Should you buy QQQ stock?

Invesco QQQ Trust Series 1. Follow. $344.44. Pre-market: $341.84. (0.75%) -2.60. Closed: Mar 18, 4:52:43 AM GMT-4 · USD · NASDAQ · Disclaimer. No data. close.

Is QQQ a good investment?

Apr 08, 2022 · Get a real-time stock price quote for QQQ (Invesco QQQ Trust). Also includes news, ETF details and other investing information.

Is QQQ overvalued or undervalued?

Apr 11, 2022 · Invesco QQQ Trust's stock was trading at $195.22 on March 11th, 2020 when COVID-19 (Coronavirus) reached pandemic status according to the World Health Organization. Since then, QQQ shares have increased by 74.6% and is now trading at $340.89. View which stocks have been most impacted by COVID-19.

What companies are in QQQ ETF?

Apr 06, 2022 · One share of QQQ stock can currently be purchased for approximately $353.26. How much money does Invesco QQQ Trust make? Invesco QQQ Trust has a market capitalization of $191.63 billion.

What is a good price for QQQ?

QQQ Price/Volume Stats - 7 Best ETFs for the NEXT Bull MarketCurrent price$346.3552-week highPrev. close$339.4552-week lowDay low$339.06VolumeDay high$347.43Avg. volume50-day MA$348.45Dividend yield1 more row

Is QQQ ETF a good investment?

The QQQ ETF offers investors big rewards during bull markets, the potential for long-term growth, ready liquidity, and low fees. QQQ usually declines more in bear markets, has high sector risk, often appears overvalued, and holds no small-cap stocks.

Does QQQ pay dividend?

Invesco QQQ Trust (QQQ) QQQ has a dividend yield of 0.50% and paid $1.74 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Mar 21, 2022.

What is the average return for QQQ?

Quarter-End Average Annual Total Returns As of 03/31/2022AverageNAV ReturnMarket Return1 Year+13.91+8.38%3 Year+27.04+21.59%5 Year+23.15+18.96%10 Year+19.42+16.55%2 more rows

How do I buy QQQ stock?

How to buy shares in Invesco QQQ Trust Series 1Compare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. ... Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

Which is better QQQ or VOO?

If you want a single diversified investment that may not earn as much but carries less risk, VOO may be your best. On the other hand, if you're willing to take on more risk for the chance at earning higher returns, QQQ could be a solid addition to your investments.Apr 5, 2022

Which ETF has the highest dividend?

Top 100 Highest Dividend Yield ETFsSymbolNameDividend YieldGTOInvesco Total Return Bond ETF7.96%JEPIJPMorgan Equity Premium Income ETF7.95%IAUFiShares Gold Strategy ETF7.85%SDIVGlobal X SuperDividend ETF7.76%93 more rows

What is VOO dividend yield?

Vanguard S&P 500 (VOO): Dividend Yield The Vanguard S&P 500 (VOO) ETF granted a 1.59% dividend yield in 2021.Mar 31, 2022

How much is the dividend for QQQ?

$1.74Invesco QQQ - 17 Year Dividend History | QQQ The current TTM dividend payout for Invesco QQQ (QQQ) as of April 01, 2022 is $1.74. The current dividend yield for Invesco QQQ as of April 01, 2022 is 0.48%.

How much does QQQ grow per year?

In the last 30 Years, the Invesco QQQ Trust (QQQ) ETF obtained a 14.12% compound annual return, with a 23.44% standard deviation. In 2021, the ETF granted a 0.54% dividend yield.

What holdings are in QQQ?

Top 10 HoldingsCompanySymbolTotal Net AssetsApple Inc.AAPL12.34%Microsoft Corp.MSFT10.22%Amazon.com Inc.AMZN7.10%Tesla Inc.TSLA3.98%6 more rows

What is the highest QQQ has ever been?

Invesco QQQ - 23 Year Stock Price History | QQQ The latest closing stock price for Invesco QQQ as of April 11, 2022 is 340.89. The all-time high Invesco QQQ stock closing price was 403.99 on November 19, 2021. The Invesco QQQ 52-week high stock price is 408.71, which is 19.9% above the current share price.

How has Invesco QQQ Trust's stock price been impacted by COVID-19?

Invesco QQQ Trust's stock was trading at $195.22 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organizati...

How often does Invesco QQQ Trust pay dividends? What is the dividend yield for Invesco QQQ Trust?

Invesco QQQ Trust declared a quarterly dividend on Friday, December 17th. Investors of record on Tuesday, December 21st will be given a dividend of...

Is Invesco QQQ Trust a good dividend stock?

Invesco QQQ Trust pays an annual dividend of $1.70 per share and currently has a dividend yield of 0.51%. View Invesco QQQ Trust's dividend history .

Who are some of Invesco QQQ Trust's key competitors?

Some companies that are related to Invesco QQQ Trust include JPMorgan Chase & Co. (JPM) , SPDR S&P 500 ETF Trust (SPY) , Bank of America (BAC) ,...

What other stocks do shareholders of Invesco QQQ Trust own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Invesco QQQ Trust investors own include NVIDIA (NVDA) , S...

What is Invesco QQQ Trust's stock symbol?

Invesco QQQ Trust trades on the NASDAQ under the ticker symbol "QQQ."

Who are Invesco QQQ Trust's major shareholders?

Invesco QQQ Trust's stock is owned by a number of institutional and retail investors. Top institutional investors include Bank of America Corp DE (...

Which institutional investors are selling Invesco QQQ Trust stock?

