What’s the Difference between Stocks and Options?

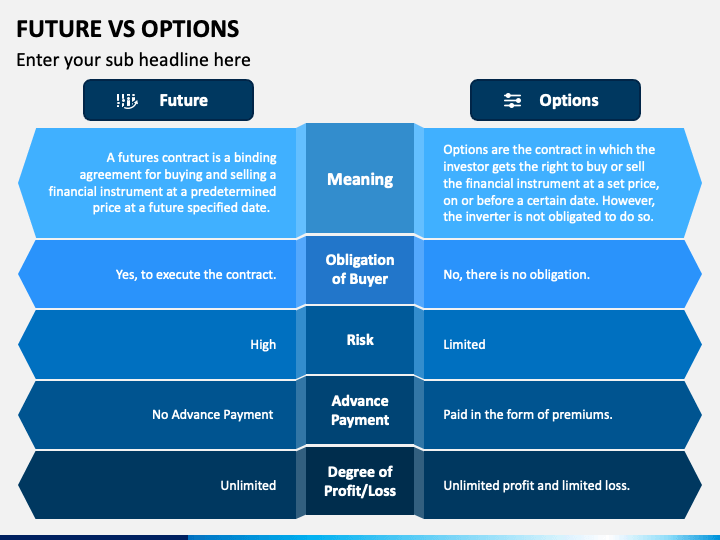

- Options are derivatives. A derivative is a financial instrument that gets its value not from its own intrinsic value but rather from the value of the underlying security and time. ...

- Options, like futures contracts, have expiration dates, while stocks do not. ...

- Owning an option doesn’t give the holder any share of the underlying security. ...

Are options better than stocks?

The key difference between stock and option is that stock represent the shares held by the person in one or more than one companies in the market indicating the ownership of a person in those companies without the expiration date, whereas, the options are the trading instrument which represents the choice with the investor for buying or selling an underlying asset on the …

What are options vs stocks?

3 rows · Oct 24, 2017 · The biggest difference between options and stocks is that stocks represent shares of ownership ...

What is the best stock trading option?

4 rows · Apr 06, 2021 · A stock is an ownership share in a company. With stock options, you essentially purchase the ...

Why are options vs. stocks?

Aug 05, 2021 · The main difference is that stocks represent the ownership in a company, while options are contracts with investors that let you bet on the direction of the price of the stock. The second biggest difference is the one mentioned above — the way you earn profit. When it comes to options, you make money simply by buying or selling stocks.

Is options better than stocks?

Options can be a better choice when you want to limit risk to a certain amount. Options can allow you to earn a stock-like return while investing less money, so they can be a way to limit your risk within certain bounds. Options can be a useful strategy when you're an advanced investor.Apr 13, 2022

Why would you buy an option instead of a stock?

The primary reason you might choose to buy a call option, as opposed to simply buying a stock, is that options enable you to control the same amount of stock with less money.Feb 25, 2019

Is stock and stock option the same?

The biggest difference between options and stocks is that stocks represent shares of ownership in individual companies, while options are contracts with other investors that let you bet on which direction you think a stock price is headed.

Are options more profitable than stocks?

If the stock price moves up significantly, buying a call option offers much better profits than owning the stock. To realize a net profit on the option, the stock has to move above the strike price, by enough to offset the premium paid to the call seller. In the above example, the call breaks even at $55 per share.Jan 24, 2022

Are options riskier than stocks?

Options can be less risky for investors because they require less financial commitment than equities, and they can also be less risky due to their relative imperviousness to the potentially catastrophic effects of gap openings. Options are the most dependable form of hedge, and this also makes them safer than stocks.

Are options gambling?

Here's How to Bet Wisely. Let us end 2021 reflecting on a powerful lesson we learned this year: America is a nation of gamblers, and the options market has become the biggest casino in the country.Dec 22, 2021

Do day traders use options?

A day trade occurs when you buy and sell (or sell and buy) the same security in a margin account on the same day. The rule applies to day trading in any security, including options. Day trading in a cash account is generally prohibited.

