Key Takeaways

- Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

- Value investors actively ferret out stocks they think the stock market is underestimating.

- Value investors use financial analysis, don't follow the herd, and are long-term investors of quality companies.

Full Answer

What is the difference between value investing and growth investing?

Value investing is characterized by the following features:

- Stock is undervalued in the market

- Stock is below industry average

- Stock offers less risk than market

How to invest in value stocks?

Value investors

- Value investors try to find stocks trading for less than their intrinsic value by applying fundamental analysis.

- Growth investors try to find stocks with the best long-term growth potential relative to their current valuations.

- Investors who take a blended approach do a little of each.

What stocks should I invest in?

Key Points

- AbbVie and Medical Properties Trust are two healthcare stocks that offer juicy dividends.

- Energy stocks Devon and Enterprise Products Partners have especially attractive dividends right now.

- Telecom giant Verizon not only pays a solid dividend but its stock is cheap as well.

What to look for in value investing?

What to Look for in Value Investing

- Value Investing. Years ago we wrote about value investing for long term profits. ...

- Look for a Margin of Safety in a Value Investment. Finding the margin of safety of a stock is the first thing to look for in value investing. ...

- Intrinsic Value in Investing. We often refer to our article about intrinsic stock value. ...

What is value investing in stock?

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively ferret out stocks they think the stock market is underestimating.

Are value stocks A Good investment?

There are times when growth stocks are undervalued and there are plenty of value stocks that grow. Regardless of their style, investors are trying to buy a stock that's worth more in the future than it is today....Value investing.TraitGrowth investingValue investingVolatilityHigherLower5 more rows•Mar 4, 2022

What is an example of value stock?

In simplest terms, a value stock is one that is cheap in relation to such basic measures of corporate performance as earnings, sales, book value and cash flow. Examples of what are commonly viewed as value stocks are Citicorp (C), ExxonMobil (XOM)and JPMorgan Chase (JPM).

Why should I invest in value stocks?

Some studies show that value investing has outperformed growth over extended periods of time on a value-adjusted basis. Value investors argue that a short-term focus can often push stock prices to low levels, which creates great buying opportunities for value investors.

Do value stocks pay dividends?

Common characteristics of value stocks include high dividend yield, low price-to-book ratio (P/B ratio), and a low price-to-earnings ratio (P/E ratio).

Is Warren Buffett a value investor?

What Strategy Does Warren Buffett Use? Warren Buffett's investing strategy is value investing. Value investing involves selecting stocks whose share price is trading below its intrinsic value or book value. This signals that the market is currently undervaluing the stock and that the stock will rise in the future.

Is value riskier than growth?

We find reliable evidence that value stocks are riskier than growth stocks in bad times when the expected market risk premium is high, and to a lesser extent, growth stocks are riskier than value stocks in good times when the expected market risk premium is low.

Is Apple considered a value stock?

Apple epitomizes what it means to be both a good value stock and a good tech stock with its strong margins, outsized cash flows, stable balance sheet, and a loyal base of customers supporting the brand.

What is a value stock vs a growth stock?

Growth stocks are those companies that are considered to have the potential to outperform the overall market over time because of their future potential. Value stocks are classified as companies that are currently trading below what they are really worth and will thus provide a superior return.

Is value investing safer?

Value stocks have more limited upside potential and, therefore, can be safer investments than growth stocks.

What are the best value stocks to buy right now?

Comparison ResultsNamePriceMarket CapT AT&T$20.66$148.91BINTC Intel$37.20$155.34BMU Micron$57.81$66.04BCSCO Cisco Systems$43.25$179.68B6 more rows

How do you learn value investing?

In this article, we will look at some of the more well-known value investing principles.Buy Businesses, Not Stocks.Love the Business You Buy Into.Invest in Companies You Understand.Find Well-Managed Companies.Don't Stress Over Diversification.Your Best Investment Is Your Guide.Ignore the Market 99% of the Time.More items...

What Is Value Investing?

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively ferret out stocks they think the stock market is underestimating. They believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond to a company's long-term fundamentals. The overreaction offers an opportunity to profit by buying stocks at discounted prices—on sale.

How do stocks work?

Stocks, like TVs, go through periods of higher and lower demand leading to price fluctuations —but that doesn't change what you’re getting for your money.

Why are stocks overpriced?

Or a stock might be overpriced because investors have gotten too excited about an unproven new technology (as was the case of the dot-com bubble). Psychological biases can push a stock price up or down based on news, such as disappointing or unexpected earnings announcements, product recalls, or litigation.

Why do value investors have margin of safety?

Value investors require some room for error in their estimation of value, and they often set their own " margin of safety ," based on their particular risk tolerance. The margin of safety principle, one of the keys to successful value investing, is based on the premise that buying stocks at bargain prices gives you a better chance at earning a profit later when you sell them. The margin of safety also makes you less likely to lose money if the stock doesn’ t perform as you had expected.

