Who sells American International Group (AIG) stock?

Apr 20, 2022 · AIG | Complete American International Group Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

What price target do analysts set for AIG stock?

102 rows · Discover historical prices for AIG stock on Yahoo Finance. View daily, weekly or monthly format back to when American International Group, Inc. stock was issued.

Why American International (AIG) is set to beat on Q4 earnings?

Apr 14, 2022 · American International Group, Inc. New Common Stock (AIG) Stock Quotes - Nasdaq offers stock quotes & market activity data for US and global markets.

When will American International Group stock pay a dividend?

The Ascent American International Group (AIG) New York Stock Exchange AIG $60.44 -$2.69 -4.3% Price as of April 22, 2022, 4:00 p.m. ET View Interactive AIG Charts A holding company …

Is AIG a good stock to buy?

Out of 6 analysts, 1 (16.67%) are recommending AIG as a Strong Buy, 1 (16.67%) are recommending AIG as a Buy, 4 (66.67%) are recommending AIG as a Hold, 0 (0%) are recommending AIG as a Sell, and 0 (0%) are recommending AIG as a Strong Sell. What is AIG's earnings growth forecast for 2022-2024?

Why did AIG fail?

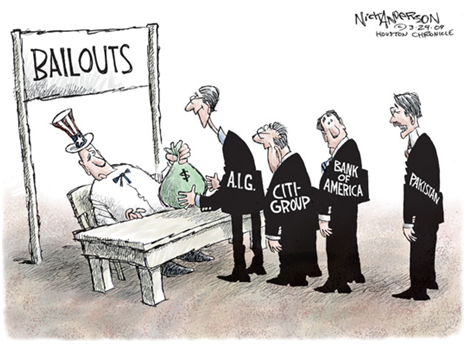

Simply put, AIG was considered too big to fail. A huge number of mutual funds, pension funds, and hedge funds invested in AIG or were insured by it, or both. Money market funds, generally seen as safe investments for the individual investor, were also at risk since many had invested in AIG bonds.

Is AIG undervalued?

Price-to-book (P/B) is one of the multiples used for valuing insurance stocks. Compared with the multiline industry's trailing 12-month P/B ratio of 1.6, AIG has a reading of 0.7. It is quite evident that the stock is currently undervalued.Sep 17, 2021

How much money is AIG worth?

According to the 2016 Forbes Global 2000 list, AIG is the 87th largest public company in the world. On December 31, 2017, AIG had $65.2 billion in shareholder equity....American International Group.AIG Headquarters in New YorkTotal assetsUS$596.11 billion (2021)Total equityUS$65.96 billion (2021)Number of employees49,600 (2020)Websiteaig.com14 more rows

Is AIG financially stable?

AIG has excellent ratings for financial stability including an A rating from AM Best. AIG's variable universal life policies offer more than 40 different investment options. AIG offers up to $10 million of permanent life coverage.

Is AIG the largest insurance company in the world?

American International Group Chief Executive Edward Liddy is inching toward several more asset sales, has plans for a trio of initial public offerings, and expects the financial products unit to be a much smaller problem by year-end.Apr 29, 2009

Who is buying AIG?

BlackstoneNEW YORK – July 14, 2021 – American International Group, Inc. (NYSE: AIG) and Blackstone (NYSE: BX) today announced that they have reached a definitive agreement for Blackstone to acquire a 9.9% equity stake in AIG's Life & Retirement business for $2.2 billion in an all cash transaction.Jul 14, 2021

Why is AIG stock price so low?

The general insurance premiums suffered an 11% y-o-y decline in 2020, primarily due to the impact of the Covid-19 crisis in the travel category and personal & commercial lines. Further, the net investment income dropped 7% y-o-y in 2020 due to the lower interest rate environment.Jun 18, 2021

How do I sell my AIG stock?

How do I buy (sell) shares of AIG common stock? You must use a licensed broker to buy or sell shares of AIG common stock.

Is AIG profitable?

AIG 0.08% swung to a fourth-quarter profit from the year before when the Covid-19 pandemic hurt results, as a turnaround effort lifted earnings in its main business-insurance unit. The global company reported net income of $3.74 billion, compared with a net loss of $60 million in the year-earlier quarter.Feb 16, 2022

Is AIG and American General the same company?

American General Life Insurance Company was established in 1960. As American General expanded its national presence and added new financial products and services over the years, the company was acquired by American International Group (AIG) in 2001.

