Full Answer

How do you calculate standard deviation of stock?

- calculate the daily log% change

- = LN (t/t-1)

- create a time series from the Log % change column

- calculate the STDEV of the Log % changes for N days

- N=number of days you want in your sample

- i.e., 20 day vol = use the last 19 log % changes

How do you calculate expected return and standard deviation?

- Expected Return for Portfolio = 50% * 15% + 50% * 7%

- Expected Return for Portfolio = 7.5% + 3.5%

- Expected Return for Portfolio = 11%

What does standard deviation mean in an investment?

What is Standard Deviation?

- Calculating Standard Deviation. Basic Statistics Concepts for Finance A solid understanding of statistics is crucially important in helping us better understand finance.

- Standard Deviation Example. ...

- Normal Distribution of Returns. ...

- More Resources. ...

What are the advantages of standard deviation?

What are the benefits of standard deviation?

- Shows how much data is clustered around a mean value.

- It gives a more accurate idea of how the data is distributed.

- Not as affected by extreme values.

What are the standard deviations of stocks A and B?

The market index has a standard deviation of 22% and the risk-free rate is 8%. a. What are the standard deviations of stocks A and B?...Question:Stock A0.30Stock B0.45T-bills0.25

What was the standard deviation of returns for stock B?

10.50%The standard deviation of the returns on Stock B is 10.50%.

How do you find the standard deviation of a daily stock return?

3:384:28Stock returns: average, variance, and standard deviation - YouTubeYouTubeStart of suggested clipEnd of suggested clipMore decimal points and the standard deviation standard deviation is basically the square root ofMoreMore decimal points and the standard deviation standard deviation is basically the square root of the variance. I. Will explain to you the difference between the two you know in a. Bit.

Where can I find the standard deviation of a stock?

The calculation steps are as follows:Calculate the average (mean) price for the number of periods or observations.Determine each period's deviation (close less average price).Square each period's deviation.Sum the squared deviations.Divide this sum by the number of observations.More items...

How do I calculate standard deviation?

Step 1: Find the mean. Step 2: For each data point, find the square of its distance to the mean. Step 3: Sum the values from Step 2. Step 4: Divide by the number of data points.

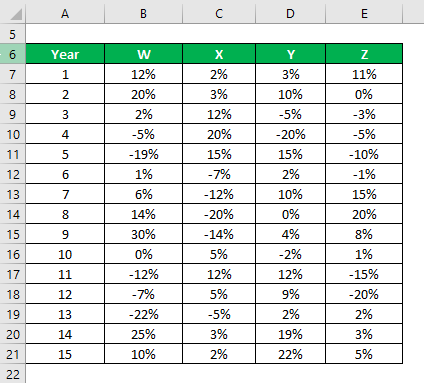

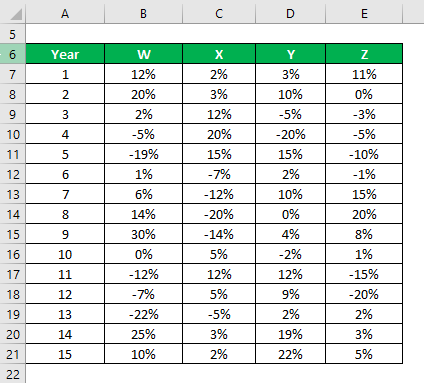

How do you find the standard deviation of a stock in Excel?

Using the numbers listed in column A, the formula will look like this when applied: =STDEV. S(A2:A10). In return, Excel will provide the standard deviation of the applied data, as well as the average.

How do you calculate return on a stock?

ROI is calculated by subtracting the initial value of the investment from the final value of the investment (which equals the net return), then dividing this new number (the net return) by the cost of the investment, and, finally, multiplying it by 100.

What does a standard deviation of 1 mean?

A normal distribution with a mean of 0 and a standard deviation of 1 is called a standard normal distribution. Areas of the normal distribution are often represented by tables of the standard normal distribution. A portion of a table of the standard normal distribution is shown in Table 1.

What is standard deviation in investing?

Standard Deviation (Volatility) • Standard deviation, also referred to as volatility, measures the variation from average performance. • If all else is equal, including returns, rational investors would select investments with lower volatility.

How do you use standard deviation in stock trading?