Do you have to buy 100 shares of stock with options?

You could buy shares of the stock, or you could buy a call option. Say a call option that gives you the right, but not the obligation, to buy 100 shares of XYZ anytime in the next 90 days for $26 per share could be purchased for $100.

Is option buying profitable?

Option writing or futures aren't safe either Lesser the risk, the higher the odds of generating profits. At Zerodha, normally on the end of day positions, ~80% of all open buy option positions are in a loss. ~25% of all open short option positions are in a loss.Jul 1, 2021

How do you buy options?

How to trade options in four stepsOpen an options trading account. Before you can start trading options, you'll have to prove you know what you're doing. ... Pick which options to buy or sell. ... Predict the option strike price. ... Determine the option time frame.

Why option selling requires more money?

A seller of the option takes a risk of being obligated to sell the underlying. His profit overall is premium paid by buyer. His loss is unlimited. Hence margin required is more.

How do options Work example?

The strike price of $70 means that the stock price must rise above $70 before the call option is worth anything; furthermore, because the contract is $3.15 per share, the break-even price would be $73.15. When the stock price is $67, it's less than the $70 strike price, so the option is worthless.

What is the difference between options and stocks?

The biggest difference between options and stocks is that stocks represent shares of ownership in individual companies, while options are contracts with other investors that let you bet on which direction you think a stock price is headed. But despite their differences, these assets can complement one another in a portfolio.

Why are stocks more common than options?

For beginner investors, and especially people with a long-term strategy, stocks are a more common entry point into the stock market than options, because they’re more straightforward, tend to have lower expenses and allow for a hands-off approach.

How to invest in options?

While many people like the flexibility afforded by options — namely, time to see how a trade plays out and the ability to lock in a price without an obligation to buy — they do add complexity to the investing process. Rather than making one decision, such as betting that a stock’s price will go up, you must make three: 1 What direction the stock is headed. 2 How high or low it will move from its current price. 3 The time frame in which that will happen.

What are the drawbacks of investing in stocks?

The drawbacks of stocks. The risk associated with stocks is straightforward: The price could plummet and you’d lose all or most of your investment. Because the performance of individual stocks can be volatile day to day, experts generally recommend investing in stocks with money you won’t need for at least five years.

How much does an option trader pay?

Options traders may pay a flat fee per trade — which is typically the same as the broker’s stock trading commission, if it charges one — plus a per-contract fee ranging from 15 cents to 75 cents. The more you trade, the higher your costs — and don’t forget, you may pay fees to sell, too.

How long do options last?

All options contracts have expiration dates, which can range from days to years.

Do beginners stick to stocks?

Those who favor an active investment approach and love to watch the market may find options appealing. But don’t assume you have to stick to one asset.

What is stock option?

When you invest in stock options, you essentially purchase the right to buy or sell shares of an underlying stock for a set price at a future date. There’s no direct ownership of the company at all.

What are the advantages of stocks over options?

But an advantage stocks have over options is that there’s no pressure to sell. You can buy a stock at one price and sell it right away, potentially earning some short-term capital gains. Or you could buy it and hold it for years, selling when the time is right for you.

What does it mean to buy a put option?

When you buy a put, it gives you the right (but not the obligation) to sell a specific stock at a specific price per share within a specific time frame. In terms of what you want to happen with a put option, it’s the reverse of a call. Buying put options can help you take advantage of the downward movement of a stock.

What happens when you buy stock?

When you buy one or more stock shares, you purchase part of the company that issued the stock. When you invest in stocks, the goal is to buy shares at one price, then sell them at a higher price. When you do so, you realize profits, a.k.a. capital gains, in your portfolio. Some stocks have an added benefit: paying dividends.

What happens if you assume a stock is wrong?

If your assumption about a stock’s price movement turns out to be wrong or you get the timing incorrect when buying or selling, you could lose money instead of turning a profit. Investing in stocks also carries risk, since the market can go through periods of volatility.

What happens when you buy a call option?

