How much is an IAG share worth?

Mar 31, 2022 · 7 Wall Street analysts have issued 1-year price targets for IAMGOLD's stock. Their forecasts range from $2.75 to $5.00. On average, they anticipate IAMGOLD's stock price to reach $3.59 in the next year. This suggests a possible upside of 5.1% from the stock's current price.

What are analysts'target prices for Iamgold's stock?

IAMGOLD (IAG) Stock Price, News & Info | The Motley Fool IAMGOLD (IAG) New York Stock Exchange IAG $3.64 $0.16 4.6% Price as of April 1, 2022, 4:00 p.m. ET …

What do analysts see for International Consolidated Airlines Group's stock's price?

IAG | Complete International Consolidated Airlines Group S.A. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

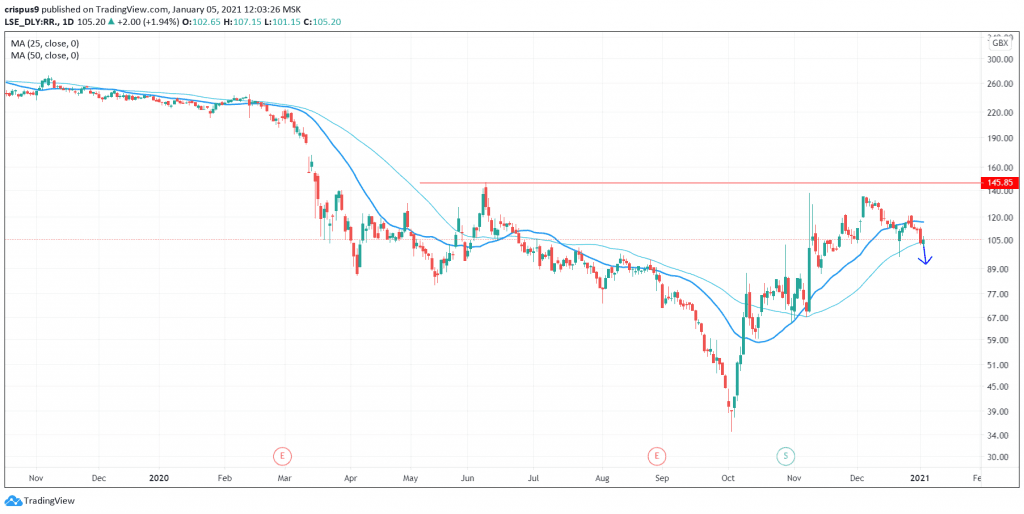

Is it an opportunity to go long on IAG?

IAG has activated a divergence between price and MACD with target price at 2.70€ that is +24% from current price. Once reached this price a second impulse will be …

Is IAG successful?

Overall Iago was successful; he didn't get promoted to Cassio's job, but he did ruin Othello's life like he wanted to. He seemed to enjoy carrying out the plan, which is the main reason he did it.

Is IAG SA a buy?

According to data compiled by MarketBeat, as of 23 March, eight of the 11 analysts surveyed recommended IAG stock a 'buy' and three rated it a 'hold'.Mar 23, 2022

How much are British Airways shares worth today?

LSE the current share price is 145.48p (25 minute delay). British Airways is owned by International Consolidated Airlines (IAG) a leading Airlines business based in the UK. It opened the day at 141.96p, after a previous close of 140.3p.

Is I Am gold a good buy?

Is IAMGOLD a buy right now? 6 Wall Street analysts have issued "buy," "hold," and "sell" ratings for IAMGOLD in the last year. There are currently 1 sell rating, 2 hold ratings and 3 buy ratings for the stock. The consensus among Wall Street analysts is that investors should "hold" IAMGOLD stock.

Is Airline Stock good to buy now?

Bottom line: Airline stocks are not buys right now. Investors eager to play the recovery could step in once those stocks enter buy zones. But IBD advises investors to seek out stocks with better ratings that are closer to their highs.3 days ago

Will capita shares go up?

The median estimate represents a 160.42% increase from the last price of 21.12....Share price forecast.High231.4%70.00Med160.4%55.00Low-0.6%21.00

How do I buy IAG L shares?

How to buy shares in IAGChoose a platform. If you're a beginner, our share-dealing table below can help you choose.Open your account. ... Confirm your payment details. ... Search the platform for stock code: IAG in this case.Research IAG shares. ... Buy your IAG shares.

What are British Airways shares called?

That's because British Airways is part of International Airline Group, which trades on the London Stock Exchange under the ticker symbol IAG.Aug 6, 2021

Is IMG a good buy?

