Should I buy stock in Walt Disney?

The Walt Disney Co. announced Wednesday it will close 20% of its Disney stores across North America before the end of 2021 in a bid to shift focus to its e-commerce business. The closures will affect roughly one-third, or at least 60, of its brick-and ...

Why buy Disney stock now?

Now, here's why Disney could be one of the best stocks to buy today... Disney stock trades for $177 today. It's down from a year-high of $197, which could indicate a buy opportunity. The stock ...

Is Walt Disney stock currently paying dividends?

You'll often find him writing about stocks in the consumer goods and technology sectors. Disney paid annual dividends of $2.9 billion in 2019. Its balance sheet is bloated from hoarding cash and adding debt during the pandemic. Management reiterated its commitment to paying a dividend but hasn't said when it will do so.

Is Disney a good stock to buy?

- Pros of buying DIS.

- Cons of buying DIS.

- Getting the timing right.

See more

Is Disney a Buy Sell or Hold?

Walt Disney has received a consensus rating of Buy. The company's average rating score is 2.78, and is based on 18 buy ratings, 5 hold ratings, and no sell ratings.

What is a fair price for Disney stock?

The 26 analysts offering 12-month price forecasts for Walt Disney Co have a median target of 142.50, with a high estimate of 176.00 and a low estimate of 110.00. The median estimate represents a +43.36% increase from the last price of 99.40.

What was Disney's highest stock price?

The all-time high Disney stock closing price was 201.91 on March 08, 2021.

Can I buy 1 share of Disney?

Yes, you can buy and sell shares directly through The Walt Disney Company Investment Plan.

What is a good price to buy Disney stock?

According to TipRanks, the average price target for DIS stock is $155, based on the estimate of 22 analysts, suggesting rich gain potential of 52%. Even the pessimists seem to think that the risk-reward dynamic is favorable. On TipRanks, the lowest price target for the stock is $110, $8 above the current price.

Why you should buy Disney stock?

Pros of Buying Disney Stock The quarter recorded more than 73 million paid subscribers to Disney+, 10 million for ESPN+ and 36 million for Hulu. Disney+ launched in November 2019 and has seen massive success in 2020. Disney's subscription services have been a strong play for its business.

Is Disney a good long term investment?

End-of-Year Results Should Lift DIS For long-term investors, buying Disney stock now, when the company is on a downswing, might be a good option. This is because the company has several plans to further increase its profits and has been meeting its long-term goals announced at Investor Day 2020.

Will Disney stock pay dividends in 2021?

Disney CFO Christine McCarthy declared the company's intention to pay a dividend again: "In light of the ongoing recovery from the COVID-19 pandemic as well as our continued prioritization of investments that support our growth initiatives, the board decided not to declare or pay a dividend for the first half of fiscal ...

What is Disney's 2021 worth?

203.61 billion U.S. dollarsIn 2021, the Walt Disney Company held assets worth a total of over 203.61 billion U.S. dollars. In the same year, the American media company generated global revenue of 67.41 billion U.S. dollars.

Who owns the most Disney stock?

The Vanguard Group, Inc.Top 10 Owners of Walt Disney CoStockholderStakeShares ownedThe Vanguard Group, Inc.7.32%133,300,322BlackRock Fund Advisors4.12%75,039,128SSgA Funds Management, Inc.3.96%72,175,793State Farm Investment Management ...1.87%33,996,5926 more rows

What should I invest in right now?

Overview: Top long-term investments in June 2022Growth stocks. In the world of stock investing, growth stocks are the Ferraris. ... Stock funds. ... Bond funds. ... Dividend stocks. ... Value stocks. ... Target-date funds. ... Real estate. ... Small-cap stocks.More items...•

How can I buy Disney stock today?

Direct Investment Through a partnership with Computershare, you can buy Disney stock via The Walt Disney Company Investment Plan. Once you open an account, you can buy and sell stock online or over the phone. As far as specifics go, you should check out the Disney plan prospectus on Computershare's website.

Is Walt Disney stock a Buy, Sell or Hold?

Walt Disney stock has received a consensus rating of buy. The average rating score is A2 and is based on 54 buy ratings, 8 hold ratings, and 1 sell...

What was the 52-week low for Walt Disney stock?

The low in the last 52 weeks of Walt Disney stock was 99.47. According to the current price, Walt Disney is 106.17% away from the 52-week low.

What was the 52-week high for Walt Disney stock?

The high in the last 52 weeks of Walt Disney stock was 187.57. According to the current price, Walt Disney is 56.30% away from the 52-week high.

What are analysts forecasts for Walt Disney stock?

The 63 analysts offering price forecasts for Walt Disney have a median target of 181.03, with a high estimate of 230.00 and a low estimate of 97.00...

What are the biggest players in the streaming market?

When is Cinamacon 2021?

Netflix (NASDAQ: NFLX) and Walt Disney (NYSE: DIS) are the two biggest players in the worldwide streaming content market. The same factors that affect subscriber growth for one sometimes affect subscriber growth for the other as well.

Is Black Widow a one of a kind movie?

The event is taking place from August 23-26 at Caesars Palace. The studio made the decision due to the increasing spread of the COVID-19 Delta variant, particularly a spike in cases in Clark County, NV. Disney still plans to screen a movie at CinamaCon 2021, and a virtual presentation may also take place at the event.

Will Disney executives attend Cinemacon 2021?

As one of the clearest examples yet that the Marvel brand is a one-of-a-kind draw to movie theaters, Black Widow appears poised to smash the global box office this weekend.

Is Disney a modern company?

Disney Executives And Stars Will Not Attend CinemaCon 2021. What happened: The Walt Disney Company (NYSE: DIS) has announced that its executives and stars will not be attending CinemaCon 2021 in Las Vegas. The event is taking place from August 23-26 at Caesars Palace.

What is the Walt Disney Company?

Don’t misunderstand – Disney is also a thoroughly modern company with a firm and growing foothold in the content-streaming revolution. In other words, even if the post-pandemic return to normalcy is stalled, Disney is sufficiently diversified to withstand the rough.

What is the key stats?

The Walt Disney Company, commonly known as Disney, is an American diversified multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank, California.

Where is Disney headquartered?

Key stats. A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. The Walt Disney Company, commonly known as Disney, is an American diversified multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank, California.

Where is Disney Studios?

About. . . The Walt Disney Company, commonly known as Disney, is an American diversified multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank, California.

When was Disney founded?

The Walt Disney Company, commonly known as Disney, is an American diversified multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank, California. Disney was originally founded on October 16, 1923, by brothers Walt and Roy O. Disney as the Disney Brothers Cartoon Studio;

How long are futures trading delayed?

Disney was originally founded on October 16, 1923, by brothers Walt and Roy O. Disney as the Disney Brothers Cartoon Studio; it also operated under the names The Walt Disney Studio and Walt Disney Productions before officially changing its name to The Walt Disney Company in 1986.

How to calculate restricted stock?

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle.

How to calculate P/E?

To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded. A company's dividend expressed as a percentage of its current stock price.

What is public float?

The Price to Earnings (P/E) ratio, a key valuation measure, is calculated by dividing the stock's most recent closing price by the sum of the diluted earnings per share from continuing operations for the trailing 12 month period.

What is Walt Disney?

Public Float. The number of shares in the hands of public investors and available to trade. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded. Dividend Yield.

What is the media network?

The Walt Disney Co. is a diversified international family entertainment and media enterprise. It operates through the following segments: Media Networks, Parks, Experiences and Products, Studio Entertainment and Direct-to-Consumer and International (DTCI). The Media Networks segment includes cable and broadcast television networks, television production and distribution operations, domestic television stations, radio networks and stations. The Parks, Experiences and Products segment owns and operates the Walt Disney World Resort in Florida; the Disneyland Resort in California; Aulani, a Disney Resort & Spa in Hawaii; the Disney Vacation Club; the Disney Cruise Line; and Adventures by Disney. The Studio Entertainment segment produces and acquires live-action and animated motion pictures, direct-to-video content, musical recordings and live stage plays. This segment distributes films primarily under the Walt Disney Pictures, Pixar, Marvel, Lucasfilm and Touchstone banners. The DTCI segment licenses the company's trade names, characters and visual and literary properties to various manufacturers, game developers, publishers and retailers throughout the world. It also develops and publishes games, primarily for mobile platforms, and books, magazines and comic books. This segment also distributes branded merchandise directly through retail, online and wholesale businesses. The company was founded by Walter Elias Disney on October 16, 1923 and is headquartered in Burbank, CA.

Where is Disney headquartered?

The Media Networks segment includes cable and broadcast television networks, television production and distribution operations, domestic television stations, radio networks and stations. The Parks, Experiences and Products segment owns and operates the Walt Disney World Resort in Florida; the Disneyland Resort in California; Aulani, ...

NYSE: DIS

The company was founded by Walter Elias Disney on October 16, 1923 and is headquartered in Burbank, CA.

Should you bring a bucket or a thimble to the buying window for Disney shares?

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Market moves

Entertainment giant Walt Disney ( DIS 0.09% ) is one of those stocks you should buy in almost any situation. As master investors Warren Buffett says, "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." The House of Mouse is the walking, talking definition of a wonderful company.

Disney's unique properties

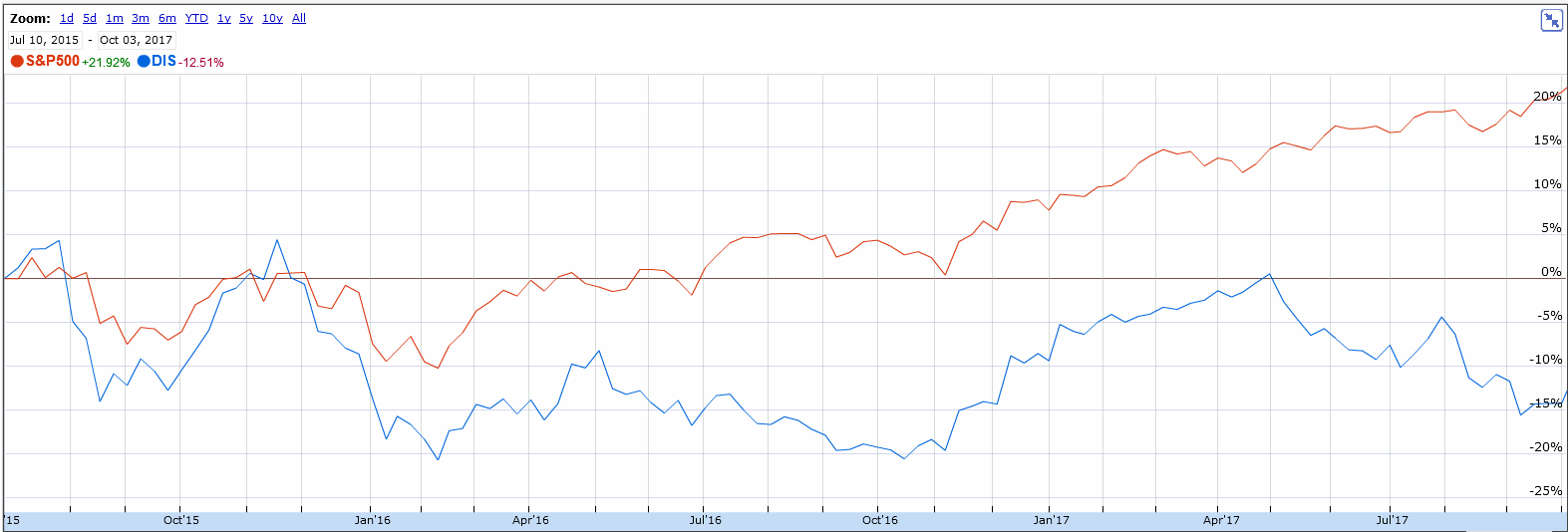

2021 hasn't been kind to us Disney shareholders. Share prices have fallen 2% year-to-date, missing out on a 19% gain for the S&P 500 market barometer.

So, is it time to buy Disney today?

If you think that sounds like an incorrect market reaction to Disney's strong results, you're not alone.

Premium Investing Services

Some might say that Disney looks expensive right now. The stock is trading at lofty valuation ratios such as 283 times trailing earnings and 228 times free cash flows. Surely that's too rich, even for a media titan with nearly a hundred years of history and its eyes on an increasingly digital entertainment market.