When you purchase a call option from the option writer or seller, the two of you agree on the strike price, or what you’d pay to buy the underlying stock. You ultimately want the underlying asset to increase above the strike price. That way, you can then exercise your option, buy the stocks at a lower price and sell them to realize a profit.

Why do you buy put options?

Buying put options can help you take advantage of the downward movement of a stock. Instead of hoping the price rises, you want it to drop so you earn the difference between the strike price and the stock’s price in profit.

What is stock option?

The textbook definition of stock options is: “a contract that gives you the non-obligatory right to buy or sell an underlying stock at an agreed-upon price and date.”. Options allow investors to speculate on the price of certain stocks.

How to make profit from stocks vs options?

When making the stocks vs options comparison, it’s important to explain how you earn profit. You can earn profit from stocks by choosing stocks that give dividends. The other option is to hold stocks until they rise to a favorable price and sell them .

What are the risks of investing in options?

Despite all of the benefits, no investment is without risk. Here are some risks related to investing in options: 1 They are short-term. While you can buy stocks and hold them for how many years you want, options have an expiration date. This means that there is a limited amount of time for your investment thesis to bear out. If it doesn’t, you will have lost the invested premium. 2 They can expose sellers to unlimited losses. When you, as an investor, write a put or call, are obligated to buy or sell shares at a specified price within the contract time frame. Since there is no limit on how high a stock can rise, the purchase price can become exorbitant.

What is strike price in put options?

The strike price is the price the stocks must be bought or sold at by the specified date. Depending on the trader’s risk tolerance, they can employ various strategies to determine the strike price.

How long are options good for?

Additionally, stocks can remain yours until you decide to sell them, while options are only good until their expiration date.

Why is it important to understand stocks?

Understanding stocks is easier because they are straightforward. When purchasing stocks, you buy a part of all the shares of a corporation. This essentially means that you are entitled to the corporation’s assets and profit. This means that stocks are more common, and they usually come with lower expenses than options investing. Generally, you will buy stocks and hold them for a certain amount of time, hoping that the stock price rises so you can sell at a profit. Some corporations give quarterly dividends to all shareholders proportional to the number of shares they hold.

What are units of stocks called?

Units of stocks are called shares. That’s the basic overview of the difference between stocks and options. But there’s a bit more to it so let’s take a closer look. The two main types of stocks are common stocks and preferred stocks.

Differences Between Stocks & Stock Options - Introduction

To trade Stocks or Options, that's the question... What's the difference anyways? Options trading is gaining popularity all over the world and have created many rags to riches legends in recent years.

Differences Between Stocks & Stock Options - Relationship between stocks and stock options

Options are derivative instruments based on stocks, funds, currencies, commodities, futures or index. Derivative instruments are trading instruments that derive their value from another security. This means that the value of options move up and down in reponse to changes in the price of their underlying securities and other variables.

Differences Between Stocks & Stock Options - Trading Characteristics

The only similarity between Stocks and Stock Options is the fact that they can be bought and sold just like a stock. But that is where the similarity ends. Stock options behaves very differently from stocks and can be utilized in far more ways.

Explosive Profits

The ability to make leveraged profit is the reason why so many lucky options traders get rich quickly in options trading.

Profit to Downside Without Shorting or Margin

To profit when a stock drops, stock traders can only short the stocks, incurring unlimited losses and margin if the stock rises instead. In fact, shorting a stock is possible only with a margin enabled account. With options trading, anyone can profit from a drop in the underlying stock just by buying a put option.

