Par value stock

- Definition and explanation. Par value stock is a type of common or preferred stock having a nominal amount (known as par value) attached to each of its share.

- Presentation of par value stock in balance sheet. ...

- Par value vs market value. ...

- Journal entries for the issuance of par value stock. ...

- Example. ...

Full Answer

Why would a stock have no par value?

The par value is the value of one share of common stock. The par value is set by the company’s organization or charter documents. The par value does not indicate the market value of the stock. The par value is fixed and does not fluctuate based on the market price of the stock. As you can see in the visual below, the par value is set by the company ...

What does par value per share of common stock represent?

Feb 09, 2022 · With common stocks, the par value simply represents a legally binding agreement that the company will not sell shares below a certain price, such as $0.01. As the par value is often no more than a...

What does "par value" mean in stocks?

Jan 02, 2022 · Companies set a par value for their common stock because they are often legally required to do so. In case of common stock, it just represents a legally binding contract that the stock will not be sold below a certain price, like $0.1 per share or $0.01 per share etc. Moreover, the par value of a common stock often doesn’t have any connection with its dividend rate.

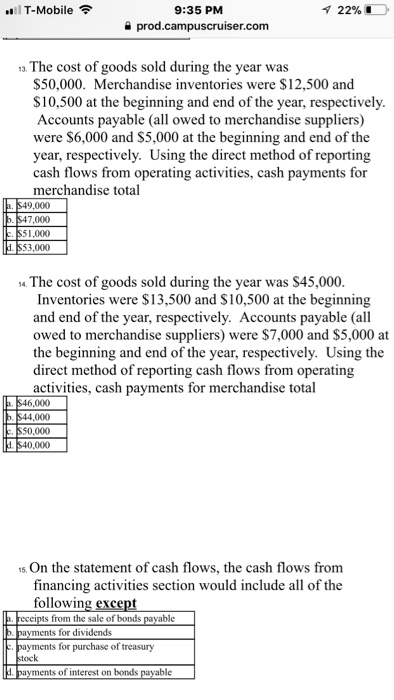

What is the current price of the common stock?

When shares have a par value, the amount shareholders pay for them in excess of par is accounted for as paid-in capital on the corporation's balance sheet. For example, if a shareholder pays $5 for 1000 shares with a par value of $1, $4,000 would be credited to the corporation's paid-in capital account and $1,000 to the common stock account. No Par Value Stock. Some states …

What is par value in common stock?

With common stocks, the par value simply represents a legally binding agreement that the company will not sell shares below a certain price, such as $0.01.

Why do stocks have par value?

Par value remains fixed for the life of a security, unlike market value, which fluctuates regularly. Because it influences interest and dividend payments, it ’s a key factor for understanding your return on investment in bonds and preferred stock.

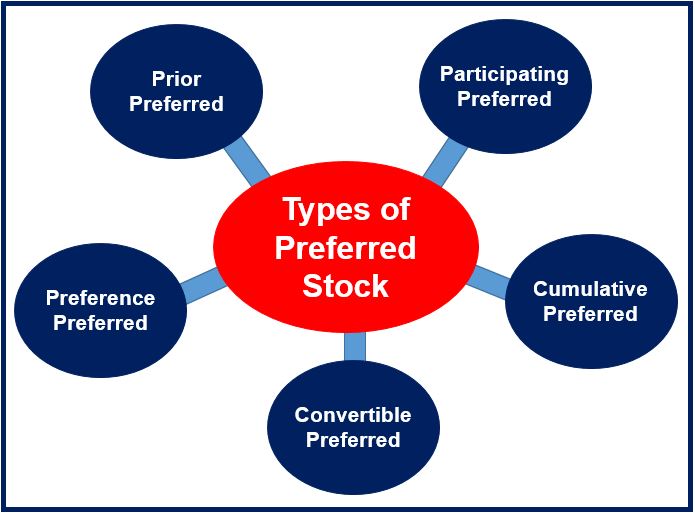

What is preferred stock par value?

