A few key concepts to take note of regarding standard deviation are:

- The standard deviation of a stock determines the dispersion of a dataset in relation to its mean.

- A high standard deviation represents volatile stocks, while a low standard deviation usually points to consistent blue-chip stocks.

- The greater the standard deviation, the riskier the stock.

What does the standard deviation of a stock tell you?

Understanding the Standard Deviation

- The Formula for Standard Deviation

- Calculating the Standard Deviation. The mean value is calculated by adding all the data points and dividing by the number of data points.

- Using the Standard Deviation. ...

- Standard Deviation vs. ...

- A Big Drawback. ...

- Example of Standard Deviation. ...

What do you consider a good standard deviation?

What do you consider a good standard deviation?

- MattMcConaha. Obviously one can expect some sort of deviation in solve times from a number of different variables, but how large should be expected for a "consistent" solver?

- Dene. Interesting question. ...

- MaeLSTRoM. ...

- cubernya. ...

- MalusDB. ...

- Dacuba. ...

- mDiPalma

- JonnyWhoopes. ...

- MTGjumper. ...

- MattMcConaha. ...

What is the formula for calculating standard deviation?

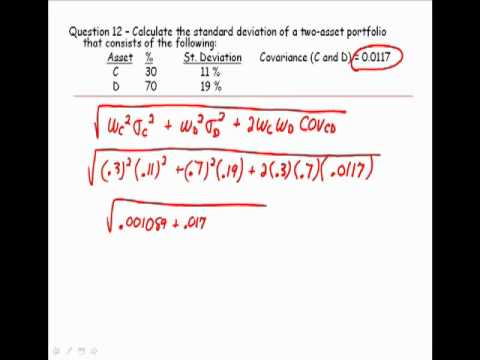

Formulas for Standard Deviation. Population Standard Deviation Formula. σ = √ ∑(X−μ)2 n σ = ∑ ( X − μ) 2 n. Sample Standard Deviation Formula. s =√ ∑(X−¯X)2 n−1 s = ∑ ( X − X ¯) 2 n − 1.

What does standard deviation mean in an investment?

What is Standard Deviation?

- Calculating Standard Deviation. Basic Statistics Concepts for Finance A solid understanding of statistics is crucially important in helping us better understand finance.

- Standard Deviation Example. ...

- Normal Distribution of Returns. ...

- More Resources. ...

What is a good standard deviation for stock?

When stocks are following a normal distribution pattern, their individual values will place either one standard deviation below or above the mean at least 68% of the time. A stock's value will fall within two standard deviations, above or below, at least 95% of the time.

How do you find the standard deviation of a stock?

The calculation steps are as follows:Calculate the average (mean) price for the number of periods or observations.Determine each period's deviation (close less average price).Square each period's deviation.Sum the squared deviations.Divide this sum by the number of observations.More items...

What is a standard deviation in investing?

Standard Deviation (Volatility) • Standard deviation, also referred to as volatility, measures the variation from average performance. • If all else is equal, including returns, rational investors would select investments with lower volatility.

How do you use standard deviation in stock trading?

The standard deviation calculation is based on a few steps:Find the average closing price (mean) for the periods under consideration (the default setting is 20 periods)Find the deviation for each period (closing price minus average price)Find the square for each deviation.Add the squared deviations.More items...•

Is standard deviation the same as volatility?

Volatility is often measured as either the standard deviation or variance between returns from that same security or market index. In the securities markets, volatility is often associated with big swings in either direction.

Why standard deviation is important?

The answer: Standard deviation is important because it tells us how spread out the values are in a given dataset. Whenever we analyze a dataset, we're interested in finding the following metrics: The center of the dataset. The most common way to measure the “center” is with the mean and the median.

What does a standard deviation of 1 mean?

A normal distribution with a mean of 0 and a standard deviation of 1 is called a standard normal distribution. Areas of the normal distribution are often represented by tables of the standard normal distribution. A portion of a table of the standard normal distribution is shown in Table 1.

How do you know if a standard deviation is high or low?

As a rule of thumb, a CV >= 1 indicates a relatively high variation, while a CV < 1 can be considered low. This means that distributions with a coefficient of variation higher than 1 are considered to be high variance whereas those with a CV lower than 1 are considered to be low-variance.

What is a 1 standard deviation move?

0:4211:23Standard Deviation Explained | Options Trading Concepts - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo standard deviation is essentially a distribution of occurrences. Around the mean. So if weMoreSo standard deviation is essentially a distribution of occurrences. Around the mean. So if we imagine this middle line here as the stock price if I've got all these dots which are occurrences.

What is standard deviation in finance?

Standard deviation is a statistical measurement in finance that , when applied to the annual rate of return of an investment, sheds light on that investment's historical volatility . The greater the standard deviation of securities, the greater the variance between each price and the mean, which shows a larger price range.