What does it mean when a stock is cheap?

In the stock market, the equivalent of a stock being cheap or discounted is when its shares are undervalued. Value investors hope to profit from shares they perceive to be deeply discounted. Investors use various metrics to attempt to find the valuation or intrinsic value of a stock.

How to avoid emotions when investing?

It is difficult to ignore your emotions when making investment decisions. Even if you can take a detached, critical standpoint when evaluating numbers, fear and excitement may creep in when it comes time to actually use part of your hard-earned savings to purchase a stock. More importantly, once you have purchased the stock, you may be tempted to sell it if the price falls. Keep in mind that the point of value investing is to resist the temptation to panic and go with the herd. So don't fall into the trap of buying when share prices rise and selling when they drop. Such behavior will obliterate your returns. (Playing follow-the-leader in investing can quickly become a dangerous game.

What is intrinsic value?

Intrinsic value is a combination of using financial analysis such as studying a company's financial performance, revenue, earnings, cash flow, and profit as well as fundamental factors, including the company's brand, business model, target market, and competitive advantage.

What is value stock?

Value stocks are companies with share prices that are lower than what their fundamentals suggest they should be . Think of a value stock as a public company that’s currently on sale: Buy shares now, and you’ll profit when other investors eventually realize what they’re missing out on.

How to invest in value stocks?

Once you’ve found value stocks, be prepared to buy and hold them for longer periods of time. 1. Research, Research, Research. Deploying fundamental analysis to find value stocks and learn their intrinsic value always begins with research.

What does it mean when a company's dividend exceeds its competitors?

High dividend yield. If a company’s dividend yield exceeds its competitors, this could be telling you that its share price is undervalued —relative to its dividend. Of course, this might also be telling you the company is in financial trouble or paying unsustainable dividends, so tread carefully. Company plans.

What is growth stock?

With growth stocks, investors are looking for companies that are growing at a faster rate than others based on revenue or profits. They are expanding at a quick pace, so they reinvest money into the company rather than paying dividends to shareholders.

What is value investing?

Value investing is a long-term, conservative approach to investing. When you invest in value stocks, you’re looking to buy and hold companies whose share prices are currently lower than their intrinsic value.

How to determine intrinsic value?

To calculate intrinsic value and determine good buys, value investors analyze the fundamentals of a company’s performance—things like earnings, revenue, cash flow and price-to-earnings ratios, along with a host of other financial information. By identifying and purchasing stocks priced by the market below their intrinsic value, ...

When do value stocks gain ground?

When interest rates decrease and company earnings are up , growth stocks should gain ground. By contrast, value stocks do best when the economy is in decline or in a full recession. That’s because their fundamentals are in a state to function, even under less auspicious circumstances.

What Is Value Investing?

Value investing is nothing more or less than buying investments on sale.

Who is the most successful value investor?

Warren Buffett, the most successful practitioner of value investing, was a student of Graham’s at Columbia. Value investing starts from the premise that an investor who buys stock in a company owns part of the business.

What is intrinsic value?

“Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life ,” he wrote.

What is a growth investor?

Where a value investor may look for a low P/E ratio or P/B ratio, a growth investor is more concerned with how quickly a company is growing its revenue and profits. In fact, many growth companies have astronomically high P/E and P/B ratios.

What is a mutual fund?

Most major fund companies offer both actively managed and passively managed (i.e., index funds) value funds. As an example, the Vanguard Value Index Fund Admiral Shares ( VVIAX) invests in value companies. A simple comparison of this fund with the Vanguard Growth Index Fund Admiral Shares ( VIGAX) underscores the difference in these two investment approaches.

What does 1.0 mean in stock market?

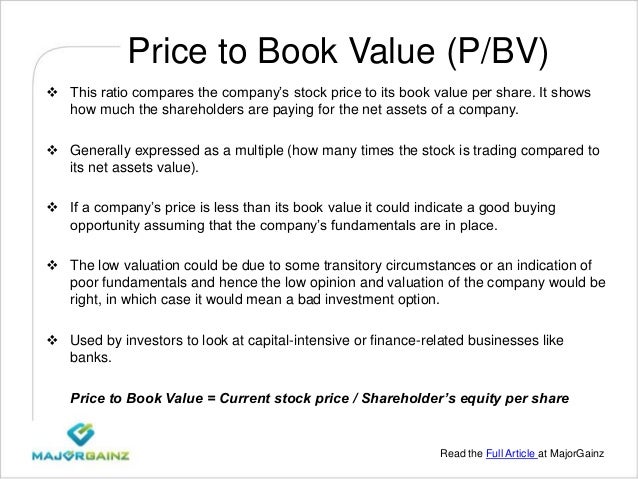

In theory, any value below 1.0 indicates that a company’s stock is selling for less than the net worth of the company. Today, some banks trade below their book value, while some growth companies trade at many multiples of their net worth.

