What is the price-to-free cash flow ratio (P/FCF)?

CAPS - Stock Picking Community Other Services The Ascent First Commonwealth Financial (FCF) New York Stock Exchange FCF $14.45 -$0.20 -1.4% Price as of April 14, 2022, 4:00 p.m. ET …

Do you know how much free cash flow (FCF) is available?

Apr 02, 2022 · First Commonwealth Financial Stock Forecast, Price & News $15.07 -0.16 (-1.05%) (As of 04/4/2022 12:00 AM ET) Today's Range $14.94 $15.23 50-Day Range $15.07 $16.93 52-Week Range $12.36 $17.63 Volume 402,786 shs Average Volume 587,758 shs Market Capitalization $1.42 billion P/E Ratio 10.39 Dividend Yield 3.02% Beta 1.02 Profile

Where can I buy shares of FCF?

Aug 28, 2020 · Price to free cash flow is an equity valuation metric used to compare a company's per-share market price to its per-share amount of free …

What does a low P/FCF ratio mean for a stock?

Historical price to free cash flow ratio values for Greenidge Generation Holdings (GREE) since 2020. For more information on how our historical price data is adjusted see the Stock Price Adjustment Guide .

Is First Commonwealth Financial a buy right now?

6 Wall Street analysts have issued "buy," "hold," and "sell" ratings for First Commonwealth Financial in the last year. There are currently 2 hold...

How has First Commonwealth Financial's stock been impacted by Coronavirus?

First Commonwealth Financial's stock was trading at $9.60 on March 11th, 2020 when Coronavirus reached pandemic status according to the World Healt...

When is First Commonwealth Financial's next earnings date?

First Commonwealth Financial is scheduled to release its next quarterly earnings announcement on Tuesday, April 26th 2022. View our earnings forec...

How were First Commonwealth Financial's earnings last quarter?

First Commonwealth Financial Co. (NYSE:FCF) posted its earnings results on Tuesday, January, 25th. The bank reported $0.37 earnings per share (EPS)...

How often does First Commonwealth Financial pay dividends? What is the dividend yield for First Commonwealth Financial?

First Commonwealth Financial declared a quarterly dividend on Tuesday, January 25th. Stockholders of record on Friday, February 4th will be paid a...

Is First Commonwealth Financial a good dividend stock?

First Commonwealth Financial pays an annual dividend of $0.46 per share and currently has a dividend yield of 2.91%. First Commonwealth Financial h...

What price target have analysts set for FCF?

6 equities research analysts have issued 12-month price targets for First Commonwealth Financial's stock. Their forecasts range from $16.50 to $19....

Who are First Commonwealth Financial's key executives?

First Commonwealth Financial's management team includes the following people: Thomas Michael Price , President, Chief Executive Officer & Directo...

What is T. Michael Price's approval rating as First Commonwealth Financial's CEO?

28 employees have rated First Commonwealth Financial CEO T. Michael Price on Glassdoor.com . T. Michael Price has an approval rating of 66% among...

Who bought FCF stock?

What does "hold" mean in FCF?

FCF stock was purchased by a variety of institutional investors in the last quarter, including State of Alaska Department of Revenue. Company insiders that have bought First Commonwealth Financial stock in the last two years include Matthew C Tomb, and Stephen A Wolfe.

What is the dividend payout ratio of First Commonwealth Financial?

A hold rating indicates that analysts believe investors should maintain any existing positions they have in FCF, but not buy additional shares or sell existing shares. View analyst ratings for First Commonwealth Financial or view top-rated stocks.

Is First Commonwealth Financial a hold?

First Commonwealth Financial does not yet have a strong track record of dividend growth. The dividend payout ratio of First Commonwealth Financial is 56.79%. This payout ratio is at a healthy, sustainable level, below 75%. Based on earnings estimates, First Commonwealth Financial will have a dividend payout ratio of 38.98% next year.

How to calculate price to free cash flow?

Wall Street analysts have given First Commonwealth Financial a "Hold" rating, but there may be better buying opportunities in the stock market. Some of MarketBeat's past winning trading ideas have resulted in 5-15% weekly gains.

Why is price to free cash flow important?

It is calculated by dividing its market capitalization by free cash flow values.

What does it mean when a company has a lower price to free cash flow?

Because price to free cash flow is a value metric, lower numbers generally indicate that a company is undervalued and its stock is relatively cheap in relation to its free cash flow . Conversely, higher price to free cash flow numbers may indicate that the company's stock is relatively overvalued in relation to its free cash flow.

Who is James Chen?

A lower value for price to free cash flow indicates that the company is undervalued and its stock is relatively cheap. A higher value for price to free cash flow indicates an overvalued company.

How to calculate free cash flow yield?

James Chen, CMT, is the former director of investing and trading content at Investopedia. He is an expert trader, investment adviser, and global market strategist. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years.

What does it mean when a company has a positive free cash flow?

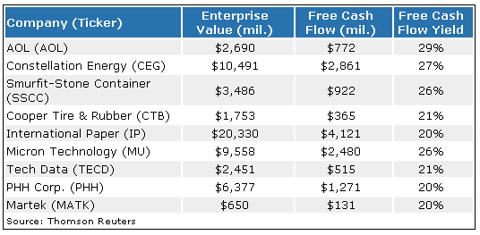

Another way to calculate free cash flow yield is to use enterprise value as the divisor. To many, enterprise value is a more accurate measure of the value of a firm, as it includes the debt, value of preferred shares and minority interest, but minus cash and cash equivalents. The formula is as follows:

Why do investors use cash flow statements?

