How much is an APO stock worth?

Apollo Global Management (APO-A) stock price, charts, trades & the US's most popular discussion forums. Free forex prices, toplists, indices and lots more. 02/04/2022 01:00:53 1-888-992-3836 Free ...

What is Apollo Global Management's (Apo) stock symbol?

Find the latest Apollo Global Management, Inc. (APO) stock quote, history, news and other vital information to help you with your stock trading and investing.

What is Apollo Global Management LLC's (APO) Q3 earnings report?

Apr 08, 2022 · APO | Complete Apollo Global Management Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

What is Apollo Global Management's PE (price/earnings) ratio?

Apollo Global Management (APO-A) stock price, charts, trades & the US's most popular discussion forums. Free forex prices, toplists, indices and lots more.

Is Apo stock a good buy?

Out of 7 analysts, 3 (42.86%) are recommending APO as a Strong Buy, 2 (28.57%) are recommending APO as a Buy, 1 (14.29%) are recommending APO as a Hold, 1 (14.29%) are recommending APO as a Sell, and 0 (0%) are recommending APO as a Strong Sell.

Is Apollo stock a buy?

Apollo Global Management has received a consensus rating of Buy. The company's average rating score is 2.70, and is based on 8 buy ratings, 1 hold rating, and 1 sell rating.

Is Apo A buy Zack?

(APO) - Zacks....(Delayed Data from NYSE)Zacks RankDefinitionAnnualized Return1Strong Buy24.93%2Buy18.44%3Hold9.99%4Sell5.61%2 more rows

Who owns Apollo Global?

Apollo Global ManagementApollo Global's headquarters at the Solow BuildingKey peopleMarc Rowan, CEO Josh Harris, senior managing director Scott Kleinman, Co-President and Lead Partner, Private Equity James Zelter, Co-President and Chief Investment Officer, Credit Gary Parr, Senior Managing Director18 more rows

What is the dividend of Apollo Global Management?

How much does Apollo Global Management make?

Apollo Global Management pays an annual dividend of $2.00 per share and currently has a dividend yield of 3.42%. The dividend payout ratio of Apollo Global Management is 99.01%. Payout ratios above 75% are not desirable because they may not be sustainable.

When is Apollo earnings call?

Apollo Global Management has a market capitalization of $13.81 billion and generates $2.35 billion in revenue each year. The financial services provider earns $156.61 million in net income (profit) each year or $2.02 on an earnings per share basis.

Who is the founder of Apollo?

Apollo Global Management will be holding an earnings conference call on Wednesday, August 4th at 8:30 AM Eastern. Interested parties can register for or listen to the call using this link or dial in at 404-537-3406 with passcode "2704008".

Where is Apollo Global Management located?

NEW YORK, May 20, 2021 (GLOBE NEWSWIRE) -- Apollo Global Management, Inc. (“Apollo” or “the firm”) (NYSE: APO) today announced that Co-Founder Josh Harris has decided to step down from his day-to-day role at the firm to return to his roots as an investor and entrepreneur. Mr. Harris will continue to serve on Apollo’s Board of Directors and Executive Committee of the Board. The effective date of Mr. Harris’ transition will coincide with Apollo’s combination with Athene (NYSE: ATH) expected to close in the first quarter of 2022. Mr. Harris will focus on continuing to build his multi-asset-class investing business and HBSE, a sports and entertainment company, as well as growing his family’s foundation. Apollo CEO Marc Rowan said, “Josh has been an amazing partner and it has been my privile...

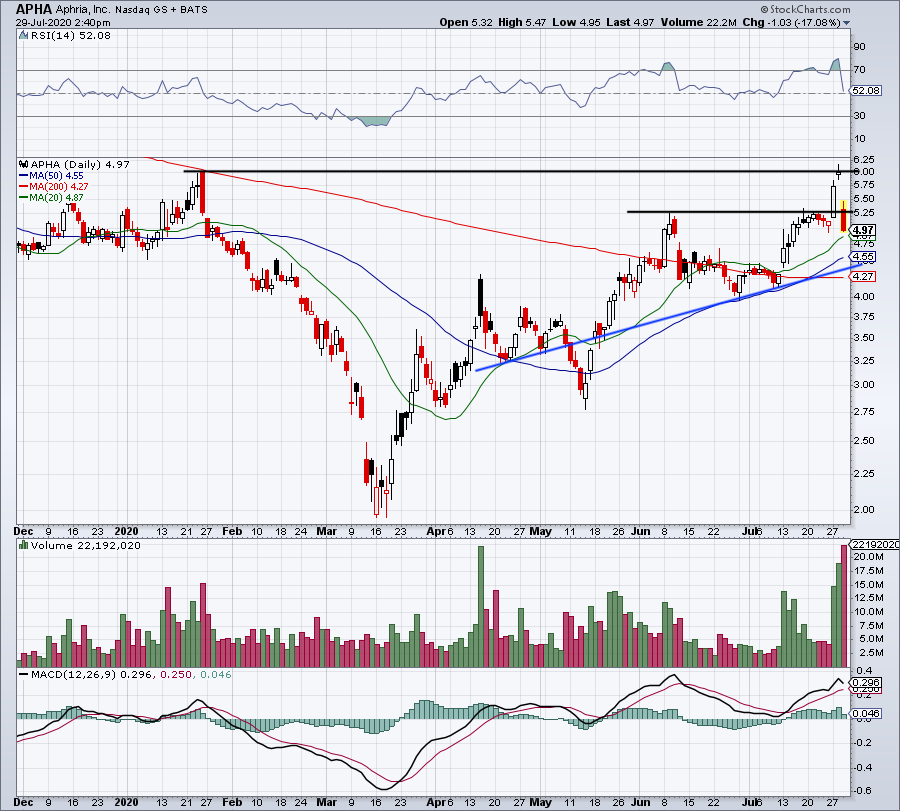

Signals & Forecast

The company was founded in 1990 and is based in New York.

Support, Risk & Stop-loss

Mostly positive signals in the chart today. The Apollo Global Management LLC stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average.

Is Apollo Global Management LLC stock A Buy?

Apollo Global Management LLC finds support from accumulated volume at $61.58 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.