What happened to TSMC stock?

TSMC (TSM) closed the most recent trading day at $119.14, moving -0.16% from the previous trading session. Futurum Research Principal Analyst Daniel Newman joins Yahoo Finance Live to discuss Nvidia's stock movement and other aspects of the company's trajectory.

What does TSMC stand for?

Taiwan Semiconductor Manufacturing Company, Limited ( TSMC; Chinese: 台灣積體電路製造股份有限公司; pinyin: Táiwān jī tǐ diànlù zhìzào gǔfèn yǒuxiàn gōngsī, also called Taiwan Semiconductor) is a Taiwanese multinational semiconductor contract manufacturing and design company.

Should Taiwan's TSMC stock be trading at a discount?

Like Saudi Arabia, Taiwan faces significant political turmoil, especially with China's renewed threats to reclaim what it considers its rogue "province." Such a risk infers that TSMC should trade at a discount.

How big is TSMC's market capitalisation?

In March 2017, TSMC's market capitalisation surpassed that of semiconductor giant Intel for the first time, hitting NT$5.14 trillion (US$168.4 billion), with Intel's at US$165.7 billion.

See more

Is TSMC listed in the US?

It has been listed on the Taiwan Stock Exchange (TWSE: 2330) since 1993; in 1997 it became the first Taiwanese company to be listed on the New York Stock Exchange (NYSE: TSM)....TSMC.Total assetsUS$134.29 billion (2021)Total equityUS$77.48 billion (2021)Number of employees65,152 (2021)Chinese name27 more rows

Who owns the most TSMC stock?

Top 10 Owners of Taiwan Semiconductor Manufacturing Co LtdStockholderStakeShares bought / soldThe Vanguard Group, Inc.0.34%-943,606JPMorgan Investment Management, I...0.32%+550,563Fiera Capital Corp. (Investment M...0.30%-379,772MFS International (UK) Ltd.0.26%-2,211,1016 more rows

Is TSMC a publicly traded company?

TSMC is traded on both the Taiwan Stock Exchange (TWSE: 2330) and the New York Stock Exchange (NYSE: TSM).

Can you buy TSMC stock in US?

Taiwan Semiconductor Manufacturing is a semiconductors business based in the US. Taiwan Semiconductor Manufacturing shares (TSM) are listed on the NYSE and all prices are listed in US Dollars.

Who owns Taiwan semiconductor?

Morris ChangMorris ChangKnown forFounder, chairman and CEO, Taiwan Semiconductor Manufacturing Company (TSMC)Spouse(s)Sophie ChangChildren3Chinese name12 more rows

How many shares of TSMC are there?

Share StatisticsAvg Vol (3 month) 310.77MShares Outstanding 55.19BImplied Shares Outstanding 6N/AFloat 84.84B% Held by Insiders 10.04%7 more rows

Is TSMC stock a good buy?

TSMC reported revenue of $15.74 billion, above its $15.4 – $15.7 guidance. It achieved gross margin of 52.7%. Return on equity of 31.3% is a strong 0.6 ppt sequential increase from Q3/2021. TSMC benefited from 7nm accounting for 27% of revenue.

Why is TSMC stock dropping?

Expect TSMC stock to move higher as the effects of the chip shortage continue to multiply through the global economy.

How do I buy shares in TSMC?

How to buy shares in Taiwan Semiconductor Manufacturing CompanyCompare share trading platforms. ... Open and fund your brokerage account. ... Search for Taiwan Semiconductor Manufacturing Company. ... Purchase now or later. ... Decide on how many to buy. ... Check in on your investment.

Does TSMC give a dividend?

What is TSMC's dividend policy? TSMC intends to maintain a sustainable quarterly cash dividend, and to distribute the cash dividend each year at a level not lower than the year before.

Will TSM stock go up?

Based on our forecasts, a long-term increase is expected, the "TSM" stock price prognosis for 2027-06-11 is 227.381 USD. With a 5-year investment, the revenue is expected to be around +169.03%. Your current $100 investment may be up to $269.03 in 2027. Get It Now!

Who does TSMC make chips for?

AppleAs of December 2021, Apple — TSMC's largest customer — contributed 25.93% of the foundry's revenue mostly because the company uses TSMC's latest, most advanced, and most expensive N5 and N5P nodes for hundreds of millions of its chips. MediaTek was the distant second with 5.80%, whereas AMD was TSMC's No.

Should I buy or sell Taiwan Semiconductor Manufacturing stock right now?