When free cash flow is positive, it indicates the company is generating more cash than is used to run the business and reinvest to grow the business. It’s fully capable of supporting itself, and there is plenty of potential for further growth. A negative free cash flow number indicates the company is not able to generate sufficient cash ...

What is a positive cash flow?

Also, investors who recognize the importance of cash generation use the company's cash flow statements when analyzing its fundamentals. They acknowledge that these statements offer a better representation of the company's operations.

Why do small businesses not have free cash flow?

A company that has a positive net cash flow is meeting operating expenses at the current time, but not long-term costs, so it is not always an accurate measurement of the company’s progress or success.) The P/E ratio measures how much annual net income is available per common share.

What is a lacfy?

However, many small businesses do not have positive free cash flow as they are investing heavily to grow their venture rapidly. Free cash flow is similar to earnings for a company without the more arbitrary adjustments made in the income statement.

Is free cash flow a fundamental indicator?

Though not commonly used in company valuation, liability-adjusted cash flow yield (LACFY) is a variation. This fundamental analysis calculation compares a company's long-term free cash flow to its outstanding liabilities over the same period. Liability adjusted cash flow yield can be used to determine how long it will take for a buyout to become profitable or how a company is valued. The calculation is as follows:

What is FCF in finance?

Investors who wish to employ the best fundamental indicator should add free cash flow yield to their repertoire of financial measures. You should not depend on just one measure, of course. However, the free cash flow amount is one of the most accurate ways to gauge a company's financial condition.

Why use FCF?

In other words, FCF measures a company’s ability to produce what investors care most about: cash that’s available to be distributed in a discretionary way.

What is it called when you own stock?

Companies can also use their FCF to expand business operations or pursue other short-term investments. Compared to earnings per se, free cash flow is more transparent in showing the company’s potential to produce cash and profits. Meanwhile, other entities looking to invest.

Why is price to free cash flow important?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. pricing.

What does 15 mean in a price to free to free cash flow?

The metric is used because it helps to understand a company’s assets, liquidity, and revenue. Price to free cash flow can be manipulated on financial statements by preserving cash or putting off purchases, but it’s still a good measure of how a company is doing. A low price to free cash flow suggests the company’s market cap is low relative to ...

Why do you want a lower free cash flow?

A price to free to free cash flow under 15 means the company is trading for a market capitalization that’s less than 15 times the free cash flow it generated over the past 12 months. These are rolling 12-month periods, and that 15 number is a good rule of thumb. Higher ratios might suggest the market capitalization is lofty relative to ...

What is Kinross Gold Corporation?

That’s why you want a lower free cash flow – it’s because the company is trading at a low multiple of cash flows. It’s clear that lots of free cash flow can make attractive investment opportunities, which begs the question:

What is Pitney Bowes?

Kinross Gold Corporation ( NYSE:KGC) is a Toronto, Canada-based gold and silver mining company founded in 1993. These days it has a price to free cash flow ratio of 2.9, putting it just above 1800 Flowers but still very low relative to the majority of companies trading on the market.

What is 1-800-Flowers.com?

Pitney Bowes Inc ( NYSE:PBI) is a Stamford, Connecticut-based tech company most well known for its postage meters and services. The company also has a price to free cash flow ratio of 9.8, making it an compelling investment based on this metric.

Which companies have a high free cash flow?

This is astounding and puts the ecommerce gift giant at the top of the list. This $2 billion company is a floral and food gift delivery company that gets a big boost from holidays like Mother’s Day and Valentine’s Day.

What is the price to free cash flow ratio?

Companies like Verizon ( VZ ), Walmart ( WMT ), and Pfizer ( PFE) also have a high free cash flow. When sales are high and costs are in check, a company like Verizon or Walmart can post enormous levels of cash. After all, top line revenues are the source of all cash that a company makes, and cash is the lifeblood of any company.

What is free cash flow?

The Price to Free Cash Flow Ratio, or P / FCF Ratio, values a company against its Free Cash Flow. It is the Share Price of the company divided by its Free Cash Flow per Share. This is measured on a TTM basis and uses diluted shares outstanding.

Is P/FCF more expensive than other investment multiples?

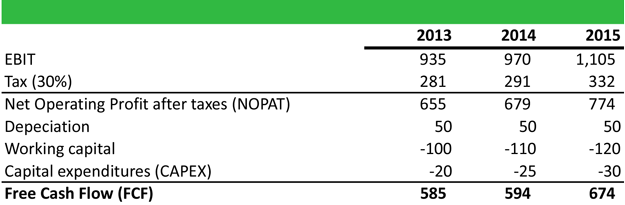

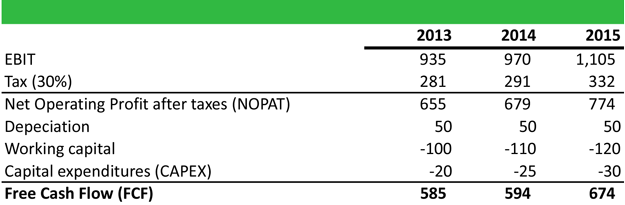

Free Cash Flow is the amount left over a company can use to pay down debt, distribute as dividends, or reinvest to grow the business. It is Operating Cash Flow minus Capital Expenditures. A more detailed definition would be: