The historical earnings growth rate for a stock is a measure of how the stock’s earnings per share (EPS) has grown over the last five years. Morningstar uses EPS from continuing operations to calculate this growth rate. Historical earnings growth is one of the five growth factors used to calculate the Morningstar Style Box.

Full Answer

How is the historical rate of return of the stock market calculated?

How the Historical Rate of Return of the Stock Market is Calculated. Over the stock market history, corporate earnings have gone up an average of 7% per year and the inflation history of the markets shows that inflation has averaged around 4% per year. The % weights of sectors have changed a lot from 1900 to 2000. For example, back in 1900,...

Does the rate of historical returns include dividends?

The rate of historical returns needs to include dividend distributions in order to get an accurate measure of the total return one would have gotten from investing in the stock market. During the 20th century, the stock market returned an average of 10.4% a year.

What is the average stock market return per year?

Stock Market History of Returns Decade Average Return Per year 1980s 17.57% 1990s 18.17% 2000s 1.07% 2010-2013 16.74% 8 more rows ...

How to calculate the average stock growth rate?

How to Calculate Stock Growth Rate Step 1. Divide the final value of the stock by the initial value of the stock. For example, if the stock started off... Step 2. Divide 1 by the number of years the growth occurred over. For example, if it took three years to go form $120 to... Step 3. Raise the ...

How do you find the historical growth rate of a stock?

The periodic dividend growth can be calculated by dividing the current dividend Di by the last dividend Di-1 and subtracting one from the result, then expressed in percentage. Gi denotes it. Next, determine the number of periods for which the historical growth rates have been collected, denoted by n.

What is historical growth rate?

The historical earnings growth rate for a stock is a measure of how the stock's earnings per share (EPS) has grown over the last five years.

How do you find the growth rate?

To find the growth rate, subtract the starting value from the ending value and divide the difference by the starting value. In our example, (100-25)/25 gives you 75/25, or 3. Multiply the growth rate by 100% to convert it to a percent value.

How do you calculate rate of return on a stock?

ROI is calculated by subtracting the initial value of the investment from the final value of the investment (which equals the net return), then dividing this new number (the net return) by the cost of the investment, and, finally, multiplying it by 100.

How do you calculate year over year growth?

How to Calculate YOY GrowthTake your current month's growth number and subtract the same measure realized 12 months before. ... Next, take the difference and divide it by the prior year's total number. ... Multiply it by 100 to convert this growth rate into a percentage rate.

How do I calculate my 3 year growth rate?

Divide the current year's total revenue from last year's total revenue. This gives you the revenue growth rate. For example, if the company earned $300,000 in revenue this year, and earned $275,000 last year, then the growth rate is 1.091. Cube this number to calculate the growth rate three years from now.

What is a good rate of return on a stock?

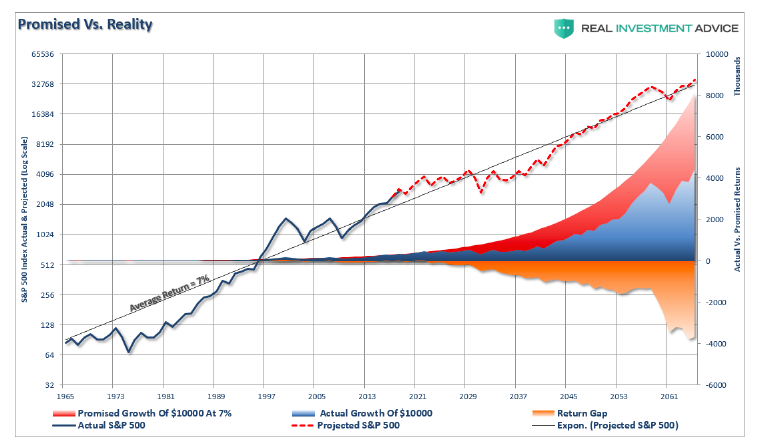

about 7% per yearA good return on investment is generally considered to be about 7% per year. This is the barometer that investors often use based off the historical average return of the S&P 500 after adjusting for inflation.

What is the average rate of return on stocks?

about 10% per yearThe average stock market return is about 10% per year for nearly the last century. The S&P 500 is often considered the benchmark measure for annual stock market returns. Though 10% is the average stock market return, returns in any year are far from average.

Are Robinhood returns accurate?

Past performance does not guarantee future results or returns. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy.

What is growth rate?