Is growth investing better than value investing?

Over time, both approaches can outperform average market returns. In the current market, growth investing has outperformed value investing for a number of years. This can be seen most clearly in the returns of companies such as Amazon, Apple and Tesla. In the past, however, there have been long periods where value investing has performed better.

What is value stock?

Value stocks are stocks that are currently trading at a price lower than their actual intrinsic price. It basically means that the stocks are undervalued, i.e., traded at a price lower than their true value, making them an attractive investment option for investors.

What is Value Investing?

Value investing is the act of investing in value stocks. Hence, when investors specifically invest in value stocks to profit out of an undervalued stock in the market, it is referred to as value investing. The investment strategy is primarily based on the idea of “buy low, sell high.”

What are the three metrics used to estimate the intrinsic value of a stock?

The three popular investing metrics used to estimate the intrinsic value of a stock are the P/E ratio, P/B ratio, and the Earnings Per Share (EPS).

Why do stocks drop in winter?

During the winter, less demand for cooling can cause the stock price to be lower than what it usually is. 3. Market recessions. Due to either a market crash or uncertainty, investors tend to dump a lot of stocks out of their portfolios due to fear of further losses.

Why are stocks undervalued?

Common reasons we identified are cyclical businesses, seasonal businesses, market recessions, bad news, and market blind spots.

What is the investment strategy of CFI?

The investment strategy is primarily based on the idea of “buy low, sell high.”. Investing in value stocks is a highly sought-after investment strategy. Investing: A Beginner's Guide CFI's Investing for Beginners guide will teach you the basics of investing and how to get started.

Why are stocks discounted?

It is because stocks that are realistically expected to be priced at a high price are being traded in the market for a lower than expected price. The availability of lucrative stocks at a discounted price offers a huge profit-making opportunity for investors.

What is value stock?

What is a value stock? A value stock is a stock with a price that appears low relative to the company's financial performance, as measured by such fundamentals as the company's revenue, dividends, yield, earnings and profit margins. Investors in value stocks are assuming that the price of the stock will eventually rise, ...

Why do investors value stocks?

Because they see the stock as relatively undervalued, they're anticipating that its growth will outpace the growth of the value stock's competitors or the market overall.

Why do people combine growth and value stocks?

When investing long term, some people combine growth and value stocks to get the potential for high returns with less volatility.

Which is more likely to issue dividends or growth stocks?

Value stocks also are more likely to issue dividends to their investors than growth stocks. "When investing long term, some people combine growth and value stocks to get the potential for high returns with less volatility.".

How Do I Value a Company’s Stock?

For investors on a quest for the “diamond in the rough” stocks—value stocks about to soar —there are three common techniques they can use to identify stocks with high intrinsic value:

What Is the True Value of a Stock?

Value investors like Warren Buffett do not believe in the efficient market hypothesis, which assumes that stocks are efficiently priced at all times. Therefore, they seek to identify the “true value” of a stock by examining its fundamentals. One of the most popular methods to do so is by examining the price-to-earnings ratio (P/E ratio).

What Determines a Stock’s Value?

Simply put, a stock’s value is determined by the simple rules of supply and demand: supply of shares available and demand for shares. Value investors seek inefficiencies in the market that cause truly valuable companies to be priced at less than what they’re worth.

What Are the Top Value Stocks Right Now?

As the economy has slowed from the threat of multiple COVID variants, certain sectors, such as communications, utilities, and health care, have trended higher. Utilities and healthcare are typically value sectors that can withstand market corrections. For specific ideas, check out TheStreet.com’s list of 25 value stocks poised for big gains in 2022.

Who Is the Greatest Value Investor?

There’s nothing cheap about Warren Buffett, who has amassed a fortune exceeding $100 billion. A businessman and philanthropist, Buffett generated his wealth through value investing by finding companies to invest in that were trading far below their intrinsic value and then holding them for the long term. In 2013, Buffett published his investing fundamentals in a letter to shareholders of his company, Berkshire Hathaway.

What is value investing?

Value investing is a long-term investment strategy of buying stocks that appear undervalued and seem to be trading for less than their intrinsic value. It means purchasing stocks that are sold for less than their intrinsic value and therefore getting them at a highly discounted price, with the potential to earn higher than average profits.

What is the intrinsic value of a stock?

Intrinsic value is a measure to assess the value of something independently of other external factors. It is typically used in value investing to evaluate if a stock is worth more than its current market price.

What makes stocks undervalued?

Several aspects can make stocks become undervalued. The efficient market hypothesis argues that the markets are efficient, meaning that the trading price always reflects the accurate cost of the company stock with no room for extra margins.

What is Value Investing?