Par Value for Preferred Stock. It’s helpful to think of preferred stock as a hybrid of bonds and common stock. Preferred stock represents equity in a company—a portion of ownership, like common stock. In addition, though, you are entitled to fixed dividend payments, like a bond’s fixed interest payments.

What is par value in bonds?

Par Value for Bonds. When you buy bonds, you’re lending money for a set amount of time to an issuer, like a government, municipality or corporation. The issuer promises to repay your initial investment—known as the principal—once the term is over, as well as pay you a set rate of interest over the life of the bond.

Is par value the price you pay for a security?

Even though par value may not be the price you pay for a security, it’s still important to be aware of as it may impact the amount of interest or dividend payments you receive.

Is the principal the same as the par value?

The principal in a bond investment may or may not be the same as the par value. Some bonds are sold at a discount, for instance, and pay back their par value at maturity. In any case, the fixed par value is used to calculate the bond’s fixed interest rate, which is referred to as its coupon. A bond’s market value, meanwhile, is ...

Does common stock pay dividends?

In addition, common stock’s par value has no relationship to its dividend payment rate. Instead, common stock dividends are generally paid as a certain dollar value per share you own. Many people will then divide this value by the cost of a share to create its dividend yield.

What is par value stock?

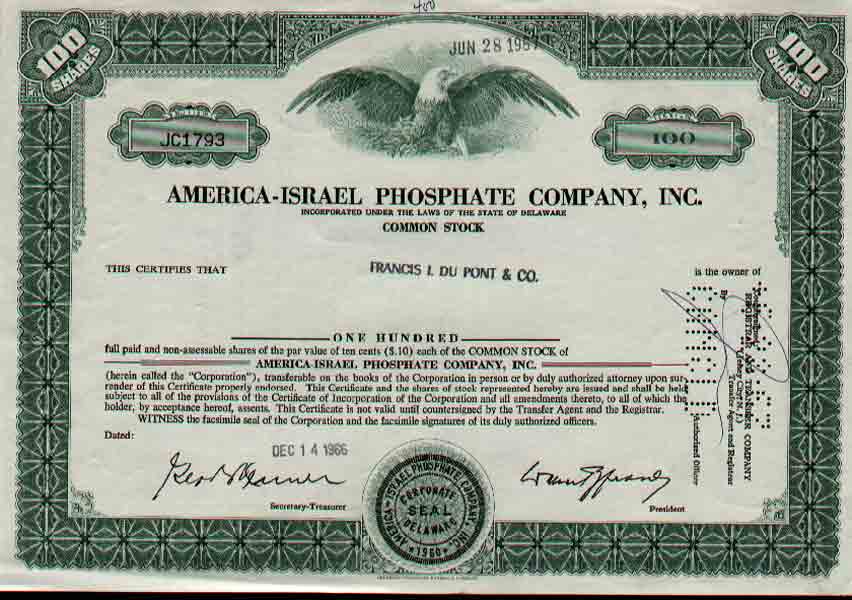

Par value stock is a type of common or preferred stock having a nominal amount (known as par value) attached to each of its share. Par value is the per share legal capital of the company that is usually printed on the face of the stock certificate. It is also known as stated value and face value. A company is free to choose any amount as ...

How many ways can a stock be issued at par value?

The par value stock can be issued in three ways – at par, above par and below par. A brief explanation and journal entries for all the situations are given below:

What does it mean when a stock is issued below par?

When stock is issued at a price lower than its par value, it is said to have been issued below par. In such an issue, the cash account is debited with the total amount of cash received, discount on issue of capital stock account is debited with the difference between amount received and the par value of shares issued and the common stock account is credited with the par value of the shares issued. The journal entry for such an issue is given below:

What happens when stock is issued above par?

When stock is issued at a price higher than its par value, it is said to have been issued above par. When stock is issued above par, the cash account is debited with the total amount of cash received , capital stock account is credited with the total par value of shares issued and an account known as additional paid-in capital or capital in excess of par is credited with the difference between cash received and the par value of shares issued. This information is summarized in the form of the following journal entry:

What happens when a stock has a par value?

