The short-term prediction for Lowe's stock is that the company's business should do well in the second quarter of 2022 while its share price is expected to remain resilient, and there are two factors supporting my assertion.

Full Answer

What will Lowe's companies'stock price be in 2019?

On average, they expect Lowe's Companies' stock price to reach $259.90 in the next year. This suggests a possible upside of 3.9% from the stock's current price. View analysts' price targets for Lowe's Companies or view top-rated stocks among Wall Street analysts. Who are Lowe's Companies' key executives?

What are analysts'price forecasts for Lowe's Companies Inc (low)?

The 28 analysts offering 12-month price forecasts for Lowe's Companies Inc have a median target of 284.00, with a high estimate of 300.00 and a low estimate of 230.00. The median estimate represents a +22.91% increase from the last price of 231.07.

How much is a share of Lowes stock worth?

One share of LOW stock can currently be purchased for approximately $250.09. How much money does Lowe's Companies make? Lowe's Companies has a market capitalization of $168.50 billion and generates $89.60 billion in revenue each year.

What are the targets for Lowe's (low) stock?

31 brokers have issued 12-month target prices for Lowe's Companies' stock. Their forecasts range from $146.00 to $250.00. On average, they expect Lowe's Companies' share price to reach $200.59 in the next twelve months. This suggests a possible upside of 5.2% from the stock's current price.

Is LOWes a good stock to Buy right now?

What Is Lowe's Stock's Price Prediction? Sell-Side Analysts are bullish on the company. Out of 30 analysts covering the stock, 17 have a strong buy rating, five have a buy rating, and the remaining eight have a hold rating.

How high will LOWes stock go?

Based on 20 Wall Street analysts offering 12 month price targets for Lowe's in the last 3 months. The average price target is $232.78 with a high forecast of $300.00 and a low forecast of $190.00. The average price target represents a 33.27% change from the last price of $174.67.

Is LOWes stock a Buy or hold?

Lowe's Companies has received a consensus rating of Moderate Buy. The company's average rating score is 2.70, and is based on 15 buy ratings, 4 hold ratings, and 1 sell rating.

Where Will Lowes stock be in 5 years?

According to S&P Capital IQ data, Lowe's will grow its top line by an annualized growth rate of +3.0% in the next five years, while its EBIT margin will expand by approximately +130 basis points over this same period.

Is Lowes Stock Expected to Rise?

Lowe's Companies Inc (NYSE:LOW) The 25 analysts offering 12-month price forecasts for Lowe's Companies Inc have a median target of 238.00, with a high estimate of 300.00 and a low estimate of 190.00. The median estimate represents a +28.86% increase from the last price of 184.69.

How many times has Lowes stock split?

According to our Lowes Companies stock split history records, Lowes Companies has had 5 splits.

Is Lowe's a good dividend stock?

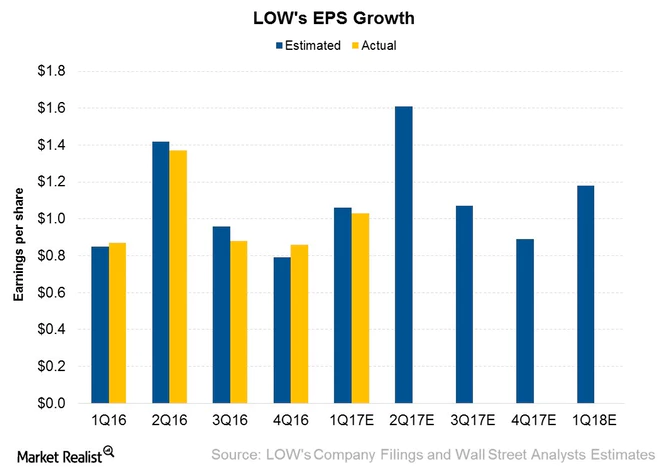

We are encouraged to see that Lowe's Companies has grown earnings per share at 33% per year over the past five years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

Is Home Depot a good stock to buy?

This massive retailer is still showing signs of strength. In the most recent quarter (ended May 1), Home Depot posted year-over-over revenue growth of 3.8%. This was on top of 32.7% growth in Q1 2021.

Will Home Depot stock go up?

For full-year 2022, Home Depot now anticipates full-year sales and comps growth of 3% each, with earnings per share growing by mid-single-digit percentages. Earlier in February, the company predicted flat to slightly positive comps for 2022.