8 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Taiwan Semiconductor Manufacturing in the last year. There are cu...

What is Taiwan Semiconductor Manufacturing's stock price forecast for 2022?

8 Wall Street research analysts have issued 12-month price objectives for Taiwan Semiconductor Manufacturing's shares. Their forecasts range from $...

How has Taiwan Semiconductor Manufacturing's stock price performed in 2022?

Taiwan Semiconductor Manufacturing's stock was trading at $120.31 at the beginning of 2022. Since then, TSM stock has decreased by 26.3% and is now...

When is Taiwan Semiconductor Manufacturing's next earnings date?

Taiwan Semiconductor Manufacturing is scheduled to release its next quarterly earnings announcement on Thursday, July 21st 2022. View our earnings...

How were Taiwan Semiconductor Manufacturing's earnings last quarter?

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) issued its quarterly earnings data on Thursday, April, 14th. The semiconductor compan...

How often does Taiwan Semiconductor Manufacturing pay dividends? What is the dividend yield for Taiwan Semiconductor Manufacturing?

Taiwan Semiconductor Manufacturing declared a quarterly dividend on Wednesday, May 11th. Investors of record on Friday, September 16th will be paid...

Is Taiwan Semiconductor Manufacturing a good dividend stock?

Taiwan Semiconductor Manufacturing(NYSE:TSM) pays an annual dividend of $1.50 per share and currently has a dividend yield of 1.69%. The dividend p...

What guidance has Taiwan Semiconductor Manufacturing issued on next quarter's earnings?

Taiwan Semiconductor Manufacturing issued an update on its first quarter 2022 earnings guidance on Friday, April, 22nd. The company provided EPS gu...

Who are Taiwan Semiconductor Manufacturing's key executives?

Taiwan Semiconductor Manufacturing's management team includes the following people: Dr. C. C. Wei , Vice Chairman & CEO Mr. Jen-Chau Huang , VP...

Recently Viewed Tickers

Taiwan Semiconductor Manufacturing Co. Ltd. ADR

Visit a quote page and your recently viewed tickers will be displayed here.

When will Taiwan Semiconductor Manufacturing release its earnings?

Taiwan Semiconductor Manufacturing Co., Ltd. engages in the manufacture and sale of integrated circuits and wafer semiconductor devices.

Does Taiwan Semiconductor have dividends?

Taiwan Semiconductor Manufacturing is scheduled to release its next quarterly earnings announcement on Thursday, October 21st 2021. View our earnings forecast for Taiwan Semiconductor Manufacturing.

The world's most advanced chipmaker is firing on all cylinders

Taiwan Semiconductor Manufacturing does not yet have a strong track record of dividend growth. The dividend payout ratio of Taiwan Semiconductor Manufacturing is 41.59%. This payout ratio is at a healthy, sustainable level, below 75%.

Reviewing TSMC's growth rates

Leo is a tech and consumer goods specialist who has covered the crossroads of Wall Street and Silicon Valley since 2012. His wheelhouse includes cloud, IoT, analytics, telecom, and gaming related businesses. Follow him on Twitter for more updates!

But mind the capex, competition, and cyclical challenges

TSMC's revenue and earnings growth decelerated in 2021 as its gross and operating margins declined. It generated 50% of its revenue from its top-tier 5nm and 7nm wafers in 2021, compared to 41% in 2020.

Is it too late to buy TSMC?

TSMC remains far ahead of Samsung and Intel ( NASDAQ:INTC), its two largest rivals, in the "process race" to manufacture smaller and more advanced chips. But to maintain that lead, TSMC needs to significantly increase its capex every year to develop smaller nodes and expand its overall capacity.

Signals & Forecast

I believe TSMC will remain a linchpin of the semiconductor market, and that Intel's chances of catching up by 2025 are slim to none.

Support, Risk & Stop-loss

There are mixed signals in the stock today. The Taiwan Semiconductor Manufacturing Co stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

Is Taiwan Semiconductor Manufacturing Company Ltd stock A Buy?

Taiwan Semiconductor Manufacturing Co finds support from accumulated volume at $117.61 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

About Taiwan Semiconductor Manufacturing Company Ltd

Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying opportunity as there is a fair chance for Taiwan Semiconductor Manufacturing Co stock to perform well in the short-term.

Golden Star Signal

Taiwan Semiconductor Manufacturing Company Limited manufactures and sells integrated circuits and semiconductors. It also offers customer service, account management, and engineering services.

Top Fintech Company

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

What is the net income of TSMC?

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

Which companies use TSMC?