QQQ stock was sold by a variety of institutional investors in the last quarter, including Citigroup Inc., Susquehanna International Group LLP, Cita...

Which institutional investors are buying Invesco QQQ Trust stock?

QQQ stock was bought by a variety of institutional investors in the last quarter, including Bank of America Corp DE, Parallax Volatility Advisers L...

How long do Q.Ai ETFs last?

Q.ai's deep learning algorithms have identified several to look out for based on their fund flows over the last 90-days, 30-days, and 7-days.

Is ETF market booming?

In a booming stock market, the ETF industry is seeing explosive growth piling up huge assets in recent years. This has resulted in enough liquidity with most of the funds trading at extremely higher vol...

How has Invesco QQQ Trust's stock been impacted by COVID-19?

Invesco QQQ Trust's stock was trading at $195.22 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organization (WHO). Since then, QQQ shares have increased by 74.9% and is now trading at $341.51. View which stocks have been most impacted by COVID-19.

How often does Invesco QQQ Trust pay dividends? What is the dividend yield for Invesco QQQ Trust?

Invesco QQQ Trust announced a quarterly dividend on Friday, December 17th. Investors of record on Tuesday, December 21st will be given a dividend of $0.491 per share on Friday, December 31st. This represents a $1.96 dividend on an annualized basis and a yield of 0.58%. The ex-dividend date is Monday, December 20th.

Is Invesco QQQ Trust a good dividend stock?

Invesco QQQ Trust pays an annual dividend of $1.70 per share and currently has a dividend yield of 0.49%. View Invesco QQQ Trust's dividend history.

Who are some of Invesco QQQ Trust's key competitors?

Some companies that are related to Invesco QQQ Trust include JPMorgan Chase & Co.

What other stocks do shareholders of Invesco QQQ Trust own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Invesco QQQ Trust investors own include NVIDIA (NVDA), SPDR S&P 500 ETF Trust (SPY), Netflix (NFLX), Alibaba Group (BABA), Tesla (TSLA), Walt Disney (DIS), PayPal (PYPL), Visa (V), Boeing (BA) and Bank of America (BAC).

Who are Invesco QQQ Trust's major shareholders?

Invesco QQQ Trust's stock is owned by a number of retail and institutional investors. Top institutional shareholders include Bank of America Corp DE (0.00%), Barclays PLC (0.00%), Susquehanna International Group LLP (0.00%), Citadel Advisors LLC (0.00%), Millennium Management LLC (0.00%) and Citigroup Inc. (0.00%).

Which institutional investors are selling Invesco QQQ Trust stock?

QQQ stock was sold by a variety of institutional investors in the last quarter, including Citigroup Inc., Susquehanna International Group LLP, Citadel Advisors LLC, Wolverine Trading LLC, Goldman Sachs Group Inc., Laurion Capital Management LP, Elliott Investment Management L.P., and Gladius Capital Management LP.

Is Invesco QQQ Trust a good dividend stock?

Invesco QQQ Trust pays an annual dividend of $1.70 per share and currently has a dividend yield of 0.50%.

What other stocks do shareholders of Invesco QQQ Trust own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Invesco QQQ Trust investors own include Tesla (TSLA), NVIDIA (NVDA), Advanced Micro Devices (AMD), Walt Disney (DIS), Netflix (NFLX), AbbVie (ABBV), Alibaba Group (BABA), JPMorgan Chase & Co. (JPM), PayPal (PYPL) and AT&T (T).

What is Invesco QQQ Trust's stock symbol?

Invesco QQQ Trust trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "QQQ."

How do I buy shares of Invesco QQQ Trust?

Shares of QQQ can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

What is Invesco QQQ Trust's stock price today?

One share of QQQ stock can currently be purchased for approximately $329.61.

What companies does QQQ own?

QQQ stock holdings include 100 of the biggest companies in the Nasdaq, such as Apple, Amazon, Google, and Facebook.

What is Invesco QQQ?

What Is the Invesco QQQ ETF? QQQ is an ETF that includes 100 of the largest international and domestic companies listed on the Nasdaq stock exchange, just like the Nasdaq 100 Index that it tracks. 1 The index excludes financial companies, and it is based on market capitalization.

Which companies have strong cash flow?

Also, Microsoft, Google, and Amazon all have strong operational cash flow. Most of these top stock holdings consistently deliver on the bottom line, which helps investors feel secure. Amazon, for its part, makes significant investments in expanding its businesses.

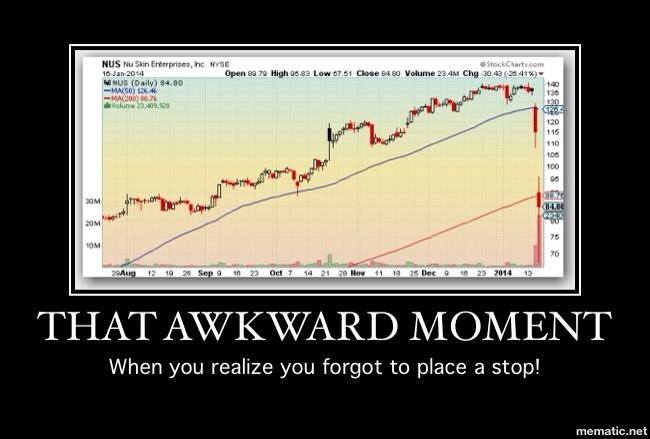

Does QQQ outperform the S&P 500?

High bear market risk: Just as QQQ tends to outperform the S&P 500 during bull markets, it also often underperforms during bear markets. In particular, the QQQ stock price declined significantly when the dotcom bubble collapsed.