What are the drawbacks of standard deviation?

The biggest drawback of using standard deviation is that it can be impacted by outliers and extreme values. Standard deviation assumes a normal distribution and calculates all uncertainty as risk, even when it’s in the investor's favor—such as above-average returns.

Why is variance smaller than standard deviation?

However, this is more difficult to grasp than the standard deviation because variances represent a squared result that may not be meaningfully expressed on the same graph as the original dataset.

How to find variance?

Variance is derived by taking the mean of the data points, subtracting the mean from each data point individually, squaring each of these results, and then taking another mean of these squares. Standard deviation is the square root of the variance. The variance helps determine the data's spread size when compared to the mean value.

Why is an index fund likely to have a low standard deviation versus its benchmark index?

As it relates to investing, for example, an index fund is likely to have a low standard deviation versus its benchmark index, as the fund's goal is to replicate the index.

What is the difference between a volatile stock and a blue chip stock?

A volatile stock has a high standard deviation, while the deviation of a stable blue-chip stock is usually rather low . As a downside, the standard deviation calculates all uncertainty as risk, even when it’s in the investor's favor—such as above-average returns. 1:52.

Is standard deviation the same as variance?

Standard deviations are usually easier to picture and apply. The standard deviation is expressed in the same unit of measurement as the data, which isn't necessarily the case with the variance. Using the standard deviation, statisticians may determine if the data has a normal curve or other mathematical relationship.

Description

Standard deviation is the statistical measure of market volatility, measuring how widely prices are dispersed from the average price. If prices trade in a narrow trading range, the standard deviation will return a low value that indicates low volatility.

How this indicator works

Standard deviation rises as prices become more volatile. As price action calms, standard deviation heads lower.

What does standard deviation mean in trading?

Simply put, standard deviation helps determine the spread of asset prices from their average price. When prices swing up or down significantly, the standard deviation is high, meaning there is high volatility. On the other hand, when there is a narrow spread between trading ranges, the standard deviation is low, meaning volatility is low.

What does it mean when a stock has a low standard deviation?

When prices move wildly, standard deviation is high, meaning an investment will be risky. Low standard deviation means prices are calm, so investments come with low risk.

How to determine risk of an investment?

One of the most common methods of determining the risk an investment poses is standard deviation. Standard deviation helps determine market volatility or the spread of asset prices from their average price. When prices move wildly, standard deviation is high, meaning an investment will be risky.

What is the most common metric used to assess volatility?

Traders and analysts use a number of metrics to assess the volatility and relative risk of potential investments, but the most common metric is standard deviation . Read on to find out more about standard deviation, and how it helps determine risk in the investment industry.

Is standard deviation a risk?

While standard deviation is an important measure of investment risk, it is not the only one. There are many other measures investors can use to determine whether an asset is too risky for them—or not risky enough.

What is standard deviation in statistics?

Standard Deviation (SD) is a popular statistical tool that is represented by the Greek letter ‘σ’ and is used to measure the amount of variation or dispersion of a set of data values relative to its mean (average), thus interpret the reliability of the data. If it is smaller then the data points lies close to the mean value, thus shows reliability.

Why is standard deviation important?

Standard deviation is helpful is analyzing the overall risk and return a matrix of the portfolio and being historically helpful . It is widely used and practiced in the industry. The standard deviation of the portfolio can be impacted by the correlation and the weights of the stocks of the portfolio.

Does the deviation of the first fund matter?

If the first fund is a much higher performer than the second one, the deviation will not matter much. and is widely taught by professors among various top universities in the world however, the formula for standard deviation is changed when it is used to calculate the deviation of the sample.

What is standard deviation used for?

Standard deviation is also used in weather to determine differences in regional climate. Imagine two cities, one on the coast and one deep inland, that have the same mean temperature of 75°F.

Why is standard deviation used in statistics?

In addition to expressing population variability, the standard deviation is also often used to measure statistical results such as the margin of error.

What is standard deviation in industrial settings?

Standard deviation is widely used in experimental and industrial settings to test models against real-world data. An example of this in industrial applications is quality control for some product. Standard deviation can be used to calculate a minimum and maximum value within which some aspect of the product should fall some high percentage of the time. In cases where values fall outside the calculated range, it may be necessary to make changes to the production process to ensure quality control.

Which stock has a higher probability of an average return?

While Stock A has a higher probability of an average return closer to 7%, Stock B can potentially provide a significantly larger return (or loss). These are only a few examples of how one might use standard deviation, but many more exist.

Is sample standard deviation unbiased?

It is worth noting that there exist many different equations for calculating sample standard deviation since unlike sample mean, sample standard deviation does not have any single estimator that is unbiased, efficient, and has a maximum likelihood. The equation provided below is the "corrected sample standard deviation.".