Who bought CHMI stock?

Mar 18, 2022 · CHMI-A support price is $24.95 and resistance is $25.32 (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility and applying a one standard deviation move around the stock's closing price, stastically there is a 67% probability that CHMI-A stock will trade within this expected range on the day.

Is Cherry Hill mortgage investment (CHMI) a great dividend stock?

Apr 03, 2022 · Cherry Hill Mortgage Investment's stock was trading at $12.25 on March 11th, 2020 when Coronavirus (COVID-19) reached pandemic status according to the World Health Organization. Since then, CHMI stock has decreased by 40.0% and is now trading at $7.35. View which stocks have been most impacted by COVID-19.

Will Cherry Hill mortgage investment (CHMI) outperform or underperform the S&P 500?

Apr 08, 2022 · The Cherry Hill Mortgage Investment Corp stock price gained 0.14% on the last trading day (Friday, 8th Apr 2022), rising from $7.34 to $7.35.During the day the stock fluctuated 0.54% from a day low at $7.35 to a day high of $7.39.The price has fallen in 8 of the last 10 days and is down by -10.26% for this period. Volume fell on the last day by -406 thousand shares and …

What is the stock price of China Mobile?

Mar 07, 2022 · CHMI | Complete Cherry Hill Mortgage Investment Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

0.0 Analyst's Opinion

Is Cherry Hill Mortgage Investment a buy right now?

There is not enough analysis data for Cherry Hill Mortgage Investment.

How has Cherry Hill Mortgage Investment's stock been impacted by COVID-19 (Coronavirus)?

2 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Cherry Hill Mortgage Investment in the last twelve months. There are currently 1 hold rating and 1 buy rating for the stock.

Are investors shorting Cherry Hill Mortgage Investment?

Cherry Hill Mortgage Investment's stock was trading at $12.25 on March 11th, 2020 when COVID-19 (Coronavirus) reached pandemic status according to the World Health Organization. Since then, CHMI shares have decreased by 35.8% and is now trading at $7.87. View which stocks have been most impacted by COVID-19.

When is Cherry Hill Mortgage Investment's next earnings date?

Cherry Hill Mortgage Investment saw a decline in short interest during the month of January. As of January 15th, there was short interest totaling 507,000 shares, a decline of 16.5% from the December 31st total of 607,400 shares.

How were Cherry Hill Mortgage Investment's earnings last quarter?

Cherry Hill Mortgage Investment is scheduled to release its next quarterly earnings announcement on Tuesday, March 8th 2022. View our earnings forecast for Cherry Hill Mortgage Investment.

How often does Cherry Hill Mortgage Investment pay dividends? What is the dividend yield for Cherry Hill Mortgage Investment?

Cherry Hill Mortgage Investment Co. (NYSE:CHMI) issued its quarterly earnings data on Tuesday, November, 9th. The real estate investment trust reported $0.25 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.30 by $0.05.

Signals & Forecast

Cherry Hill Mortgage Investment declared a quarterly dividend on Thursday, December 9th. Stockholders of record on Friday, December 31st will be paid a dividend of $0.27 per share on Tuesday, January 25th. This represents a $1.08 dividend on an annualized basis and a yield of 13.72%.

Support, Risk & Stop-loss

A buy signal was issued from a pivot bottom point on Monday, February 14, 2022, and so far it has risen 3.15%. Further rise is indicated until a new top pivot has been found. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD).

Is Cherry Hill Mortgage Investment Corporation stock A Buy?

Cherry Hill Mortgage Investment Corp finds support from accumulated volume at $7.81 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Insiders are very positive buying more shares than they are selling in Cherry Hill Mortgage Investment Corp

Cherry Hill Mortgage Investment Corp holds several negative signals and we believe that it will still perform weakly in the next couple of days or weeks. We, therefore, hold a negative evaluation of this stock.

About Cherry Hill Mortgage Investment Corporation

In the last 100 trades there were 413.14 thousand shares bought and 104.86 thousand shares sold. The last trade was done 50 days ago by Evans Julian who bough 8 thousand shares. The large amount of stocks bought compared to stocks sold indicate that the insiders believe there is a potential good upside.

Golden Star Signal

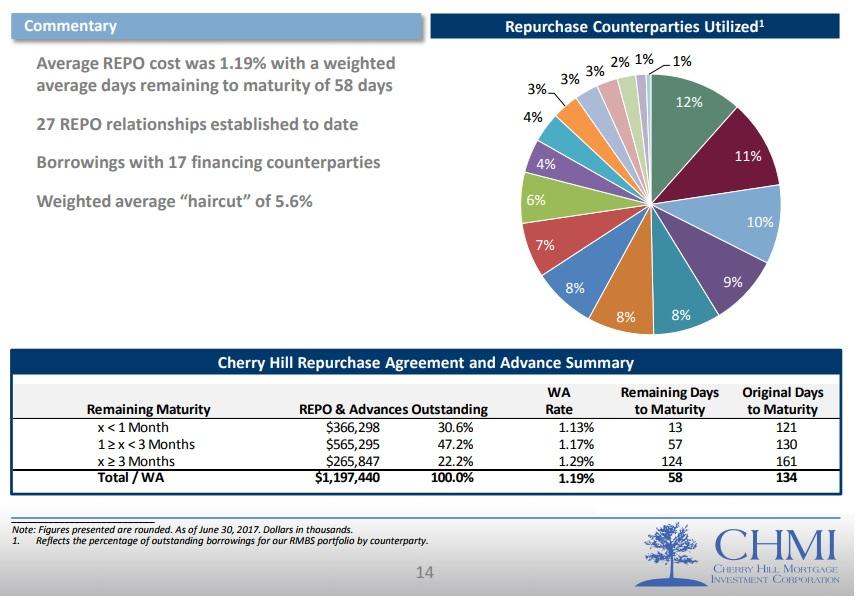

Cherry Hill Mortgage Investment Corporation, a residential real estate finance company, acquires, invests in, and manages residential mortgage assets in the United States. The company operates through Investments in Residential Mortgage-Backed Securities (RMBS); and Investments in Servicing Related Assets segments.

Top Fintech Company

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!