MoviePass' majority shareholder (82%), HMNY, is currently trading at $3.00 a share, with a price target of $12. by K C Ma and Matthew Sweeney Today, you pay $6.95 a month to get a MoviePass.

Full Answer

Is MoviePass’s stock still a buy at $17?

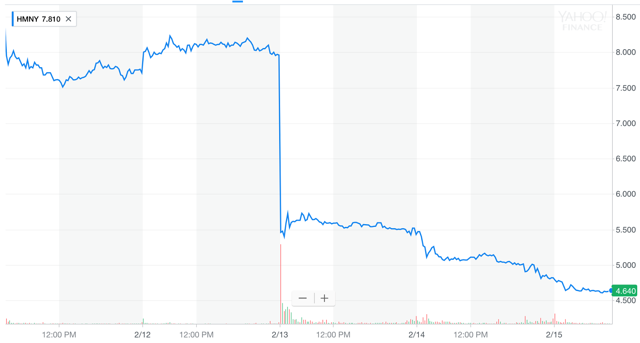

Its stock has fallen 99% to as low as 17 cents per share from nearly $39 last October. That was just after MoviePass announced it was cutting its price to $10 per month. MoviePass recently announced that it has 3 million subscribers. But the cost has also caused analysts to wonder just how sustainable the company can be.

How does MoviePass work?

MoviePass Inc. offers online ticketing services. The Company provides a subscription service that allows customers to attend movies in theaters at a fixed monthly price through a mobile application. Subscribe for $1.99 today. Explore offer.

Why did MoviePass stock crash?

Photo by Darron Cummings/AP/REX/ShutterstockCassie Langdon holds her MoviePass card outside AMC Indianapolis 17 theatre in Indianapolis. MoviePass stock value crashed in the wake of a service interruption, new subscription revenue increase measures, and other disappointments. MoviePass stock dropped to $0.496 as of 3:55 p.m. PT on July 31, 2018.

Is MoviePass coming back from the dead?

A new MoviePass countdown clock has some investors betting on a return for Helios and Matheson In an already whirlwind year, it seems that MoviePass could be coming back from the dead. Helios and Matheson Analytics (OTCMKTS: HMNY ), its parent company, could see its share price come back too.

Is MoviePass publicly traded?

The new entity, MoviePass Entertainment Holdings, will be publicly traded, the company says. The company is also planning to distribute some outstanding shares of MoviePass Entertainment common stock as a dividend to Helios and Matheson shareholders.

How can I buy HMNY stock?

How To Buy HMNYFind a reliable broker. Don't worry, it's easy and free to open a brokerage account. ... Fund your new account. You'll need to transfer money into your new brokerage account before you can buy the stock. ... Search for HMNY on the brokerage app or site. ... Buy the stock.

What happens to my HMNY stock?

HMNY stock lost its Nasdaq Exchange listing, and now trades on the over-the-counter markets. In September 2019, MoviePass called off service for its customers, citing a lack of capital. Helios and Matheson filed for bankruptcy in 2020 after simply running out of cash.

Is Helios and Matheson still in business?

Helios and Matheson Analytics is the parent company of MoviePass and went through a rough patch last year. The company ended up filing for bankruptcy in January 2020 with plans to liquidate its assets.

What company owns MoviePass?

Helios and Matheson AnalyticsMoviePass / Parent organizationHelios and Matheson Analytics was a publicly traded data analytics company based in New York City, New York. It was the parent company of MoviePass. Wikipedia

Does Helios and Matheson own MoviePass?

Key Takeaways. Helios and Matheson Analytics is a data and social media analytics firm that services a broad spectrum of industries. In 2017, Helios purchased movie ticket subscription firm MoviePass to leverage its expertise in the entertainment space.

Who owns Helios and Matheson?

Helios and Matheson Analytics, parent company of MoviePass, CEO Ted Farnsworth (Nasdaq: HMNY) in an exclusive interview, tells Proactive Investors' Christine Corrado the company is going ahead with a a reverse stock split, taking it to US$21 from US$0.09, to avoid being delisted by Nasdaq.

Share this article

Welcome to FTW Explains: a guide to catching up on and better understanding stuff going on in the world.