Value investing as an investment practice was popularized by Benjamin Graham and David Dodd in their 1934 classic treatise “Security Analysis”. The idea itself rests on a very simple premise: Stock prices tend to differ from the intrinsic value of the company in the short term. In the long term however, the stock price and the intrinsic value of the company converge. Therefore, if an investor purchases a stock when it can be bought at a discount to the intrinsic value, the investment is likely to be profitable as the stock price rises to erase the discount or even trade at a premium.

What is Your Favorite Value Stock Investing Book?

There are many value investing books I like and I think investors should read. Every book has its own approach and takes us into the mind of the practitioner. I have noted the books I like and can recommend here.

What do Value Investors do When Markets are not Favorable?

Since most markets are cyclical with booms punctuated by busts or recessions, there are times when value investing does not work for a number of years at a stretch. For example, the US stock market starting from 2008 has seen tremendous growth, but most of the growth has come from momentum stocks. Value stocks have taken a back seat and have underperformed as a group. Investors looking for undervalued stocks have not found many candidates to actual make up a reasonable portfolio. These markets can be frustrating, however a dyed in the wool value investor will find several ways to cope.

Is Value Investing Dead?

Every few years investors ask the question: Is value investing dead? Investors see that value stocks are no longer performing well and the markets are rocketing higher with growth stocks. The glamour and glitz of high growth stocks can be very tempting to many investors, but this is the proverbial flash in the pan. For every Amazon and Google, there are countless high growing companies that fizzled out and investors lost their investments. The fact is, stocks do well when the companies do well, and companies that do well generally have or quickly build a sustainable competitive advantage over others in the industry. Quality, it would seem, is the key determinant of which stocks succeed. Value, as we can anticipate, arises from quality, as the quality and the sustainable competitive advantage provides a moat.

What are value stocks?

Most stocks are classified as either value stocks or growth stocks. Generally speaking, a value stock trades for a price that’s cheaper than its financial performance and fundamentals suggest that it’s worth. A growth stock is a stock in a company expected to deliver above-average returns compared to its industry peers or the overall stock market.

What is the best stock valuation metric?

P/E ratio: This is the best-known stock-valuation metric, and for a good reason. The price-to-earnings, or P/E, ratio can be a very useful tool for comparing valuations of companies in the same industry. To calculate it, simply divide a company's stock price by its last 12 months of earnings.

What are the best stocks to buy for beginners?

3 best value stocks for beginners 1 Berkshire Hathaway: Since CEO Warren Buffett took over in 1964, Berkshire Hathaway has snowballed into a conglomerate of more than 60 wholly owned businesses and a massive stock portfolio with more than four dozen different positions. Berkshire has steadily increased its book value and earnings power over time -- and it currently operates under the same business model that has led the stock to more than double the annualized return of the S&P 500 index for over 55 years. 2 Procter & Gamble: Consumer products manufacturer Procter & Gamble is the company behind brands such as Gillette, Tide, Downy, Crest, Febreze, and Bounty, but there are dozens more in its product portfolio. Through the success of its many brands, Procter & Gamble has been able to steadily add to its revenue over time and has become one of the most reliable dividend stocks in the market, increasing its payout annually for more than 60 consecutive years. 3 Johnson & Johnson: The healthcare giant is best known for its consumer healthcare products, such as the Band-Aid, Tylenol, Neutrogena, Listerine, and Benadryl brand names, just to name a few. But the majority of its revenue comes from its pharmaceutical and medical device businesses. Healthcare is one of the most recession-resistant businesses in the economy, and Johnson & Johnson has produced steady revenue (and dividend) growth over time.

What is a growth stock?

Generally speaking, stocks that trade for valuations below that of the average stock in the S&P 500 are considered value stocks, while stocks with above-average growth rates are considered growth stocks. Some stocks have both attributes or fit in with average valuations ...

Who is the best value investor?

Warren Buffett, the CEO of Berkshire Hathaway, is perhaps the best-known value investor of all time. From the point that Buffett took control of Berkshire in 1964 to the end of 2019, the S&P 500 has generated a total return of 19,784%. Berkshire's total return during the same period has been a staggering 2,744,062%. That's not a typo.

Is Tesla a growth stock?

For example, 130-year-old spice manufacturer McCormick ( NYSE:MKC) is clearly a value stock, while fast-moving Tesla ( NASDAQ:TSLA) is an obvious example of a growth stock. On the other hand, some stocks can fit into either category. For example, there's a case to be made either way for tech giants Apple ( NASDAQ:AAPL) and Microsoft ( NASDAQ:MSFT).

Is Procter and Gamble a dividend stock?

Through the success of its many brands, Procter & Gamble has been able to steadily add to its revenue over time and has become one of the most reliable dividend stocks in the market, increasing its payout annually for more than 60 consecutive years.