How do I sell my Lowes stock?

How do I sell my shares? You can sell some or all of the Lowe's Plan shares you hold in book-entry form in any of three ways: by providing written instructions to the Plan Administrator; by calling the Plan Administrator toll free at 1-877-282-1174; or by accessing your Computershare shareholder account online.

What do the analysts think of the Morgan Stanley stock?

Morgan Stanley (NYSE:MS) The 23 analysts offering 12-month price forecasts for Morgan Stanley have a median target of 97.00, with a high estimate of 123.00 and a low estimate of 79.30. The median estimate represents a +27.72% increase from the last price of 75.95.

Is Lowes publicly traded?

Lowe's Goes Public Lowe's becomes a publicly-traded company on October 10, 1961. Roughly 400,000 shares are sold at $12.25 per share on the first day of trading.

Should I buy or sell Lowe's Companies stock right now?

19 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Lowe's Companies in the last twelve months. There are c...

What is Lowe's Companies' stock price forecast for 2022?

19 brokerages have issued 12 month target prices for Lowe's Companies' stock. Their forecasts range from $190.00 to $285.00. On average, they predi...

How has Lowe's Companies' stock performed in 2022?

Lowe's Companies' stock was trading at $258.48 at the start of the year. Since then, LOW stock has decreased by 27.9% and is now trading at $186.33...

When is Lowe's Companies' next earnings date?

Lowe's Companies is scheduled to release its next quarterly earnings announcement on Wednesday, August 17th 2022. View our earnings forecast for L...

How were Lowe's Companies' earnings last quarter?

Lowe's Companies, Inc. (NYSE:LOW) posted its quarterly earnings data on Wednesday, May, 18th. The home improvement retailer reported $3.51 earnings...

How often does Lowe's Companies pay dividends? What is the dividend yield for Lowe's Companies?

Lowe's Companies declared a quarterly dividend on Friday, May 27th. Investors of record on Wednesday, July 20th will be paid a dividend of $1.05 pe...

Is Lowe's Companies a good dividend stock?

Lowe's Companies(NYSE:LOW) pays an annual dividend of $3.20 per share and currently has a dividend yield of 1.72%. Lowe's Companies has been increa...

How will Lowe's Companies' stock buyback program work?

Lowe's Companies declared that its Board of Directors has approved a share repurchase plan on Wednesday, December 15th 2021, which authorizes the c...

What guidance has Lowe's Companies issued on next quarter's earnings?

Lowe's Companies updated its FY 2022 earnings guidance on Wednesday, June, 8th. The company provided earnings per share guidance of $13.10-$13.60 f...

Stock Price Forecast

The 28 analysts offering 12-month price forecasts for Lowe's Companies Inc have a median target of 284.00, with a high estimate of 300.00 and a low estimate of 230.00. The median estimate represents a +33.06% increase from the last price of 213.43.

Analyst Recommendations

The current consensus among 33 polled investment analysts is to Buy stock in Lowe's Companies Inc. This rating has held steady since February, when it was unchanged from a Buy rating. Move your mouse over past months for detail

Market share

Lowe's and Home Depot have both benefited from rising demand in the home improvement space, but the gains haven't been evenly split between the No. 1 and No. 2 retailers. Leader Home Depot is adding more revenue -- up 16% through the first three quarters compared to Lowe's 8% increase -- in 2021.

Price hikes

Lowe's raised its profitability outlook several times in 2021. Despite mounting supply chain costs and soaring expenses in areas like labor and transportation, the company is likely to cross 12% operating margin for the full year and set a new high for the business. That's a key reason the stock has beaten the market in the past year.

Looking out to 2022

Lowe's first official 2022 outlook was modest. Management said in mid-December that the company should hold sales close to the $95 billion it expects to book for 2021. Comps should be anywhere from flat to a 3% decrease after jumping 33% over the last two years, it said.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.

Soaring home values spur home improvement

In its fiscal fourth quarter ended Jan. 28, Lowe's generated sales of $21.3 billion. That was 5% higher than in the same quarter of the prior year. Sales growth is slowing considerably from surging levels. In the same quarter last year, revenue increased by 26.7%.

Lowe's is working to hold gains from the pandemic boom

That said, 2022 will be more about sustaining rather than growing the business for Lowe's. In January, comparable-store sales (which measures sales at stores open for the previous 12 months and excludes the impact of new store openings or closings) decreased by 0.7%.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.