Could someone just be messing with us?

Absolutely. There’s no real evidence the service is making a comeback. No one has come forward to say the website is theirs.

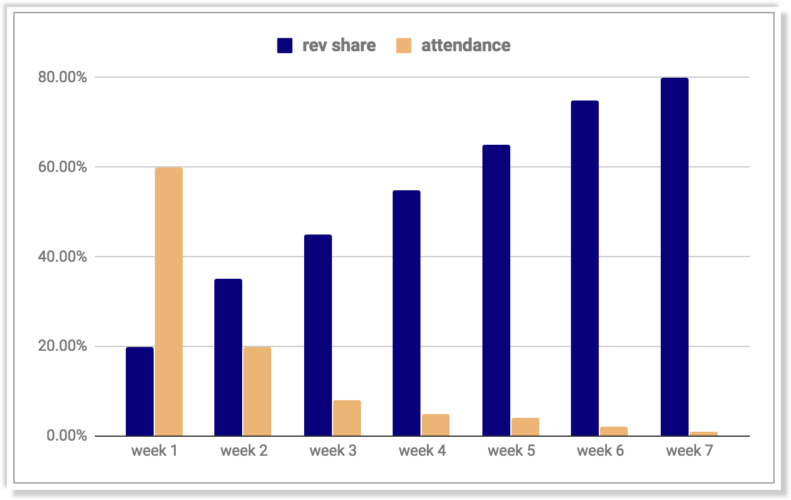

Supply Chain Revenue-Sharing Model

First of all, by offering low prices, MoviePass increases theater traffic and "reconnects the cord" of a struggling movie industry. Since 2002, ticket prices have increased by 54% while ticket sales have fallen by 22%. Pair these numbers with the introduction of streaming and you can easily see the issue. This is where MoviePass comes in.

Explosive Subscriber Growth

With new, disruptive companies, we should focus on revenue and gross margin growth. As both of these increase, profit will eventually follow. In MoviePass' case, investors have been focusing on the unsustainability of their loss leader strategy. However, MoviePass never intended to earn heavily on subscriptions.

Financial Analysis

The total subscription revenue is estimated by the average MoviePass price, at $7.95 (the actual cost at the time) and the historical number of subscribers. The revenue sharing portion is estimated first by identifying 1,053 theaters which they have revenue-sharing contracts with.

Valuation

As MoviePass is still mainly driven by the subscribers' growth, we use Sales Franchise Value Model (SFV) which focuses on future revenue growth and gross margin. Using the input values drawn from the previous discussions, the base case is demonstrated as below:

An Unprofitable Company with A Profitable Stock

At this point, MoviePass might be seen as a company with a business model doomed to fail. How could a subscription-based model survive if the company loses money whenever a new subscriber signs up? However, MoviePass' subscription revenue is just a "loss leader" for company to pay for the renewed theater traffic.

Is MoviePass still inactive?

Additionally, former MoviePass CEO Mitch Lowe says he is not familiar with the countdown, and MoviePass social media accounts have been inactive since 2019.

Is MoviePass 9.99 over the counter?

As Rebecca Rubin wrote for Variety, $9.99 is less than the price of one ticket in most cities. HMNY stock lost its Nasdaq Exchangelisting, and now trades on the over-the-counter markets. In September 2019, MoviePass called off service for its customers, citing a lack of capital.

The movie-ticket subscription service shook up the industry in 2017 and 2018. Things are very different this time

Anders Bylund is a Foolish Technology and Entertainment Specialist. Where the two markets intersect, you'll find his wheelhouse. He has been an official Fool since 2006 but a jester all his life.

Key Points

The original MoviePass service tried to turn an expensive, time-limited promotion into a long-term business plan. It failed dreadfully.

Things are different this time

The rebooted MoviePass will not offer completely unsustainable discounts on movie tickets, the way the first iteration of this company did. Spikes was reportedly a voice of reason back then, fired for his habit of raising objections to the cash-draining operating model.

I mean, they're really different

Keen on staying on the bleeding edge of new technology, Spikes wants to build the new MoviePass service around blockchain technologies. When the service launches this summer, it will let users buy, sell, and trade movie-watching credits through a blockchain-based marketplace.