Is New York Life a Fortune 500 company?

For 2020 New York Life ranked 4th in the category of Insurance: Life and Health. FORTUNE MAGAZINE'S FORTUNE 500 FOR 2021. We rank #67 on the prestigious Fortune 500 list. Each year, Fortune magazine collects revenue data from the largest companies in the United States and publishes the rankings.

What is American International Group?

What is the general insurance segment?

engages in the provision of a range of property casualty insurance, life insurance, retirement products, and other financial services to commercial and individual customers. It operates through the following segments: General Insurance, Life and Retirement and Other Operations.

What is American International Group?

The General Insurance segment consists of insurance businesses in North America and International business areas. The Life and Retirement segment includes Individual Retirement, Group Retirement, Life Insurance, and Institutional Markets. The Other Operations segment covers income from assets held by the company and other corporate subsidiaries.

What time do you trade in the pre market?

American International Group is one of the largest insurance and financial services firms in the world and has a global footprint. It operates through a wide range of subsidiaries that provide property, casualty, and life insurance. Its revenue is split roughly evenly between commercial and consumer lines.

New York Stock Exchange

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices.

News & Analysis: American International Group

A holding company which, through its subsidiaries, is engaged in a range of insurance and insurance-related activities in the United States and abroad. Its primary activities include General Insurance and Life Insurance & Retirement Services operations.

Environmental, Social, and Governance Rating

The Fool has written over 800 articles on American International Group.

Business Summary

"B" score indicates good relative ESG performance and an above-average degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.

2.2 Analyst's Opinion

A holding company which, through its subsidiaries, is engaged in a range of insurance and insurance-related activities in the United States and abroad. Its primary activities include General Insurance and Life Insurance & Retirement Services operations.

Is American International Group a buy right now?

American International Group has received a consensus rating of Hold. The company's average rating score is 2.42, and is based on 3 buy ratings, 8 hold ratings, and no sell ratings.

How has American International Group's stock price been impacted by Coronavirus?

12 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for American International Group in the last twelve months. There are currently 8 hold ratings, 3 buy ratings and 1 strong buy rating for the stock.

When is American International Group's next earnings date?

American International Group's stock was trading at $32.43 on March 11th, 2020 when Coronavirus reached pandemic status according to the World Health Organization (WHO). Since then, AIG stock has increased by 87.3% and is now trading at $60.74. View which stocks have been most impacted by COVID-19.

How can I listen to American International Group's earnings call?

American International Group is scheduled to release its next quarterly earnings announcement on Wednesday, February 16th 2022. View our earnings forecast for American International Group.

How were American International Group's earnings last quarter?

American International Group will be holding an earnings conference call on Thursday, February 17th at 8:30 AM Eastern. Interested parties can register for or listen to the call using this link.

How often does American International Group pay dividends? What is the dividend yield for American International Group?

American International Group, Inc. (NYSE:AIG) released its earnings results on Thursday, November, 4th. The insurance provider reported $0.97 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.88 by $0.09.

Stock Price Forecast

American International Group announced a quarterly dividend on Thursday, November 4th. Stockholders of record on Thursday, December 16th will be given a dividend of $0.32 per share on Thursday, December 30th. This represents a $1.28 annualized dividend and a dividend yield of 2.11%.

Analyst Recommendations

The 13 analysts offering 12-month price forecasts for American International Group Inc have a median target of 65.00, with a high estimate of 75.00 and a low estimate of 50.00. The median estimate represents a +10.22% increase from the last price of 58.98.

Signals & Forecast

The current consensus among 18 polled investment analysts is to Hold stock in American International Group Inc. This rating has held steady since February, when it was downgraded from a Buy rating. Move your mouse over past months for detail

Support, Risk & Stop-loss

The American International Group Inc stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average.

Is American International Group Inc stock A Buy?

American International Group Inc finds support from accumulated volume at $60.74 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Insiders are very negative

Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying opportunity as there is a fair chance for American International Group Inc stock to perform well in the short-term.

About American International Group Inc

In the last 1 trades there were . The last trade was done 19 046 days ago by who bough 0 shares.

Golden Star Signal

American International Group, Inc. provides insurance products and services for commercial, institutional, and individual customers in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company operates through two segments, Commercial Insurance and Consumer Insurance.

Top Fintech Company

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!