The standard deviation calculation is based on a few steps:Find the average closing price (mean) for the periods under consideration (the default setting is 20 periods)Find the deviation for each period (closing price minus average price)Find the square for each deviation.Add the squared deviations.More items...•

What is the normal standard deviation for stocks?

When stocks are following a normal distribution pattern, their individual values will place either one standard deviation below or above the mean at least 68% of the time. A stock's value will fall within two standard deviations, above or below, at least 95% of the time.

Why is standard deviation used in stock returns?

When it comes to stock returns and investments, the standard deviation is used to determine market volatility and, therefore, risk. A higher risk stock will demonstrate an unpredictable price and a wider range.

How much does a stock fall within a standard deviation?

A stock’s value will fall within two standard deviations, above or below, at least 95% of the time. For instance, if a stock has a mean dollar amount of $40 and a standard deviation of $4, investors can reason with 95% certainty that the following closing amount will range between $32 and $48. This also means that 5% of the time, ...

Why is standard deviation important?

Standard deviation can be used throughout the financial world, but it is especially useful when it comes to investing in stocks and determining trading strategies. The use of standard deviation assists in measuring the volatility of the market and stocks as well as predicting stocks’ performance trends.

What does it mean when the standard deviation is higher?

When the standard deviation is higher, it points to a larger variance between the stock’s prices and the mean . This points to a more vast price range. For example, a high standard deviation will appear for volatile stocks, while a lower standard deviation is present in stocks that are more consistent.

Why do aggressive growth funds have a higher standard deviation?

Conversely, investors can expect an aggressive growth fund to have a higher standard deviation compared to standard stocks because the whole point of these funds is to generate exceptionally high returns. There isn’t necessarily a better level of standard deviation.

How to find standard deviation?

When calculating the standard deviation, you first need to determine the mean and variance of the stock. To calculate the mean, you add together the value of all the data points and then divide that total by the number of data points.

Is a low standard deviation a good stock?

When its standard deviation is low, it’s usually a reliable blue-chip stock. In taking all this to mind, investors can assume that a low standard deviation points to a less risky investment, while a greater variance and standard deviation reflects a higher risk stock. While 95% of the time, investors can reasonably assume ...

What is standard deviation in investing?

An investor uses an expected return to forecast, and standard deviation to discover what is performing well and what is not.

What is expected return and standard deviation?

The expected return of a portfolio is the anticipated amount of returns that a portfolio may generate, whereas the standard deviation of a portfolio measures the amount that the returns deviate from its mean.

How to calculate expected return?

The expected return of a portfolio is calculated by multiplying the weight of each asset by its expected return and adding the values for each investment.

What is standard deviation in finance?

Standard deviation is a statistical measurement in finance that , when applied to the annual rate of return of an investment, sheds light on that investment's historical volatility . The greater the standard deviation of securities, the greater the variance between each price and the mean, which shows a larger price range.

What are the drawbacks of standard deviation?

The biggest drawback of using standard deviation is that it can be impacted by outliers and extreme values. Standard deviation assumes a normal distribution and calculates all uncertainty as risk, even when it’s in the investor's favor—such as above-average returns.

Why is variance smaller than standard deviation?

However, this is more difficult to grasp than the standard deviation because variances represent a squared result that may not be meaningfully expressed on the same graph as the original dataset.

How to find variance?

Variance is derived by taking the mean of the data points, subtracting the mean from each data point individually, squaring each of these results, and then taking another mean of these squares. Standard deviation is the square root of the variance. The variance helps determine the data's spread size when compared to the mean value.

Why is variance important?

The variance helps determine the data's spread size when compared to the mean value. As the variance gets bigger, more variation in data values occurs, and there may be a larger gap between one data value and another. If the data values are all close together, the variance will be smaller.

Why is an index fund likely to have a low standard deviation versus its benchmark index?

As it relates to investing, for example, an index fund is likely to have a low standard deviation versus its benchmark index, as the fund's goal is to replicate the index.

What is the difference between a volatile stock and a blue chip stock?

A volatile stock has a high standard deviation, while the deviation of a stable blue-chip stock is usually rather low . As a downside, the standard deviation calculates all uncertainty as risk, even when it’s in the investor's favor—such as above-average returns. 1:52.