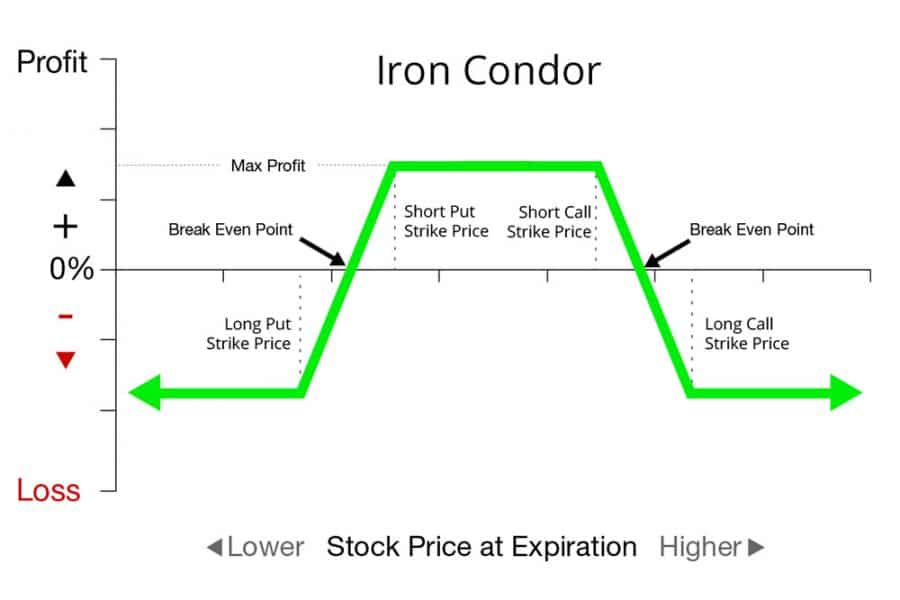

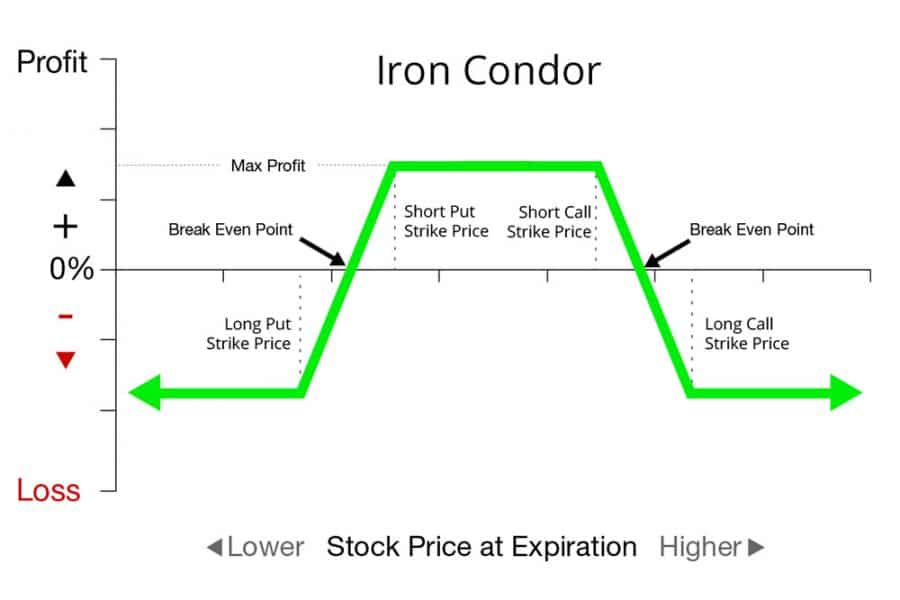

Profit in All Directions

Stocks only profit when they go up while profit is possible in every possible direction in options trading by combining various stock options of various strikes or expiration. In fact, it is possible to make a profit in more than one direction at once using options strategies such as Covered Calls.

Expiring Worthless

The reason why so many options traders lose all their money in a very short period of time because stock options expires worthless if the underlying stock did not move in accordance to expectation. When you purchase stocks, you can hold on to it for as long as you want to if the stock did not go up.

What is stock option?

Stock options are the right to buy a certain number of shares at a certain price in the future , with the employee benefiting only if the stock price then exceeds the stock option price.

How do stock options work?

Stock options are normally restricted by a market standoff provision, which restricts the sale of shares for a certain period of time after an initial public offering (IPO) to stabilize the market price of the stock.

What is restricted stock?