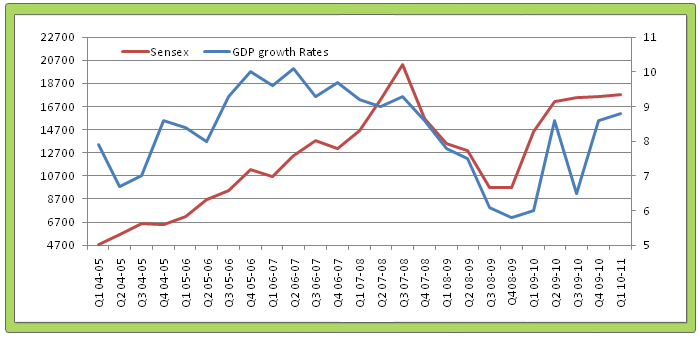

Growth rates refer to the percentage change of a specific variable within a specific time period. For investors, growth rates typically represent the compounded annualized rate of growth of a company's revenues, earnings, dividends, or even macro concepts, such as gross domestic product (GDP) and retail sales.

What is the purpose of growth rate?

At their most basic level, growth rates are used to express the annual change in a variable as a percentage. An economy's growth rate, for example, is derived as the annual rate of change at which a country's GDP increases or decreases. This rate of growth is used to measure an economy's recession or expansion.

Why is the Gordon Growth Model important?

The Gordon Growth Model (GGM) is a popular approach used to determine the intrinsic value of a stock based on a future series of dividends that grow at a constant rate .

Why is retail sales growth important?

In addition to GDP growth, retail sales growth is another important growth rate for an economy because it can be representative of consumer confidence and customer spending habits. When the economy is doing well and people are confident, they increase spending, which is reflected in retail sales.

Why use industry growth rates?

Industry growth rates can be used as a point of comparison for firms seeking to gauge their performance relative to their peers. The use of historical growth rates is one of the simplest methods of estimating the future growth of an industry.

Why is growth rate important?

Growth rates are used to express the annual change in a variable as a percentage. Growth rates were first used by biologists studying population sizes, but have since been brought into use studying economic activity, corporate management, or investment returns. Growth rates can be beneficial in assessing a company’s performance ...

What happens when the economy is in recession?

When the economy is in a recession, people reduce spending, and retail sales decline. For example, Q2 2016 retail sales growth for Ireland was reported in July 2016, revealing that domestic retail sales flatlined through the second quarter of the year.

How does down year affect the market?

The market's down years have an impact, but the degree to which they impact you often gets determined by whether you decide to stay invested or get out. An investor with a long-term view may have great returns over time, while one with a short-term view who gets in and then gets out after a bad year may have a loss.

What is the average annualized return of the S&P 500?

Between 2000 and 2019, the average annualized return of the S&P 500 Index was about 8.87%. In any given year, the actual return you earn may be quite different than the average return, which averages out several years' worth of performance. You may hear the media talking a lot about market corrections and bear markets:

How much money would you lose if you invested $1,000 in an index fund?

If you invested $1,000 at the beginning of the year in an index fund, you would have 37% less money invested at the end of the year or a loss of $370, but you only experience a real loss if you sell the investment at that time.

When does a bear market occur?

A bear market occurs when the market goes down over 20% from its previous high. Most bear markets last for about a year in length. 1 .

When to look at rolling returns?

You can alternatively view returns as rolling returns, which look at market returns of 12-month periods, such as February to the following January, March to the following February, or April to the following March. Check out these graphs of historical rolling returns, for a perspective that extends beyond a calendar year view.

Is the stock market cruel?

On the other hand, if you try and use the stock market as a means to make money fast or engage in activities that throw caution to the wind, you'll find the stock market to be a very cruel place. If a small amount of money could land you big riches in a super short timespan, everybody would do it.

Can you stay out of stocks during a bear market?

No one knows ahead of time when those negative stock market returns will occur. If you don't have the fortitude to stay invested through a bear market, then you may decide to either stay out of stocks or be prepared to lose money, because no one can consistently time the market to get in and out and avoid the down years.

How many assets can you compare in 1960?

1960. As mentioned, you can compare the returns for up to 3 assets at a time. The calculator places few restrictions on what a user can do. However, it probably does not make much sense to do a comparative analysis that starts before the first data of the index with the least amount of data points (years).

Is investing in the stock market scary?

According to an Ally Financial survey as quoted by Andrea Coombes in Forbes 66% of people aged 18 to 29 (and 65% of those 30 to 39) say investing in the stock market is scary or intimidating.

Do historical returns account for inflation?

They do not account for the inflation tax. Therefore, it is better to evaluate real performance, i.e., inflation-adjusted returns. The Historical Investment Returns Calculator has an option for an inflation-adjusted calculation.