How much is the dividend of FNB?

Get FNB Corp (FNB'E:NYSE) real-time stock quotes, news, price and financial information from CNBC.

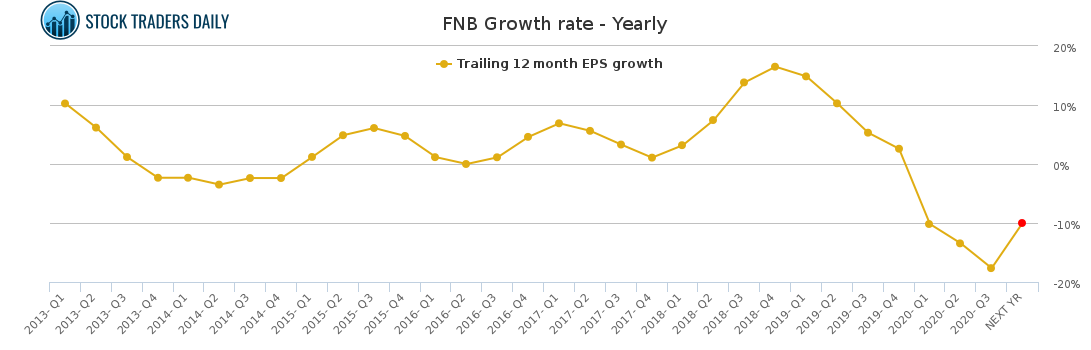

Does FNB’s earnings hold clues to what lies ahead for the stock?

You can watch FNB-E and buy and sell other stock and options commission-free on Robinhood. Change the date range, see whether others are buying or selling, read news, get earnings results, and compare F.N.B. (Preferred) against related stocks people have also bought. ... Open price. $26.89. Volume. 6.64K. 52 Week high. $31.43. 52 Week low. $25.46.

What is the rating of FNB Corporation?

Open $27.23. High $27.36. Low $27.16. Trade FNB-E. FNB-E. Download the Public app to invest in this stock with any amount of money. Enter your …

What does FNB do for a living?

F.N.B. Corporation Depositary Shares, each representing a 1/40th interest in a share of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series E (FNB^E) Stock Quotes - …

Is FNB a buy?

F.N.B. has received a consensus rating of Buy. The company's average rating score is 2.67, and is based on 4 buy ratings, 2 hold ratings, and no sell ratings.

Is National Bank of Canada stock a good buy?

Is National Bank of Canada a good investment or a top pick? National Bank of Canada was recommended as a Top Pick by on . Read the latest stock experts ratings for National Bank of Canada.

Who bought FNB?

Simultaneously with the parent company merger, Howard Bank will merge with and into FNB's subsidiary, First National Bank of Pennsylvania. Vincent J. Delie, Jr., Chairman, President and Chief Executive Officer of F.N.B.Jul 13, 2021

Are banks a good investment now?

The banking sector is a good choice for value investors. Value investors look for stocks that trade for less than their intrinsic value. The banking sector pays dividends, which demonstrates a great history and provide investors with a share in profits.

Why is National Bank of Canada stock down?

While the overall growth trend in National Bank's financials looks impressive, it missed Street analysts' earnings and revenue estimates in the latest quarter by a narrow margin. Its latest quarterly earnings miss could be the reason why its stock tanked by nearly 3.5% Wednesday.Dec 2, 2021

Did FNB Buy Howard bank?

On Jan. 22, Pittsburgh-based FNB Corp. completed its merger with Howard Bancorp Inc., the holding company of Howard Bank, a move that will make First National Bank the sixth-largest bank in the Baltimore metropolitan region by deposit share. The customer and branch conversion will be final on Feb.Jan 28, 2022

What bank did Fnbo buy?

Western States BankI'm pleased to announce that FNBO has entered into a definitive merger agreement with Western States Bank (wsb. bank), pending regulatory approval. Western States Bank is headquartered in Wyoming and has a 10-branch network across Northern Colorado, Western Nebraska, and Southeastern Wyoming.Nov 22, 2021

Who does Bancorp own?

U.S. Bank National AssociationIt is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions.

About FNB-E

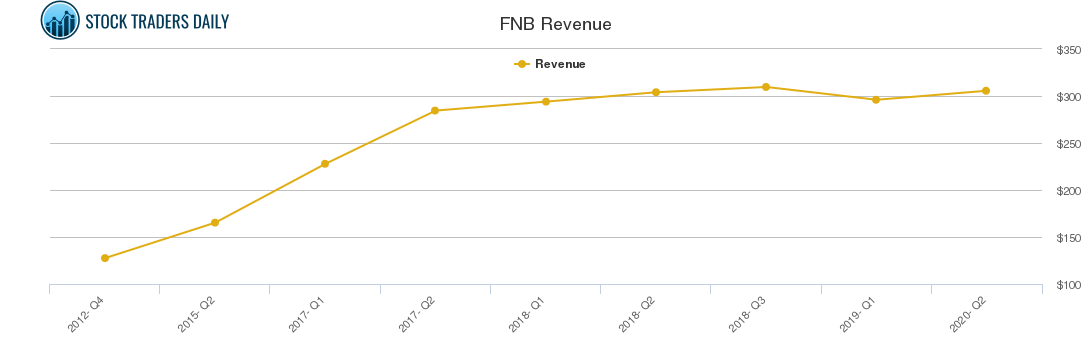

F.N.B. Corp. is a financial holding company. It engages in the provision of financial services to consumers, corporations, governments, and small to medium-sized businesses. The firm operates through the following segments: Community Banking, Wealth Management, Insurance, and Other.

Stats

Download the Public app to invest in this stock with any amount of money. Enter your cell phone number below to get started.