When shares have a par value, the amount shareholders pay for them in excess of par is accounted for as paid-in capital on the corporation's balance sheet. For example, if a shareholder pays $5 for 1000 shares with a par value of $1, $4,000 would be credited to the corporation's paid-in capital account and $1,000 to the common stock account.

What is the par value of a company?

Typically, large companies establish a par value of one cent or a fraction of one cent per share. This way they can issue many shares without the founders or other initial purchasers being legally required to pay huge amounts of money for them. For example, the par value for shares of Apple, Inc.

What is par value?

"Par value," also called face value or nominal value, is the lowest legal price for which a corporation may sell its shares.

Why is par value misleading?

The term par value can be misleading because it has nothing to do with how much a corporation's shares are actually worth. It is only a minimum legal value. A corporation's board of directors may require investors to pay far more than par value for the corporations' shares.

How much do you have to pay for 10,000 shares?

If you purchase 10,000 shares, you'll have to pay at least $10,000 for them. If you pay only $5,000, you'll owe your corporation another $5,000. If your corporation later goes out of business, its creditors can sue to force you to pay that remaining $5,000 to your now defunct corporation to help pay off its debts.

What does "par value" mean in a corporation?

In some states, when a corporation is formed, the articles of incorporation must set a "par value" for its stock.

Is the purchase price of no par shares credited to the common stock account?

For accounting purposes, the entire purchase price for no par shares is credited to the common stock account, unless the company decides to allocate a portion to surplus.

What is par value in stock?

What is Par Value for Stock? Par value is the stock price stated in a corporation’s charter. The intent behind the par value concept was that prospective investors could be assured that an issuing company would not issue shares at a price below the par value.

What is the par value of preferred stock?

What is Par Value for Preferred Stock? The par value of a share of preferred stock is the amount upon which the associated dividend is calculated. Thus, if the par value of the stock is $1,000 and the dividend is 5%, then the issuing entity must pay $50 per year for as long as the preferred stock is outstanding.

What happens if a bond price is higher than the par value?

If the price is higher than the par value, the issuing entity still only has to base its interest payments on the par value, so the effective interest rate to the owner of the bond will be less than the stated interest rate on the bond.

Is par value still used?

Thus, the reason for par value has fallen into disuse, but the term is still used, and companies issuing stock with a par value must still record the par value amount of their outstanding stock in a separate account. The amount of the par value of a share of stock is printed on the face of a stock certificate.

How to calculate par value of shares?

The par value of common stock for the company is simply: Par value of common stock = (Par value per share) x (Number of issued shares)

What is par value?

The par value of a common share is an arbitrary value assigned to shares to fulfill state requirements. The par value is unrelated to the price at which the shares are first issued or their market price once they begin trading. The par value is stated in the company's articles of incorporation and figures on the paper stock certificates ...

Why do companies have a low par value?

Companies like to set a very low par value because it represents their legal capital, which must remain invested in the company and cannot be distributed to shareholders. Another reason for setting a low par value is that when a company issues shares, it cannot sell them to investors at less than par value. How does one calculate the par value of ...

Do bonds have a par value?

Bonds have a par value, of course – it's just the principal amount. However, stocks can also have a par value. Here you'll learn what that par value represents and how to calculate the company's par value of common stock for the purpose of financial accounting.

What is par value in stock?

The par value of a share of common stock is its stated face value. The issuer assigns a par value when a stock is originated; it is usually quite low--$0.01 or even $0. The par value is different from the current market price of the stock. In theory, if the market price of a stock fell below the par value, the company could be liable for ...

What happens if the market price of a stock falls below the par value?

In theory, if the market price of a stock fell below the par value, the company could be liable for the difference. The shareholders' equity portion of a company's balance sheet gives information about the par value of common stock. Advertisement.