Restricted shares and stock options are both forms of equity compensation that are awarded to employees. Restricted shares represent actual ownership of stock but come with conditions on the timing of their sale. Stock options are the right to buy a certain number of shares at a certain price in the future, with the employee benefiting only if ...

What happens to an employee's shares after a merger?

That means that an employee's shares become unrestricted if the company is acquired by another and the employee is fired in the restructuring that follows. Insiders are often awarded restricted shares after a merger or other major corporate event.

Do restricted shares have to be vested?

However, they are usually vested. That is, when restricted shares are given to an employee, it is on condition that the employee will continue working at the company for a number of years or until a particular company milestone is met. This might be an earnings goal or another financial target.

Understanding How Options Contracts Work and Options Trading Essentials

First, what exactly is an option? An option is a contract between two entities, a buyer and seller, that guarantees the product will be delivered at the date of expiration. The delivery is typically related to the value of the underlying asset or component, like equities or indexes.

Understanding How Indexes Relate to the Stock Market

Here are few popular indexes that its critical, as a trader, to be familiar with:

Quick Overview: Index Options vs. Stock Options

There are two main components that make an option: the option premium and the strike price. The option premium is the fee paid to purchase the option. With stock/equity options, the strike price is determined by the options seller. If you buy a call option, a specific strike price is offered to you.

How does Cash Settlement Differ Between Index Options and Stock Options?

Another critical difference between stock options and index options lies in the settlement process

Are the Settlement Rules Different for Index Options and Stock Options?

The topic of settlement rules can be pretty dull. However, understanding these rules and differences related to the buying and selling of index and stock/equity options is important nonetheless. Traders can end up in trouble with headaches and losses without this necessary information.

Summary

For traders, index options and stock options are both essential tools for successful trading and capitalization of your trading portfolio. Index options are utilized for speculation and hedging positions in a liquid, tax-preferential market.

Schaeffer

Schaeffer's Investment Research, Inc. has been providing stock market publications, market recommendation services and stock option education since its inception in 1981 by founder and CEO, Bernie Schaeffer.

Be sure you understand your rights and the tax consequences

Erin Gobler is personal finance coach and a writer with over decade of experience. She specializes in writing about investing, cryptocurrency, stocks, and more. Her work has been published on major financial websites including Bankrate, Fox Business, Credit Karma, The Simple Dollar, and more.

Which Is Right for You?

As an employee, whether you have access to RSUs or stock options will depend on the company you work for. Some companies may offer one or the other, while others may offer both.

Company Stock in Your Investment Portfolio

If your company offers either RSUs or stock options, it’s important to consider how those shares will fit into your overall investment portfolio. Allowing a single company—even the one you work for—to comprise too large a share of your portfolio could create unnecessary risk and the chance of excessive loss if the company underperforms.

The Bottom Line

RSUs and stock options are both types of equity compensation that companies may offer their employees as a way to attract and retain talent and reward them for hard work. Which you have access to will largely depend on the company you work for and your role within it.

What are the two types of stock options?

On the other hand, two types of stock options exist: non-qualified stock options (NSOs) and incentive stock options (ISOs). For NSOs, you are taxed on the difference between the market price and the grant price. This is called the spread, and it is taxed as regular income.

Why are stock options valuable?

Stock options are only valuable if the market value of the stock is higher than the grant price at some point in the vesting period. Otherwise, you’re paying more for the shares than you could in theory sell them for. RSUs, meanwhile, are pure gain, as you don’t have to pay for them.

How long do you have to work to buy stock?

This often involves a vesting schedule, where you have to work at the company for a certain period of time, often one year, before you can purchase the stock. This is to prevent people who only work at the company for a short period of time from ending up with potentially valuable stock.

When did restricted stock units come into use?

Restricted stock units (RSU) came in vogue in the ’90s and early 2000s. They are a bit simpler than stock options in that there is no transaction or stock pricing involved. Instead, the company simply commits to giving an employee stock in the company when a certain requirement is fulfilled.