TSMC results for 2020 were net income of US$17.60 billion on consolidated revenue of US$45.51 billion, which increased 57.5 percent and 31.4 percent respectively from the 2019 level of US$11.18 billion net income and US$34.63 billion consolidated revenue. Its market capitalization was over $550 billion in April 2021.

Where is TSMC fab?

Most of the leading fabless semiconductor companies such as AMD, Apple, ARM, Broadcom, Marvell, MediaTek, Nvidia, and Qualcomm are customers of TSMC, as are emerging companies such as Allwinner Technology, HiSilicon, Spectra7, and Spreadtrum.

When did TSMC acquire Powerchip?

Fab planned as of 2020: TSMC has four Backend Fabs under operation: Fab 1 (Hsinchu), 2 (Tainan), 3 (Taoyuan City), and 5 (Taichung) In 2020, TSMC announced a planned fab in Arizona, USA, intended to begin production by 2024 at a rate of 20,000 wafers per month.

When will TSMC stop shipping?

On 12 January 2011, TSMC announced the acquisition of land from Powerchip Semiconductor for NT$2.9 billion (US$96 million) to build two additional 300mm fabs (Fab 12B) to cope with increasing global demand.

Is TSM listed on the New York Stock Exchange?

On June 27, 2020, TSMC briefly became the world's 10th most valuable company, with a market capitalization of US$410 billion. In July 2020, TSMC confirmed it would halt the shipment of silicon wafers to Chinese telecommunications equipment manufacturer Huawei and its subsidiary HiSilicon by the 14th of September.

How much will TSMc invest in 2021?

It has been listed on the Taiwan Stock Exchange (TWSE: 2330) since 1993; in 1997 it became the first Taiwanese company to be listed on the New York Stock Exchange (NYSE: TSM). Since 1994, TSMC has had a compound annual growth rate (CAGR) of 17.4% in revenue and a CAGR of 16.1% in earnings.

Does TSMC have geopolitical issues?

In the first-quarter 2021 earnings call, the company pledged to invest $100 billion over the next three years to add capacity. TSMC will also receive some help with capacity increases with its fab under construction in Arizona, according to Bloomberg.

Is TSMC a chip stock?

Geopolitical issues could hurt TSMC. Unfortunately, the Arizona facility will account for less than 2% of TSMC's production, which amounted to 12.4 million wafers in 2020. This occurs at a time when foreign governments have become increasingly concerned about Taiwan becoming the Saudi Arabia of chip production.

Reviewing TSMC's Growth Rates

- TSMC's revenue and earnings growth decelerated in 2021 as its gross and operating margins declined. It generated 50% of its revenue from its top-tier 5nm and 7nm wafers in 2021, compared to 41% in 2020. Source: TSMC. YOY = Year over year. *USD terms. TSMC's decelerating revenue growth isn't a major concern, since it faced much easier year-over-year...

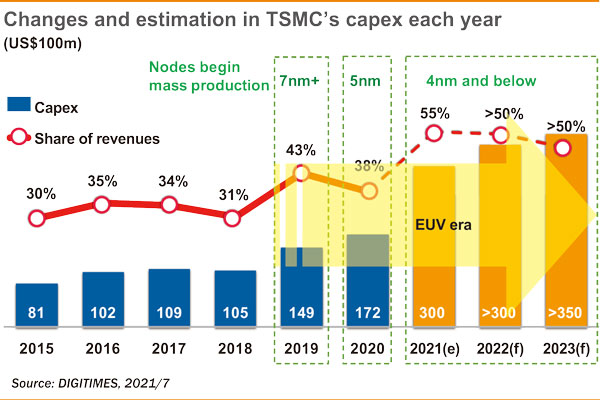

But Mind The Capex, Competition, and Cyclical Challenges

- TSMC remains far ahead of Samsung andIntel (INTC-2.96%), its two largest rivals, in the "process race" to manufacture smaller and more advanced chips. But to maintain that lead, TSMC needs to significantly increase its capex every year to develop smaller nodes and expand its overall capacity. TSMC's capex already rose 65% year over year to $30 billion in 2021, and it plans to bo…

Is It Too Late to Buy TSMC?

- I believe TSMC will remain a linchpin of the semiconductor market, and that Intel's chances of catching up by 2025 are slim to none. I also believe we're experiencing a "supercycle" in chip sales -- fueled by the expansion of the 5G, data center, cloud, AI, Internet of Things (IoT), and autonomous driving markets -- which will last much longer than previous growth cycles. If you a…