Iamgold Corp(IMG-T) Rating A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock.

Is IAMGOLD a buy right now?

7 Wall Street analysts have issued "buy," "hold," and "sell" ratings for IAMGOLD in the last year. There are currently 5 hold ratings and 2 buy rat...

How has IAMGOLD's stock price been impacted by COVID-19 (Coronavirus)?

IAMGOLD's stock was trading at $2.52 on March 11th, 2020 when COVID-19 (Coronavirus) reached pandemic status according to the World Health Organiza...

Are investors shorting IAMGOLD?

IAMGOLD saw a decrease in short interest in the month of February. As of February 28th, there was short interest totaling 8,600,000 shares, a decre...

When is IAMGOLD's next earnings date?

IAMGOLD is scheduled to release its next quarterly earnings announcement on Monday, May 2nd 2022. View our earnings forecast for IAMGOLD .

How were IAMGOLD's earnings last quarter?

IAMGOLD Co. (NYSE:IAG) posted its quarterly earnings results on Wednesday, February, 23rd. The mining company reported $0.09 earnings per share for...

What price target have analysts set for IAG?

7 Wall Street analysts have issued 1-year price objectives for IAMGOLD's shares. Their forecasts range from $3.00 to $5.00. On average, they expect...

Who are IAMGOLD's key executives?

IAMGOLD's management team includes the following people: Daniella Elena Dimitrov , President, Chief Executive & Financial Officer Bruno Lemelin ,...

What is Peter Harmer's approval rating as IAMGOLD's CEO?

87 employees have rated IAMGOLD CEO Peter Harmer on Glassdoor.com . Peter Harmer has an approval rating of 84% among IAMGOLD's employees.

Who are some of IAMGOLD's key competitors?

Some companies that are related to IAMGOLD include Pan American Silver (PAAS) , Yamana Gold (AUY) , B2Gold (BTG) , B2gold (BTG) , First Majest...

About IAMGOLD

IAMGOLD (NYSE:IAG) Frequently Asked Questions

IAMGOLD Corp. engages in the exploration, development and production of gold and mineral resource properties. It owns and operates the Westwood mine in Quebec and the Cote Gold project, a development project located in Ontario.

New York Stock Exchange

7 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for IAMGOLD in the last twelve months. There are currently 5 hold ratings and 2 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should "hold" IAMGOLD stock.

Environmental, Social, and Governance Rating

The Company is engaged in the exploration, development and operation of gold mining properties and of a niobium mine.

Business Summary

"B" score indicates good relative ESG performance and an above-average degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.

How many aircraft does British Airways have?

The Company is engaged in the exploration, development and operation of gold mining properties and of a niobium mine.

Is 2.5 EUR risky?

It combines the airlines in the United Kingdom, Spain and Ireland. It has approximately 550 aircrafts to over 280 destinations.

About International Consolidated Airlines Group

The idea is to hold - Hospitality Business is still too risky. Level 2.5 EUR is a significant level. (Based on the latest news on the COVID in Europe, the idea of going long is 55%, short 45%)

International Consolidated Airlines Group (LON:IAG) Frequently Asked Questions

International Consolidated Airlines Group, S.A., together with its subsidiaries, engages in the provision of passenger and cargo transportation services in the United Kingdom, Spain, Ireland, the United States, and rest of the world. The company operates under the British Airways, Iberia, Vueling, Aer Lingus, and LEVEL brands.

Signals & Forecast

12 Wall Street analysts have issued "buy," "hold," and "sell" ratings for International Consolidated Airlines Group in the last twelve months. There are currently 3 hold ratings and 9 buy ratings for the stock.

Support, Risk & Stop-loss

Mostly positive signals in the chart today. The Iamgold Corporation stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock, but the stock has a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

Is Iamgold Corporation stock A Buy?

Iamgold Corporation finds support from accumulated volume at $2.79 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

About Iamgold Corporation

Several short-term signals are positive, despite the stock being in a falling trend, we conclude that the current level may hold a buying opportunity as there is a fair chance for stock to perform well in the short-term. We have upgraded our analysis conclusion for this stock since the last evaluation from a Sell to a Buy candidate.

Golden Star Signal

IAMGOLD Corporation explores for, develops, and operates mining properties in North and South America, and West Africa. The company explores for gold, copper, zinc, and silver.

Top Fintech Company

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

When will IAG pay dividends?

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

When is the IAFNF earnings call 2021?

This dividend will be payable on June 15, 2021, to all common shareholders of record at the close of business on May 21, 2021.