example, if today's date is Aug. 21, 2021, MTD refers to the period of time from Aug. 1, 2021, to Aug. 20, 2021. This metric is used i…

What Is A Benchmark?

Calculating Year-To-Date Performance

- Year-to-date (YTD) performance refers to the change in price since the first day of the current year. For example, if a stock ends the previous calendar year trading for $50 per share and is worth $60 at the end of June, the return (assuming the stock paid no dividends) is $10 or 20%. In this case, where the period ends at the end of June, the YTD ...

Sources of Year-To-Date Information

- Yahoo Finance has a charts section with the option to view price history over various period lengths, including YTD. Yahoo Finance also provides downloadable historical price data for a variety of different investment types.3 Similar to Yahoo's service, Google Finance also has a price chart function that allows users to select YTD as the observed period for equities and inde…